$CMG Chipotle Mexican Grill Earnings Preview | TickerTrends.io

$CMG KPI Metrics, Earnings Preview Tracking, Expectations And Alternative Data Comps

Market Expectations

Analysts expect 9.02% YOY growth which is an acceleration of 3.53% QoQ going into Q1 2025.

Overall, Chipotle's Q4 2024 performance reflects solid growth in revenue and comparable sales, driven by increased transactions and strategic restaurant expansions. However, the company faces challenges from rising operational costs and inflationary pressures, which may impact future profitability.

Q4 2024 Financial Highlights

Revenue: $2.8 billion, a 13.1% increase year-over-year, though slightly below analyst expectations of $2.847 billion. GuruFocus

Comparable Restaurant Sales: Up 5.4%, driven by a 4.0% rise in transactions and a 1.4% increase in average check size. GuruFocus

Adjusted Earnings Per Share (EPS): $0.251, slightly surpassing the estimated $0.25, reflecting a 19% year-over-year increase. GuruFocus

Operating Margin: Decreased to 14.6% from 16.9% in the previous quarter, indicating pressure from rising costs. Reuters

Net Income: $331.8 million, up from $282.1 million in Q4 2023. GuruFocus

Operational Metrics

New Restaurant Openings: 119 new company-owned restaurants opened in Q4, with 95 featuring a Chipotlane drive-thru. GuruFocus

Digital Sales: Accounted for 34.4% of total food and beverage revenue in the fourth quarter. GuruFocus

Strategic Initiatives and Challenges

Cost Pressures: Food, beverage, and packaging costs rose to 30.4% of total revenue, up from 29.7% the previous year, due to increased ingredient usage and inflation. Labor costs also increased slightly to 25.2% of total revenue. GuruFocus

Pricing Strategy: Implemented a 2% menu price increase in December 2024, with the potential for further adjustments if inflation continues to impact costs. Reuters

Leadership Transition: Scott Boatwright officially became CEO in November 2024, succeeding Brian Niccol. Reuters

Full-Year 2024 Overview

Total Revenue: $11.3 billion, a 14.6% increase from 2023. GuruFocus

Comparable Restaurant Sales: Increased by 7.4%, driven by a 5.3% rise in transactions. Chipotle

Operating Margin: Improved to 16.9% from 15.8% in the previous year. GuruFocus

Restaurant-Level Operating Margin: Slightly decreased to 24.8% from 25.4% in the fourth quarter, indicating challenges in managing operational costs. GuruFocus

New Restaurant Openings: 304 new restaurants opened in 2024, including 257 with a Chipotlane. GuruFocus

Outlook

2025 Guidance: Chipotle forecasts annual comparable sales growth in the low to mid-single digits, below analysts' expectations of 5.6%, citing potential demand decline due to rising menu prices and inflationary pressures. Reuters

Commodity Costs: Facing higher costs for key commodities like avocados and beef, with potential tariffs on Mexican imports posing additional risks. Reuters

Alternative Data

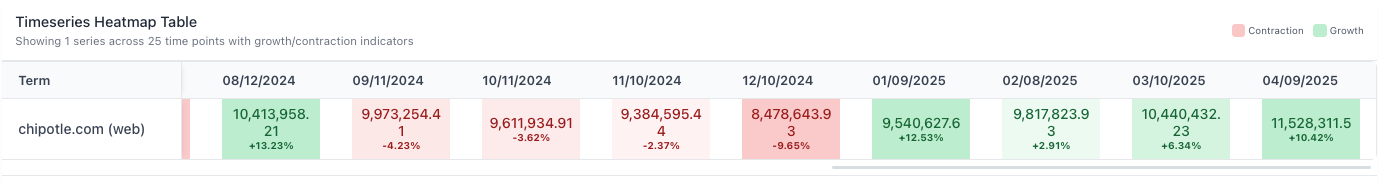

Web Traffic

Recent data indicates a +10.42% MoM acceleration in web traffic.

Recent data indicates a +0.97% MoM acceleration in web traffic.

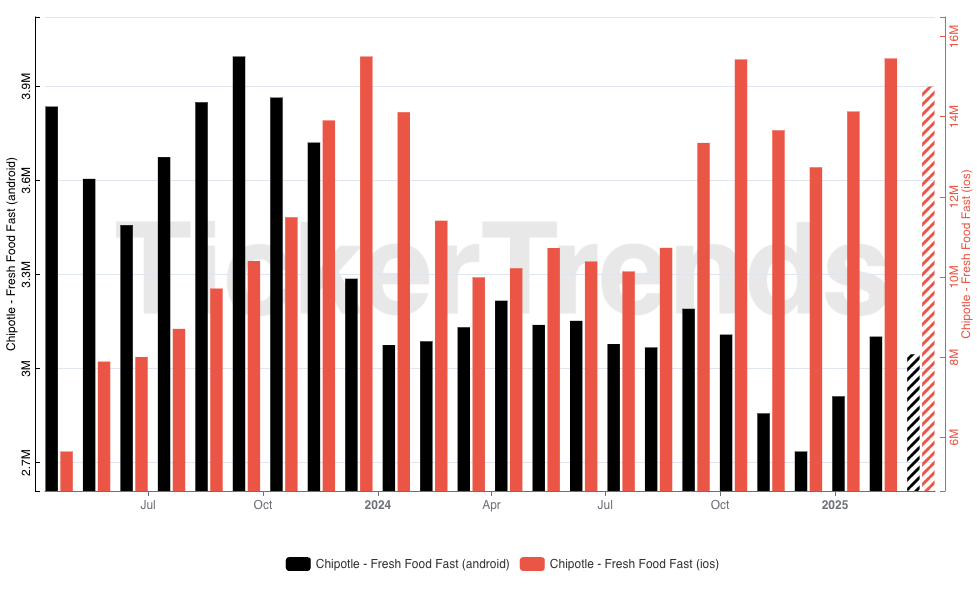

Mobile App Usage

Recent data indicates a -1.81% MoM slowdown in android usage.

Recent data indicates a -4.54% MoM slowdown in ios usage.

Reddits Subs

Recent data indicates a +64.31% MoM acceleration in reddit subscribers.

TikTok

Recent data indicates a +7.19% MoM acceleration in TikTok Viewership.

Social Followers

Recent data indicates a +55.85% MoM acceleration in instagram followers.

Search Trends

Recent data indicates a +6.04% MoM acceleration in search trends.

Conclusion

Chipotle closed out 2024 with solid topline growth and an impressive year-over-year gain in earnings, supported by higher transaction volumes and continued expansion of Chipotlane locations. However, the company’s Q4 margin compression highlights the ongoing challenge of managing inflationary pressures, rising input costs, and labor expenses. While 2025 guidance reflects a more cautious outlook, alternative data signals—such as a surge in web traffic, social engagement, and search trends—suggest strong underlying consumer interest and potential for continued brand momentum. If these forward indicators translate into sustained demand, Chipotle may outperform conservative expectations despite near-term margin headwinds.

Track real-time alternative data on TickerTrends.io