Battlefield 6 Is Powering EA's Turnaround

Why Battlefield 6’s Record-Breaking Hype Could Push EA’s Bookings Past $8B for the First Time in Years

Battlefield 6 is generating a level of attention that rivals industry leader Call of Duty. Our real-time trackers show Battlefield-related search interest is hitting new highs, well above previous franchise peaks.

That kind of surging engagement often prefigures strong launch revenue, and here’s why we think this one could deliver.

Why the Buzz Matters

Record-Shattering Beta Numbers

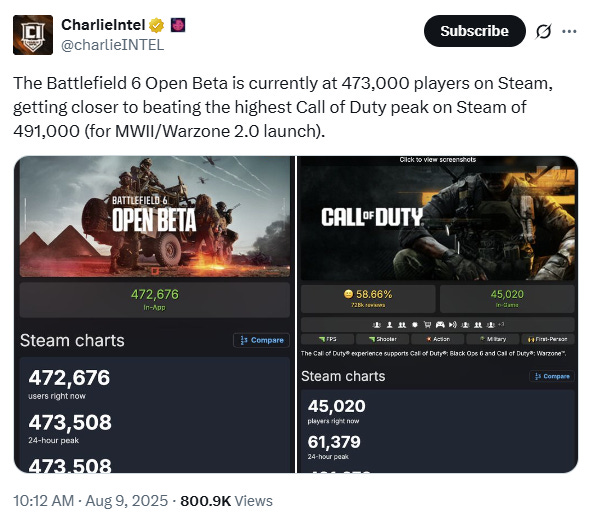

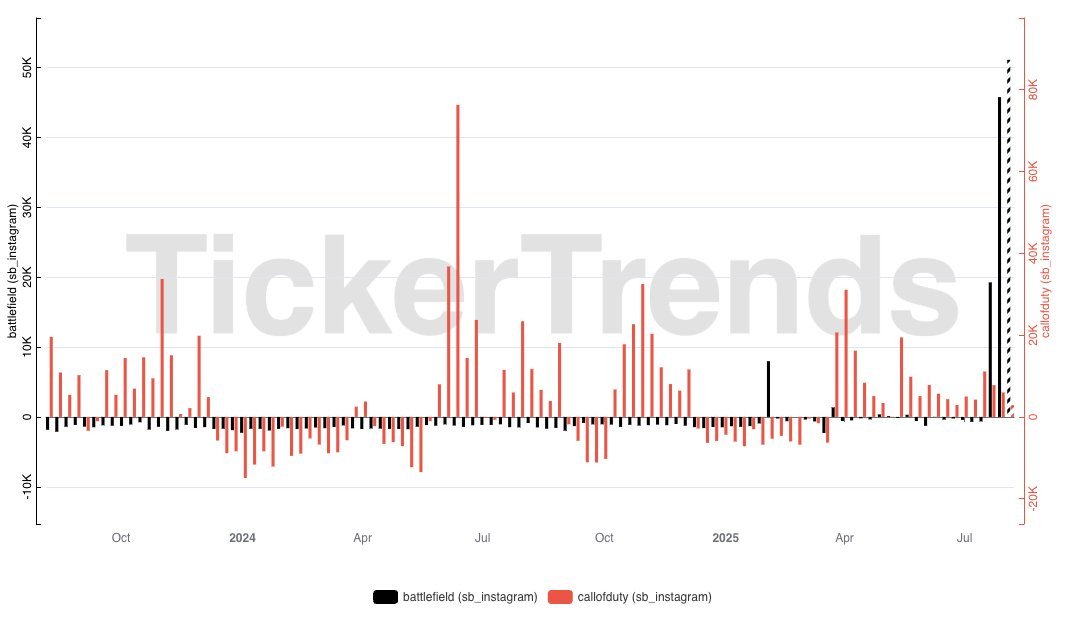

The open beta for Battlefield 6 set new industry records by topping 516,000 concurrent players on Steam, overtaking Call of Duty’s previous record.Battlefield 6 is currently nearing Call Of Duty Black Ops 6 launch in Instagram follower growth. For context, Black Ops 6 was the largest Call Of Duty launch of all time. We saw the “@battlefield” Instagram jump ~120k followers in the last three weeks compared to ~70k followers for “@callofduty” in the Call of Duty 6 launch three week period.

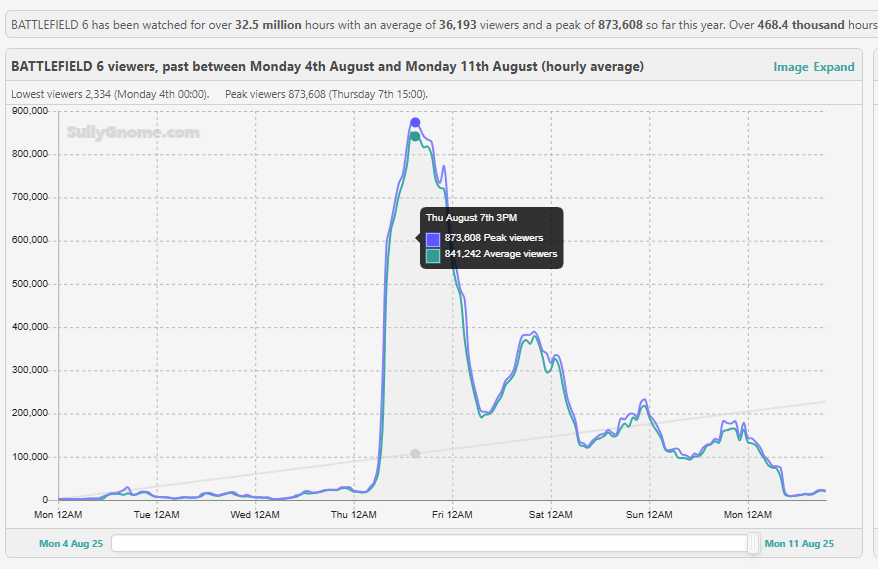

Twitch viewership also exploded, hitting ~873,000 or double the peak 346,000 seen during Battlefield 2042.

That level of digital demand is a strong early indicator for paid conversions when the full game drops.

Launch and Pricing Strategy in Check

EA confirmed that Battlefield 6 will not increase the standard edition price above $70, pushing back against the industry trend of $80 AAA titles. They are also releasing a $100 “Phantom Edition” with exclusive digital content, capturing both price-conscious and premium-tier buyers.Sales Strategy Linked to Earnings Outlook

EA CEO Andrew Wilson emphasized that Battlefield 6 marks a strategic shift for the company, stating, “This isn’t just a product. We’re really building out Battlefield as a platform.” He added that EA is “all in as a company” on the title, highlighting a multi-year investment with four development studios involved and a push toward live-service content and community engagement.

Battlefield Historical Sales and Release Context

2011 – Battlefield 3

Estimated first-year sales: ~15 million

Estimated first-week sales: ~5 million

Notes: Major commercial hit with strong multiplayer adoption.

2013 – Battlefield 4

Estimated first-year sales: ~7 million

Estimated first-week sales: ~3 million

Notes: Solid launch but mixed reviews due to bugs; strong long-tail sales.

2015 – Battlefield Hardline

Estimated first-year sales: ~4 million

Estimated first-week sales: ~1.5 million

Notes: Spin-off with a law enforcement theme; weaker reception.

2016 – Battlefield 1

Estimated first-year sales: ~15 million

Estimated first-week sales: ~3.5 million

Notes: Widely praised WWI setting with strong critical and commercial success.

2018 – Battlefield V

Estimated first-year sales: ~7.3 million

Estimated first-week sales: ~1.7 million

Notes: WWII setting; slower initial sales but steady engagement over time.

2021 – Battlefield 2042

Estimated first-year sales: ~4.2 million

Estimated first-week sales: ~1.5 million

Notes: Large-scale multiplayer focus; technical issues hurt early sales.

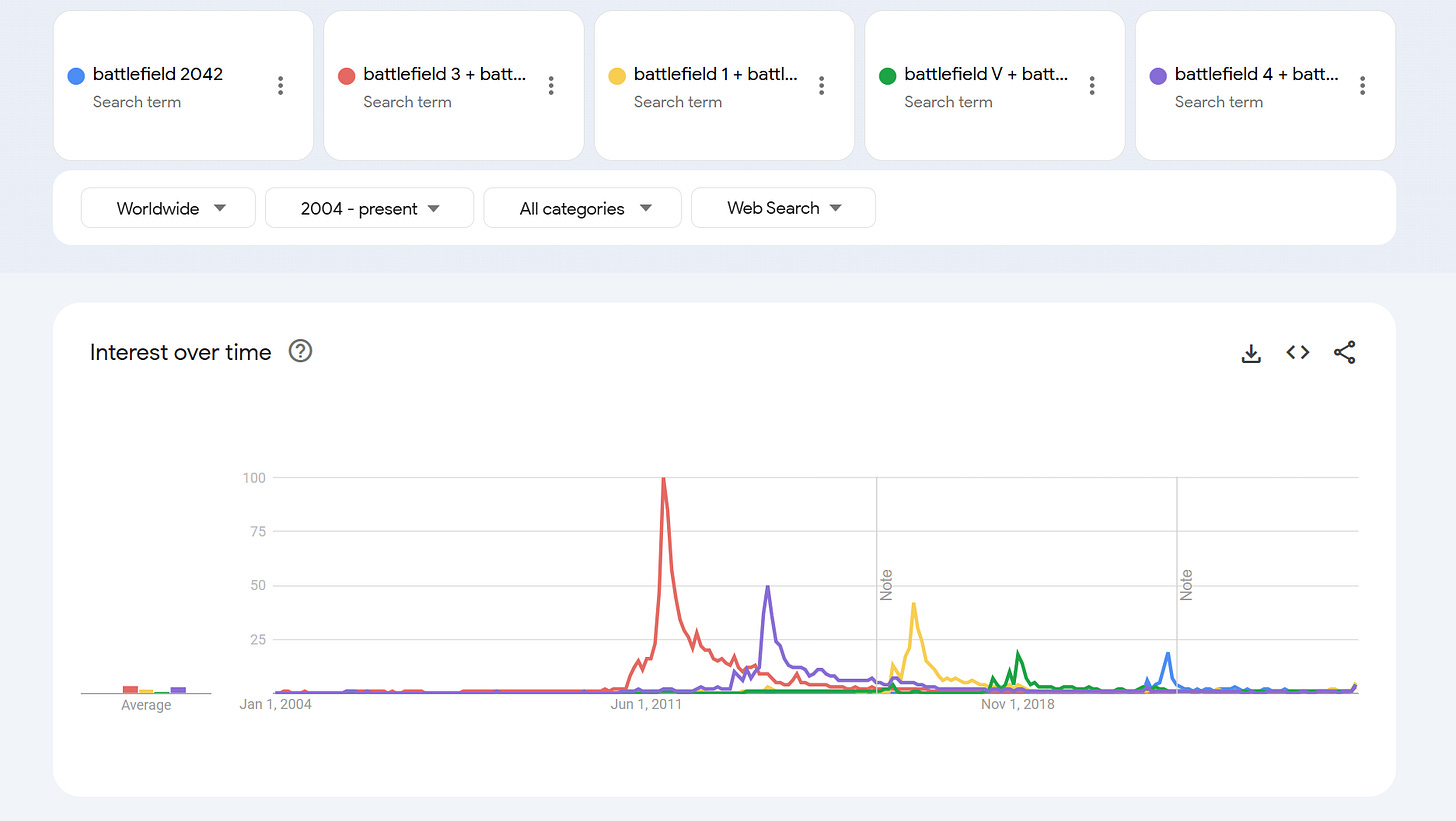

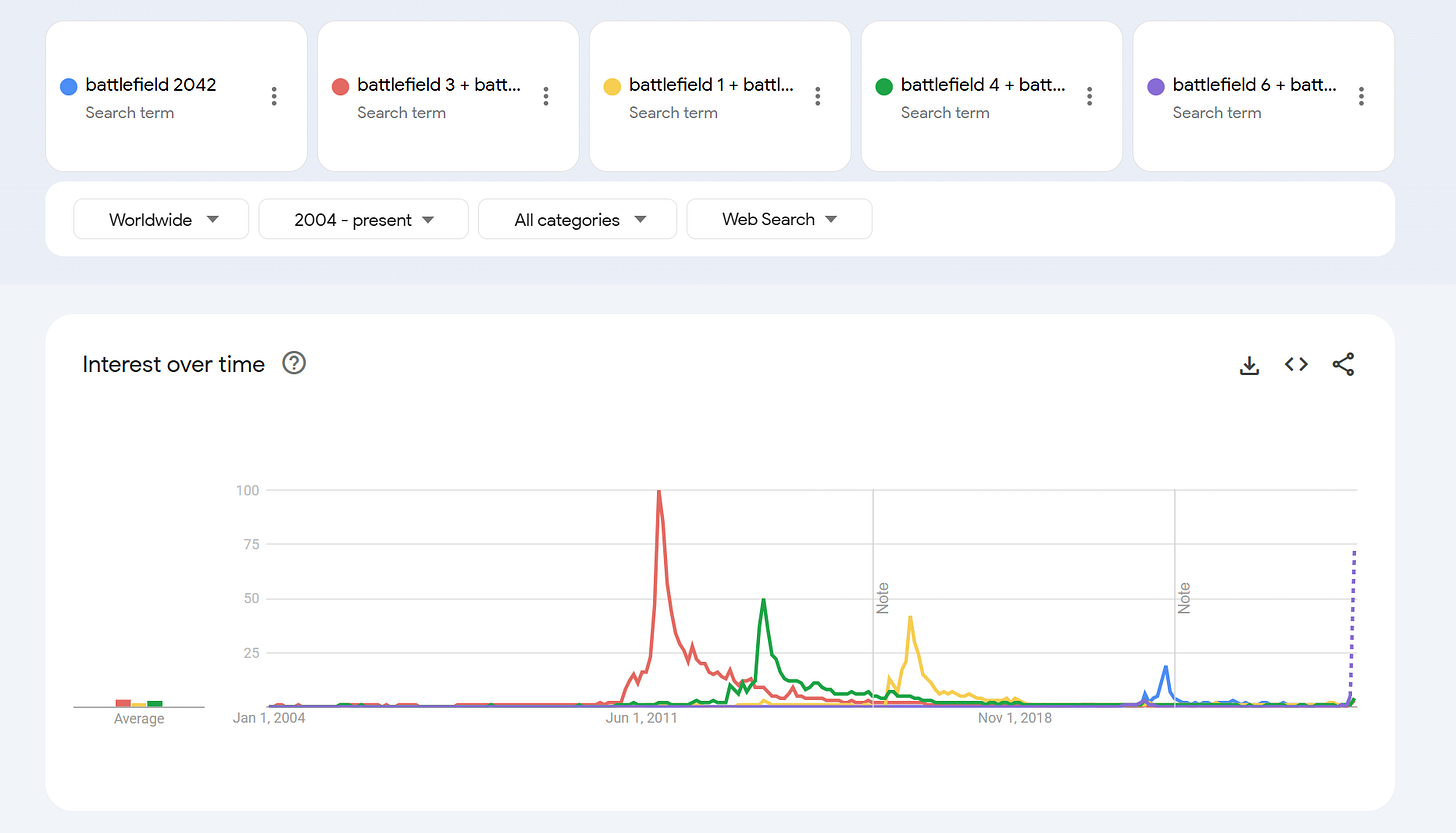

We see below that Google Search interest correlates strongly to the first week sales.

We group the Battlefield games into three distinct buckets of interest and choose relevant terms. E.g. “battlefield 1 + battlefield one” for Battlefield 1.

Battlefield 3: Highest peak —> ~5M copies in first week sales.

Battlefield 4 & Battlefield 1: Similar medium sized peaks —> ~3M copies in first week sales.

Battlefield V & Battlefield 2042: Weaker releases historically —> ~1.5M copies in first week sales.

Present day (Battlefield 6): On track to exceed Battlefield 1 & 4 levels. This would imply ~4M or so copies in potential first week sales on its October 10, 2025 release date if current trends hold.

Estimating Revenue Impact of Battlefield 6

Price Assumption: $70 per copy (standard edition, weighted average across platforms and regions)

First-Week Revenue:

4 million × $70 = $280 millionThis would already surpass Battlefield 2042’s first-month revenue, which was a disappointing release relative to other launches as seen above.

If Battlefield 6 matches Battlefield 1 & 4’s pace:

Full-year franchise revenue could land in the $800M–$1.0B range (including DLC, expansions, and live services).

This would be up significantly compared to years without a major Battlefield release. FY 2025 while not broken out by EA, saw very little Battlefield consumer search interest, this revenue is likely to be mostly all incremental.

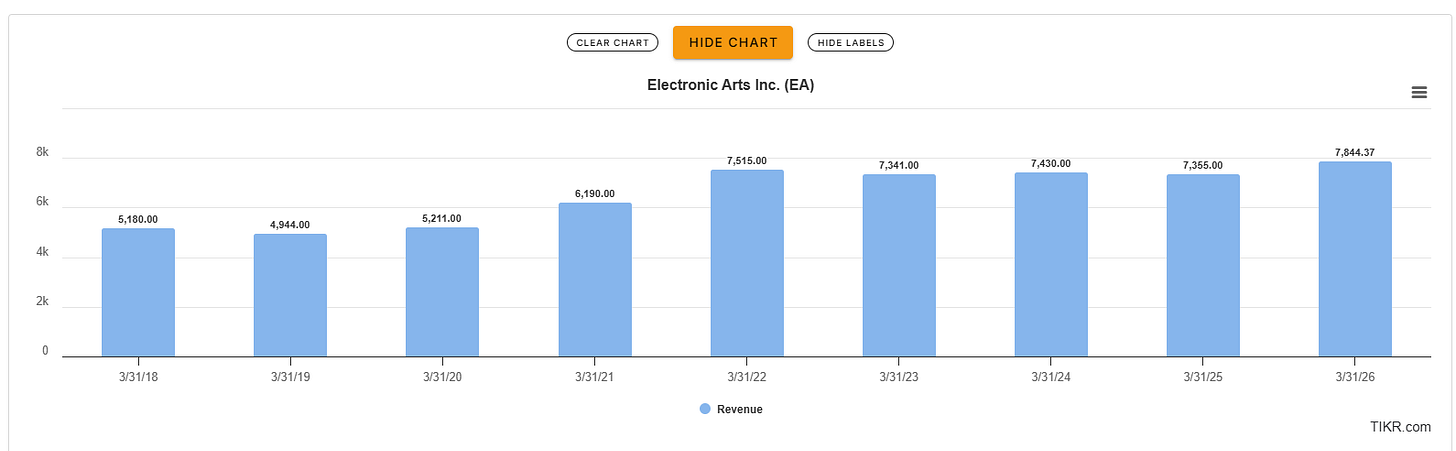

EA Revenue Context: What to Watch

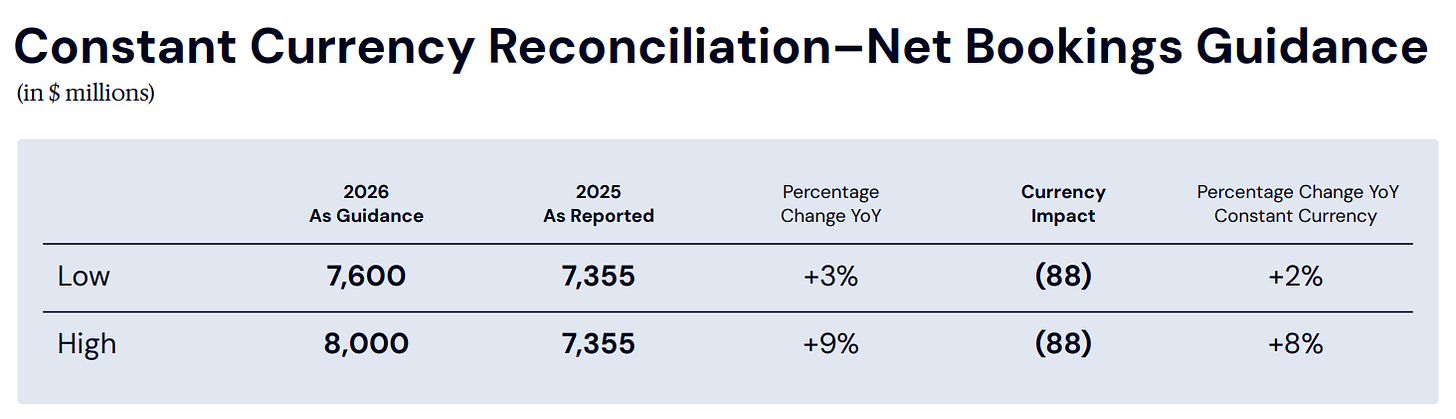

EA 0.00%↑’s FY2025 Net Bookings were $7.355 billion and the company is guiding to $7.6 billion to $8.0 billion.

There are a few main titles to watch that drive bookings for EA 0.00%↑, although exact by title revenue is not broken out. A good way to think about FY2026 revenue is the positive and negative contributions from each of the largest games they own to create an estimate. The viral and many times short lived nature of games creates booms and busts in specific titles, but since EA doesn’t breakdown revenue by title this is the best way.

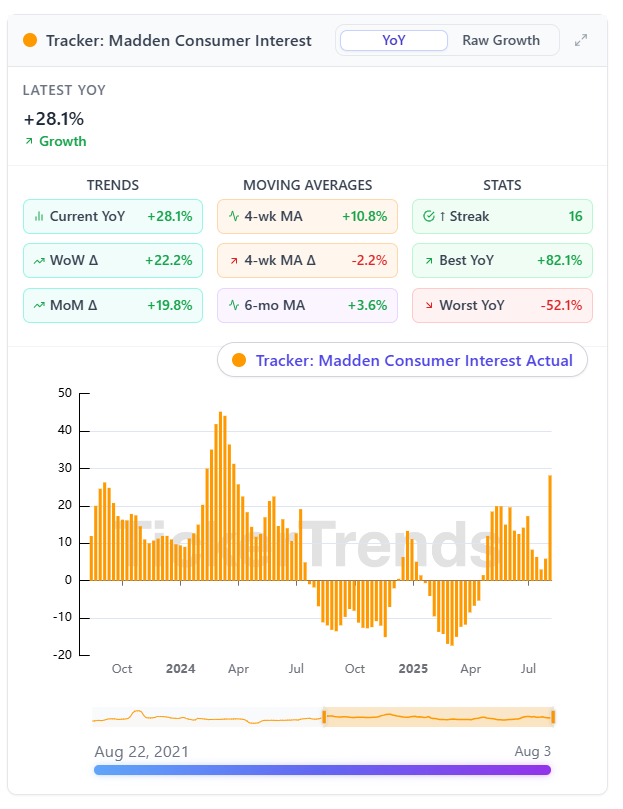

Madden Tracker

Tracking indicates flat to positive consumer interest compared to last year, with YoY growth of +28.1%. Madden remains a stable and dependable bookings contributor with consistent annual release momentum.

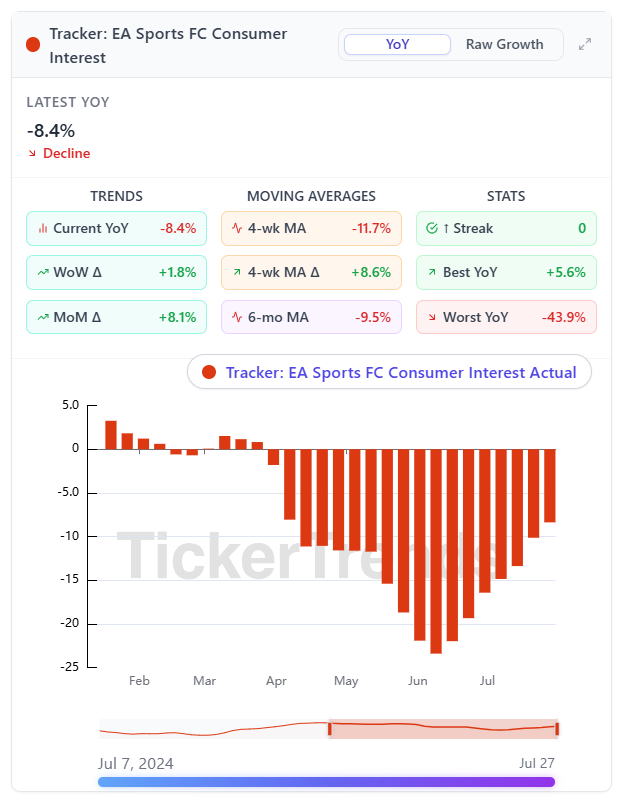

EA Sports FC Tracker

Tracking shows slightly weaker consumer interest compared to last summer, with YoY and moving average trends pointing to a mild decline. This suggests bookings from EA Sports FC could underperform versus last year’s launch cycle.

However, when you add up the Google Trends values for these franchises collectively, we see stability overall. We can assume these franchises will have a neutral contribution to bookings as a result, so for now the $7.355 billion number from last year stays intact.

EA College Football Tracker

Tracking shows a drop in interest compared to the massive launch spike in 2024. This will likely create a bookings headwind in FY2026 as last year’s release contributed strongly to results.

In FY2025, EA College Football significantly aided the company’s number to the tune of roughly ~400M-450M according to an analyst at Baird. We see a strong decline this year in our tracker compared to the hype last year.

We can pencil in a fall to potentially $100M -150M in this FY2026, representing a 300M decline.

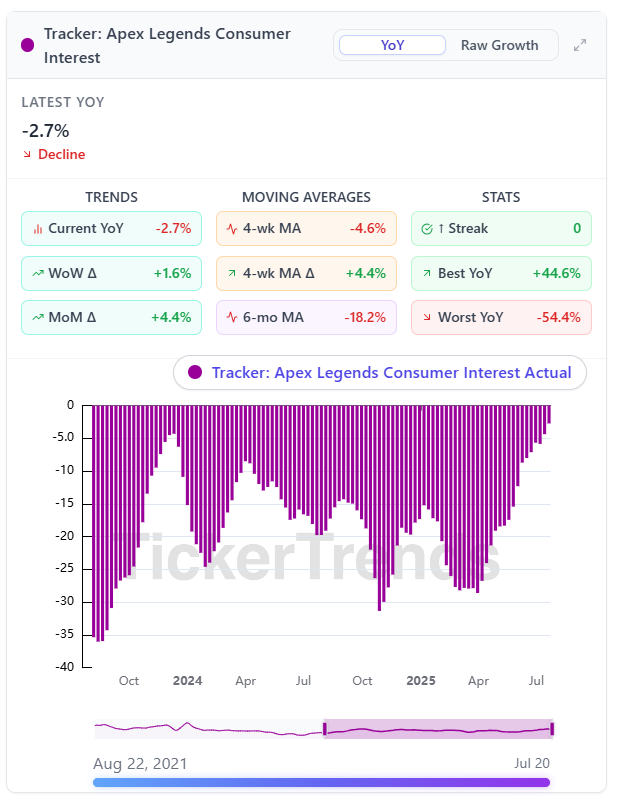

Apex Legends

Our tracker indicates a recovery throughout the last few months so revenue may end up being flat to last fiscal year.

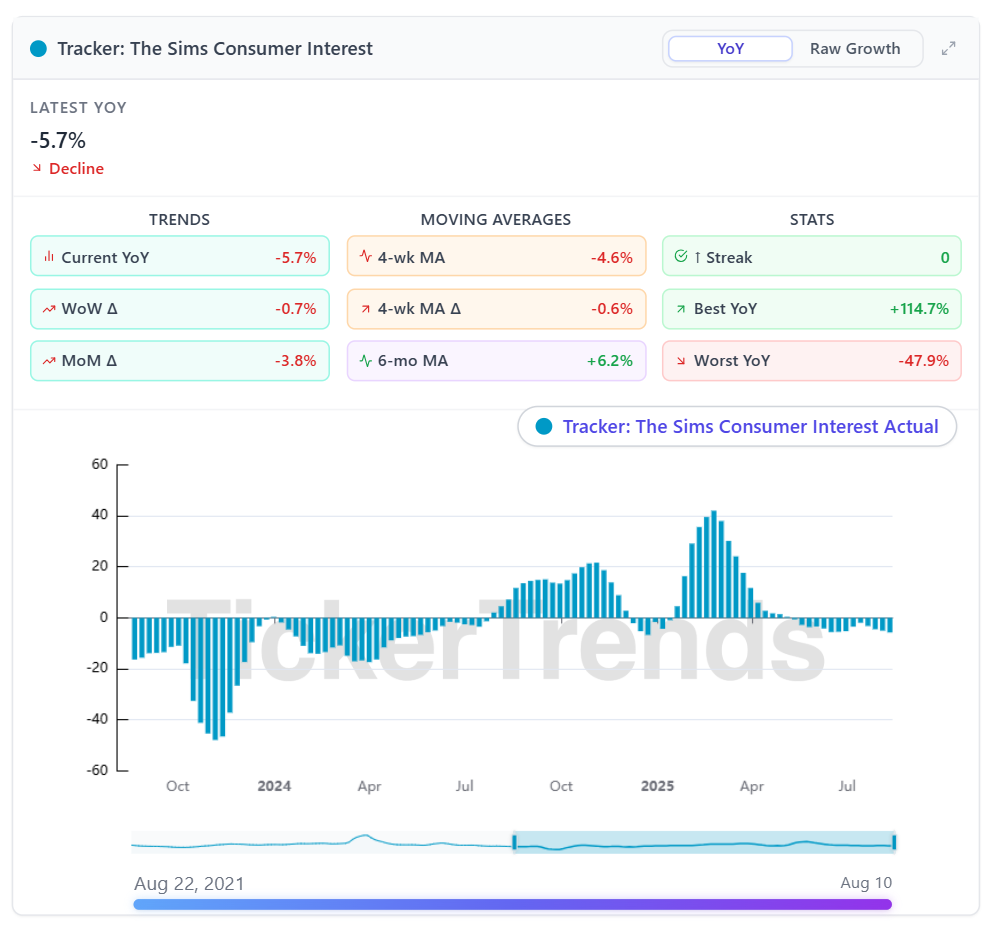

The Sims

Our tracker also indicates a more of less flat YoY reading for The Sims.

Together, the EA brand portfolio excluding Battlefield would yield a roughly ~$300 million reduction in Bookings from $7.355 billion to ~$7.055 billion.

Adding the Battlefield $800 million to $1 billion in revenue for FY2026 potential for $7.855 billion to $8.055 billion in Bookings, versus the current $7.6 billion to $8 billion current EA 0.00%↑ guidance number.

Conclusion

All-in-all, an $8 billion+ Bookings number is the key to this trade and would mark a breakout in this KPI after three years of stagnation in Bookings for the company. Additionally, listening to what management says about first week sales for Battlefield 6 will be key. A 4 million or higher number should be positively received. Tracking the data closer to the October release will be instrumental in determining confidence.

At under 20x FY2026 EPS estimates (which may be too low themselves), EA 0.00%↑ is potentially setup well for a bullish outcome.

Please email admin@tickertrends.io to gain access to our entire KPI dashboard which includes coverage of over 250 unique KPIs available on TickerTrends Enterprise: https://tickertrends.io/enterprise