Crypto’s New Dawn | The Great Wealth Transfer Meets Regulatory Renaissance | TickerTrends.io

The TickerTrends Social Arbitrage Hedge Fund is currently accepting capital. If you are interested in learning more send us an email admin@tickertrends.io . Join our Discord here for more discussion.

Introduction:

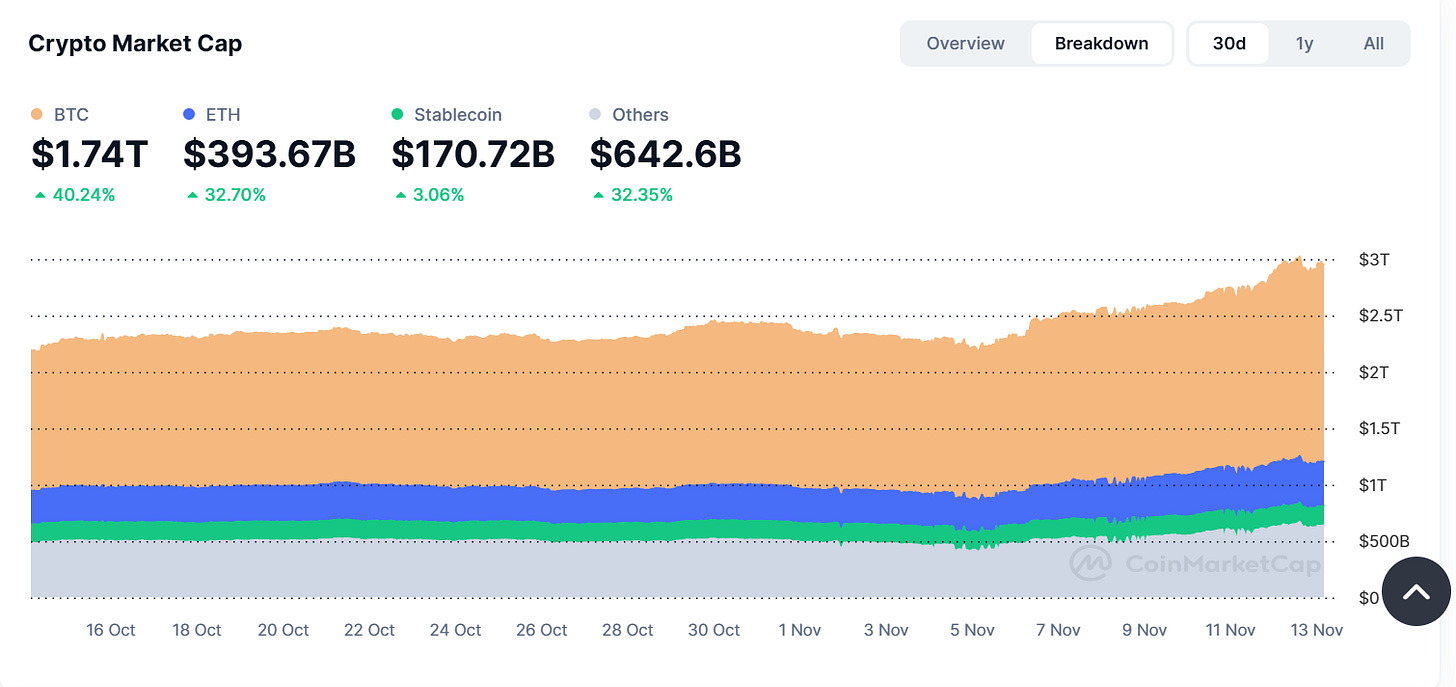

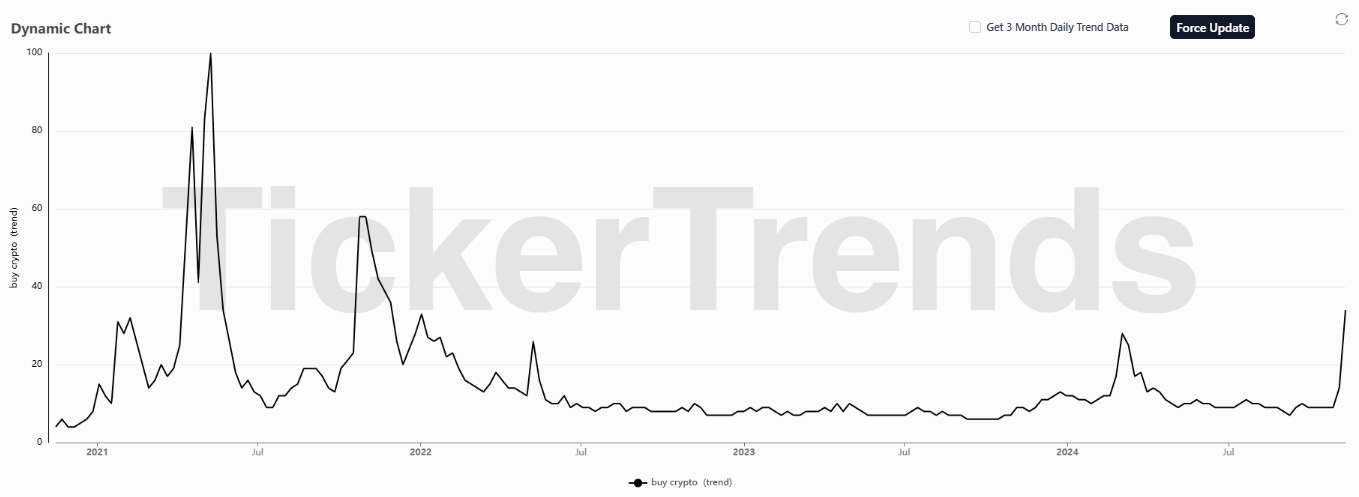

The cryptocurrency market has recently experienced a spectacular surge, with its global capitalization reaching an unprecedented $2.94 trillion as of November 13, 2024. Investors are attributing this bullish momentum to several key catalysts: substantial inflows from spot Bitcoin ETFs, the outcome of last week's U.S. presidential elections favoring Donald Trump, and supportive monetary policies like the U.S. Federal Reserve's second rate cut. The global crypto market capitalization increased by 34.06% since November 5, 2024, while the total crypto market volume soared by 31.22% to $349.04 billion.

Bitcoin (BTC) has been at the forefront of this rally, hitting an all-time high of $93,375 on November 13, 2024, as depicted in price trajectory chart showing a sharp upward trend. Ethereum (ETH) has also experienced a significant pump of approximately 30.94% since the election, reaching $3,173. Memecoins like Dogecoin have outperformed Bitcoin over the past week, surging over 80% amid an altcoin rally fueled by reduced regulatory uncertainty post-election.

In this report we delve into the underlying reasons behind the cryptocurrency market's remarkable rise and explore potential social arbitrage second order opportunities for investors to benefit from a prolonged bull market through equities without the aggressive downside that can come from a crypto winter. By analyzing market data, charts, and trends, we aim to provide insights that will help navigate and leverage the dynamic landscape of the crypto market during this bullish phase.

Alt Data:

Crypto: The Most Important Factors:

1. Great wealth transfer:

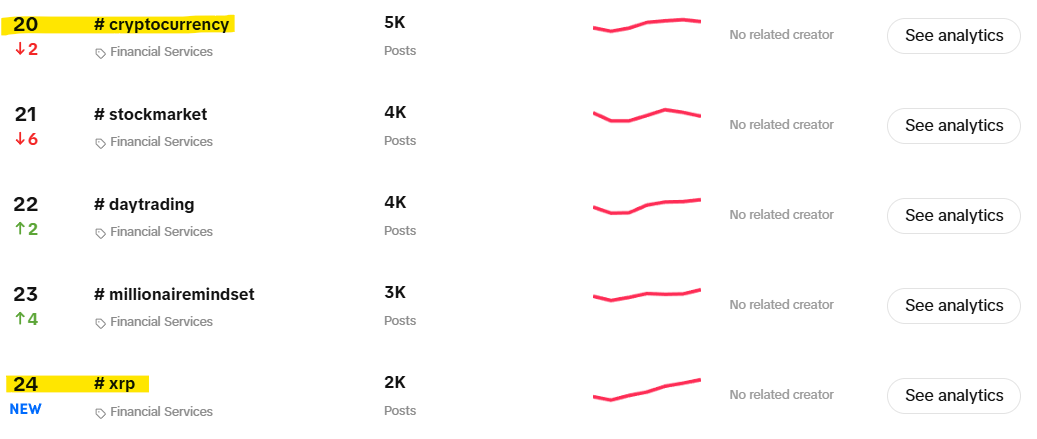

Over the last 7 days the Finance TikTok has completely been taken over by crypto as we can see from the most popular hashtags data below:

Several industry observers believe that over the next two decades, the United States is poised to witness an unprecedented transfer of wealth from older generations to their heirs, a phenomenon known as the "Great Wealth Transfer." Baby Boomers and the Silent Generation are expected to pass down an estimated $84.4 trillion to Millennials and Generation Z by 2045. This massive shift in wealth has significant implications for financial markets, particularly the cryptocurrency sector, as these younger, digitally-native generations exhibit a much higher propensity for investing in crypto assets compared to their predecessors.

Millennials are set to be the primary beneficiaries of this wealth transfer, potentially increasing their collective wealth fivefold by 2030 due to inheritances. Currently, Baby Boomers and older generations hold approximately two-thirds of U.S. household wealth, totaling around $96 trillion, despite representing less than one-third of the adult population. In contrast, Millennials and younger generations hold about $8.3 trillion, amounting to just 5.7% of total wealth. The impending inheritance could dramatically alter this landscape, empowering younger generations financially and reshaping investment trends.

These younger generations differ markedly from older cohorts in their investment behaviors and preferences. As the first to grow up with the internet and digital technology, Millennials and Gen Z are comfortable with digital assets and are more likely to invest in cryptocurrencies. Surveys indicate that approximately 45% of Millennials and 39% of Gen Z have invested in or are open to investing in cryptocurrencies, compared to only about 8% of Baby Boomers. This generational divide suggests that the influx of inherited wealth could significantly boost the cryptocurrency market.

However, several challenges and considerations temper this optimistic outlook. The distribution of inheritance is expected to be unequal, with a significant portion of the wealth transfer coming from high-net-worth individuals. Not all Millennials will receive substantial inheritances, and lower-income groups may not benefit significantly. Additionally, factors such as longer life expectancy, rising healthcare costs, and changing spending habits among Baby Boomers may reduce the overall amount of wealth passed down. Surveys indicate that recipients often overestimate the size of their expected inheritance.

The Great Wealth Transfer represents a significant economic event that could reshape financial markets in the coming decades. As trillions of dollars move from Baby Boomers to Millennials and Gen Z, the unique investment preferences of these younger generations are likely to impact various asset classes, particularly cryptocurrencies. While the potential for substantial growth in the crypto market exists, it's important to recognize the factors that may limit this impact. Nevertheless, the demographic shift toward digitally-native generations with a higher affinity for crypto assets suggests a favorable outlook for the cryptocurrency market.

Investors, financial institutions, and policymakers should consider these trends when planning for the future. The interplay between the Great Wealth Transfer and the evolving preferences of younger generations could accelerate the mainstream adoption of cryptocurrencies, fostering innovation and potentially leading to significant changes in the global financial landscape.

2. Regulatory Tailwinds:

The recent election of President Donald Trump for a second term has significant implications for the cryptocurrency industry, given his administration's promises to support and promote crypto-friendly policies. One of the most impactful potential changes is the anticipated removal of Gary Gensler as the Chair of the Securities and Exchange Commission (SEC). Gensler's tenure has been marked by stringent regulatory actions against crypto firms, including numerous enforcement cases alleging violations of federal securities laws without allegations of fraud or harm. His approach has been criticized by industry leaders for creating regulatory uncertainty and stifling innovation within the crypto space.

President Trump's pledge to replace Gensler with a more crypto-supportive SEC Chair could lead to a significant shift in the regulatory landscape. Potential candidates for the position, such as Dan Gallagher and Paul Atkins—both former SEC commissioners with pro-crypto stances—have expressed the need for clearer, more favorable regulations. A new SEC leadership might pause enforcement actions based solely on registration violations and instead focus on collaborating with industry stakeholders to develop tailored rules that recognize the unique characteristics of cryptocurrencies. This could include issuing updated guidance on when crypto assets are considered securities, proposing crypto-specific regulations, and utilizing the SEC's exemptive authority to provide relief where traditional regulations may not fit the crypto context.

Another significant promise from the Trump administration is the creation of a strategic national cryptocurrency reserve. President Trump has advocated for the United States to hold all the Bitcoin it currently possesses and to acquire more in the future, effectively treating Bitcoin as a strategic asset similar to gold reserves. This move could legitimize cryptocurrencies on a national level, encourage broader acceptance, and position the U.S. as a leader in the global digital economy. Additionally, it could stimulate domestic crypto mining operations by integrating them into energy and data center infrastructures, potentially creating jobs and technological advancements in the renewable energy sector.

The administration has also emphasized the importance of making the U.S. a powerhouse in Bitcoin mining, with policies aimed at ensuring all Bitcoin is "made in the USA." By encouraging sustainable mining practices and investing in energy dominance, the government aims to address environmental concerns while boosting the economy. Furthermore, President Trump has proposed establishing a "Bitcoin and crypto presidential advisory council" composed of industry experts to guide policy-making. This council would work towards creating regulations that support rather than hinder the industry, reflecting the administration's commitment to fostering innovation.

With Republican control of both the Senate and the House, there is potential for Congress to pass legislation that benefits the crypto industry. Bills such as the Financial Innovation and Technology for the 21st Century Act, which seeks to provide a clear regulatory framework for digital assets, could gain traction. Legislative efforts may focus on defining digital assets, providing clarity on their classification, and setting out the roles of regulatory bodies like the SEC and the Commodity Futures Trading Commission (CFTC). Such laws could facilitate the approval of cryptocurrency exchange-traded funds (ETFs), allow banks to own and custody crypto assets, and support the growth of crypto exchanges and broker-dealers.

These developments suggest that the new administration's pro-crypto stance could lead to increased institutional adoption, market growth, and innovation within the industry. By providing regulatory clarity and fostering a supportive environment, the United States could attract international businesses and investors, enhancing its competitiveness in the global digital economy. For the cryptocurrency market, these changes could result in increased liquidity, reduced volatility, and broader public acceptance, potentially driving prices upward and encouraging more widespread use of digital assets. The combination of favorable policies, leadership changes at regulatory agencies, and legislative support could mark a transformative period for the crypto industry in the United States.

The Influence of The Trump Family on Donald Trumps Decision Making

President Trump's pro-crypto stance is further underscored by his family's active involvement in the cryptocurrency sector, which has significantly shaped his policies and perspectives. In September 2024, his sons, Donald Jr. and Eric Trump, launched World Liberty Financial (WLF), a cryptocurrency and decentralized finance (DeFi) platform aimed at revolutionizing the financial industry. This initiative seeks to provide Americans with alternatives to traditional banking systems by leveraging blockchain technology to create a decentralized, peer-to-peer borrowing and lending system. Trump has personally promoted WLF in public appearances and on social media, signaling his strong support for the project and showcasing the direct influence his family holds over his views on cryptocurrency.

Barron Trump, the youngest member of the Trump family, has also been identified as the "DeFi visionary" behind WLF, playing a significant role in the project's development. His deep engagement with blockchain technology and decentralized finance exemplifies the family's alignment with cryptocurrency innovation. These familial ventures not only highlight the Trumps' commitment to financial innovation but also reveal how deeply President Trump is influenced by his family's pro-crypto enthusiasm. This influence may bias him toward policies that heavily favor the cryptocurrency industry, further intertwining personal and political interests.

By promoting and supporting family-led cryptocurrency projects, President Trump underscores his belief in the transformative potential of blockchain technology, while also demonstrating a bias shaped by familial involvement. This dynamic raises questions about the objectivity of his pro-crypto policies, as they are deeply rooted in the interests and endeavors of his inner circle. Nonetheless, this alignment between personal and political priorities could drive significant regulatory and legislative support for the industry.

3. Wall Street Acceptance:

Wall Street's adoption of cryptocurrencies has accelerated markedly, signaling a transformative shift in the financial industry's attitude toward digital assets. According to Sygnum's Future Finance 2024 survey, institutional investors are demonstrating increased confidence in cryptocurrencies, with 57% planning to boost their crypto allocations despite ongoing market volatility. The survey, which polled over 400 investment professionals across 27 countries, reveals that 63% assess their risk tolerance as high or very high, and more than half maintain portfolio allocations exceeding 10% in digital assets. Single token investments remain the preferred strategy at 44%, closely followed by actively managed exposure at 40%. The primary motivations for crypto investment include exposure to the digital asset megatrend (62%), portfolio diversification (52%), and macro hedging (45%).

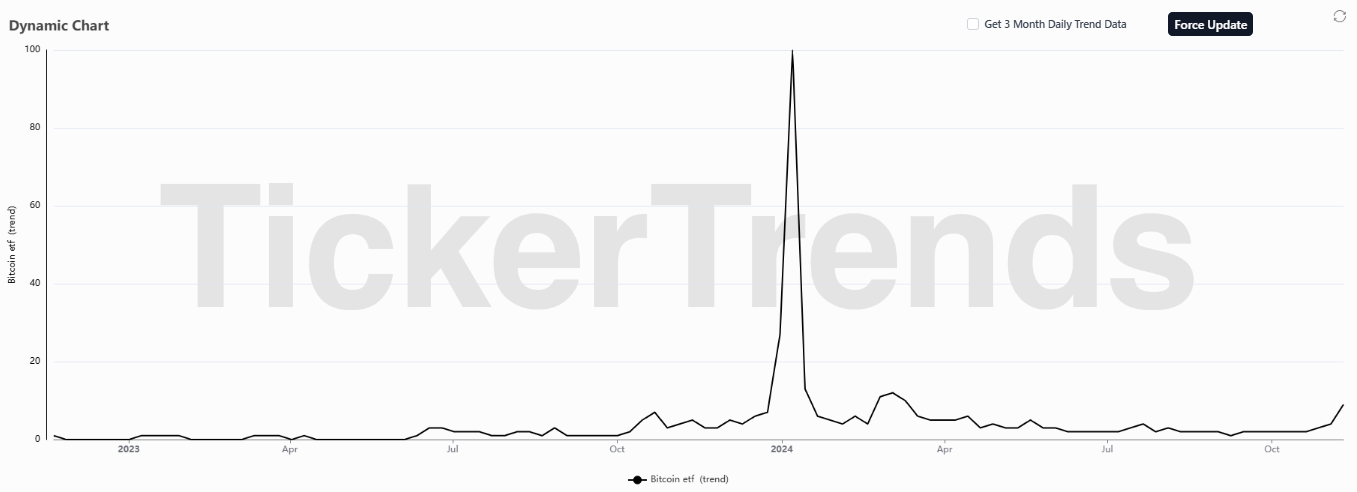

The approval of Bitcoin and Ethereum spot Exchange-Traded Funds (ETFs) has significantly boosted market confidence, with 71% of respondents expressing increased trust in the crypto space. Leading traditional financial institutions (TradFi) like BlackRock have played a pivotal role in this development. BlackRock's Bitcoin ETF has shattered records, becoming the fastest-growing ETF in history since its launch in January 2024, reaching $30 billion in assets under management (AUM). This surge reflects a substantial inflow of institutional capital, indicating a shift toward accepting Bitcoin as part of broader investment strategies.

Major Wall Street institutions are increasingly participating in the crypto market. For instance, Millennium Management manages $64 billion in total capital, with $1.94 billion allocated to Bitcoin ETFs, representing 3.03% of its capital. Other notable institutions like Morgan Stanley and Goldman Sachs have also reported significant holdings in Bitcoin ETFs. Pension funds are entering the space as well; the State of Wisconsin Investment Board, with $156 billion in assets, disclosed holdings of $98.9 million in Bitcoin ETFs. Similarly, the State of Michigan Retirement System reported substantial investments in Bitcoin and Ethereum trusts.

State governments are recognizing cryptocurrencies' potential, with Colorado and Louisiana accepting crypto payments for taxes and state services. Legislative initiatives in states like Ohio aim to further integrate cryptocurrencies into financial systems, proposing bills that require the acceptance of cryptocurrency for state and local taxes and fees. These moves by prominent financial and public institutions underscore a growing confidence in cryptocurrencies' long-term value proposition.

This increased institutional adoption is beneficial to cryptocurrency prices for several reasons. Firstly, the influx of institutional capital enhances market liquidity, which can reduce volatility and attract more investors. Secondly, institutional endorsement adds legitimacy to cryptocurrencies, fostering greater public trust and encouraging broader adoption. Thirdly, as demand for digital assets rises due to institutional buying, the limited supply—particularly of assets like Bitcoin—can drive prices upward. Additionally, the involvement of major financial players can lead to more sophisticated financial products and services related to cryptocurrencies, further integrating them into the global financial system.

In summary, Wall Street's increasing appetite for cryptocurrencies, evidenced by rising institutional investments, the approval of crypto ETFs, and government acceptance, is playing a significant role in legitimizing the crypto market. This institutional adoption not only signals confidence in the long-term viability of digital assets but also contributes to price appreciation through increased demand and market participation. As digital assets integrate further into mainstream finance, these trends are likely to continue, potentially leading to sustained increases in cryptocurrency prices.