Cloudflare ($NET) Earnings Preview: Rising Demand, Rising Bar

Cloudflare’s data shows surging developer traction and platform engagement ahead of earnings, hinting at accelerating AI-driven growth, but lofty expectations leave no margin for error

Cloudflare heads into earnings this week with data showing broad acceleration across usage, developer adoption, and customer activity. The company’s positioning around edge compute and AI infrastructure has drawn renewed interest, but the bar for execution is now higher than ever.

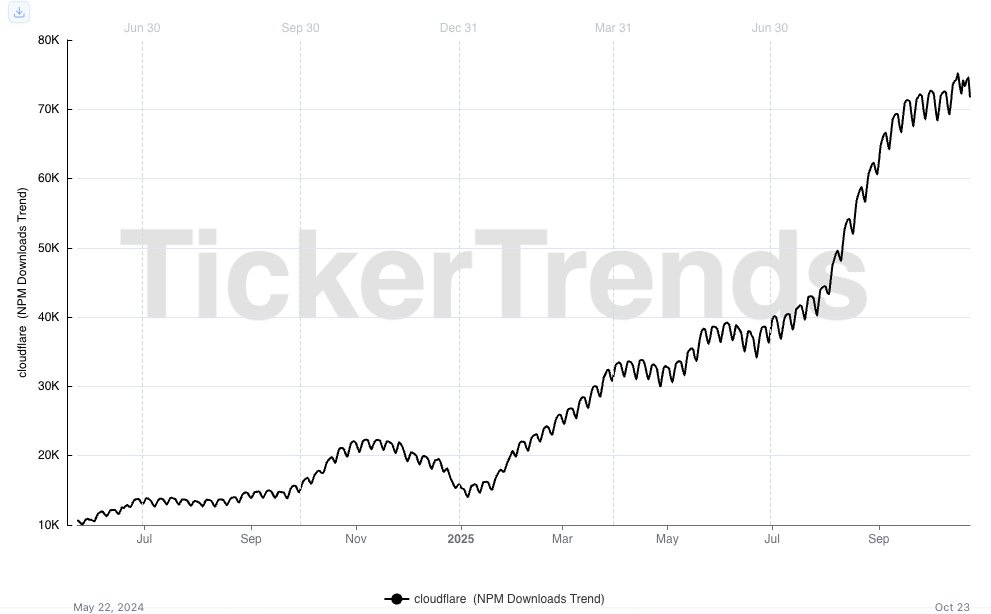

Developer Momentum Is Exploding

Our NPM Package Downloads Tracker shows a parabolic rise since early summer, up more than 4x year-over-year, signaling massive uptake in Cloudflare’s open-source and API integrations. This kind of developer traction often leads broader revenue trends by one to two quarters, as new use cases scale from experimentation to production.

This spike likely reflects early adoption of Cloudflare Workers AI, the company’s inference platform that allows developers to deploy and run AI models directly at the edge. The recent “Inference-as-a-Service” push positions Cloudflare to capture workloads that require low-latency model responses; an increasingly competitive segment where every millisecond matters.

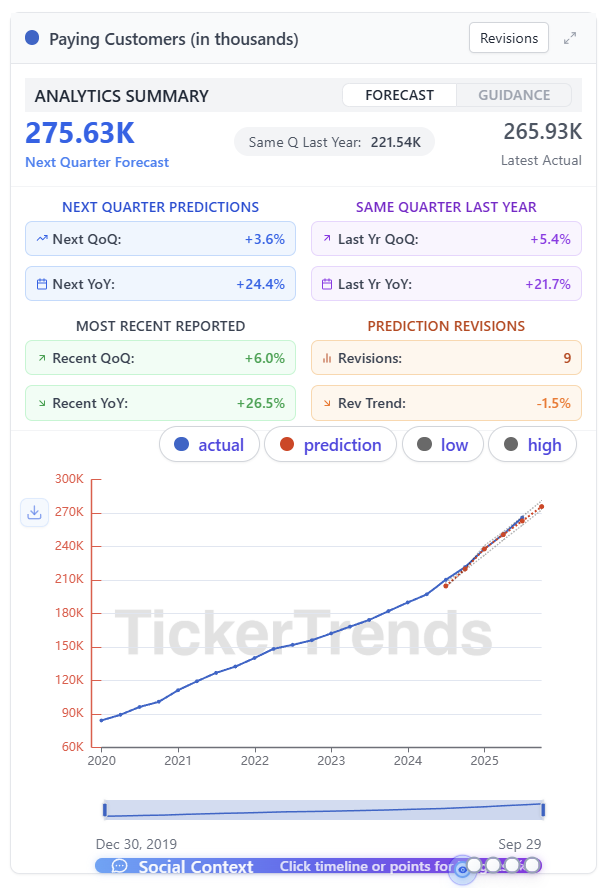

Paying Customers Still Climbing

TickerTrends forecasts 275.6K paying customers next quarter, up +3.6% QoQ and +24.4% YoY, roughly in line with prior trends but now off a much larger base. While customer adds are maturing, higher-value enterprise deals and AI-related workloads could offset slower small-business expansion. The latest quarter showed +6% QoQ growth, suggesting churn remains under control even as the company shifts focus toward larger accounts.

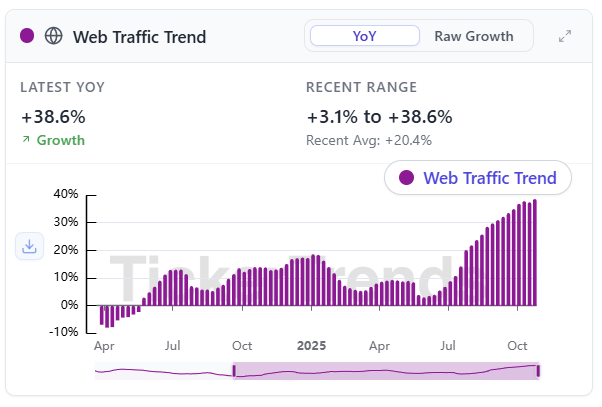

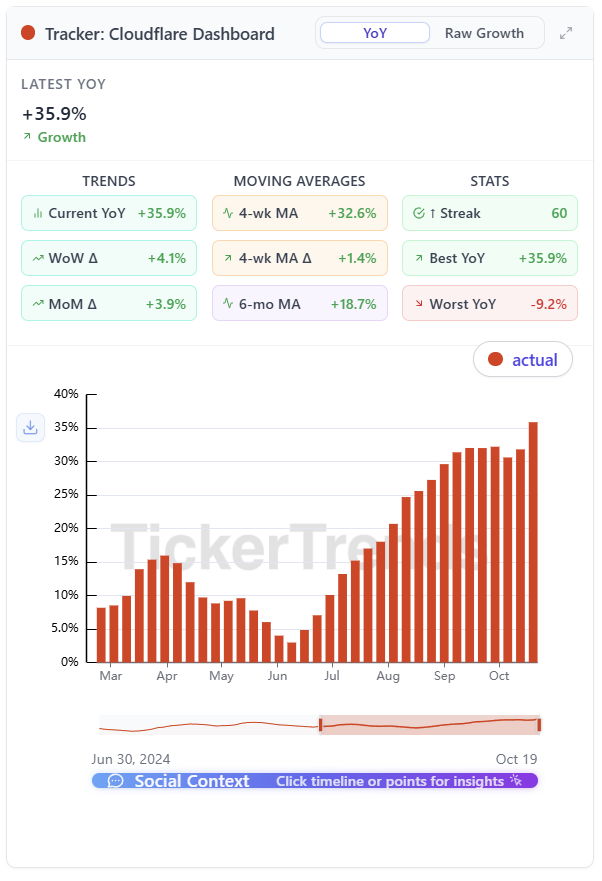

Website and Dashboard Traffic Signal Strong Activity

Website traffic has surged +38.6% YoY, and our Cloudflare Dashboard Tracker (a proxy for admin and enterprise user engagement) is up +35.9% YoY, marking a clear step-up from the prior quarter’s pace. Together, these point to stronger platform usage ahead of reported revenue.

What to Watch in Earnings

Revenue Guidance: The Street expects ~$545M (+27% YoY), but based on recent acceleration in traffic and developer adoption, a print north of $560M (+30% YoY) looks achievable.

AI Monetization: Investors want to see tangible revenue tied to Cloudflare’s inference and vector database offerings. A good update here could re-rate the AI narrative.

Customer Mix: Expect commentary on enterprise vs. self-serve customers. Larger deployments drive higher ARPU but add lag before recognition.

The Valuation Risk

At ~143x FY’27 FCF, expectations are high. Cloudflare needs to sustain this growth curve and show visible operating leverage from its AI and Workers ecosystem. If topline momentum accelerates, the setup allows for upside, but there’s little room for disappointment.

Bottom Line

Alternative data is flashing green shoots. Developer adoption and dashboard engagement are climbing sharply, and website traffic is surging ahead of the quarter. We believe Cloudflare can outpace Street revenue expectations and deliver strong guidance based on our Dashboard Tracker if current trends hold. But at this valuation, it must execute nearly perfectly to justify the premium. We lean cautiously optimistic on NET 0.00%↑ going into this earnings print.

The NPM download data is really compeling here. That 4x YoY surge is the kind of leading indicator that typically shows up in revenue a couple quarters later. What I find particularly interesting is the timing coinciding with the Workers AI push becuase that suggests developers are actually testing and integrating the platform at scale, not just kicking tires. The dashboard traffic data backing that up at 36 percent YoY makes it feel less like a one time spike and more like sustained adoptio. But you're right about the valuation risk at 143x FCF. At that multiple they basically need to print north of 560 million AND deliver strong guidance to avoid a selloff.