7 Alternative Data Sources Reshaping Investment Decisions

In today’s investment landscape, alternative data is a game-changer. It goes beyond financial reports, using unconventional sources to uncover deeper insights. Here’s a quick summary of seven key data sources transforming how investors make decisions:

Satellite Imagery: Tracks global trade, crop conditions, and industrial activity.

Social Media Sentiment: Analyzes public opinion and predicts market trends.

Web Traffic & App Usage: Monitors online consumer behavior and engagement.

Geolocation Data: Tracks physical movement, like retail foot traffic and real estate trends.

IoT Data: Provides operational insights from connected devices.

Alternative Financial Metrics: Uses real-time transaction data like credit card activity.

ESG Data: Focuses on sustainability and governance for long-term value.

These tools help investors identify opportunities, manage risks, and refine strategies. Want to stay ahead? Combine these data sources with traditional metrics for a well-rounded view of the market.

Related video from YouTube

1. Satellite Imagery

Satellite imagery offers a fresh way to gain insights into global economic activities, often revealing details that traditional metrics overlook. This technology is reshaping how investors evaluate markets and make informed decisions.

For example, monitoring port activity, shipping containers, and storage facilities can provide early clues about global trade patterns. It’s also used to evaluate crop conditions, predict harvest yields, and track factors that influence commodity prices.

By 2020, satellite data became a key tool in due diligence, influencing investment decisions worth billions [2].

"Alternative data, including satellite imagery, provides investors with new and unique insights into companies, industries, and markets." - Research.aimultiple.com [2]

Today, platforms offer satellite data at prices that are accessible even to individual investors. Practical uses include estimating retail sales by analyzing parking lot traffic, tracking oil storage levels, assessing real estate developments, and observing industrial activity.

While working with satellite data requires advanced analytical skills, its importance in decision-making keeps growing. Machine learning is making the process faster and more precise, improving the quality of insights.

When combined with other data sources, satellite imagery can paint a more complete picture of market trends. For instance, while satellite data shows physical-world changes, social media sentiment can reveal shifts in consumer behavior and market mood.

2. Social Media Sentiment

Social platforms like Twitter, Reddit, and Facebook have become essential for real-time public conversations, offering investors a fresh way to gauge market trends and consumer opinions. By using natural language processing (NLP) and machine learning, investors can sift through millions of posts to uncover insights that might influence market behavior.

Take tools like TickerTrends' Social Arbitrage Score, for instance. These tools analyze sentiment across platforms, helping investors spot shifts in consumer preferences or brand perception that could impact stock performance. Often, these signals appear on social media before making their way into traditional financial reports or news.

"Sentiment analysis of social media can capture the public mood and predict changes in market direction." - NetOwl [4]

Here’s what advanced sentiment tools can do:

Highlight emotional drivers behind discussions about companies

Track sentiment shifts among different demographics

Pinpoint emerging trends and potential market changes

Provide real-time updates on brand reputation and consumer feedback

When combined with other data sources, social sentiment analysis becomes even more powerful. For example, if sentiment data suggests rising interest in a product, web traffic data can confirm whether this interest translates into action.

The good news? These tools are no longer just for big firms. Platforms like TickerTrends offer affordable options starting at $19/month, making advanced sentiment analysis accessible to retail investors too.

To use social media sentiment effectively, it’s important to focus on long-term patterns rather than short-term spikes. This approach helps cut through the noise and delivers more reliable insights. The best strategies pair sentiment data with traditional financial metrics and alternative data sources for a well-rounded view of the market.

While social media sentiment captures public opinion, combining it with other digital data like web traffic and app usage provides a deeper understanding of consumer behavior, refining investment strategies even further.

3. Web Traffic and App Usage

Web traffic and app usage data offer a real-time look into consumer behavior, giving investors a chance to identify market trends before they show up in traditional financial reports. In today’s digital-first world, this type of data provides a direct snapshot of how consumers interact online - something traditional financial metrics often miss.

Metrics like page views, unique visitors, time on site, bounce rates, and conversion rates shed light on customer acquisition, engagement, and sales performance. These digital indicators have reshaped the way investors evaluate businesses, particularly in sectors like e-commerce and digital services.

According to Deloitte's latest investment survey, 98% of investment professionals view alternative data, such as web traffic, as essential for finding alpha-generating opportunities [3].

"Alternative data is becoming increasingly important to identify innovative ideas to boost alpha." - Deloitte Investment Management Survey [3]

Platforms like TickerTrends go beyond standard tools like Google Analytics. They combine web traffic data with other digital signals to create performance scores that help investors make more informed decisions. Different industries gain unique insights from web traffic analysis:

When diving into web traffic data, focus on sustained trends, comparisons with competitors, and seasonal patterns to get the most accurate insights. Pairing this data with other sources can significantly strengthen predictions about market performance.

However, keep in mind that changes in privacy laws or tracking technologies can impact the accuracy of web traffic data [1]. Savvy investors integrate these signals into a broader analysis framework, combining them with traditional financial metrics to gain a well-rounded understanding.

While web traffic highlights online consumer behavior, geolocation data provides a complementary view by tracking physical movement patterns, offering another layer of market insight.

Discover Alternative Data Insights

Access comprehensive consumer data, track market trends, and gain actionable insights with TickerTrends' innovative data terminal and API services.

4. Geolocation Data

Geolocation data provides a window into consumer activity in the physical world. It tracks metrics like foot traffic, dwell time, and visit frequency, giving investors a way to assess business performance in industries such as retail, real estate, and entertainment. When combined with digital metrics like web traffic, it paints a fuller picture of consumer behavior.

These platforms gather data from devices and sensors to monitor movement, offering valuable insights for investment strategies. Here's how it applies across different sectors:

When working with geolocation data, it’s essential to look for trends that suggest sustained growth or decline. For example, longer dwell times at retail locations can indicate stronger customer interest and higher sales potential. Similarly, steady foot traffic patterns often reflect stable operations and a strong position in the market.

Though privacy laws and data accuracy can pose challenges, advancements in analytics are making location-based intelligence increasingly powerful. This allows investors to spot emerging opportunities earlier than traditional financial data might reveal [1].

While geolocation data maps physical movement, IoT data adds another layer by capturing interactions with connected devices, offering even deeper insights into consumer habits and market dynamics.

5. IoT Data

Geolocation helps track movement, but IoT data goes further, offering a closer look at how operations perform through networks of connected devices. This level of detail gives businesses and investors a clearer picture of company operations.

Industrial IoT sensors monitor critical metrics like equipment runtime, inventory levels, and energy consumption. These data points can reveal essential insights for investment:

IoT-enabled tools like shipping containers and warehouse systems allow for real-time inventory tracking and cold chain monitoring, shedding light on supply chain performance. In production facilities, sensors can detect potential issues early, giving investors a chance to assess risks before they affect financial outcomes.

Smart building systems and energy monitors also play a role, especially for ESG-focused investments. These tools measure resource use and environmental impact, offering a direct way to evaluate sustainability efforts. Unlike older methods, IoT collects precise operational data straight from devices, providing early signs of efficiency and resource management.

Machine learning adds another layer by identifying patterns in IoT data to guide investment decisions. However, investors need to ensure the data is accurate and complies with privacy laws. Partnering with specialized data providers can help overcome these challenges and unlock the full potential of IoT insights.

When combined with other financial metrics, IoT data provides a more detailed understanding of both operational and financial performance, helping to refine investment strategies.

6. Alternative Financial Metrics

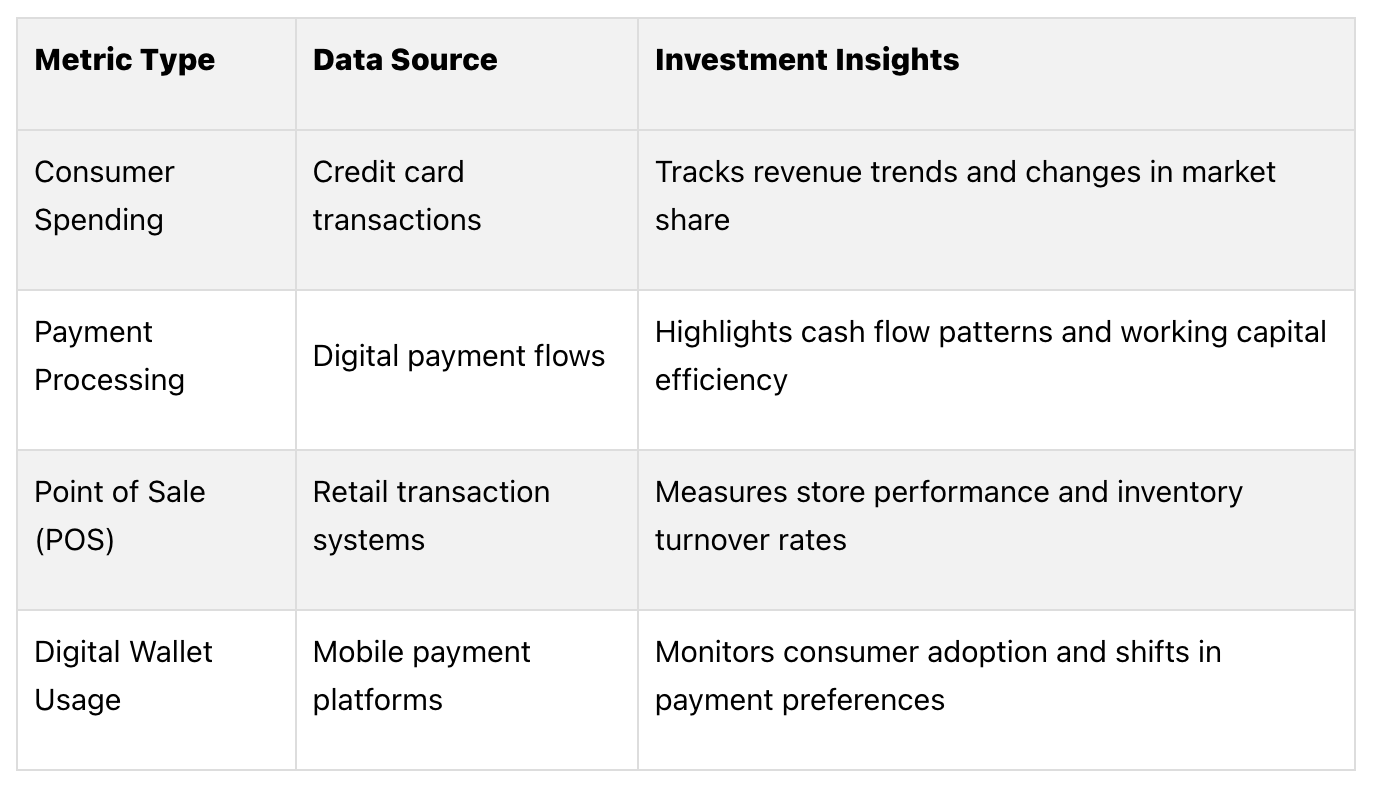

Alternative financial metrics, based on real-time transaction data, provide a closer look at company performance, often revealing patterns that traditional financial reports might overlook.

Take credit card transaction data, for example. It’s a strong indicator of consumer behavior and company health. Trends in payment processing can quickly signal shifts in revenue, offering early warnings of changing market conditions.

Here’s a breakdown of how various alternative financial metrics can guide investment decisions:

These metrics are particularly valuable for retail and consumer-focused industries. By analyzing credit card transactions, investors can examine performance across regions and timeframes, gaining a more detailed understanding of financial health.

Machine learning plays a key role here, processing millions of transactions to uncover subtle trends. This gives hedge funds and institutional investors an edge. When paired with data like geolocation or IoT insights, these metrics paint a fuller picture of both financial and operational performance.

To make the most of these tools, investors should prioritize high-quality data, account for seasonal trends, ensure privacy compliance, and combine multiple data sources for thorough analysis.

While alternative financial metrics provide a real-time perspective on company performance, ESG data complements this by focusing on sustainability and long-term value.

7. ESG Data

ESG data, which stands for Environmental, Social, and Governance data, builds on insights from IoT and alternative financial metrics to emphasize long-term business practices and governance. This data has become a key resource for investors evaluating the long-term potential of companies.

ESG metrics cover three main areas: environmental risks, social responsibility, and governance standards. These metrics help investors assess a company's sustainability practices, reputation, and management quality. Major firms like MSCI ESG and Sustainalytics analyze extensive datasets to provide detailed ESG ratings for businesses.

How ESG Components Shape Investment Decisions

The influence of ESG data on investment performance is hard to ignore. For instance, research from MSCI shows that companies with high ESG ratings outperformed their lower-rated counterparts by 4.8% annually over a decade. This performance gap underscores why major asset managers are increasingly prioritizing ESG metrics.

Take BlackRock, the largest asset manager globally, as an example. The firm has placed ESG analysis at the core of its investment strategy, leveraging artificial intelligence to process immense amounts of sustainability data.

AI-powered ESG tools deliver timely insights, improving risk assessment and uncovering new opportunities. For investors aiming to make the most of ESG data, here are some practical tips:

Focus on ESG factors that are most relevant to each industry.

Use ratings from multiple providers to minimize bias.

Stay updated on regulatory changes that impact ESG reporting.

Evaluate both overall ESG scores and trends showing improvement.

The rapid growth of sustainable investing highlights its increasing importance in today’s financial landscape. As ESG data becomes more integrated with other alternative data sources, it offers a richer framework for making informed investment decisions.

Conclusion

Alternative data sources are reshaping how investment decisions are made, offering fresh perspectives that go beyond traditional metrics. By combining these tools with established methods, investors can gain a sharper understanding of market dynamics.

The demand for alternative data is on the rise. For instance, half of alternative investment managers plan to increase their budgets by 26-50%, while 20% foresee increases of up to 75% [3].

Here’s a quick look at how these seven alternative data sources contribute to modern investment analysis:

The alternative data market is set to expand further. To succeed, investors must strike a balance between traditional and alternative data while maintaining ethical practices [1][2]. Advances in machine learning, such as improved satellite imagery analysis and IoT data processing, are making these data sources even more impactful.

As the landscape evolves, staying updated on data innovations will be critical. Mastering these diverse data streams will be a key factor in building effective investment strategies for the future.