$CELH Celsius Holdings | Alani Nu Acquisition, Competitive Pressures, and the Road to Multiple Expansion

The TickerTrends Social Arbitrage Hedge Fund is currently accepting capital. If you are interested in learning more send us an email admin@tickertrends.io.

The Rise of Celsius:

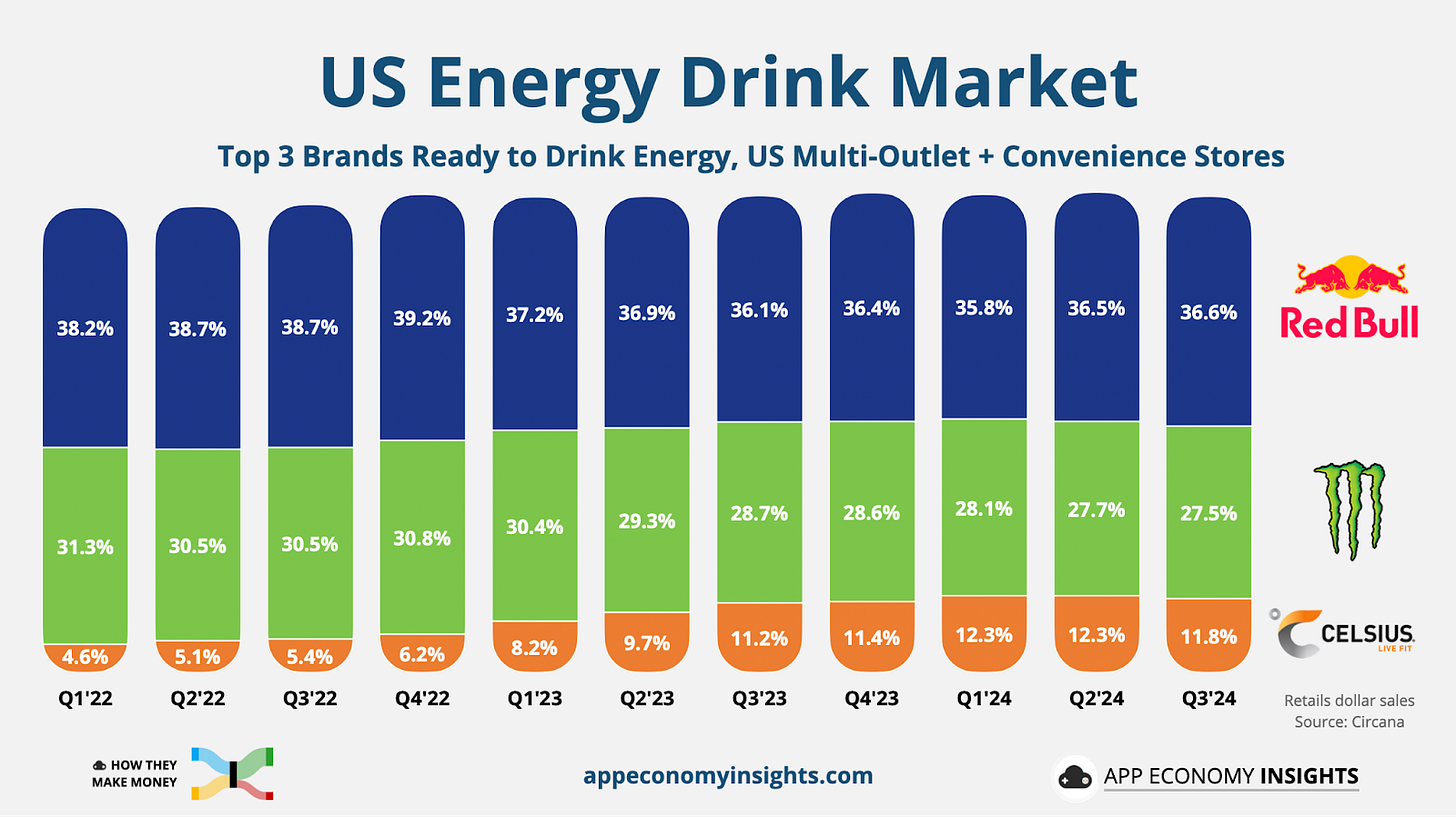

Celsius Holdings has experienced remarkable growth over the last 3 years. The company has gone from a modest market share of 4.6% in the first quarter of 2022 to an impressive 11.8% by the end of the fourth quarter of 2024. The company has been able to achieve this commendable growth due to strategic distribution enhancements, innovative product launches, targeted brand positioning and a focused digital marketing strategy.

The pivotal turning point for Celsius came in October 2022 (Q4’22), with its landmark strategic partnership with PepsiCo. This partnership fundamentally reshaped Celsius' distribution capabilities, granting it immediate access to PepsiCo’s extensive and established North American network. As a result, Celsius rapidly expanded its presence nationwide, achieving a near-complete distribution coverage with a remarkable 98.7% All Commodity Volume (ACV) by late 2024.

Particularly notable was Celsius’s dramatic growth within the convenience store channel, where its ACV surged from 45.3% in late 2022 to a commanding 98.7% by Q4 2024. Expansion within prominent club retailers, including Costco, Sam’s Club, and BJ’s, further amplified product visibility and consumer accessibility, positioning Celsius as a readily available choice for millions of consumers across various shopping environments.

Another key contributor to Celsius' success has been its aggressive and consistent product innovation strategy. The company continually introduced new, consumer-centric products designed to capture growing segments within the health and wellness space. A significant milestone in this area was the launch of CELSIUS ESSENTIALS, a 16-ounce performance-focused energy beverage line featuring enhanced caffeine content and essential amino acids, specifically targeting health-conscious and fitness-focused consumers. Additionally, Celsius maintained strong consumer engagement through seasonal and limited-time product offerings such as the Galaxy Vibe and Cosmic Vibe series, which helped sustain consumer excitement and encouraged repeat purchases. Celsius also strategically expanded its portfolio into entirely new categories, including the launch of CELSIUS HYDRATION, further diversifying its consumer base and enhancing its brand relevance across various consumption occasions.

Central to Celsius’s strategy was its precise brand positioning, aimed at aligning closely with evolving consumer preferences for healthier, functional beverages. Celsius deliberately positioned itself within the "Live Fit" lifestyle niche, emphasizing zero-sugar formulations, natural ingredients, and functionality tailored towards performance and health. The company positioned its brand positioning to tailor to women which now makes up around 50% of the company’s sales. This clear and compelling differentiation sets Celsius apart from traditional energy drink competitors like Monster and Red Bull. By consistently reinforcing this brand ethos, Celsius established a strong emotional connection with its target audience, allowing it to command premium pricing and sustain higher growth rates even as competition increased significantly within the category.

Complementing its strategic distribution and innovation was Celsius's robust digital-first marketing approach, which leveraged influencer marketing, social media platforms, and strategic e-commerce partnerships. By capitalizing on digital platforms such as Amazon and Instacart, Celsius quickly ascended to the top-selling position in the energy drink category, significantly outperforming legacy competitors. Strategic influencer campaigns, particularly those executed on platforms like TikTok and Instagram, greatly amplified brand visibility among younger consumers. Celsius adeptly harnessed the power of digital engagement, fostering viral marketing moments that organically boosted awareness and demand.

The expansion into unconventional and non-traditional distribution channels further accelerated Celsius' growth. Strategic partnerships, including availability in over 2,000 Jersey Mike’s locations and authorization across more than 3,000 Dunkin’ Donuts outlets nationwide, significantly increased brand exposure during mealtime consumption occasions. Additionally, entering non-traditional venues such as Home Depot, hospitals, universities, and corporate offices further diversified Celsius’ reach, providing incremental consumer engagement and sales opportunities beyond traditional grocery and convenience channels.

Additionally, operational excellence and supply chain optimization significantly bolstered Celsius’ performance and profitability. The acquisition of its long-term co-packer Big Beverages in 2024 enabled Celsius to vertically integrate production, thereby enhancing innovation capabilities, reducing operational costs, and improving supply chain control. Adoption of advanced AI-driven sales technologies and mobile route optimization tools dramatically improved in-store execution, shelf-space management, and overall operational efficiency. These operational improvements facilitated Celsius’s achievement of record gross margins exceeding 50%, enabling the company to effectively scale operations in line with its rapid market share gains.

The next stage of growth for Celsius hinges on the company's international expansion. The company appears to be making notable progress driven by its successful market entry into Canada, supported by PepsiCo’s global infrastructure, setting a strong foundation for future market expansions in the coming years although near term challenges remain.