American Eagle’s ($AEO) Brand Surge: Sydney Sweeney Controversy, Trump, and a Data Spike

American Eagle Surges in Online Engagement After Controversial Campaign, Defying Backlash Expectations

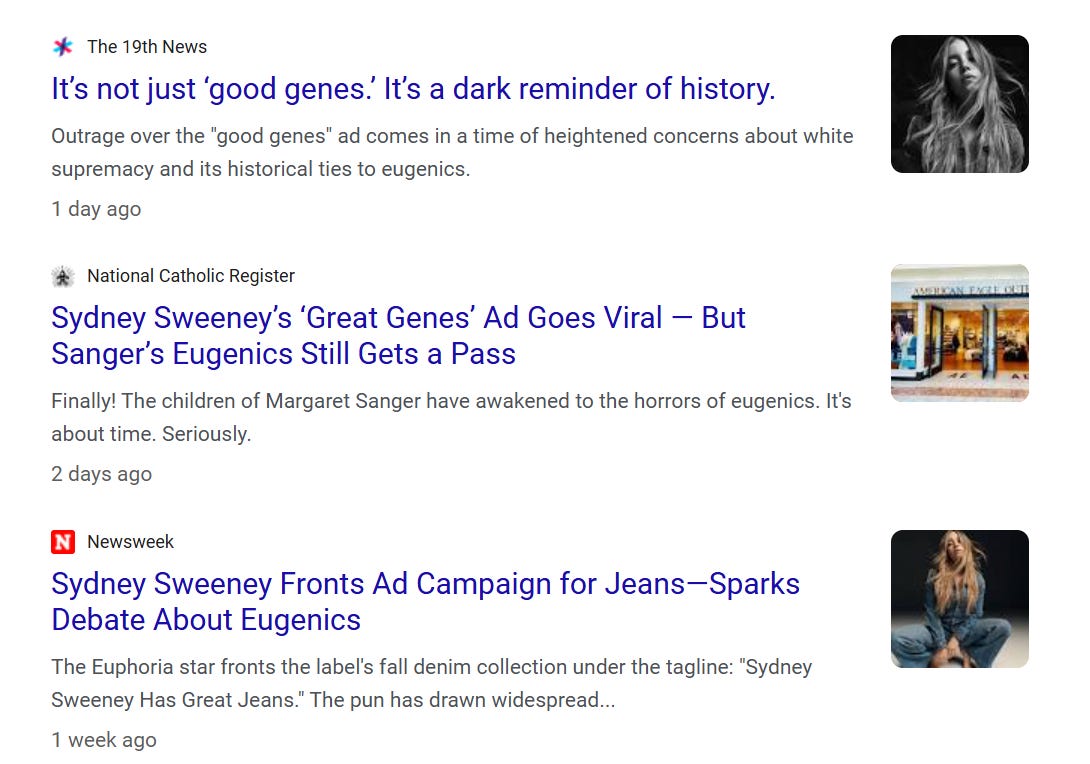

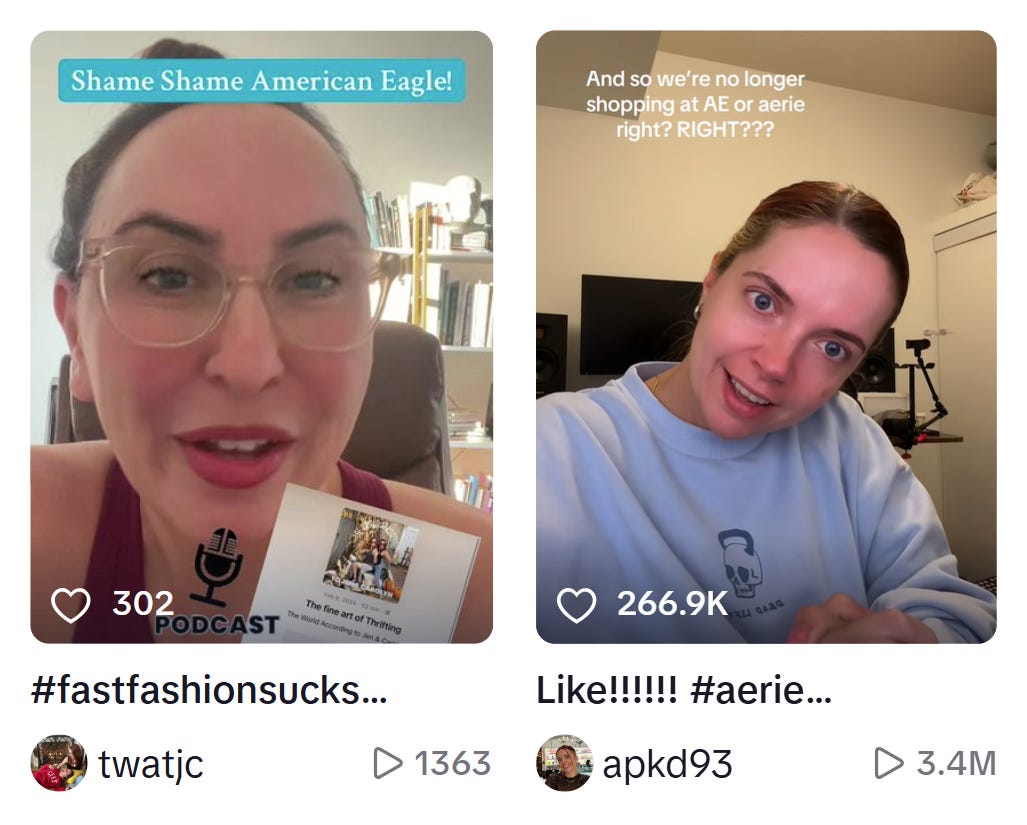

American Eagle is having a moment. The launch of its Sydney Sweeney jeans campaign stirred up controversy online, with some social media users criticizing the ad’s aesthetics, accusing it of having eugenic undertones.

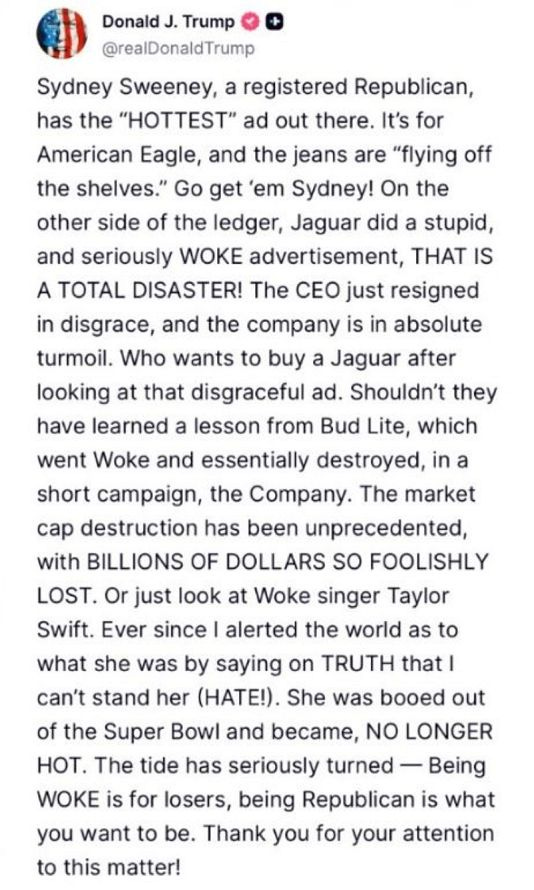

But that controversy didn’t stay confined to the internet. President Donald Trump entered the conversation, voicing strong support for the campaign and praising the brand’s direction.

This kind of spotlight can be risky for consumer brands, especially those with a predominantly female customer base. According to Pew Research, women tend to lean more Democratic than men, with 51% identifying or leaning Democratic compared to 41% Republican.

This voter ratio may alienate some of the core customer base… but the early signals from alternative data suggest American Eagle might actually unexpectedly benefit from the attention.

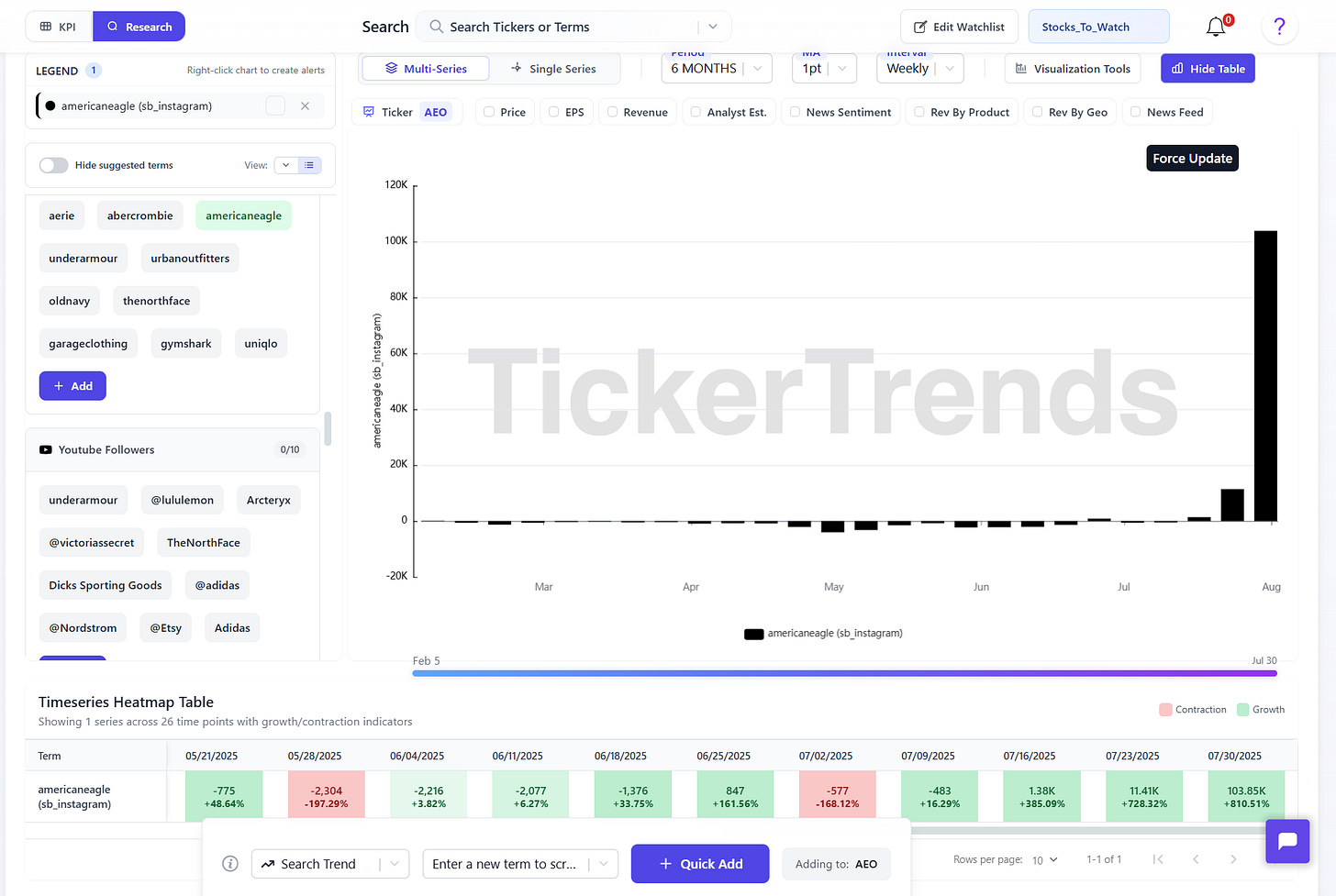

Let’s start with Instagram (@americaneagle account). The brand normally adds about ~300 followers per week (4 week average pre-controversy, however gained ~115,000 followers just in the 2 week period.

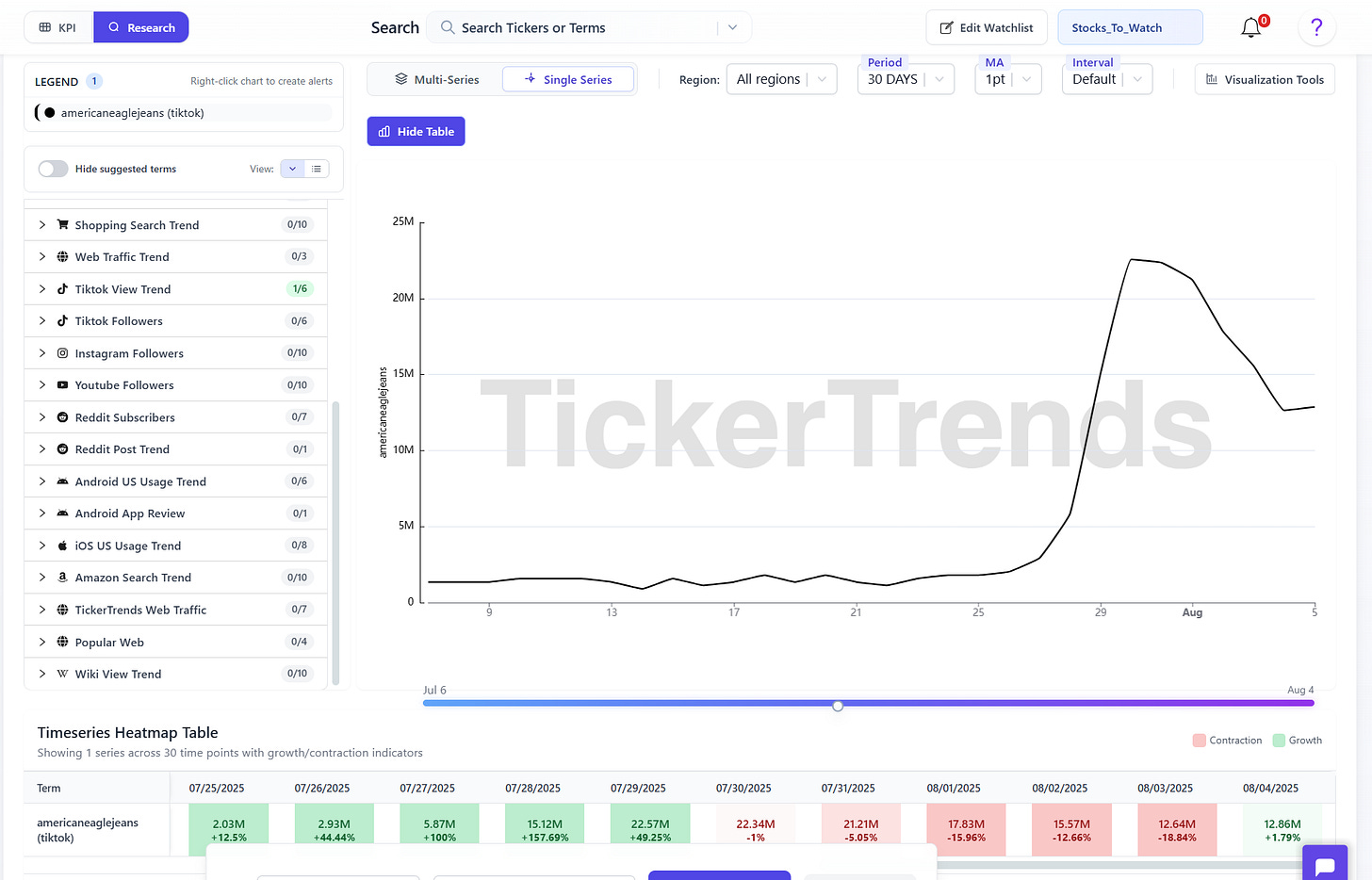

That kind of follower spike usually reflects real engagement, especially when the baseline social presence of this has been stagnant. On TikTok, hashtag activity for “#americaneaglejeans” has spiked sharply over the past month from ~1M to over ~20M impressions per day on the late July peak, mirroring the rise in broader social conversation around the brand.

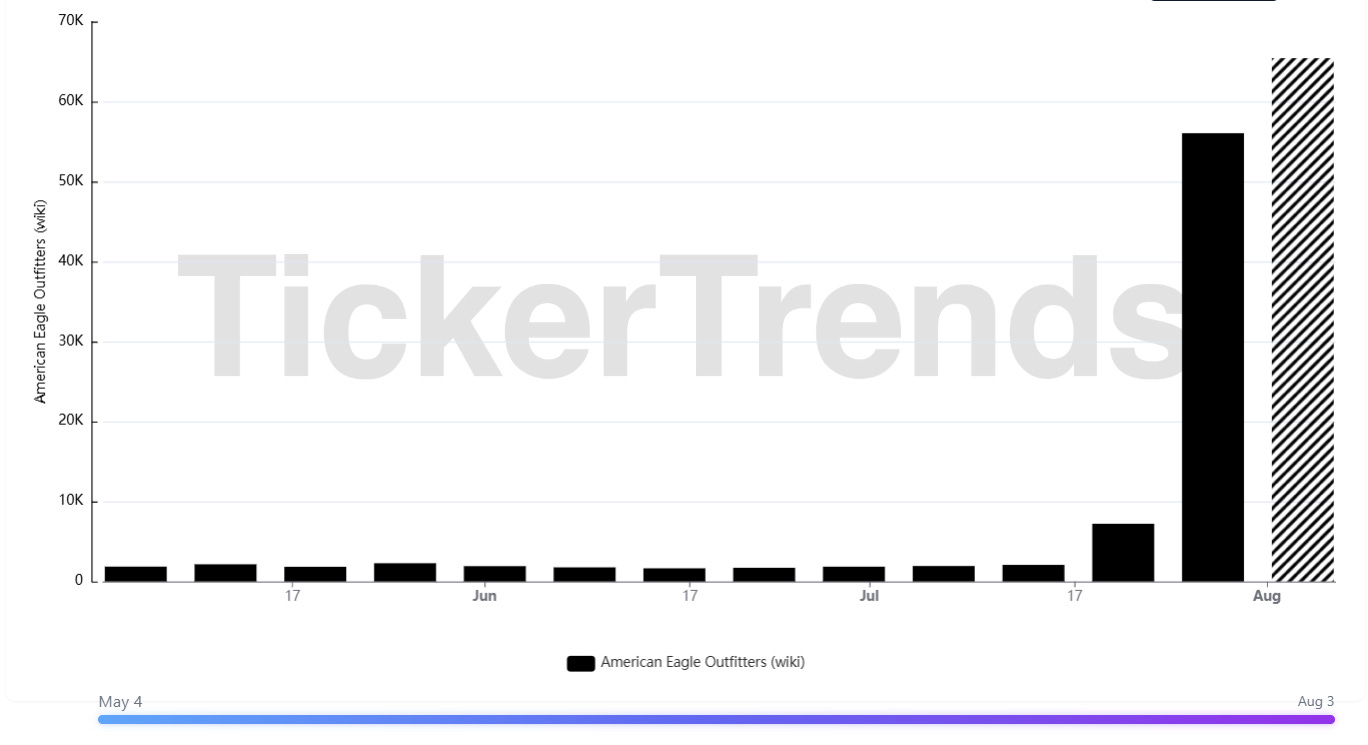

Wikipedia page views also spiked from a typical ~1,500 page views per to ~55,000+ in the last 2 weeks.

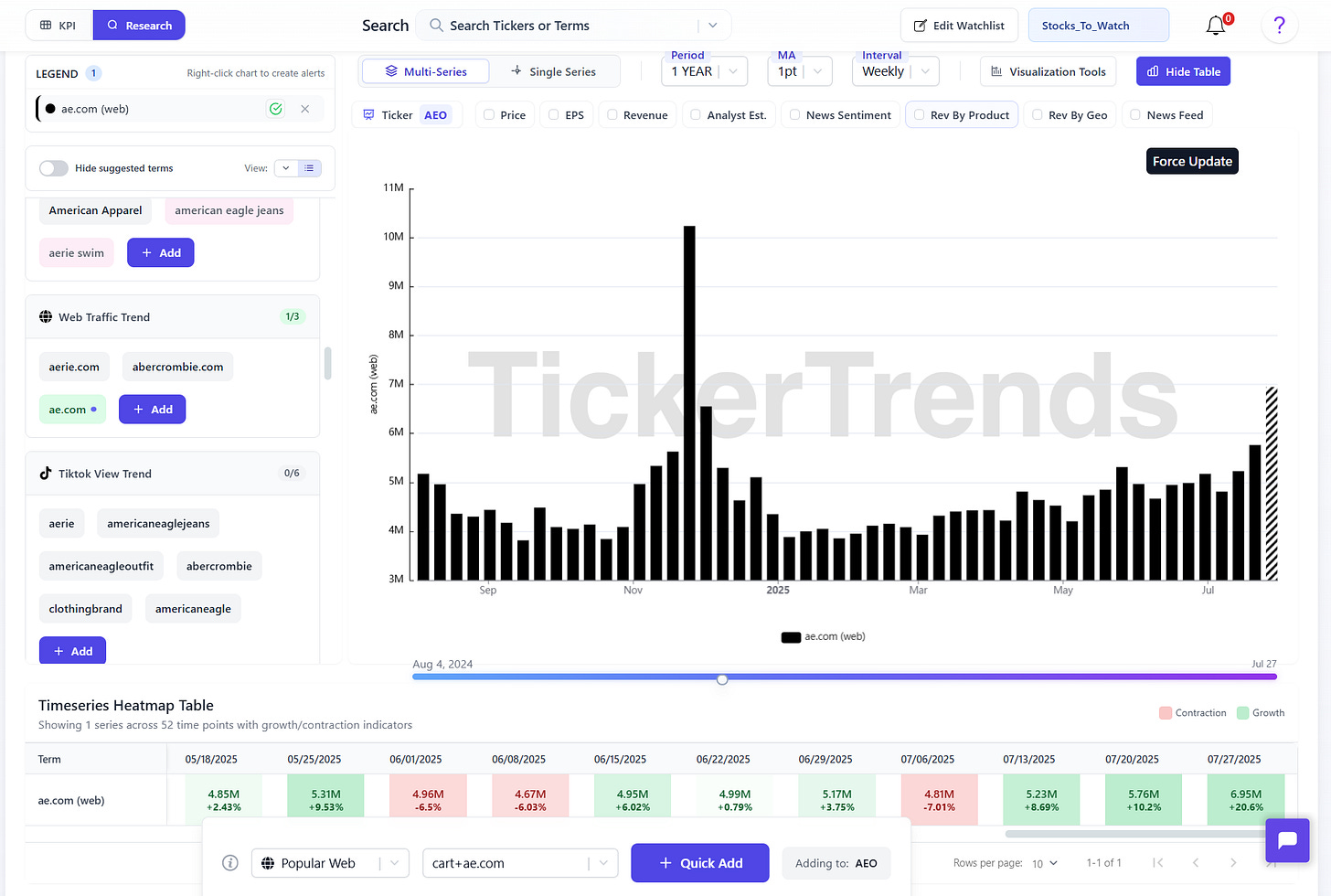

Website traffic is also picking up. Over the past few weeks, ae.com has averaged roughly 1,500,000 more visits per week than the same period last year.

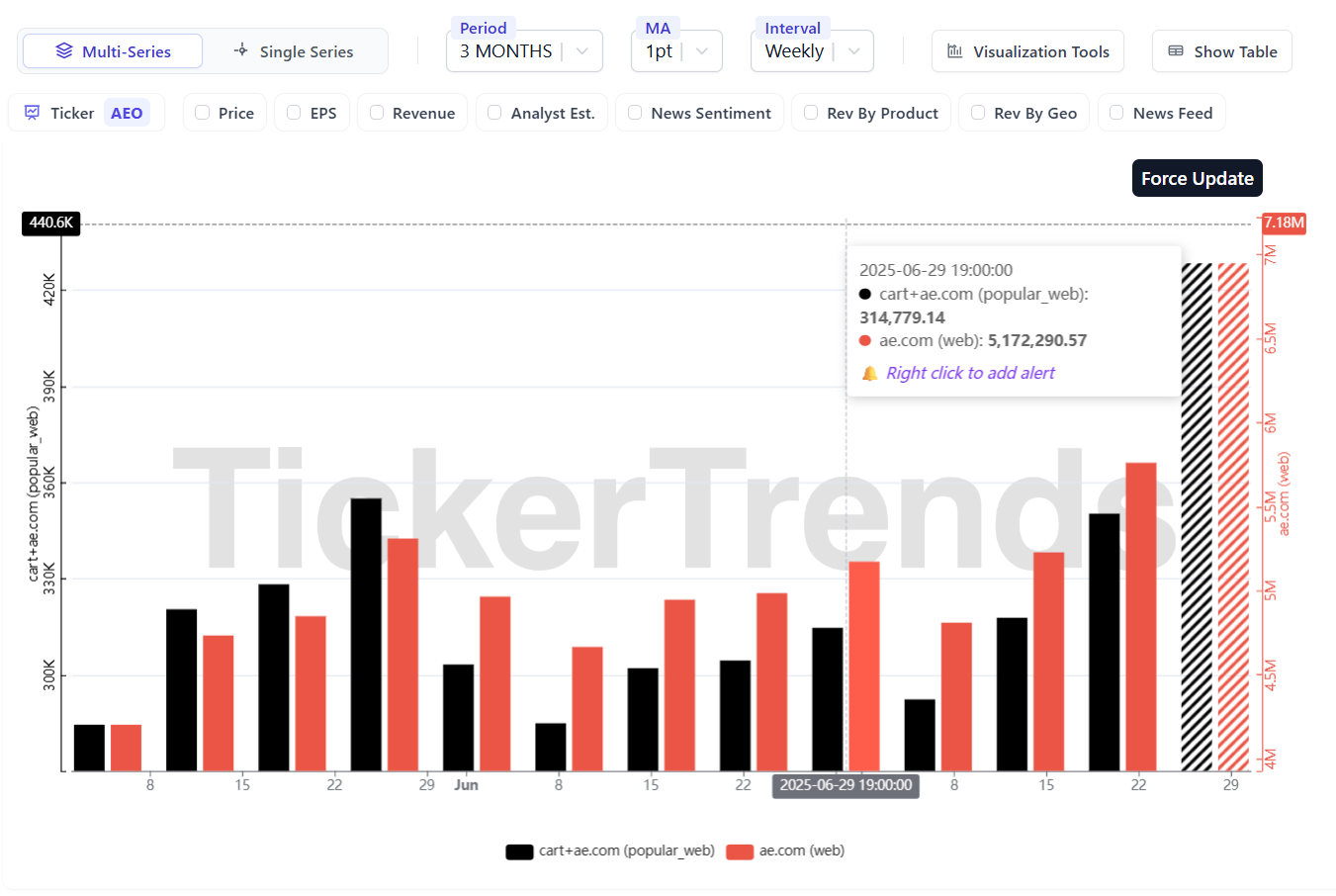

That’s not just noise. The conversion path is improving too. The percentage of users landing on the /cart page relative to total homepage visits is inline with typical ratios it has been at.

Above, we add up total visits for each week to “ae.com” and “ae.com/cart. We will define the “conversion rate” as week ended /cart value divided by the main ae.com website domain. We get the following numbers:

Week ended 6/29/2025: 6.09%

Week ended 7/06/2025: 6.08%

Week ended 7/13/2025: 6.08%

Week ended 7/20/2025: 6.08%

Week ended 7/27/2025: 6.16%

This shows that users navigating to the cart page of the website is within normal ranges despite the controversy, a great sign for the brand that buyers coming on the website are serious about buying clothes.

Overall, we think despite the controversy, AEO 0.00%↑ may benefit rather than get hurt based on previous brand controversies at this scale such as Duolingo or Bud Light given the brand interest shown above. As an example, Duolingo recently faced a lot of controversy after AI-first initiatives the company’s CEO announced on LinkedIn. Many users were very disappointed with content that seemed AI-based and jaded in-app story lines compared to the fun, original content they had gotten used to on the Duolingo platform. That directly led to follower backlash and users unfollowing “@duolingo” Instagram and TikTok accounts.

April and May both showed negative follower growth: -300K and 0K on TikTok, -65K and -33K on Instagram respectively.

But in this case, American Eagle’s follower count is rising. That’s typically a sign that new audiences are being pulled into the brand’s orbit rather than turned off by controversy. Or rather, it is a sign that more interest is being gained than lost very different from Duolingo which lost followers in its controversy.

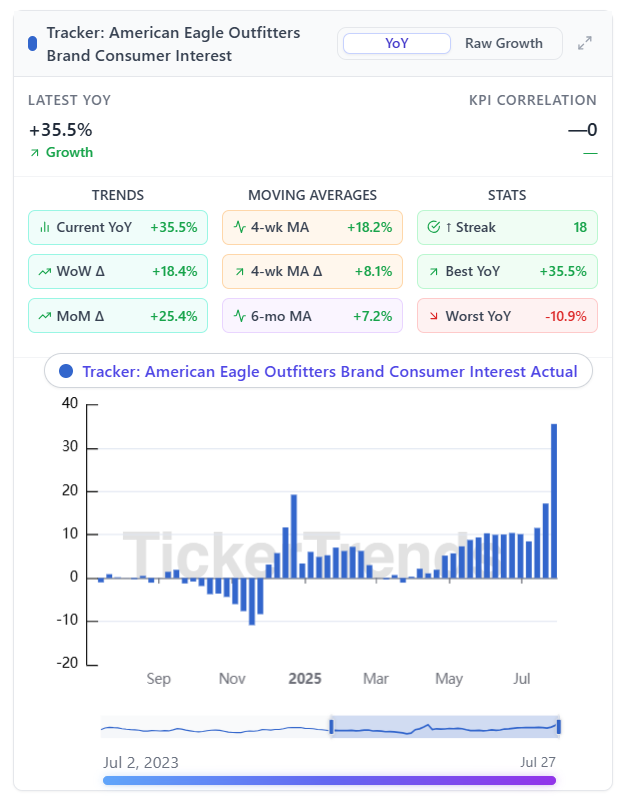

The bigger question is whether this attention sustains or fades. If American Eagle can turn this short-term spotlight into longer-term product engagement and repeat traffic, this could mark an inflection point in the brand’s momentum. Retail is often about capturing cultural relevance at the right time. Right now, the data suggests American Eagle has done just that. Our TickerTrends American Eagle Outfitters Brand Tracker currently shows a +35% YoY increase in consumer interest so far!

We’ll be watching the alternative data closely to see if this turns into a sustained boost in consumer interest or if the moment slips away.

Please email admin@tickertrends.io to gain access to our entire KPI dashboard which includes coverage of over 200 unique KPIs available on TickerTrends Enterprise: https://tickertrends.io/enterprise