$2209.HK Beauty Beyond Borders | Global Domination in K-Beauty Commerce | TickerTrends.io

The TickerTrends Social Arbitrage Hedge Fund is currently accepting capital. If you are interested in learning more send us an email admin@tickertrends.io .

Ticker: 2209.HK

Sector: Digital Retail

Share Price: 3.77 HKD

Market Cap: 1.538B HKD

Business Intro:

YesAsia Holdings Limited, based in Hong Kong, is a leading e-commerce company specializing in the sale and distribution of Asian beauty products, lifestyle goods, and entertainment items. Since its establishment in 1997, the company has grown into a globally recognized platform, connecting consumers and businesses with a wide array of high-quality products sourced from Asia. With over 25 years of experience in the e-commerce industry, YesAsia has carved out a strong niche as a trusted provider of authentic Asian goods, catering to millions of customers worldwide.

The company’s operations are centered around three primary platforms. Its flagship platform, YesStyle, serves the Business-to-Consumer (B2C) market and is a top-ranking global destination for Asian beauty and lifestyle products, especially Korean Beauty (K-Beauty) items. YesStyle offers an extensive selection of skincare, cosmetics, and fashion products, making it a favorite among consumers in key markets such as the United States, the United Kingdom, Canada, and Australia. Its ability to consistently deliver quality products at competitive prices has solidified its position as a leader in online Asian beauty retail.

For the Business-to-Business (B2B) segment, AsianBeautyWholesale provides retailers and beauty professionals with wholesale access to a diverse portfolio of beauty brands. This platform caters to the growing international demand for K-Beauty products, allowing global businesses to source innovative and premium beauty items in bulk. Through partnerships with renowned Asian brands, Asian Beauty Wholesale has become a critical channel for businesses seeking to capitalize on the worldwide popularity of Korean beauty products.

Additionally, the company operates the YesAsia platform, originally focused on entertainment products such as music, movies, and other cultural items from Asia. While its significance has declined in recent years due to the company’s strategic focus on beauty products, the platform continues to support the company’s broader e-commerce portfolio.

YesAsia Holdings is known for its robust digital infrastructure and its commitment to leveraging cutting-edge technologies, such as AI-powered customer relationship management systems and advanced logistics solutions, to enhance customer experiences and operational efficiency. The company’s dedication to quality, innovation, and global reach has positioned it as a dominant force in the e-commerce sector for Asian goods, connecting consumers and businesses to the rich and diverse products of Asia.

Alt Data:

Industry:

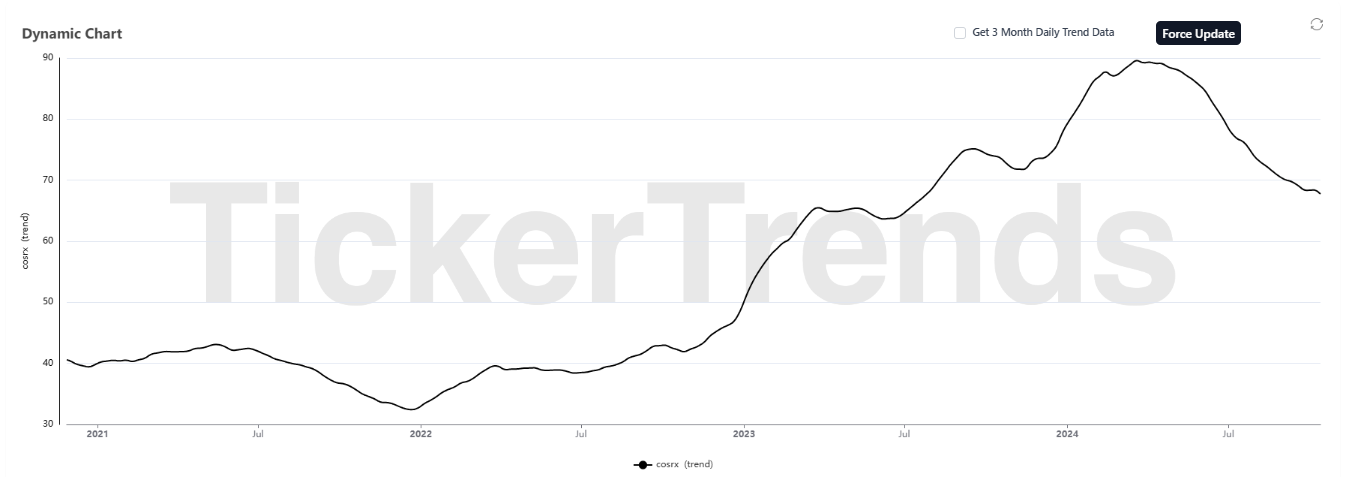

The global K-beauty products market has seen extraordinary growth, with its value estimated at USD 91.99 billion in 2022 and projected to grow at a compound annual growth rate (CAGR) of 9.3% to 2030 (Grand View Research, 2023). This growth highlights the increasing global demand for Korean beauty products, which are celebrated for their emphasis on high-quality, safe, and often natural ingredients. Consumers have embraced K-beauty for its innovative formulations and its focus on addressing specific skincare needs, such as hydration, anti-aging, and sensitivity. Korean cosmetics companies prioritize ingredient sourcing, extraction methods, and manufacturing processes to deliver effective products, making K-beauty a trusted choice for a wide audience.

The U.S. market, in particular, has emerged as a key growth driver for K-beauty. In the first four months of 2024, Korean beauty products surpassed French cosmetics in the U.S. import market share for the first time, capturing 20.1% with a value of USD 477.1 million. This marked a major milestone, reflecting the shifting preferences of American consumers towards Korean beauty products. The U.S. The K-beauty market is anticipated to grow at a robust CAGR of 10.69% to 2028, driven by increasing consumer demand for innovative and effective skincare solutions. This growth is fueled by the influence of Korean pop culture, including K-pop music, dramas, and celebrity endorsements, which have played a pivotal role in popularizing Korean beauty routines among American audiences.

The appeal of K-beauty in the U.S. market is multifaceted. Products like BB creams, sheet masks, and serums have gained widespread popularity due to their high efficacy and unique formulations featuring ingredients such as snail mucin, ginseng, and Centella Asiatica. These natural and scientifically backed ingredients cater to diverse skincare needs, including sensitive skin, acne, and anti-aging concerns. Additionally, K-beauty’s visually appealing and playful packaging has resonated with younger consumers, further enhancing the market's growth.

E-commerce has played a critical role in the proliferation of K-beauty products. Online platforms, including Amazon and dedicated K-beauty retailers like Soko Glam, have made these products widely accessible to U.S. consumers. The online segment of the K-beauty market is projected to grow at a CAGR of 11.2% from 2023 to 2030, as consumers increasingly turn to online shopping for convenience and variety. Social media platforms have also been instrumental in the rise of K-beauty, with brands leveraging influencer marketing and celebrity endorsements to drive engagement and sales. Influencers and celebrities, such as Chloe Kim and Selena Gomez, have highlighted the benefits of K-beauty products, creating cross-cultural appeal and boosting their adoption across diverse demographics.

Globally, the K-beauty market thrives on its ability to innovate and adapt. Companies are focusing on research and development, product launches, and strategic collaborations to expand their market share. For instance, AmorePacific’s recent initiatives, including a new R&D center in California, aim to tailor products to the preferences of North American consumers. Similarly, partnerships with retailers and influencers have strengthened brand visibility and consumer loyalty.

In summary, the K-beauty market’s rapid growth globally and in the U.S. is fueled by innovative product offerings, strong cultural influences, and expanding online and offline distribution channels. The combination of natural ingredients, effective formulations, and creative marketing strategies positions K-beauty as a dominant force in the global cosmetics industry, with significant potential for continued growth in the coming years.