Dutch Bros Poised to Outperform Q2 Sales Estimates on Matcha‑Fueled Digital Momentum

TickerTrends projects Dutch Bros Q2 systemwide sales to outpace consensus, powered by Matcha‑driven spikes in app usage, web traffic and search interest alongside a Starbucks sugary‑drink pullback

TickerTrends’ data suggests that Dutch Bros (BROS 0.00%↑) is on track to outperform expectations for systemwide sales growth this quarter. While the Street is pricing in a meaningful slowdown in topline growth, our high-frequency model points in the opposite direction. Based on our data, Systemwide Sales growth is accelerating, not decelerating, supported by multiple digital signals that reflect stronger underlying demand, which was mainly sparked by the launch of Matcha flavors on May 1, 2025.

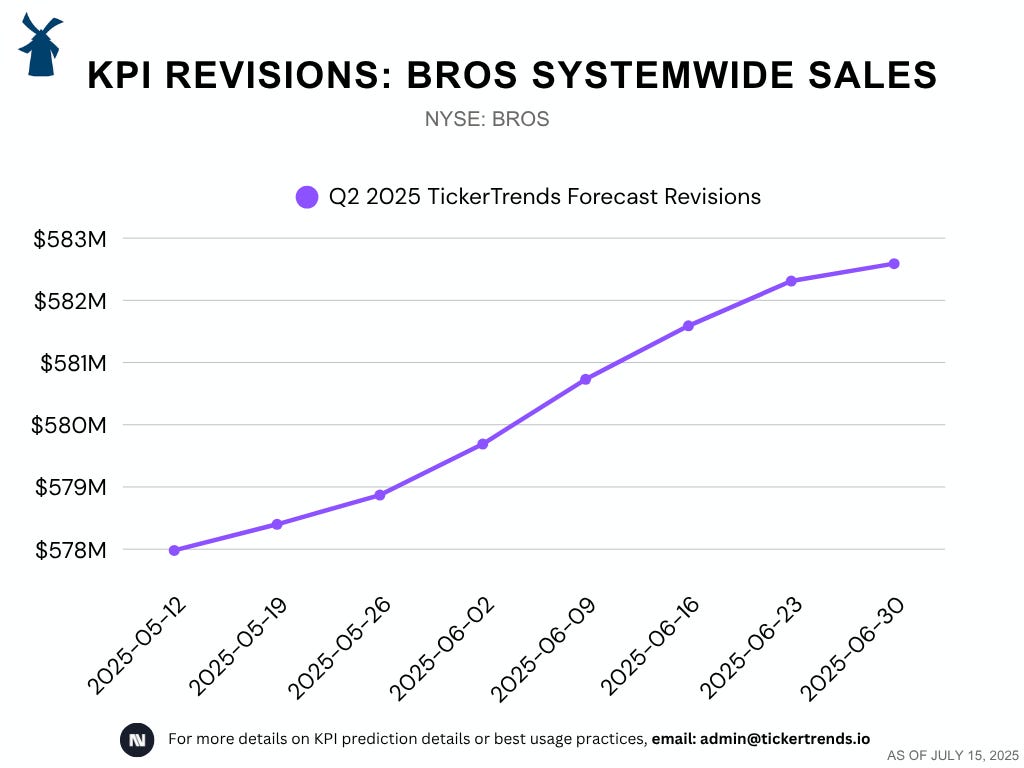

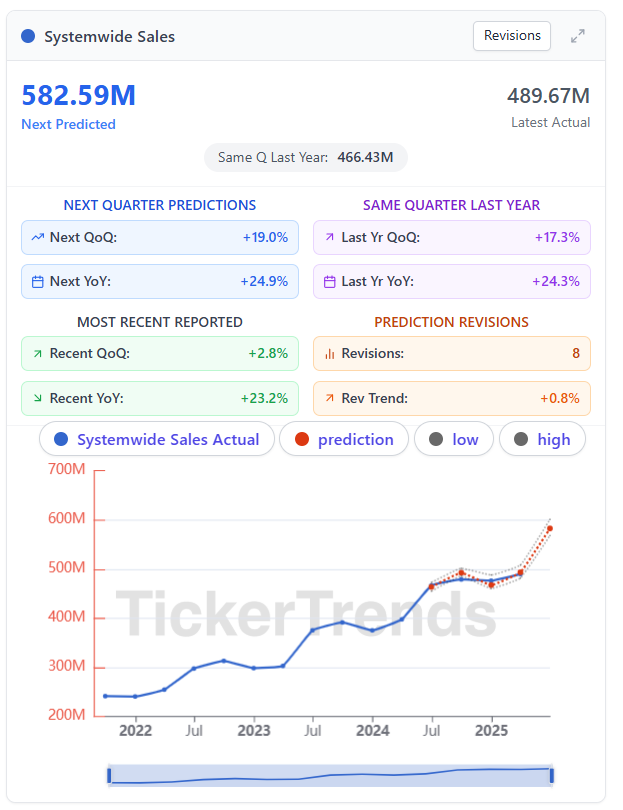

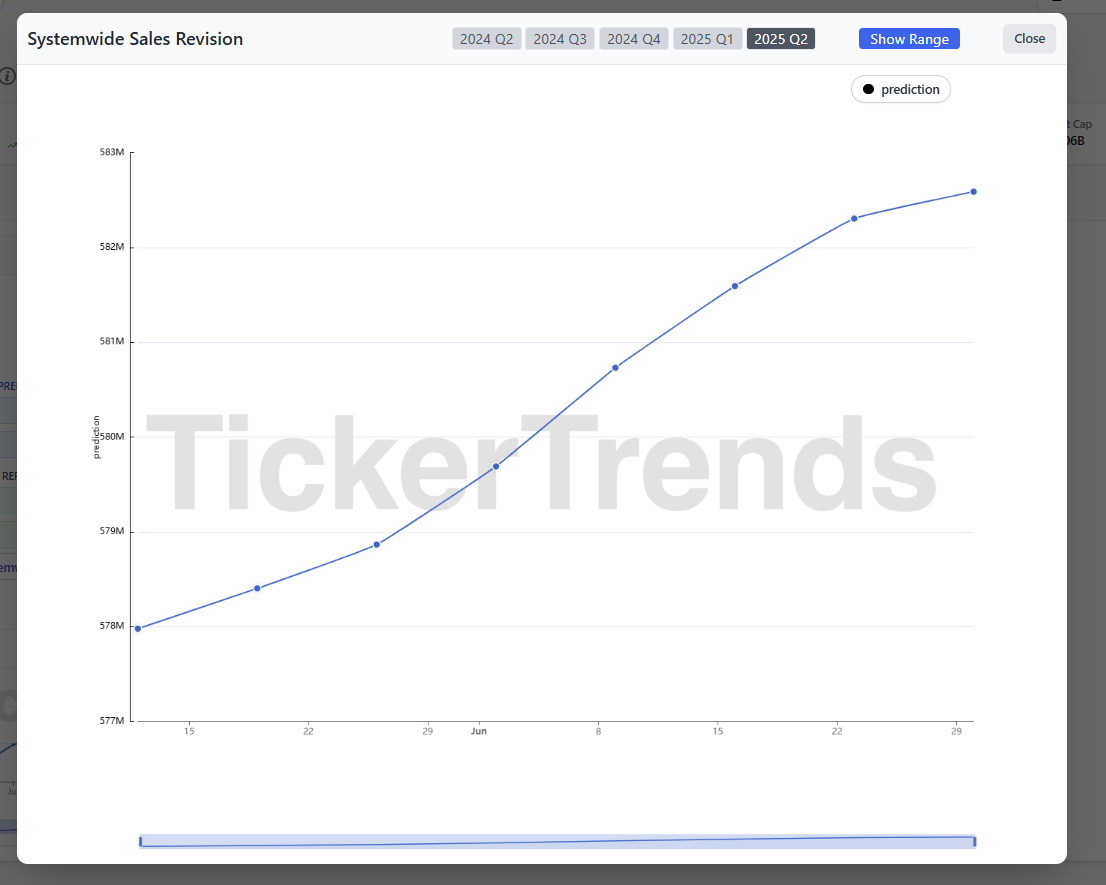

TickerTrends’ Dutch Bros Systemwide Sales Prediction for FY’25 Q2: $582.59M

Historical MOE: 1.51%

Street is Expecting a Deceleration

Consensus estimates imply a roughly 500 basis point decline in year-over-year revenue growth this quarter vs the previous reported quarter (from 29.1% to 24.0%), followed by a further 230 basis point slowdown next quarter (to 21.7%). These assumptions suggest a sharp pullback in demand momentum. However, our alternative data indicates otherwise. Our Q2 systemwide sales forecast is $582.6 million, up 24.9 percent year-over-year, compared to 23.2 percent year-over-year growth last quarter. That is an upward inflection, not a slowdown.

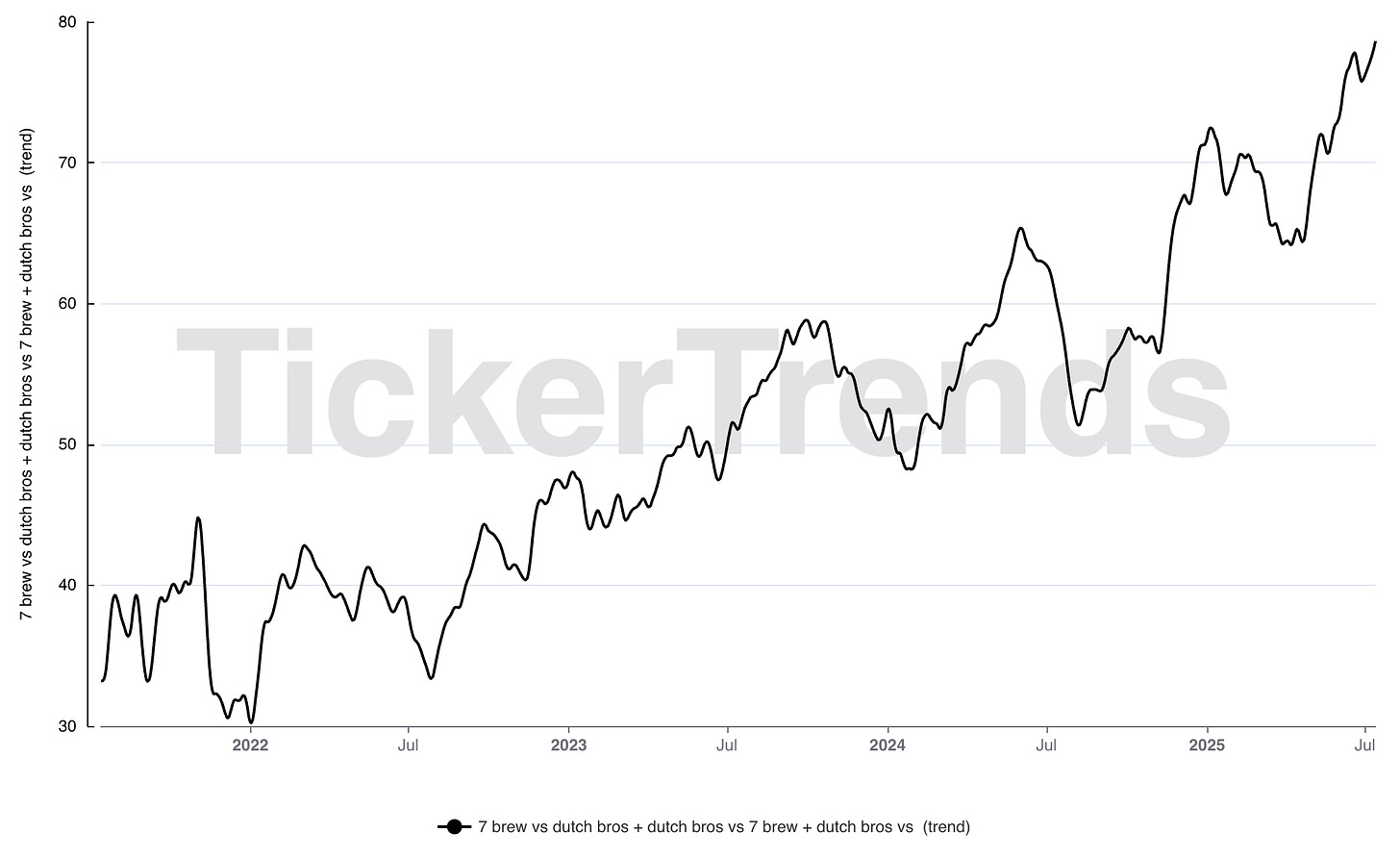

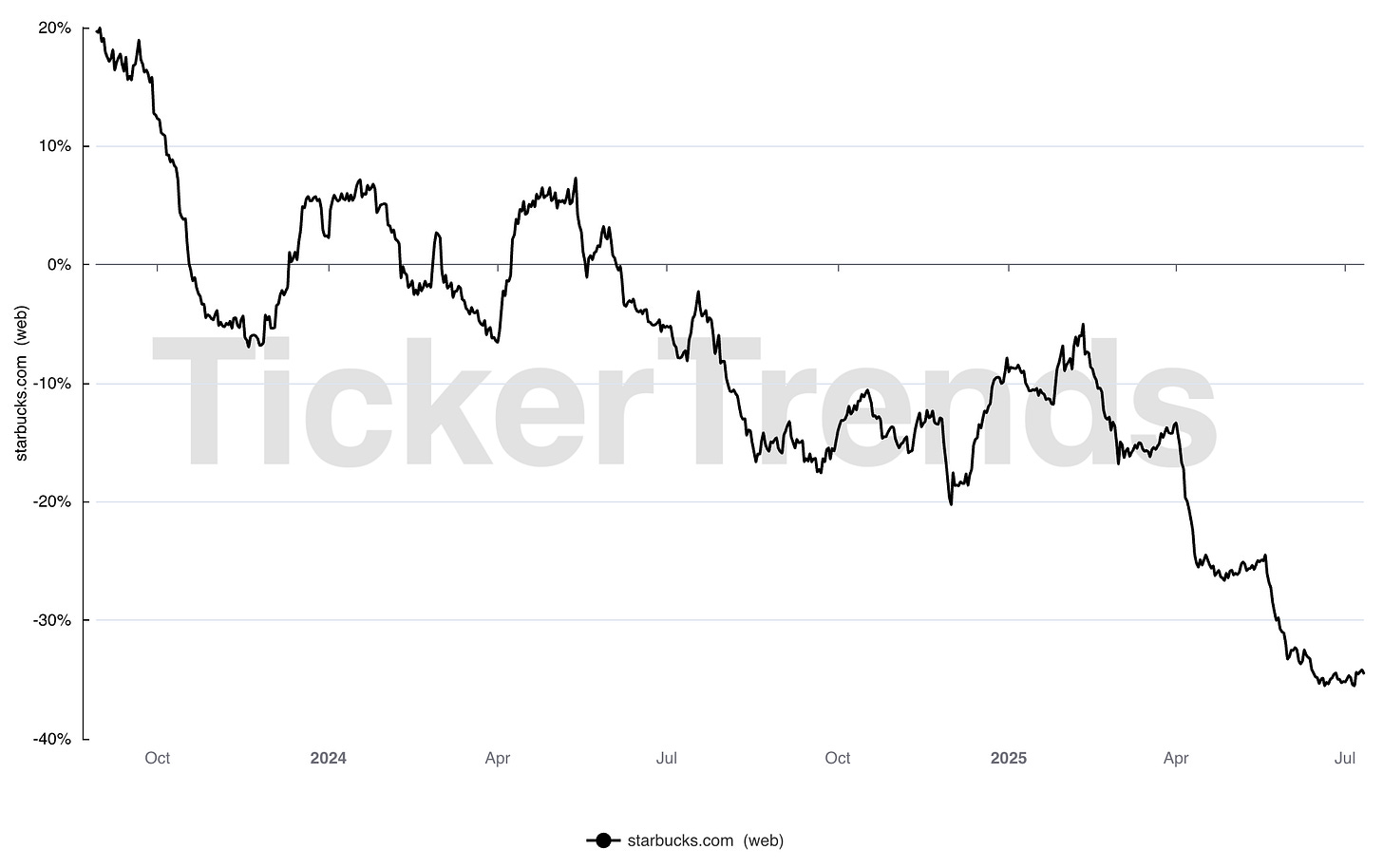

Social Catalyst - Starbucks exit of the sugary drink market

“Starbucks confirmed to ABC News that as of March 4, a selection of 13 drinks will be removed from the menu as part of the Seattle-based coffee chain's plan to "get back to Starbucks" and "focus on fewer, more popular items, executed with excellence."

"These items aren't commonly purchased, can be complex to make, or are similar to other beverages on the menu," the company stated. "This will make way for innovation, help reduce wait times, improve quality and consistency, and align with our core identity as a coffee company.

The company said that "additional beverages and food will exit Starbucks menu throughout the coming months, resulting in a roughly 30% reduction of menu items" by the end of September.”

https://www.tastingtable.com/1862740/7-brew-vs-dutch-bros-coffee-chain-difference/

SBUX 0.00%↑ Starbucks is losing considerable market share in sugary beverages.

What the Data is Telling Us

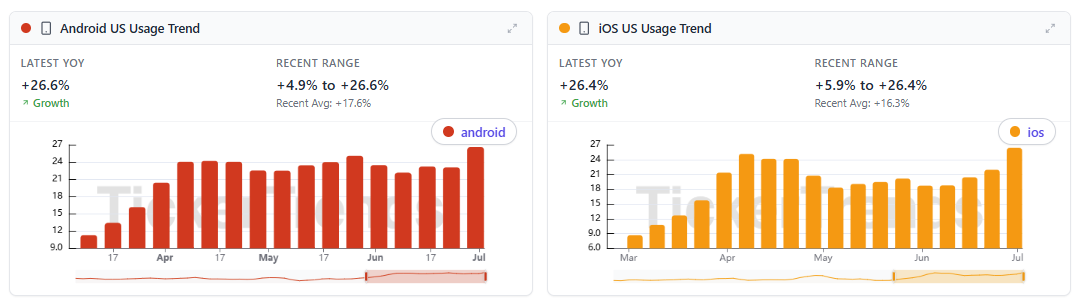

Mobile app engagement across both iOS and Android platforms has been trending higher for weeks, with increased DAUs in US locations. Both Android and iOS are now experiencing a 26% YoY growth rate vs last year at this time.

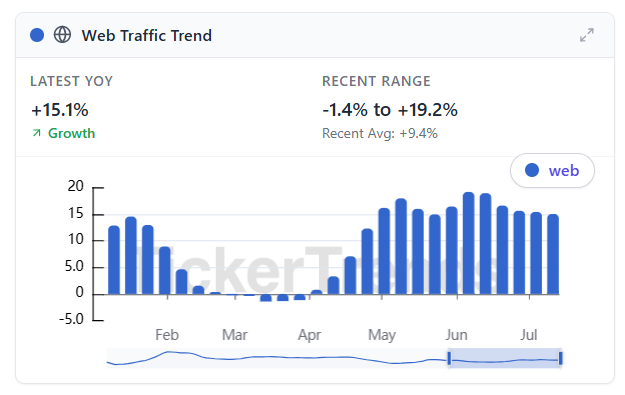

Website traffic to Dutch Bros website has accelerated since late April holding a roughly +15% YoY growth rate suggesting consumer engagement with the brand.

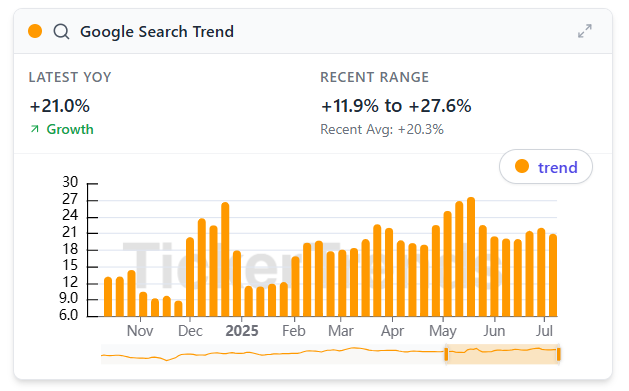

Google Search interest in Dutch Bros related google searches is moving meaningfully higher compared to last year’s levels, with a particularly sustained double digit search interest growth into June after the initial May matcha-related search acceleration.

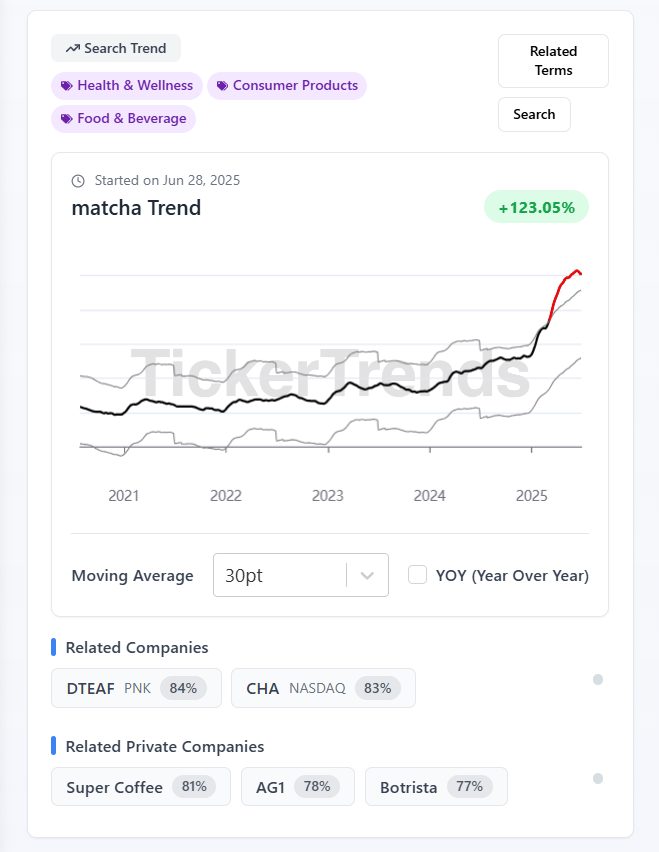

This enthusiasm aligns with our rising Mobile App usage, Web Traffic and Google Search trends suggesting Dutch Bros new matcha flavors is driving incremental demand and social brand traction / awareness. These trends have all seen acceleration around that early May timeframe, which signals that this launch likely responsible for the incremental demand in already growing brand. We also believe Dutch Bros entered the matcha category at an opportune moment, joining larger chains in capitalizing on a viral beverage trend. Google Search trends have been exploding higher… with +123% higher interest just over the past year alone.

That matcha contribution is starting to show in our data: consumer engagement metrics have stepped up noticeably since early May. Given the launch coincides with the recent spike in mobile app usage, search interest and site visits, matcha appears to be a tangible catalyst behind the recent upside in KPI trends. Although consumer sentiment towards the drink has been fairly negative.

These are not just static metrics. They have been revising higher consistently throughout the quarter, as shown by our model’s upward slope in prediction revisions. Our platform has already made eight distinct revisions to the upside for Q2 2025 since May, and the trend remains positive.

Why It Matters

Dutch Bros is demonstrating category share gains in a fragmented coffee retail environment. With Starbucks facing traffic normalization, Dutch Bros is carving out a differentiated position focused on speed, rewards programs, and new flavors / variations of products (that satisfy the consumer’s desire for sugary drink coffee). The acceleration in digital behavior suggests that its value proposition is resonating more broadly to today’s consumer.

Conclusion

If consensus holds to its growth decay assumptions, any indication of a sustained revenue growth run-rate could result in Dutch Bros stock seeing a positive earnings reaction. New drink variations (matcha flavors, protein coffee, etc) are working for the company, with more consumers willing to try the brand vs their traditional coffee shop. To us, this indicates that Dutch Bros management understands social trends well and continues to execute well for the brand. The setup favors a long bias into earnings, particularly for funds looking for names where digital and transactional data are pointing to fundamental reacceleration not yet reflected in estimates.

Please email admin@tickertrends.io to gain access to our entire KPI dashboard which includes coverage of over 100 unique KPIs available on TickerTrends Enterprise: https://tickertrends.io/enterprise