Alternative Financial Data Case Study: Outperforming Markets with TickerTrends' Social Data

The TickerTrends Social Arbitrage Hedge Fund is currently accepting capital. If you are interested in learning more send us an email admin@tickertrends.io

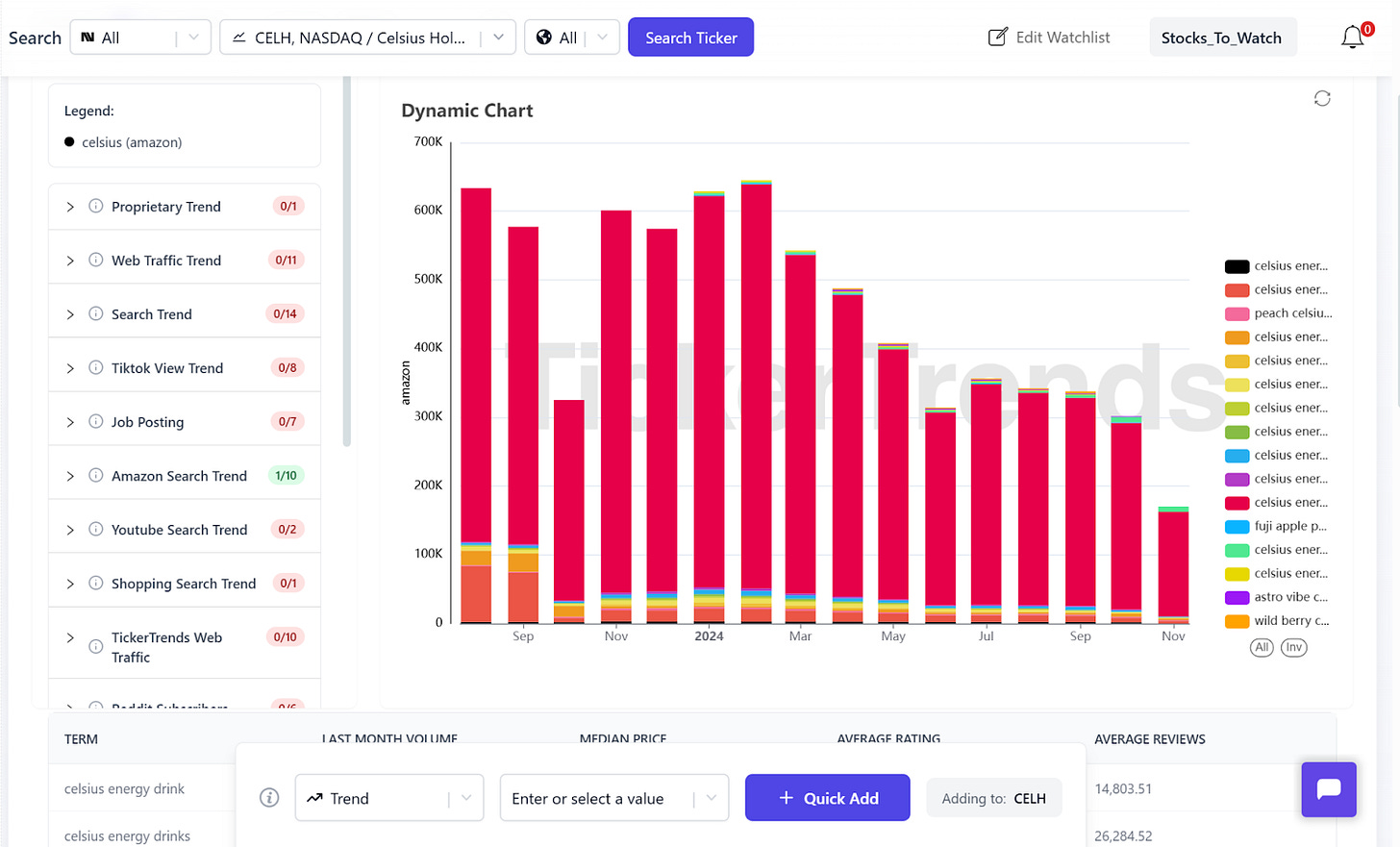

In today’s fast-paced markets, social and alternative financial data has emerged as a critical edge for investors. For those tuned into TickerTrends’ real-time signals, the signs of Celsius Holdings (CELH) slowdown were clear well before the stock decline. While traditional analysis lagged, investors leveraging our platform had the data-backed insights to act decisively.

The Early Warning Signs

TickerTrends' platform identified several key indicators of declining momentum for Celsius, the popular energy drink brand before the stock price decline. By analyzing real-time consumer behavior through Celsius Google Trends decline, Amazon search data, website traffic, and social media metrics, our clients spotted the shift before it reflected in the stock price.

1. Google Search Slowdown

Key search terms for Celsius products began to decelerate significantly:

"Celsius flavors"

"Celsius drink"

"Celsius caffeine"

Search trends, which had previously surged through spring and early summer, showed clear signs of stagnation. Historically, Celsius Google Trends decline has been a leading indicator for consumer demand. For Celsius, this sudden shift pointed to a softening interest in their products.

2. Amazon Search Volume Data

Amazon search volume, a direct proxy for purchase intent, also began to slow down. While Celsius had previously seen impressive growth in searches for its core flavors, this trend reversed, signaling weakening consumer demand in the e-commerce channel. Investors tracking Celsius Amazon sales trends spotted this early.

3. Celsius Website Traffic Decline

Website traffic, another crucial data point tracked on TickerTrends, underperformed expectations. Historically, summer has been a strong seasonal period for Celsius as consumers seek refreshing drinks, but Celsius website traffic decline failed to match the usual uptick. This suggested that both brand engagement and purchasing momentum were faltering.

4. Shopping Search Growth Underperformed

E-commerce search trends are often a direct indicator of consumer demand and brand health, especially for consumer-facing companies. For Celsius, shopping-related search growth underperformed the typical summer (August timeframe) seasonality. While previous years experienced a strong boost in search activity during the summer months, 2024's trends were noticeably weaker, signaling another red flag for investors tracking a potential slowdown in Celsius' consumer demand and brand engagement.

5. YouTube Search Interest Slowed

Search interest for Celsius-related YouTube content, a key source of organic marketing and brand discovery, also failed to exhibit the typical summer seasonality. This slowdown in searches for reviews, flavor comparisons, and influencer content hinted at waning buzz and consumer enthusiasm around the product.

6. TikTok Viewership Peaked

TikTok hashtag viewership for Celsius continues to grow at a high percentage, reflecting strong consumer engagement with the brand. However, the rate of growth is slowing, signaling a maturing audience and market saturation as more brands and creators flood the platform. This growing saturation may dilute overall visibility and limit Celsius’ ability to sustain the same level of impact moving forward, raising concerns for investors monitoring the brand’s social media momentum and dominance.

The Competitive Edge for Investors

While traditional analysts were slow to downgrade expectations for Celsius, TickerTrends users were already informed. Armed with these leading indicators: Alternative data investors exited their positions or shorted the stock early. Any Quant Trader, Retail Investor, or Institutional Investor would have benefitted from this information.

TickerTrends’ social data gave clients a massive edge in anticipating the stock’s decline. This case study highlights how Celsius alternative data research—when applied correctly—can outperform traditional analysis and deliver actionable insights ahead of the market.

Get Started with TickerTrends

Institutions: Reach out to receive a product demo here: https://tickertrends.io/contact-admin

Retail Investors: Sign up for real-time insights: https://tickertrends.io/register

Developers: Explore our API to integrate alternative data into your trading models: https://tickertrends.io/api-service

Research Access: Stay ahead with our exclusive alternative data research reports and first dibs on actionable insights:

Accredited Investors: No time for manual research? Invest directly in our fund: https://tickertrends.io/fund

The Bottom Line

Celsius' slowdown is just one example of how TickerTrends' platform empowers investors to make smarter, faster decisions using social and alternative financial data. Don’t rely solely on outdated tools—join the future of investing today.