Duolingo's Viral Surge Powers Q2 Growth, But KPI Momentum Now at Risk

Duolingo is on track to beat Q2 DAU expectations, driven by viral momentum from March -- But beneath the surface, alternative data reveals weakening sentiment, declining app rankings, social backlash

Duolingo appears set to report another strong quarter of user growth for Q2 2025, with:

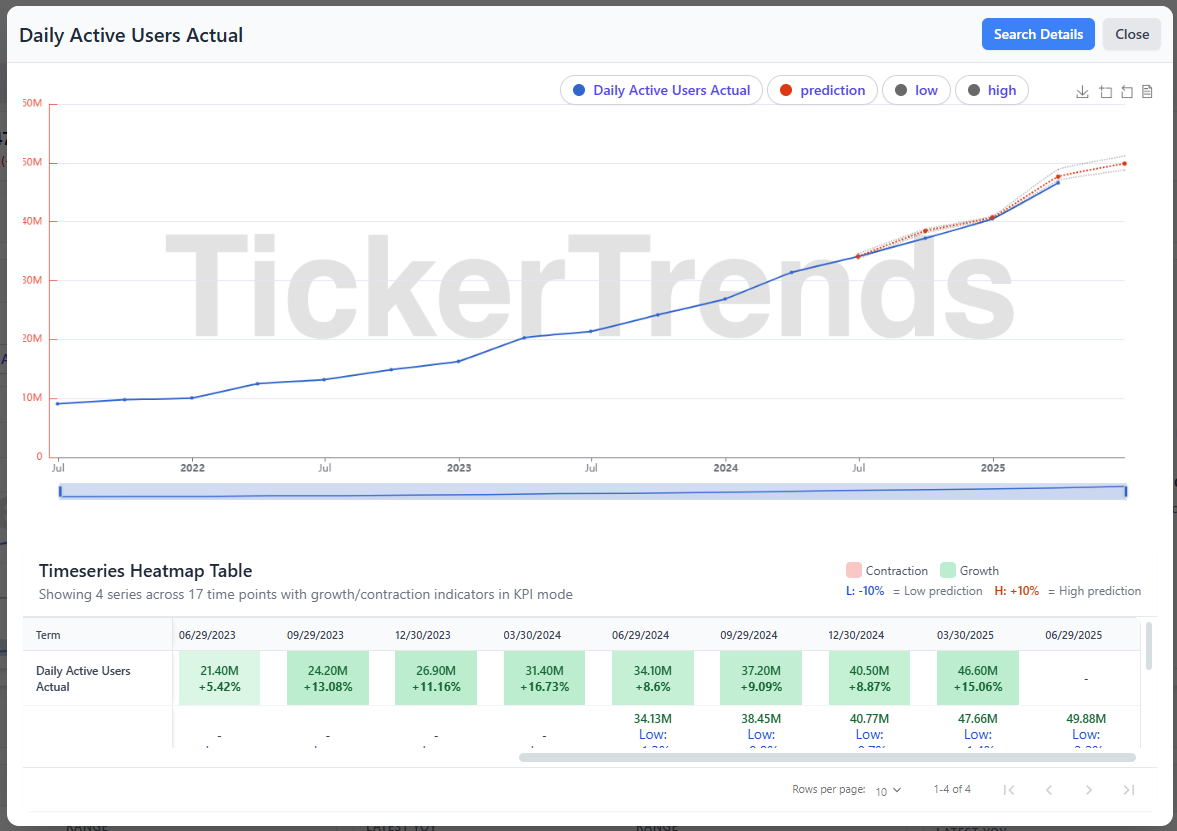

TickerTrends KPI tracking Daily Active Users (DAUs) will reach approximately 49.88 million, 7.03% QoQ or 46.26% YoY

our weekly revisions have indicated a -0.36% decline in our forecast during tracking.

This projection is based on real-time alternative data from our platform and sits modestly above

Wall Street consensus, which is expecting around 49 million DAUs.

The company’s user momentum has been largely propelled by a wildly successful viral campaign in March 2025, in which the brand’s mascot, Duo the Owl, was “killed” by a Cybertruck and later “resurrected,” generating over a billion organic views across platforms. That moment cemented Duolingo’s dominance in the cultural zeitgeist, creating a surge in app downloads, user engagement, and social media reach. As a result, Q2 daily user metrics are expected to benefit from the residual effects of that viral wave, particularly in April and early May, setting the company up for a beat on one of its most closely watched KPIs.

However, while the headline DAU figure for Q2 will likely impress, a more nuanced analysis reveals potential cracks forming beneath the surface. Multiple forward-looking indicators suggest that Duolingo may be facing the early signs of deceleration in user engagement, public sentiment, and brand momentum. These shifts raise concerns about whether the company's current growth trajectory can be sustained into the back half of 2025.

Cooling Momentum Data

TikTok Views for #Duolingo: Flat - negative YoY

@Duolingo TikTok Avg Likes: Flat - negative YoY

@Duolingo Followers: -200,000 lost in May

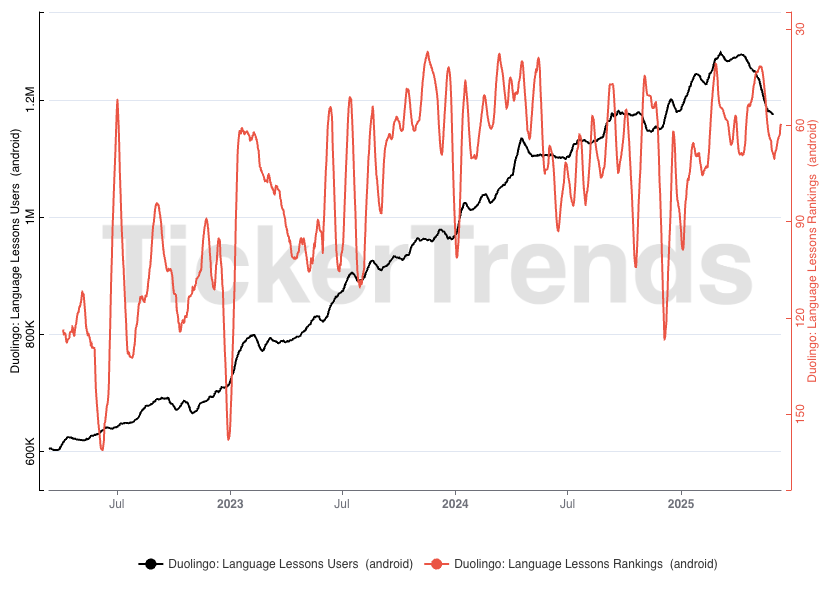

Duolingo IOS App Ranking: -14 in the last 90 days

Duolingo Android App Ranking: -5 in the last 90 days

Social comment sentiment: Exceedingly negative

One of the first signs of cooling momentum comes from TikTok, where Duolingo has traditionally excelled. Tickertrends has observed a clear decline in organic mentions of Duolingo across TikTok since the peak in March. While the brand still maintains a strong presence, the volume of posts, user-generated content, and spontaneous fan engagement has declined from Q1 levels.

More importantly, the average likes per TikTok post on Duolingo’s official account have trended downward over the past two months. This data implies diminishing engagement per video, which indicates that the content is no longer achieving the same virality.

Duolingo held a top spot in the Education category on iOS through much of April, but by late May and June, the app’s ranking had begun to slip. These changes, while not catastrophic, suggest that the immense DAU momentum from Q1 and early Q2 is flattening.

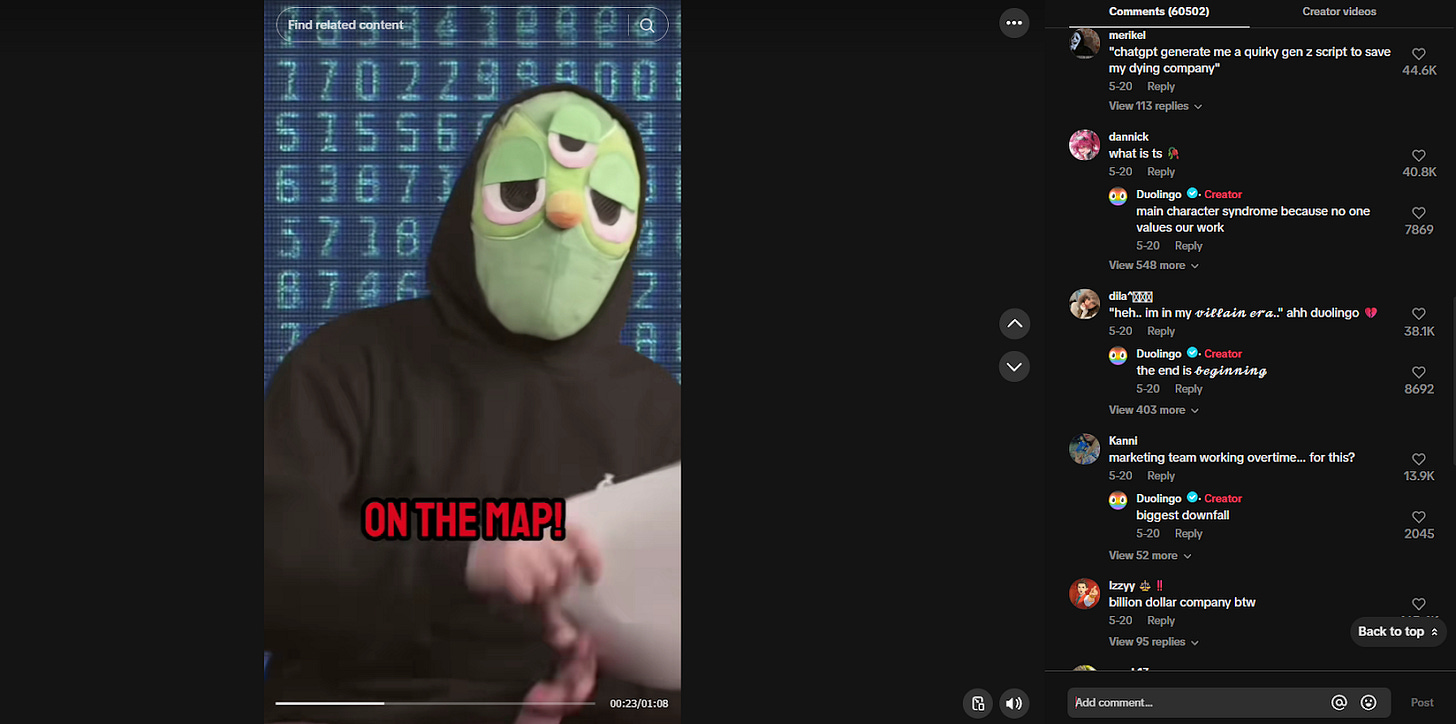

Overlaying these quantitative signals is a more subtle, but arguably more dangerous trend: a shift in public sentiment. For a brand built on humor, relatability, and fan affection, Duolingo is now navigating its most serious backlash to date. This began with the company’s AI strategy, which was revealed in April through internal memos and public comments by CEO Luis von Ahn.

Instead of offering a sober or empathetic response, the company leaned into its brand voice with surreal, self-mocking TikTok skits—one of which featured the owl confronting the CEO while wearing a third eye. These videos were intended to defuse tension with humor but ended up reinforcing perceptions that the company was trivializing serious concerns.

The backlash snowballed from there. Comments across TikTok, Instagram, and Twitter/X were flooded with disapproving messages.

Eventually, Duolingo brought on the CEO to apologize on social media.

Quantifying this sentiment erosion, Tickertrends data shows that Duolingo’s TikTok account lost nearly 200,000 followers in May alone—a rare occurrence for any brand on a growth trajectory, let alone one that just posted record earnings. The same trend extended to Instagram, where the company saw a net loss of approximately 80,000 followers during the same period. This was not due to an algorithm change or external platform issue, but rather appeared driven by user backlash.

The blowback has now intensified when Duolingo posted a Pride Month video earlier this month declaring “Duo is gay,” consistent with its history of LGBTQ+ support. But this post also drew fire from two sides. While intended to be inclusive, it reopened criticisms from certain markets where Duolingo had previously removed LGBTQ+ content, such as Russia. Some users accused the company of virtue signaling, while others—already upset over the AI debacle—saw it as a distraction. The net result was more users saying they would delete the app. Even for a brand that courts controversy, this level of disengagement is striking.

The danger here is not just bad optics. This negative sentiment appears to be bleeding into key performance indicators. While Duolingo’s DAUs remain strong for Q2, it’s possible that backlash-fueled disengagement could begin to show up more clearly in Q3 metrics.

Tickertrends is closely monitoring app activity, and the signals suggest that while total usage is up year-over-year, the rate of increase is slowing.

The company has proven time and again its ability to adapt, innovate, and bounce back. Public sentiment is notoriously fickle, and what feels like a brand crisis today may be forgotten in a matter of weeks. Wendy's example is illustrative: following a pricing controversy, fans revolted online, only to resume patronage once the outrage cycle moved on. Duolingo is capable of engineering a turnaround moment. Whether through a new AI feature, a high-profile partnership, or another viral hit, the company’s social media team has the creative firepower to flip the narrative. If that happens, engagement could rebound, and DAU momentum could accelerate again in Q3 or Q4. Thus, the key for investors is not to blindly react to sentiment, but to monitor its evolution in real time. Our alternative data sources and KPI metrics are invaluable here, offering insights into user behavior, app usage, brand health but what differentiates us is the ability to price in social risks that no other alternative data providers have visibility into.

Very useful analysis, what is the page or the app that you are suing to query the KPI's and all the data?

Nice analysis!