$DPZ Domino's Pizza Inc Earnings Preview | TickerTrends.io

$DPZ KPI Metrics, Earnings Preview Tracking, Expectations And Alternative Data Comps

Market Expectations

Analysts expect 3.65% YOY growth which is an slowdown of -22.14% QoQ going into Q1 2025.

Domino's Pizza (NYSE: DPZ) reported its Q4 2024 earnings on February 24, 2025, showcasing steady growth in key performance indicators (KPIs) despite challenges in the U.S. market. Here's a concise summary of their performance:Wikipedia

Financial Highlights

Revenue: $1.53 billion, a 2.9% increase year-over-year, driven by higher supply chain and U.S. franchise advertising revenues. GuruFocus

Net Income: $169.4 million, up 7.7% compared to Q4 2023.

Diluted EPS: $4.89, slightly below the consensus estimate of $4.99. GuruFocus

Free Cash Flow: $512 million for fiscal 2024, up from $485.5 million in 2023. GuruFocus

Operational Metrics

U.S. Same-Store Sales: Increased by 0.4% in Q4, with carryout sales up 3.2% and delivery down 1.4%. Yahoo Finance

International Same-Store Sales: Grew by 2.7% in Q4, exceeding expectations. Reuters

Global Retail Sales: $5.94 billion in Q4, up 4.4% year-over-year.

Store Growth: Added 364 net new stores in Q4, totaling 775 new stores for fiscal 2024. GuruFocus

Shareholder Returns

Dividend: Increased quarterly dividend by 15% to $1.74 per share. GuruFocus

Market Reaction & Challenges

Despite solid financials, Domino's stock declined by 6% following the earnings release, primarily due to underwhelming U.S. same-store sales growth, which fell short of the 1.5% consensus estimate. This shortfall is attributed to heightened competition from fast-food chains offering aggressive value meal promotions. Investopedia Reuters

Alternative Data

Web Traffic

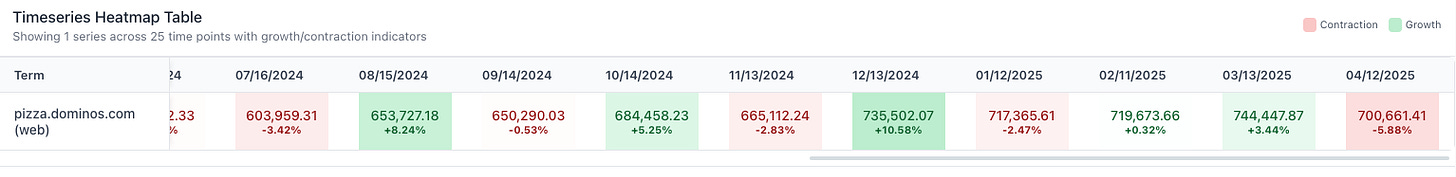

Recent data indicates a -5.88% MoM slowdown in web traffic to pizza.dominos.com .

Recent data indicates a -7.29% MoM slowdown in web traffic to dominos.com .

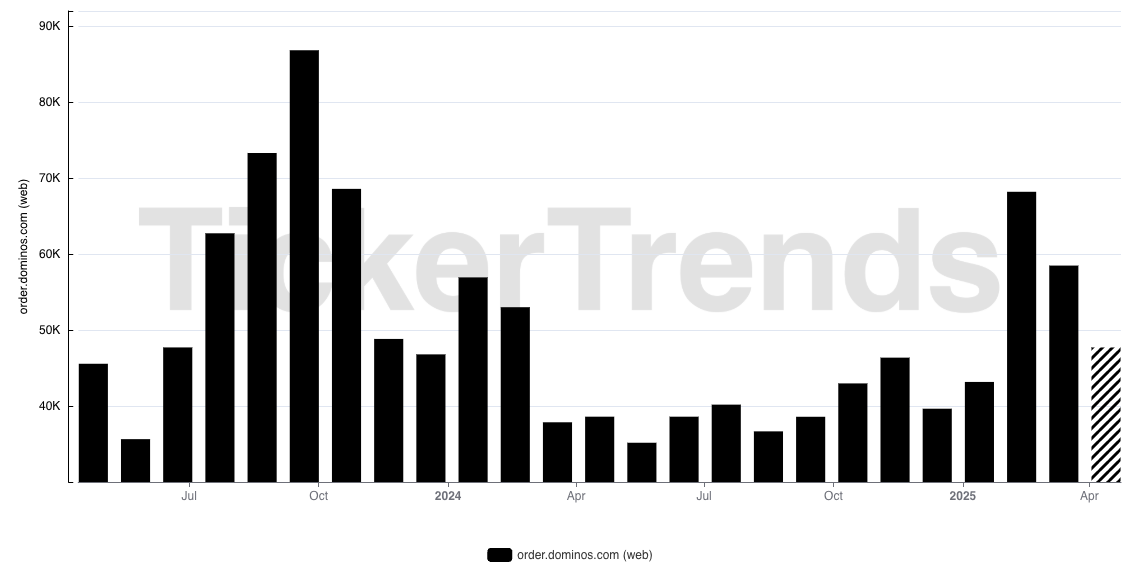

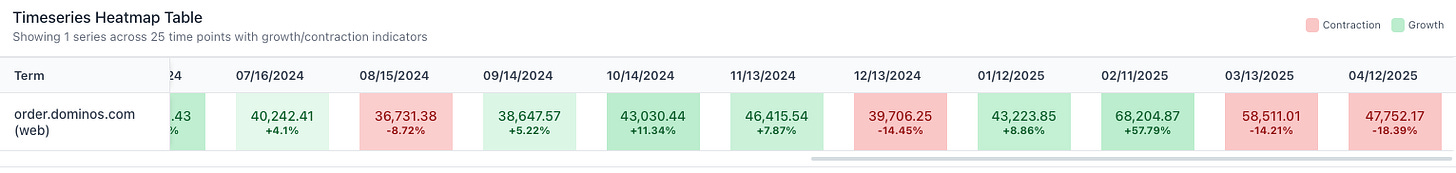

Recent data indicates a -18.39% MoM slowdown in web traffic to order.dominos.com .

Search Trends

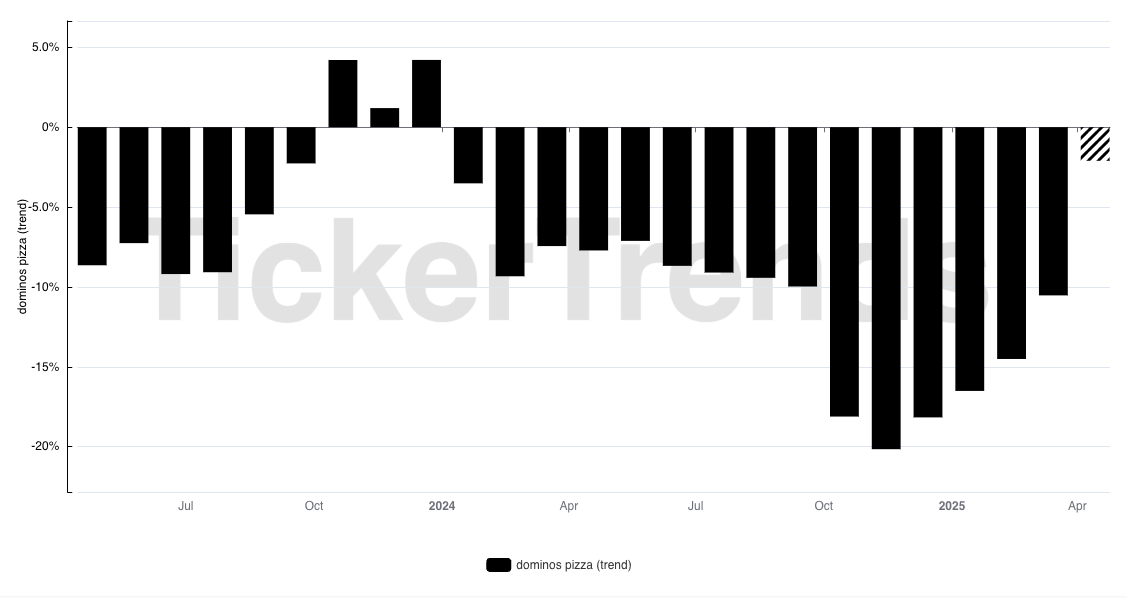

Recent data indicates a -6.02% YoY slowdown in web traffic to dominos menu search which is very strong.

Recent data indicates a -2.10% YoY slowdown in web traffic to dominos pizza search which is very strong.

Mobile Data

Recent data indicates a 6.01% MoM acceleration in android mobile app usage.

Recent data indicates a 4.02% MoM acceleration in ios mobile app usage.

Social Data

Recent data indicates a 21.60% YoY acceleration in YouTube search interest.

Recent data indicates a -19.54% MoM acceleration in TikTok views, however this is extremely elevated due to the recent strong Dominos Crust trend.

New Partnerships

Domino’s Pizza has strategically expanded its partnership portfolio in Q4 2024 and early 2025, enhancing its delivery capabilities and brand engagement:

DoorDash Collaboration: In April 2025, Domino’s announced a partnership with DoorDash, enabling customers to place orders through the DoorDash app. This initiative aims to broaden Domino’s customer base, especially in suburban and rural areas, with a nationwide U.S. launch planned for May and Canadian expansion later in the year. Notably, deliveries will continue to be fulfilled by Domino’s drivers, ensuring consistent service quality. Reuters

Uber Eats Partnership: Building on its 2023 collaboration, Domino’s extended its exclusivity agreement with Uber Eats through May 1, 2025. In 2024, this partnership contributed to 3% of U.S. sales, highlighting the growing significance of third-party aggregators in Domino’s distribution strategy. Nation’s Restaurant News

Netflix Collaborations: Domino’s continued its innovative marketing by partnering with Netflix for the "Squid Game: The Experience" event in December 2024. Participants received "Emergency Pizza" rewards, blending entertainment with brand promotion. This follows their previous collaboration on a "mind ordering" app inspired by "Stranger Things," showcasing Domino’s commitment to engaging customers through popular culture. Domino's

WorkInProgress Agency Extension: Domino’s extended its contract with its U.S. agency of record, WorkInProgress, through 2027. This extension underscores the brand’s dedication to maintaining a consistent and innovative marketing approach. Domino's

These partnerships reflect Domino’s proactive approach to expanding its reach and enhancing customer engagement through strategic collaborations.

Conclusion

Domino’s closed out Q4 2024 with steady financial growth, solid global expansion, and encouraging alternative data trends. While U.S. same-store sales growth moderated and some web traffic metrics showed slight month-over-month declines, overall consumer engagement remains healthy across digital and international channels. Strong gains in mobile app usage and YouTube search interest point to a brand that continues to resonate with consumers, while the elevated activity around new product innovations offers a promising setup for 2025. With a growing global footprint and strengthening digital momentum, Domino’s is well-positioned to build on its leadership in the quick-service restaurant space.

Track real-time alternative data on TickerTrends.io