Alternative Data API Integration: Step-by-Step Guide

Alternative data APIs provide real-time insights, a competitive edge, and better risk management by pulling data from non-traditional sources like social media, geospatial data, and web scraping. They’re widely used in finance to predict trends, enhance trading strategies, and analyze ESG factors.

Key Benefits:

Real-time Trends: Understand consumer behavior instantly.

Diverse Data Sources: Access transactional, geospatial, and social data.

Improved Decision-Making: Spot opportunities and manage risks effectively.

How to Integrate:

Choose the Right API: Focus on data quality, reliability, cost, and security.

Set Up Access: Secure API keys and configure authentication.

Retrieve Data: Use tools like Python or Excel to process and analyze data.

Ensure Scalability: Plan for growth with caching and load balancing.

Maintain Compliance: Encrypt data and follow GDPR/CCPA rules.

Quick Comparison of Popular APIs:

Real-time/historical data on stocks, forex

Developers, analysts

Free/$

Institutional-grade analytics

Large organizations

$$$

Cloud-native, strong integration support

Real-time financial data

$$

Integrating alternative data APIs helps you make smarter, data-driven decisions in finance. Follow the steps above to get started and ensure your system is accurate, scalable, and secure.

What is Alternative Data and How is it Used?

Defining Alternative Data

Alternative data comes from non-conventional sources and provides insights into markets and consumer behavior that traditional data might miss. It helps uncover patterns and relationships, giving a broader understanding of market dynamics.

Key Sources of Alternative Data

Alternative data comes from a variety of sources, each offering unique market insights:

These sources can often be accessed via APIs, making it easier to integrate them into financial systems.

How Alternative Data is Used in Finance

In finance, alternative data adds depth to traditional analysis by incorporating less conventional but highly relevant insights. APIs for alternative data have become a key tool for enhancing financial workflows.

For example, quant funds use data from social media and news to predict how events might affect stock prices and adjust their trading strategies accordingly [2]. ESG (Environmental, Social, and Governance) investments also increasingly depend on alternative data to go beyond standard metrics, offering a richer perspective on sustainability and corporate responsibility.

As alternative data continues to grow in importance, understanding its sources and applications is crucial. Up next, we’ll delve into how to select the best API for your specific needs.

Top 5 APIs for Market and Alternative Data

How to Choose the Right Alternative Data API

Picking the right API for alternative data can feel overwhelming, but focusing on a few key factors will help ensure it fits your financial analysis needs.

Factors to Consider When Choosing an API

Examples of Commonly Used APIs

Here are a few popular options, each catering to different needs:

Alpha Vantage: Great for developers and analysts, offering real-time and historical data on equities, forex, and crypto [4].

Bloomberg Open API: Known for institutional-grade analytics, but its higher cost makes it more suitable for larger organizations [4].

Xignite: Focuses on cloud-native APIs for real-time financial data and provides strong technical support for integration.

Case Study: TickerTrends

A standout example is TickerTrends, which blends social media, web traffic, and consumer trend data into a single platform. Key features include:

Proprietary metrics like the Social Arbitrage Score.

Flexible access through both an API and a data terminal.

Affordable entry pricing starting at $19/month.

The API you choose will shape how effectively you can gather insights and improve financial outcomes. Once you've made your choice, the next step is integrating it into your workflow efficiently. Here's what to do next.

Discover Alternative Data Insights

Access comprehensive consumer data, track market trends, and gain actionable insights with TickerTrends' innovative data terminal and API services.

Steps to Integrate an Alternative Data API

Once you've chosen your API, it's time to get it up and running. Each step requires attention to detail to ensure smooth data flow and accurate analysis.

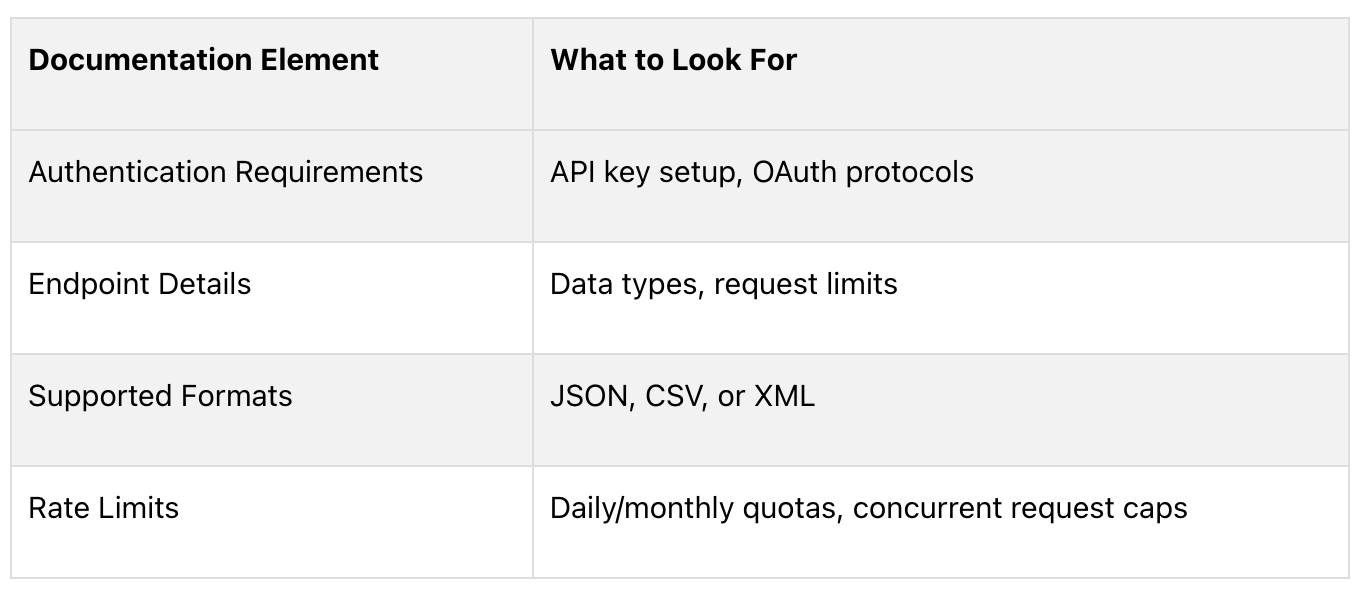

Step 1: Read the API Documentation

Start by thoroughly reviewing the API documentation. Pay attention to key elements like:

Understanding these details will help you set up secure and efficient access.

Step 2: Set Up API Access

Register for an account with the API provider. Once verified, generate your API keys via their developer portal. To secure your integration:

Configure access controls, such as IP whitelisting and user roles.

Store your API keys securely using environment variables or key management tools.

Never expose keys in your code or public repositories.

Step 3: Retrieve and Process Data

Handling alternative data correctly is critical. Here's an example of fetching sentiment data for a stock symbol:

# Fetch sentiment data for a specific stock symbol

import requests

import pandas as pd

def fetch_market_sentiment(api_key, symbol):

headers = {'Authorization': f'Bearer {api_key}'}

response = requests.get(

f'https://api.example.com/v1/sentiment/{symbol}',

headers=headers

)

return response.json()

Make sure to incorporate:

Error handling for failed requests.

Data type conversions to match your analysis needs.

Step 4: Use the Data in Analytical Tools

The final step is integrating the data into your analysis tools. Here are some common options:

"The rise of alternative data is closely linked to the influence of social media on financial markets, particularly in real-time sentiment analysis" [3]

With the data integrated, you can start generating insights to refine investment strategies and predict market trends. From here, focus on scaling your workflow while maintaining security and accuracy.

Tips for a Smooth API Integration

Once the technical integration is complete, it's crucial to ensure the system operates reliably, can handle growth, and remains secure over time.

Check Data Quality and Accuracy

Validating data is key to maintaining a reliable system. Use benchmarks and statistical tools to identify issues like missing timestamps, inconsistent formats, or incomplete data. Automating these checks can save time and reduce errors.

Here’s a quick breakdown of validation methods:

Using both real-time and batch validation ensures a thorough approach to data accuracy.

Plan for Scalability

To prepare for increasing data demands, incorporate tools like load balancing, caching, batch processing, and automated scaling. These strategies help maintain performance as your system grows.

Focus on Security and Compliance

Protecting data and meeting legal standards are non-negotiable. Implement measures like:

End-to-end encryption to safeguard sensitive information.

Role-based access control to limit data access.

Regulatory compliance with laws like GDPR and CCPA.

Regularly document your compliance efforts and consult legal experts to review and update your practices as needed. A secure and compliant system lays the groundwork for reliable and efficient API integration.

Summary of Key Points

Now that the technical integration is complete, the focus shifts to ensuring the system runs smoothly and consistently delivers useful insights. This section outlines the most important aspects of achieving a reliable API integration, covering everything from data accuracy to robust security measures.

Each step - starting with understanding API documentation and extending to implementing strong security protocols - lays the groundwork for a dependable and scalable system. Building on earlier advice, this section emphasizes three core areas: data quality, scalability, and security.

Key Priorities at a Glance

Integrating alternative data APIs has shown real-world benefits. For example, quantitative funds have used APIs like Dow Jones' to analyze how news events influence stock prices, leading to better predictive models [2]. As alternative data continues to grow, its use in areas like sentiment analysis and supply chain insights is expanding.

Steps to Ensure Long-Term Success

Performance Monitoring: Conduct regular performance reviews and set up automated error detection systems.

Data Validation: Use automated checks and statistical tests to maintain data accuracy.

Security Compliance: Keep encryption methods up to date and ensure adherence to data protection laws.

A well-integrated API system doesn’t just work - it provides consistent, actionable insights [1][2]. By focusing on these principles, investors and analysts can fully harness the power of alternative data APIs, leading to smarter, data-driven decisions.

FAQs

What is the best financial API?

The best financial API depends on what you need it for. Here's a quick breakdown of some top options:

Strong for algorithmic trading tools

Alpha Vantage

Easy-to-use interface, solid documentation

Bloomberg Open API

High-quality data and research tools

Fast streaming and rich historical data

Budget-friendly with a focus on research

Picking the right financial API is essential for analyzing market data effectively. Here are a few things to keep in mind:

Data Quality and Coverage

Look for APIs with reliable data validation and frequent updates.

Check if they offer extensive historical data.

Make sure the data format works with your systems.

Technical Considerations

Read the API documentation carefully to understand its features.

Check if it integrates well with your preferred programming languages and tools.

Ensure it can handle your growing data needs.

Cost and Support

Compare pricing plans to see what fits your budget.

Look into the quality of customer support and available developer resources.

To avoid surprises, try out a free tier or trial version before committing. This way, you can see how well the API fits your requirements and works with your existing tools.