$1070.HK TCL Electronics | Winning the Battle for Screens | Market Share Gains and Global Dominance | TickerTrends.io

The TickerTrends Social Arbitrage Hedge Fund is currently accepting capital. If you are interested in learning more send us an email admin@tickertrends.io.

Ticker: 1070.HK

Sector: Consumer Electronics

Share Price: 9.40 HKD

Market Cap: 23.7B HKD

Business Intro:

TCL Industries is a global leader in consumer electronics and smart technology, best known for its innovation in television manufacturing and its growing footprint in smart home ecosystems. Headquartered in Huizhou, China, TCL has built a reputation over four decades for delivering high-quality, affordable products that combine sleek design with cutting-edge technology.

The company’s journey began in 1981 as TTK, a small cassette tape manufacturer. It officially adopted the name “TCL” (The Creative Life) in the 1980s and began expanding into telecommunication equipment and consumer appliances. Through the 1990s and early 2000s, TCL grew rapidly, acquiring and forming joint ventures with several well-known international brands, including Thomson’s TV business in Europe and Alcatel’s mobile phone division. These moves marked the beginning of TCL’s global expansion and signaled its ambition to become a world-class electronics manufacturer.

TCL is especially well-known for its leadership in the global television market, where it has consistently ranked among the top-selling brands. Unlike many competitors, TCL is vertically integrated—it manufactures its own LCD panels through its subsidiary CSOT (China Star Optoelectronics Technology), giving the company control over key components in its supply chain. This integration not only enhances product quality and innovation speed but also helps TCL remain price-competitive across global markets. Beyond televisions, TCL has diversified into a wide range of product categories including mobile phones, air conditioners, washing machines, refrigerators, and smart home devices. In recent years, it has made a significant push into the AIoT (Artificial Intelligence + Internet of Things) space, aiming to build an interconnected ecosystem of devices that work seamlessly together to enhance users’ everyday lives.

The company operates multiple R&D centers and manufacturing facilities around the world, including in the United States, Mexico, Poland, India, and Vietnam. Its global strategy is underpinned by a “local to local” approach, combining local market insights with TCL’s global resources to better serve consumers across different regions.

TCL’s commitment to innovation, affordability, and global accessibility has made it one of the most recognized and trusted electronics brands in the world. As it continues to expand its smart product ecosystem and deepen its global presence, TCL is positioning itself as not just a manufacturer, but a lifestyle technology brand shaping the future of connected living.

Segment Analysis:

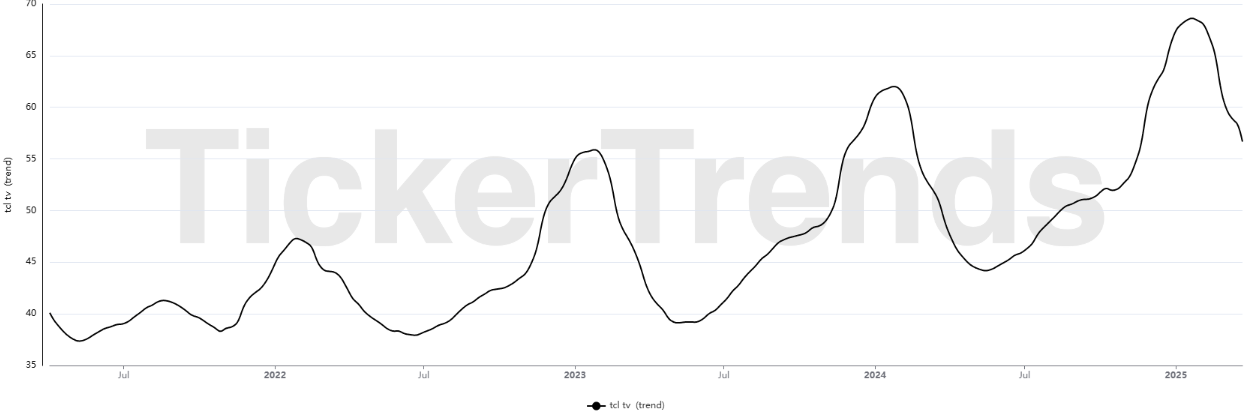

Televisions

The television segment is the cornerstone of TCL's business. The segment contributes significantly to the company’s revenues. In 2024, the revenue generated from TCL's large-sized display business, which primarily encompasses its TV offerings, reached HK$60.11 billion, indicating a robust year-over-year growth of 23.6%. TCL's broader revenue figure for its "Display Business" revenue, amounted to HK$69.44 billion, representing 69.9% of the company's total revenue for the year, with a year-over-year increase of 22.8%.

Within the TV segment, both domestic and international markets experienced substantial growth. In the domestic market of China, TCL's TV revenue grew by 18.9% year-over-year to HK$19.1 billion. The international market performance was even stronger, with TV revenue reaching HK$41.06 billion, a year-over-year increase of 25.9%. Furthermore, there was a notable trend in the average selling price (ASP) of TCL TVs in the domestic market, which increased by 12.4% year-over-year. The rise in ASP has been due to a shift towards consumers purchasing higher-value television sets, driven by increased demand for larger screens and models incorporating advanced technologies. The substantial growth in both domestic and international TV revenue, coupled with the increasing ASP in the domestic market has helped the company in capturing market demand and share.