$7832 $NCBDY Bandai Namco Dragon Ball Launch | TickerTrends.io

The TickerTrends Social Arbitrage Hedge Fund is currently accepting capital. If you are interested in learning more send us an email admin@tickertrends.io . Join our Discord here for more discussion.

Ticker: 7832.T

Sector: Leisure

Share Price: ¥ 3,392

Market Cap: ¥ 2.219T

Business Intro:

BANDAI NAMCO Holdings Inc. develops entertainment-related products and services worldwide. Its Toys and Hobby segment offers toys, capsule and candy toys, cards, confectionery, food, apparel, sundries, plastic models, figures, communications and peripheral equipment, consumer electronics, character-based products, pachinko and pachislot machines, medical and electronic-related equipment, playground equipment, bicycles, furniture, visual, RC and robot toys, molds, stationery, prizes, and other products.

This segment is also involved in the contract operations for inspecting and testing; and import and export of toys, etc. The company's Network Entertainment segment plans, develops, and distributes network content, as well as home video games, live events, machines, Internet-based online games, other software and services, amusement machines, etc.; and provides advertising, promotion, online video distribution and games platforms, communication and related tools, and shared services, as well as visual substrates.

Its Real Entertainment segment plans, produces, and sells amusement machines; plans and operates amusement facilities, etc.; and provides after-sales services and stocks and sells pre-owned amusement machines and products. The company's Visual and Music Production segment offers visual and music content and package software, and audio engineering services; conducts live entertainment operations; plans and produces animation; manages affiliated artists; operates fan clubs; produces visual products related to live performances, events, and music; plans, produces, and sells goods, tickets, etc.

Its IP Creation segment plans and produces animations, labels, events, etc., as well as music related to animations; manages and administers copyrights and other rights. The company was formerly known as NAMCO BANDAI Holdings, Inc. and changed its name to BANDAI NAMCO Holdings Inc. in June 2014. The company was founded in 2005 and is headquartered in Tokyo, Japan.

Alt Data:

Business Strategy:

Bandai Namco’s Business Strategy: A Diversified, Multi-Segment Approach to Global Growth

Bandai Namco, a global leader in entertainment, has crafted a business strategy centered around four key segments: Toys & Hobbies, IP Production, Amusement, and Digital. This diversified approach allows the company to capitalize on its intellectual property (IP) assets, drive cross-segment synergies, and adapt to ever-evolving market conditions. By leveraging its strong portfolio of globally recognized IPs, Bandai Namco has built a resilient business model that captures value across both physical and digital domains.

1. Toys & Hobbies Segment:

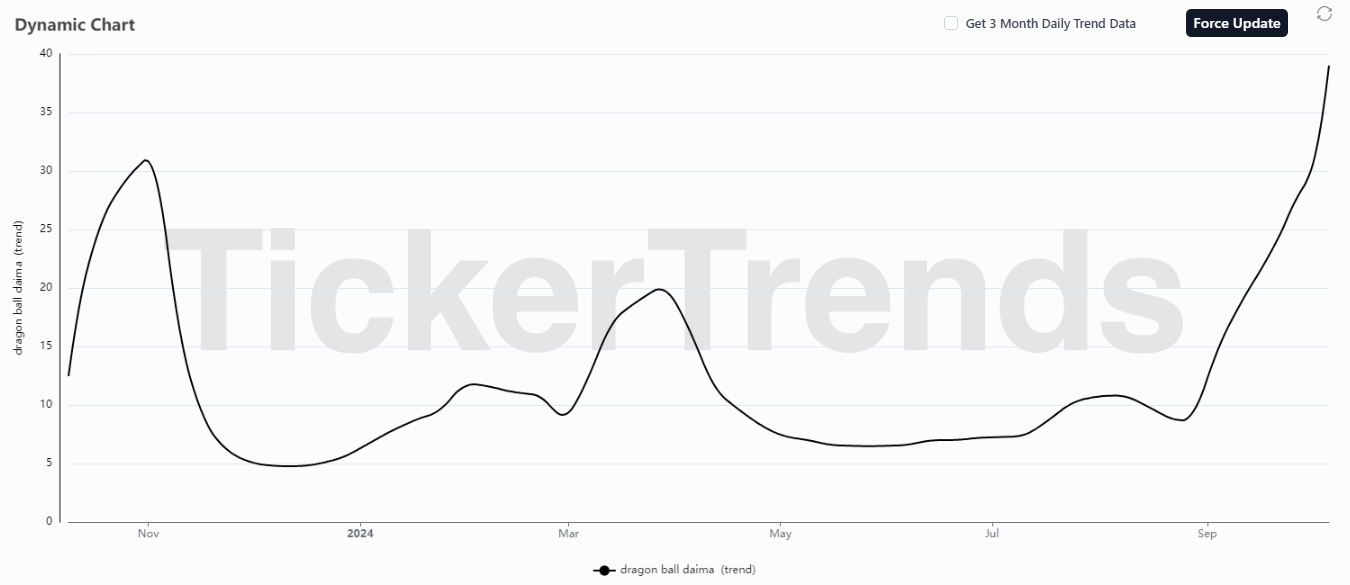

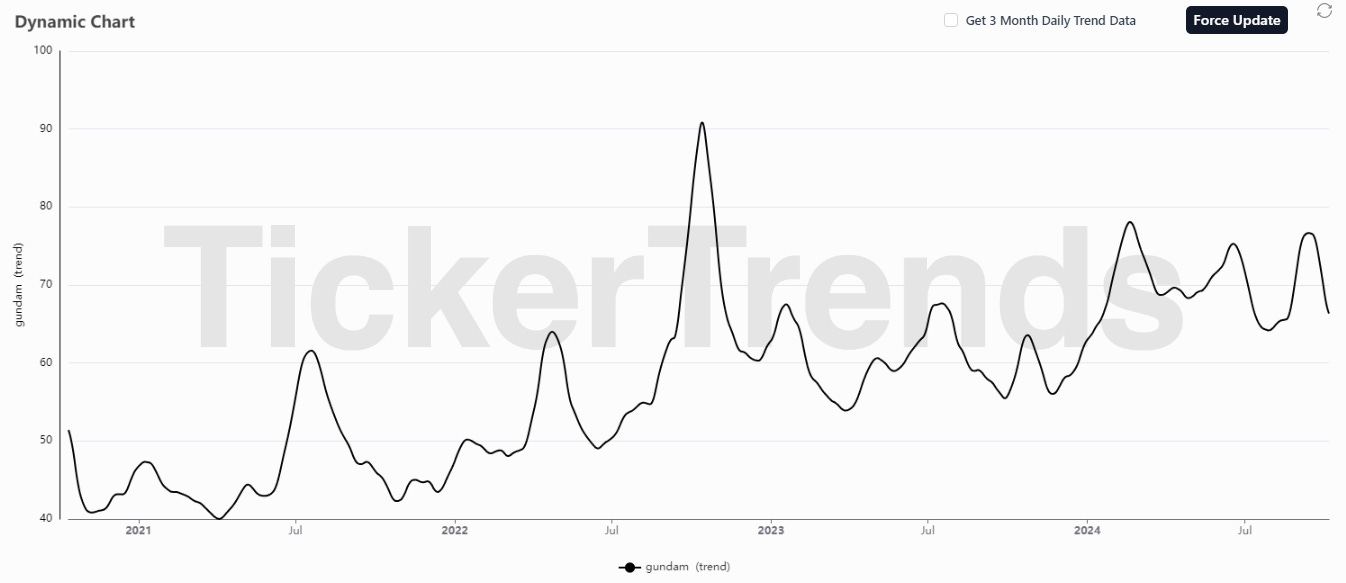

The Toys & Hobbies segment remains the cornerstone of Bandai Namco’s business, consistently delivering robust financial results and record-high performances. A key pillar of the company’s strategy in this segment is its ability to harness the power of its iconic IPs, such as Gundam, Dragon Ball, and Kamen Rider, and seamlessly translate them into a variety of toy and hobby products. These include model kits, action figures, trading cards, and capsule toys, catering to both younger consumers and a rapidly growing base of mature collectors.

In fiscal year 2024, the segment achieved significant growth due to strong demand for products targeting adult fans, such as high-end model kits and collectible items. The company also saw impressive sales in other categories, including confectionery and capsule toys. This broad product offering allows Bandai Namco to continuously engage with its fan base, creating sustained demand across different demographics.

A major driver of the Toys & Hobbies segment is the global IP merchandising rollout strategy. Bandai Namco has placed a strong emphasis on expanding its presence outside of Japan, particularly in North America and China, where demand for Japanese IP-based products is surging. The company aims to raise its overseas sales ratio from 27.8% to 50% in the coming years, focusing on expanding product categories and launching more region-specific offerings. This international expansion is supported by PREMIUM BANDAI, the Group’s official e-commerce platform, which has amassed over 5.55 million members in Japan alone, with strong membership growth in overseas markets.

To support future growth, Bandai Namco is making strategic investments in manufacturing capacity. For example, the company is constructing an additional plant at the Bandai Hobby Center to meet rising global demand for its model kits. This investment reflects the company's commitment to maintaining a stable supply chain while enhancing its ability to scale production efficiently.

2. IP Production Segment:

The IP Production segment plays a pivotal role in Bandai Namco’s strategy, focusing on the development of visual works, music, and live events. The company has long recognized the immense potential of its extensive IP portfolio, especially anime franchises like Gundam, One Piece, and Dragon Ball. By creating compelling content that resonates with audiences globally, Bandai Namco can monetize its IPs through a wide array of revenue streams, including merchandise, games, licensing, and live experiences.

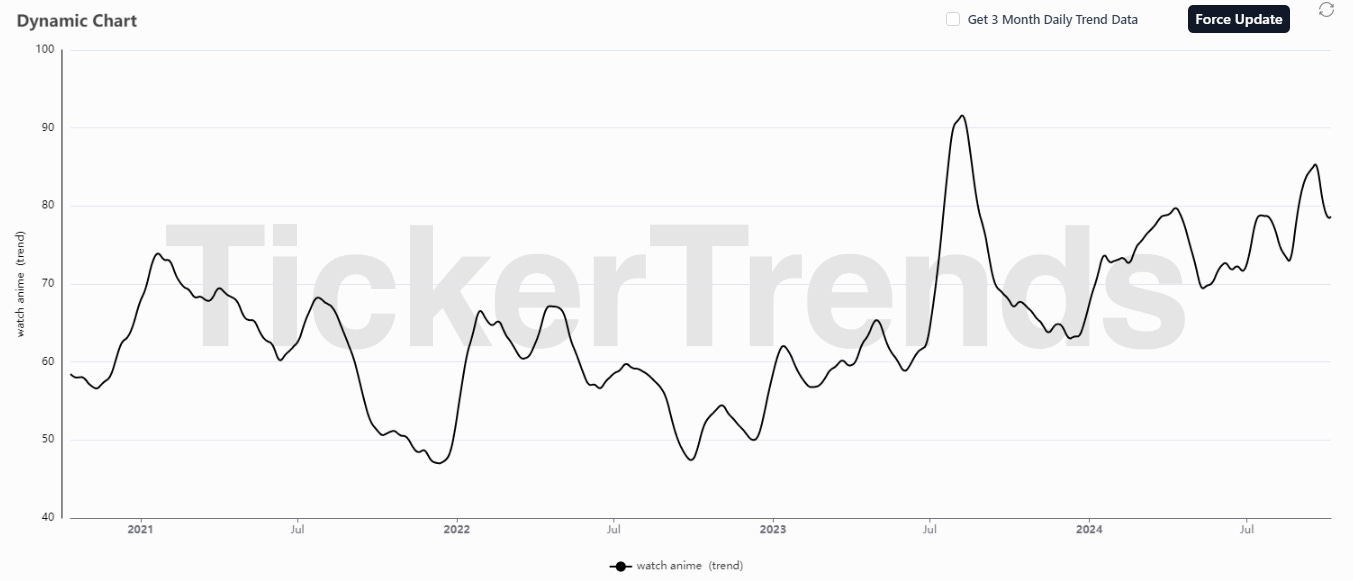

In fiscal year 2024, the company saw robust demand for its anime content, fueled in part by the rise of global streaming platforms like Netflix, which have broadened the international audience for Japanese animation. Bandai Namco capitalizes on this trend by licensing its IPs for various forms of media, including toys, video games, trading cards, and amusement machines.

The IP Production segment also focuses on live events, which have become a critical revenue driver. Bandai Namco is investing heavily in this area, with the construction of a state-of-the-art, 2,000-seat concert hall in Tokyo, slated for completion in 2026. This venue will serve as a platform for music performances and events centered around its IPs, contributing to the growth of the music and live event businesses. This strategic move demonstrates the company’s long-term commitment to building immersive experiences that further engage fans and expand its IP ecosystem.

The licensing business, a strength of Bandai Namco, is also being bolstered through strategic integration. By consolidating the licensing functions of various business units, the company aims to enhance collaboration and efficiency in monetizing its IPs across merchandise, TV, film, and streaming content.

3. Amusement Segment:

The Amusement segment is where Bandai Namco delivers tangible, physical entertainment experiences to its customers. This segment operates in two main areas: amusement facilities (arcades, amusement parks) and amusement machines (physical game machines). This segment has rebounded significantly after the challenges posed by the COVID-19 pandemic, as demand for out-of-home entertainment surged post-lockdown.

A key aspect of Bandai Namco’s strategy in the Amusement segment is its three-pronged approach of TRANSFORM, UNITE, and CONTROL. Under the TRANSFORM initiative, the company has focused on reorganizing its internal structure to enhance operational efficiency and innovation. Despite facing challenges such as labor shortages and limited opportunities to open new locations in Japan, Bandai Namco continues to optimize its existing operations while exploring new formats for amusement facilities.

The UNITE initiative emphasizes collaboration across the Group to integrate physical and digital experiences, maximizing the potential of its amusement machines and locations. As Bandai Namco seeks to expand its global footprint, it is leveraging its popular Japanese IPs to establish official Bandai Namco stores and amusement facilities worldwide. These physical touchpoints allow fans to engage directly with the company’s products and services, creating a deeper connection with its IPs.

The CONTROL strategy focuses on enhancing financial governance and management across the Amusement segment. By adopting stricter cash flow management practices, Bandai Namco ensures that its investments in amusement facilities and machines are optimized for long-term profitability. This strategic approach has helped the company weather market volatility while positioning it for sustainable growth in the amusement space.

4. Digital Segment:

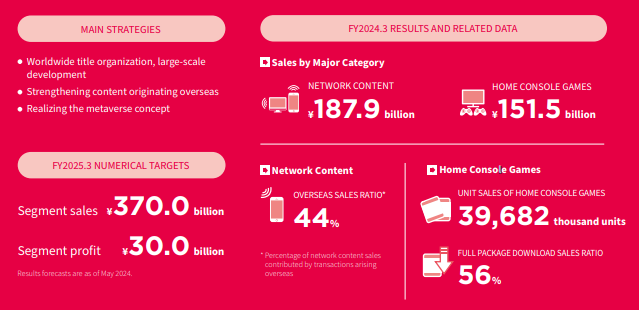

The Digital segment, which includes Bandai Namco’s gaming business, has historically been one of the company’s most lucrative units. However, in fiscal year 2024, the segment faced challenges due to valuation losses on new online games and the disposal of underperforming titles. This led to a temporary decline in profitability. Despite these setbacks, the company remains focused on rebuilding its Digital Business to ensure long-term growth.

Bandai Namco is strategically refocusing the Digital segment by emphasizing two core principles: high-quality content and long-lasting engagement. This approach is designed to create games that have a deep emotional connection with players and can sustain long-term popularity. Successful releases like TEKKEN 8 and the highly anticipated DLC for Elden Ring are examples of Bandai Namco’s ability to deliver global hits. These titles will be critical drivers of revenue growth in fiscal year 2025 and beyond.

One of the key challenges facing the Digital segment is the increasing development time and complexity of modern games. To address this, Bandai Namco is overhauling its title evaluation system, ensuring that new games are greenlit only when they meet stringent quality and marketability criteria. This strategic shift is intended to prevent future valuation losses and create a more robust game pipeline.

The company also plans to enhance its global marketing capabilities, particularly by fostering closer collaboration between its teams in Japan and North America. This will allow Bandai Namco to tailor its marketing strategies to different regions, ensuring that its games resonate with local audiences.