$CHWY Redefining Pet Care | Empowering Pet Parents | TickerTrends.io

The TickerTrends Social Arbitrage Hedge Fund is currently accepting capital. If you are interested in learning more send us an email admin@tickertrends.io. Join our Discord here for more discussion.

Ticker: CHWY 0.00%↑

Sector: Consumer Cyclical

Share Price: $35.01

Market Cap: $14.35B

Business Intro:

Chewy, Inc. is a pioneering force in the pet care retail industry, revolutionizing how pet owners access products and services. Established in 2011, Chewy has grown from a startup into the premier online destination for pet supplies, known for its extensive product offerings, innovative services, and unparalleled commitment to customer satisfaction. Headquartered in Dania Beach, Florida, the company operates as a comprehensive e-commerce platform catering to the needs of pet parents across the United States.

At its core, Chewy offers a wide-ranging catalog of over 100,000 products, encompassing pet food, treats, toys, accessories, healthcare, and specialty items for a variety of pets, including dogs, cats, fish, reptiles, birds, and small mammals. Chewy’s became a publicly traded company on the New York Stock Exchange under the ticker symbol "CHWY." The company has continued its upward trajectory, delivering consistent revenue growth while expanding its market presence. In 2024, Chewy was included in the S&P 400 Index, reflecting its stature as a mid-cap company with enduring growth potential.

As of today, Chewy serves approximately 20 million active customers, with over 80% of its revenue driven by its subscription-based Autoship program. The company’s diverse product mix, including premium pet food, healthcare services, and private-label offerings, caters to both mainstream and niche segments of the pet care market. Chewy also maintains strong relationships with top-tier vendors and brands, ensuring its catalog remains competitive and appealing to a broad audience. As the pet care industry continues to grow, fueled by trends such as pet humanization and increased spending on pet health, Chewy could remain at the forefront, delivering value to its customers and investors alike.

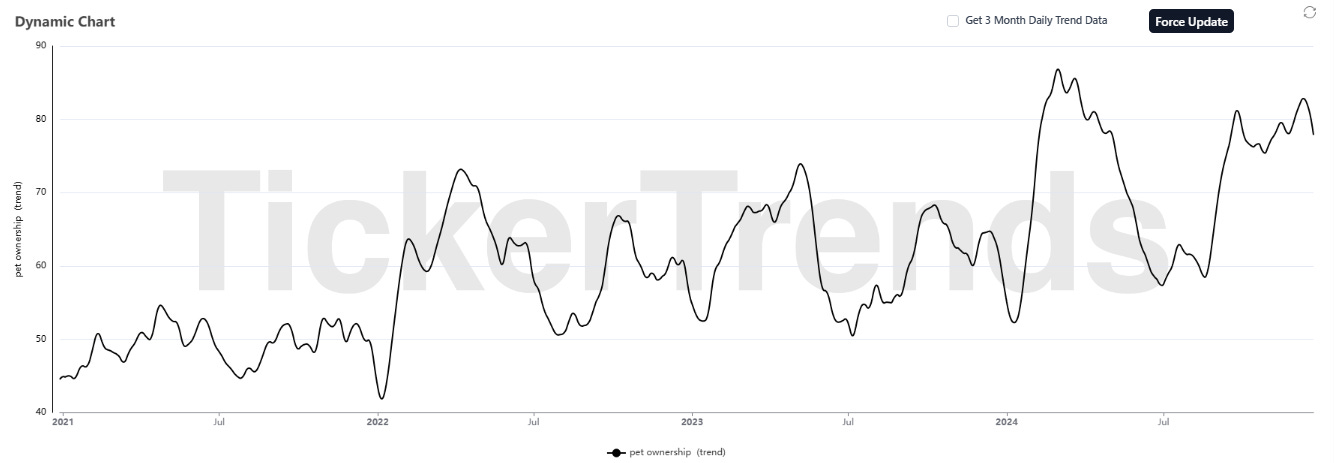

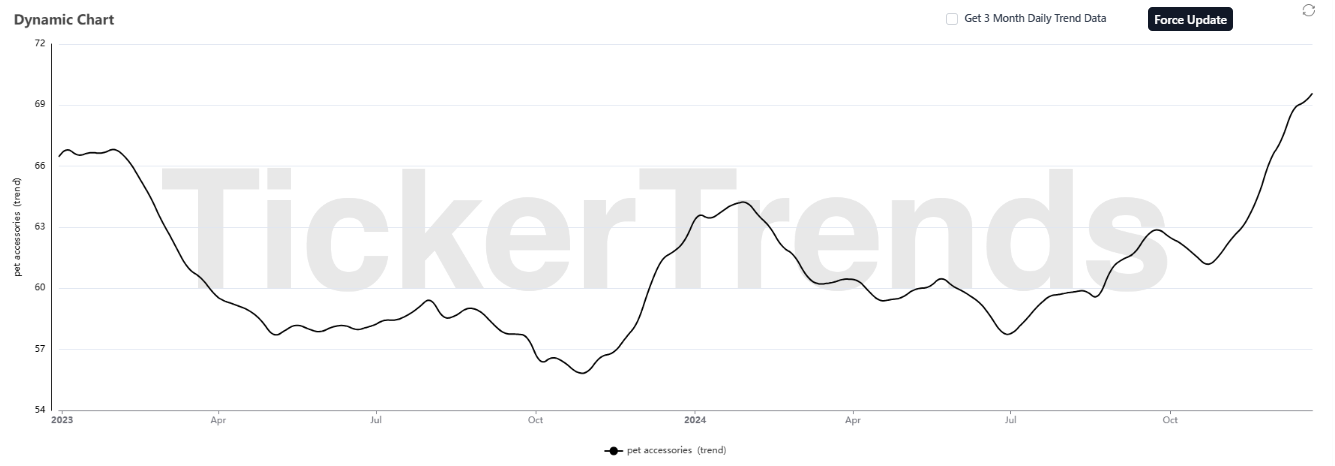

Alt Data:

Strategy:

Customer-Centric Business Model

Chewy, Inc. has built its success on a deeply ingrained customer-centric philosophy, tailoring its operations and services to meet the unique needs of pet parents. The company’s mission to "be the most trusted and convenient destination for pet parents everywhere" is reflected in its dedication to creating a seamless shopping experience. Central to this approach is the Autoship subscription program, which allows customers to automate regular deliveries of pet essentials like food, treats, and medications.

Autoship not only enhances customer convenience by ensuring timely delivery of recurring needs but also fosters long-term loyalty and recurring revenue streams, making it one of Chewy’s most vital strategic pillars. By maintaining competitive pricing and offering discounts on Autoship orders, Chewy incentivizes customers to remain within its ecosystem.