CELSIUS Holdings Q2 2025 Outlook: Alani Nu's First Quarter Consolidation Poised to Outperform

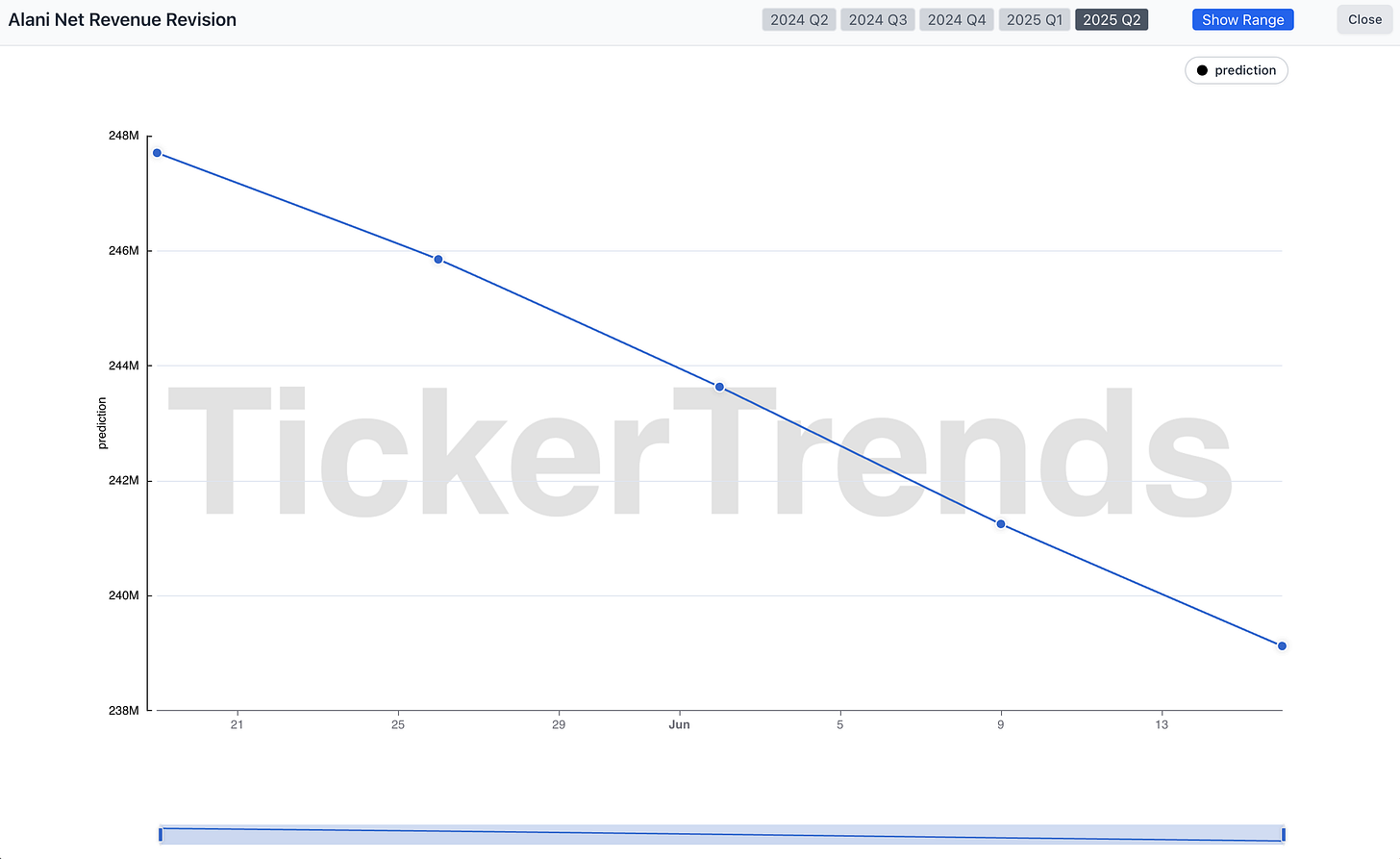

TickerTrends projects Alani Nu revenue at $239.12M for Q2 2025—a significant beat driven by strong LTOs, surging digital engagement, and explosive social media traction.

At TickerTrends, we are forecasting $239.12M in revenue for Q2 2025 for Alani Nu the newly acquired subsidiary of Celsius Holdings Inc., (NASDAQ: CELH) which would put the combined market share for Celsius Holdings well above 17% as of Q2' 25 and would imply a YoY revenue growth rate of 64%.

The Alani Nu acquisition was closed on April 1, 2025 and Q2’ 25 will be the first quarter in which the company will be reporting the consolidated sales numbers for Alani and the market is unsure on what to expect. This uncertainty stems from the inherent differences in how Alani Nu recognizes revenue versus external scanner data.

As Jarrod Langhans, CFO of Celsius Holdings, explained, "When preparing this slide, we utilize Circana data for the 13-week period associated with the quarter noted. As a reminder, Circana does not include all channels and the timing of customer scans within Circana data can vary from sales recognized by Alani Nu as Alani recognizes sales driven by GAAP accounting based upon delivery terms to a variety of locations, including to the retailer distribution centers, delivery to consumers and delivery to distributors, while Circana recognizes sales based upon consumer scans at the register."

Furthermore, Alani Nu's business model heavily relies on Limited-Time Offerings (LTOs), which can cause significant spikes and dips in sales that are not consistently reflected in scanner data. This kind of gap is exactly what we look for in our KPI predictions and the edge Enterprise Users can expect to see on our platform. It’s what gives analysts, managers and investors an actionable edge heading into earnings.

( For KPI revisions and tracking access email: admin@tickertrends.io )

What is driving our Q2 prediction?

1. Search trends are spiking:

From February onwards, Alani Nu’s website saw a surge in search trends as well as website traffic data. Total site visits have continued increasing month on month from February onwards into June exceeding 430,000, up a whopping 27% month over month. These strong search trends are being aided by a general momentum in the energy drink category but it appears that Alani Nu continues to outgrow the category.

These strong search trends are correlating well with the scanner sales data as confirmed by Celsius’ Q1 earnings presentation.

The scanner sales for the period ended February 23, 2025 showed an increase of 17.66% over the period ended January 26, 2025 and further increasing by 16.72% and 12.15% for the periods ending March 23, 2025 and April 20, 2025 respectively.

2. Strong LTOs during the quarter:

Another major driver behind our bullish Q2 forecast is Alani Nu’s aggressive Limited-Time Offering (LTO) strategy, which has consistently proven to boost both base business performance and incremental sell-through. The company released the Q1 LTO, Strawberry Sunrise in mid-March and the flavor has seen continued momentum into Q2. In Q2 the company has rolled out both Cotton Candy and the much-anticipated Sherbet Swirl also made a return, which the company confirmed was the #1 energy drink SKU at certain large national retailers during its first few weeks on shelves. These LTOs are not just brand-building events; they are high-conversion activations that create tangible spikes in sell-in and sell-through, particularly in digital channels and major retail accounts. Our data shows the aggregate search trends for the three flavors accelerating into June.

Importantly, management has mentioned that LTOs not only provide strong initial volume surges, but also help lift the base business in their aftermath. That compounding effect—driven by demand from repeat consumers, increased shelf presence, and social media virality should position Q2 as a standout quarter for Alani Nu, with multiple drivers converging at once. We expect the strength of these Q2 LTOs, particularly Sherbet Swirl, to materially boost GAAP-reported sales beyond what scanner data alone may suggest.

3. Explosive social momentum:

Another crucial element driving Alani Nu's anticipated strong Q2 performance is the robust social traction. Alani Nu has created immense hype around its LTOs through a "treasure hunting" mechanism and launching without widespread pre-market announcements. This generates significant organic buzz and a sense of discovery. Consumers actively engage in finding the new flavors in stores and sharing their discoveries on TikTok and Instagram, effectively turning them into brand advocates. Our data shows that #alani and #alaninu hashtags are gaining month-over-month traction, signifying increasing user-generated content and brand visibility. The posts for #alani have effectively doubled from 60 million from December 2024 to over 120 million in June 2025 so far.

Alani Nu has also gained over 325,000 followers on TikTok over the last six months, effectively doubling its following, and has attracted over 160,000 new followers on Instagram during the same period. This strong social engagement data is translating into heightened brand awareness, increased direct engagement with consumers. The loyal and expanding online community acts as a self-sustaining marketing channel, amplifying new launches and reinforcing brand affinity.

Bottom Line

Forecasting the precise financial outcome for Alani Nu, and consequently Celsius Holdings, in Q2 2025 presents a formidable challenge, making accurate predictions almost impossible. The inherent complexities of Alani Nu's revenue recognition, as articulated by Jarrod Langhans, create a significant disconnect between the scanner data and actual GAAP-recognized sales. The timing of inventory delivery to distribution centers and retailers, coupled with the unique nature of their Limited-Time Offerings, means that consumer scans at the register (what Circana tracks) often lag or simply do not fully capture the revenue that Alani Nu books. This makes it extraordinarily difficult to ascertain an exact revenue number based solely on publicly available market data.

Furthermore, the absence of directly comparable Q1 2025 financial data for Alani Nu as a standalone entity exacerbates this challenge. Since the acquisition closed on April 1, 2025, Q2 will be the first quarter where Alani Nu's sales are consolidated into Celsius Holdings' financial statements. Without a baseline of previously reported financial performance for Alani Nu in a prior comparable period under Celsius' ownership, any precise prediction is built on a foundation of significant unknowns, making it a high-risk endeavor for traditional forecasting models.

Given these considerable uncertainties and the nuanced interplay of revenue recognition, promotional strategies, and data discrepancies, our aim at TickerTrends is not to provide a definitive, granular revenue figure for Celsius Holdings. Instead, our focus is on leveraging alternative data to ascertain the direction and magnitude of the top-line momentum. Our insights into spiking search trends, robust website traffic, and the demonstrated success of key LTOs like Sherbet Swirl and Cotton Candy, combined with the significant social media growth, offer a powerful directional signal that the brand is experiencing substantial organic growth. This "directional edge" is what we believe provides Enterprise Users with actionable intelligence, allowing them to anticipate underlying business health and performance trends even amidst the complexities of a newly integrated and uniquely operated CPG brand.

Stay Ahead

We’ll continue monitoring digital demand signals for Celsius and other top companies. If you’re interested in getting access to these real-time forecasts across hundreds of public tickers, contact us at admin@tickertrends.io.

( For KPI revisions and tracking access email: admin@tickertrends.io )