Bullish on BTI: How Velo Pouches Are Igniting British American Tobacco’s Growth

Velo pouch growth reshaping BAT’s future beyond combustible cigarettes

British American Tobacco has upgraded its 2025 revenue growth guidance to 1–2%, underpinned by strong U.S. momentum and Velo pouch adoption, and is currently trading at ~15–16× P/E—well below peers like Philip Morris (~20×), suggesting upside if Velo sustains growth.

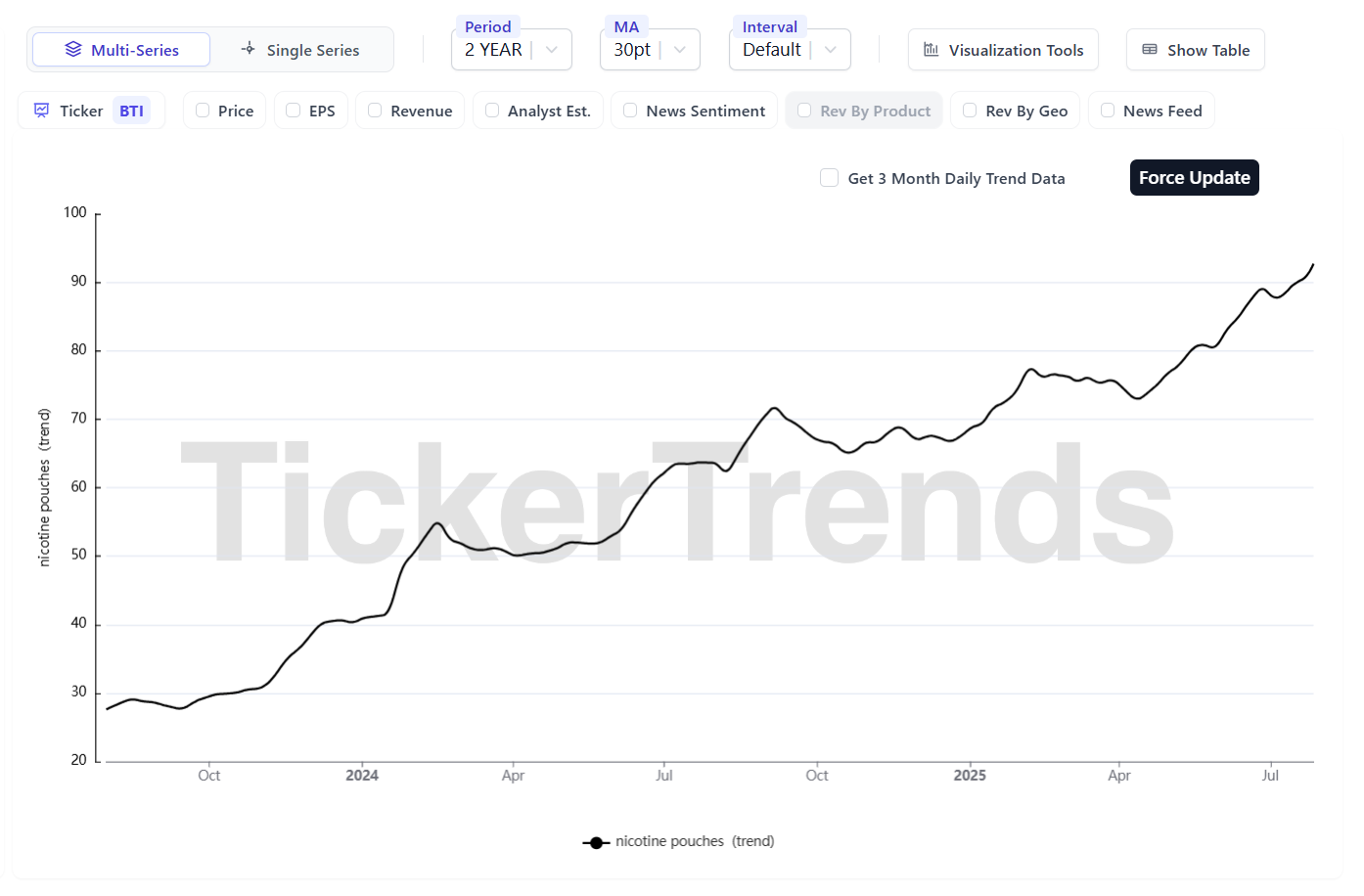

With cigarette volumes still declining, Velo’s rapid growth is helping offset losses and shift BTI’s trajectory. New Categories (including Velo) grew 8.9% organically in 2024 and now represent 17.5% of Group revenue, up from 16.5% in 2023. Now, momentum in the U.S. and Europe points to a business pivoting toward modern oral and vapor products.

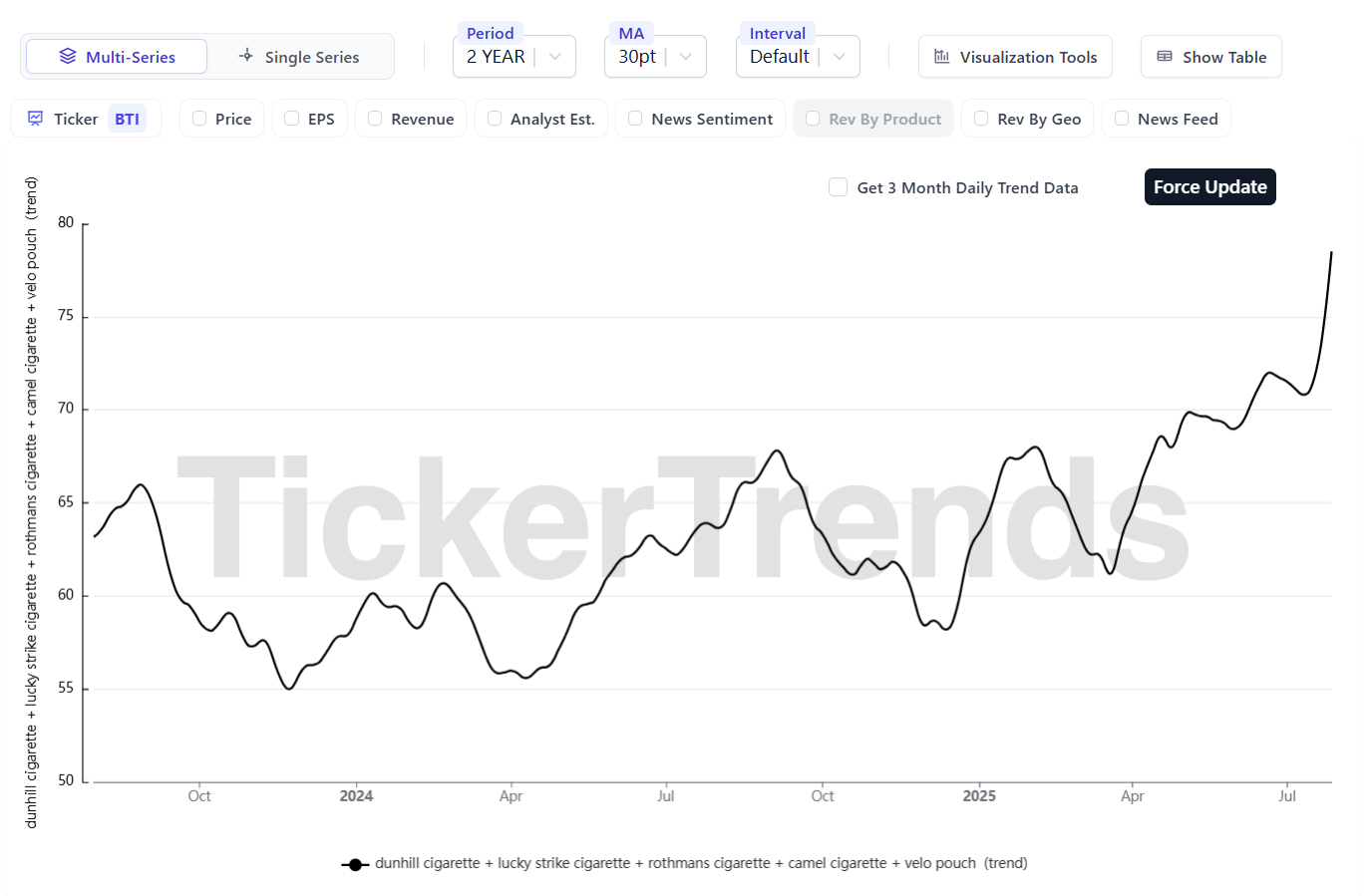

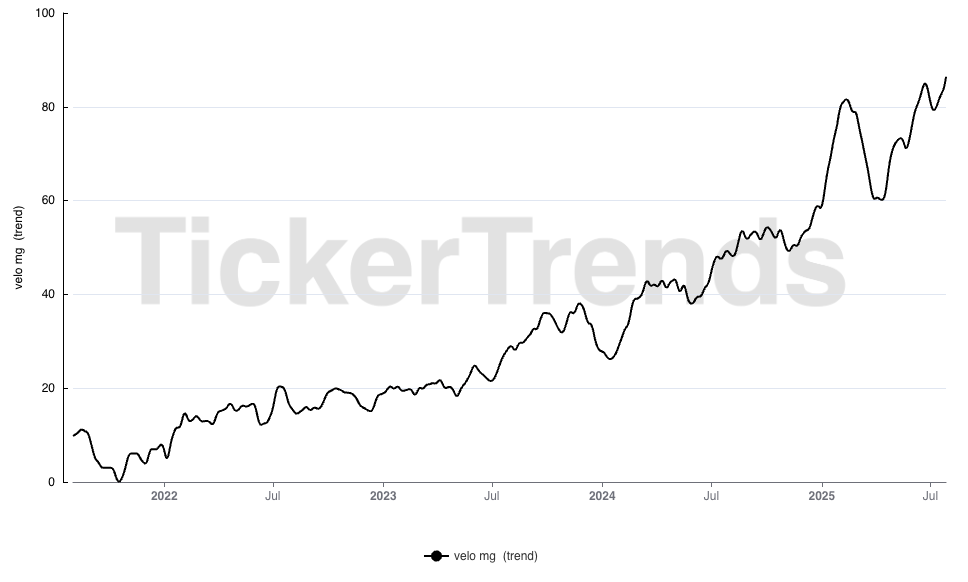

That's where Velo comes in. In 2024, Velo grew 47% to nearly £800 million in revenue (~3% of the total business at ~£25 billion in revenue). Volumes rose even faster, up 55% to 8.3 billion pouches. In 2025, that momentum has continued according to our consumer interest tracker. Our tracker shows sustained mid-50’s percentage year-over-year growth which is great considering the tough comps from last year’s stellar performance.

Velo Plus launched late 2024 is already showing triple-digit growth in early 2025, capturing 5.4% U.S. Modern Oral share within 12 weeks and boosting Velo’s U.S. volume share to 11.9% (+550 bps YoY).

If Velo sustains even high double-digit growth, it could soon add an incremental £400 to £800 million annually to BTI’s top line (an additional +1.5% to 3% to the top-line). At sustained triple-digit growth, it becomes even more meaningful, potentially reaching £2 to £3 billion in revenue within a few years. That kind of performance could move Velo into a top-five revenue contributor, helping shift BTI’s overall growth profile and reduce dependence on cigarettes.

Margins are improving too. New categories turned profitable in 2024 with a 7% margin. While not formally quantified by management, investors increasingly view each percentage point of revenue shifting toward New Categories as meaningfully accretive to margins over time. The higher gross margins and recurring nature of products like Velo give this segment the potential to be a long-term driver of EBITDA expansion as mix improves.

Conclusion

BTI trades at ~15.5× P/E versus Philip Morris at ~20×, if Velo adds £500M+ in FY26 revenue (with ~25% EBITDA margin), that could imply EPS upside of £0.05–0.07, justifying a multiple rerate.

BTI (BTI 0.00%↑ ) still trades at under 11x earnings and the Velo story in our view supports both the revenue and profitability story of this company. If Velo keeps growing at its current pace, there is room for that multiple to expand. Phillip Morris (PM 0.00%↑ ) trades at nearly 19x FY’26 EPS estimates for reference.

In short, BTI has found a credible growth engine in Velo. It's not just a defensive play anymore. If the company executes, nicotine pouches could take BTI from low single-digit growth to a stronger and more sustainable earnings profile. Investors looking for a turnaround story with improving fundamentals and strong cash returns should keep BTI on their radar. The long setup looks good for the bulls going into tomorrow’s earnings report.

Please email admin@tickertrends.io to gain access to our entire KPI dashboard which includes coverage of over 200 unique KPIs available on TickerTrends Enterprise: https://tickertrends.io/enterprise

Outstanding data-driven analysis! Your consumer interest tracker showing sustained mid-50's percentage YoY growth is exactly the kind of granular insight that traditional sell-side analysts miss. The Velo Plus launch trajectory is remarkable - 5.4% U.S. market share in just 12 weeks validates the product-market fit. What I find most compelling is the margin story. New Categories achieving 7% profitability in 2024 while still in rapid growth phase suggests significant operating leverage ahead. As mix shift continues and scale benefits kick in, those margins should expand materially. Your valuation comparison is spot on - BTI at ~15.5x P/E versus PMI at ~20x creates a meaningful discount despite comparable growth trajectories in NGPs. The market is still pricing BTI as a declining cigarette company, not recognizing the transformaton underway. If Velo reaches £2-3 billion within a few years as you project, that's transformative for a £25 billion revenue business. The combination of accelerating growth, margin expansion, and multiple re-rating creates a compelling triple-tailwind setup. Agree completely that BTI has moved from defensive value play to credible growth story.