Byrna (BYRN) – Q4 2025 Preview: Consumer KPIs Point to Upside vs. Consensus

With consumer KPIs re-accelerating post-August, Byrna appears positioned for record holiday-quarter revenues despite muted market expectations

Introduction

Byrna enters Q4 2025 with demand indicators accelerating across every key KPI, setting up a potential disconnect between Street expectations and reported results. Management commentary highlights a sharp rebound in traffic and conversion efficiency in August, which our alternative data shows has continued to strengthen into September and early Q4.

“This was particularly evident on our e-commerce channel, where average daily sessions on Byrna.com jumped from about 36,000 in July to about 52,000 in August, a 45% month-over-month increase. At the same time, average daily sessions on Amazon jumped from about 15,000 in July to about 23,000 in August. We believe that this surge in sessions has the potential to drive growth in future quarters, similar to the jump in sessions we saw in the fourth quarter of 2023 when we introduced our celebrity endorsement model.

While this surge in sessions did not translate immediately into increased sales due to the lag time between consumers’ initial introduction to Byrna and their purchase decision, by the end of August, we began to see a noticeable lift in sales as our online conversion rate strengthened toward the historical average. During the final ten days of August, our online conversion rate climbed 57% compared to the prior 10-day period, reaching 0.9%. This performance drove sales up 47% even as sessions held steady at an average of about 56,000 per day.

This performance bodes well for Byrna as we enter the all-important holiday fourth quarter. With sessions and organic search at an all-time high and Byrna products now offered in more than 1,000 chain store locations, Byrna believes it has the potential to set a new revenue record in Q4.”

Investor takeaway: Consensus currently models a slowdown in revenue growth, but both management’s commentary and real-time KPI data point to reacceleration into Q4 and the potential for a revenue record. This creates a clear upside risk scenario for investors.

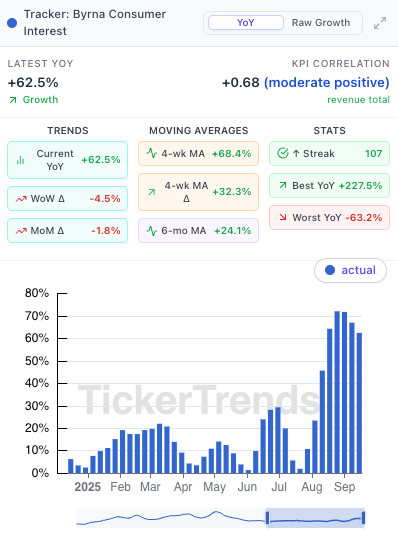

Consumer Interest Tracker

Byrna Consumer Interest Tracker currently stands at +62.5% YoY growth, with a significant +32.3% acceleration in the past month.

Historical Pearson R correlation: +0.68 vs. reported revenue, making it a statistically strong lead indicator.

Importantly, tracker growth re-accelerated post-August, suggesting that consumer awareness and intent remain on an upward trajectory heading into the holiday quarter.

E-Commerce KPIs

Search Interest: At an all-time high, up +120% YoY, supported by rising organic discovery and brand awareness.

Historical correlation to revenue: +0.79 Pearson R, historically one of the most predictive Byrna KPIs.

Conversion: Rates rebounded toward the historical baseline (0.9%) by late August, improving sales efficiency.

Retail Distribution: With Byrna products now carried in 1,000+ chain locations, the company is positioned to capture omnichannel demand beyond direct-to-consumer channels.

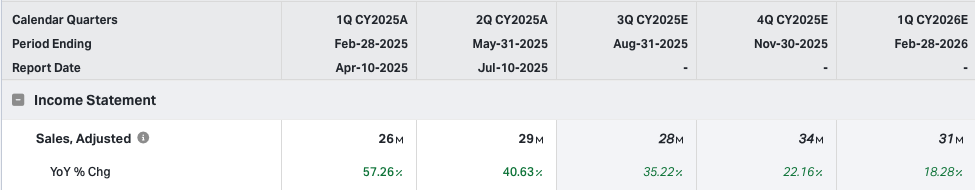

Market Expectations

Street Consensus Q4 2025 Revenue: $34.18M (+22.2% YoY).

Q3 2025 Revenue Growth: +35.2% YoY.

Consensus implies a growth deceleration into Q4, despite alternative data pointing to sustained acceleration.

Conclusion

All tracked demand KPIs, consumer interest, e-commerce sessions, search activity, and conversion rates, point to continued acceleration through the transition from Q3 into Q4. Market expectations are modeling a slowdown, leaving a material gap between Street forecasts and the momentum evident in leading indicators.

With consumer interest and search activity at record highs, a rebound in conversion, and expanded retail distribution, Byrna is positioned for a potential revenue record in Q4 2025. Investors should recognize the clear upside risk to consensus and the likelihood that current market expectations underestimate holiday-quarter demand strength.