Fitness Trackers Surge: Zepp, Garmin, and Coros Capture Peak Consumer Demand

Social and ecommerce data confirm that fitness wearables are more than a fad, with public and private brands showing durable growth trajectories

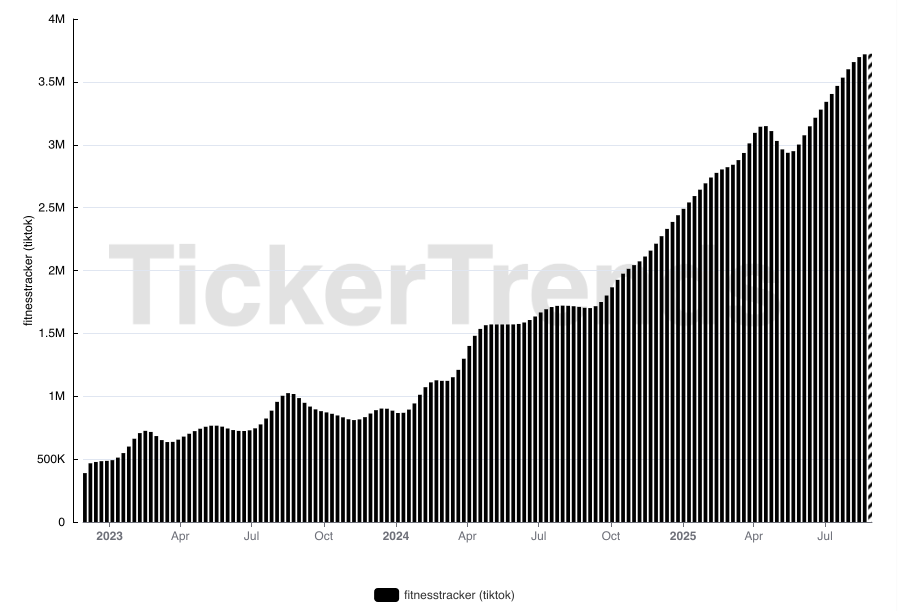

Consumer attention for “fitness trackers” is peaking across social channels, and the category is benefitting from (1) faster product cycles at the value end, (2) premium multi-sport devices expanding TAM beyond runners into hybrid/strength, and (3) TikTok-led discovery loops for new launches and training formats. Industry press and brand comms through 2025 highlight social as a primary top-of-funnel for wearables discovery and purchase intent.

Zepp Health ZEPP 0.00%↑ (Amazfit): momentum, why the stock rerated, and what’s next

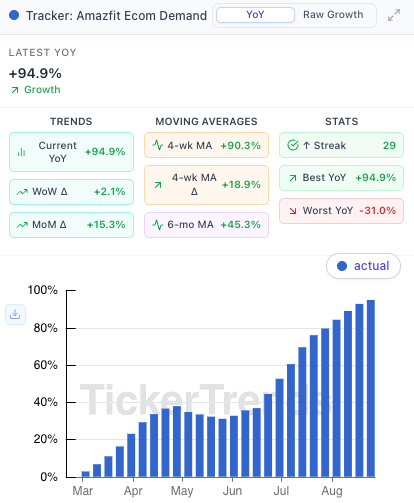

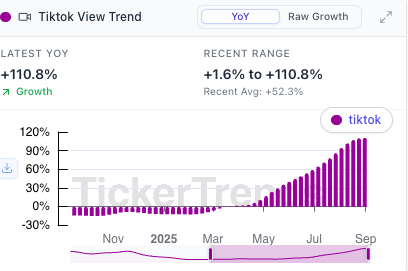

Data (TT): Our Ecommerce demand tracker accelerated +18.9% in the past 4 weeks and is +94.9% YoY, coincident with the Amazfit Balance 2 launch. TikTok viewership has inflected +110.8% YoY (Amazfit).

What changed fundamentally:

Return to growth + raised outlook. Q2’25 revenue +46% YoY to $59.4M with narrowed losses; Q3 guidance implies +70–79% YoY—Zepp’s first sustained growth inflection in years. The print/guide triggered a sharp re-rating. Zepp

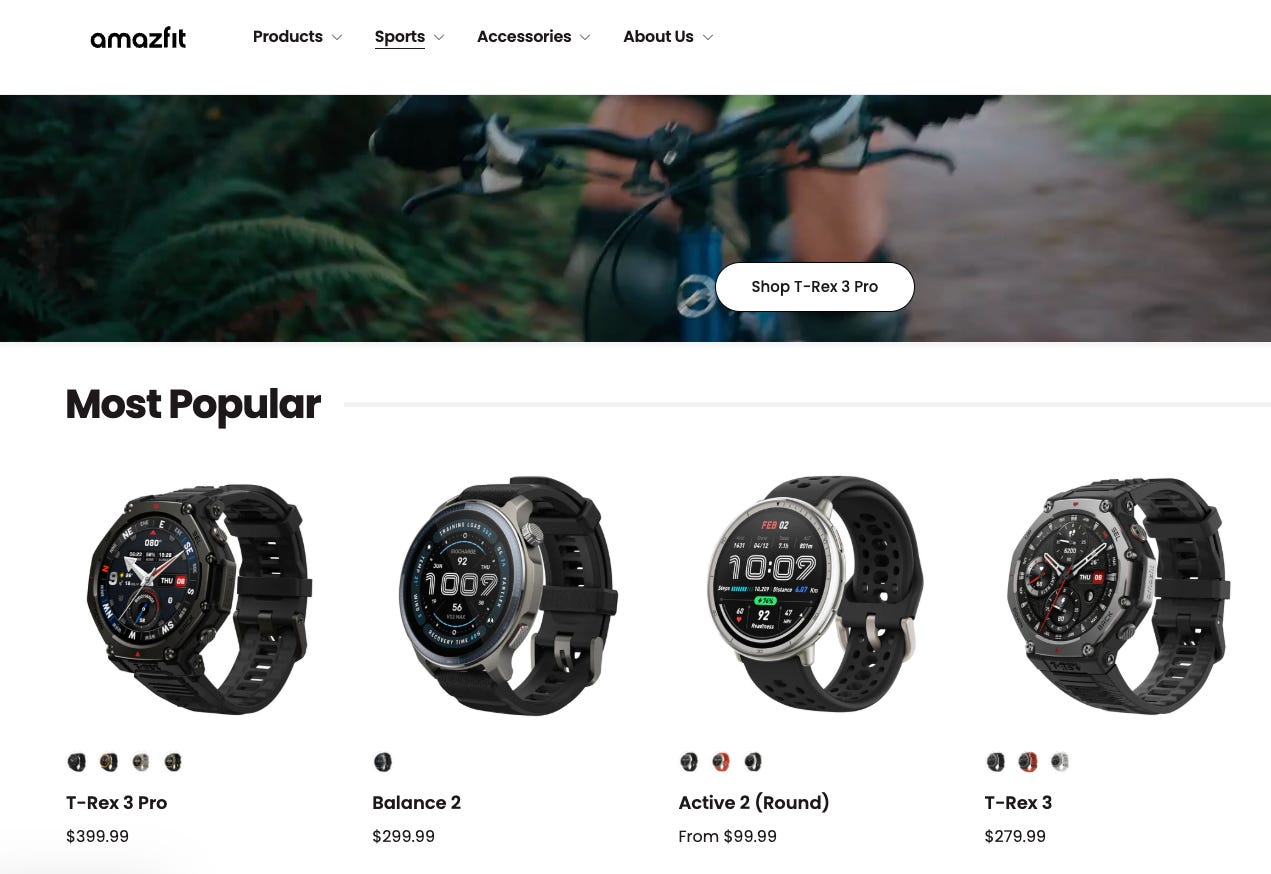

Product engine firing across price tiers. 2025 has seen multiple launch vectors: budget Active 2 (viral pricing/promotions), and mid-premium Balance 2 (sapphire, dual-band GNSS, 10-ATM, offline maps) at ~$300. These broaden reach while improving perceived value. The Verge

Brand/geo mix shift. Coverage notes a successful Amazfit rebrand and expansion outside China—key to multiple expansion as investors underwrite a more global revenue base. Seeking Alpha

Why the stock ripped: Following the Q2 beat and Q3 acceleration guide, ZEPP spiked ~28% that day and has been one of the best YTD performers in wearables (multi-hundred-percent move cited across coverage), with the move tied to new products + operational improvements.

What to watch (risk/reward):

Gross margin/marketing efficiency. Bulls need evidence that promo-driven units translate to sustained GM expansion; bears point to historically thin margins.

Repeat engagement via Zepp OS + services. Balance 2/Active 2 bring AI-assistant and training features; retention from this layer is the medium-term multiple driver. The Verge

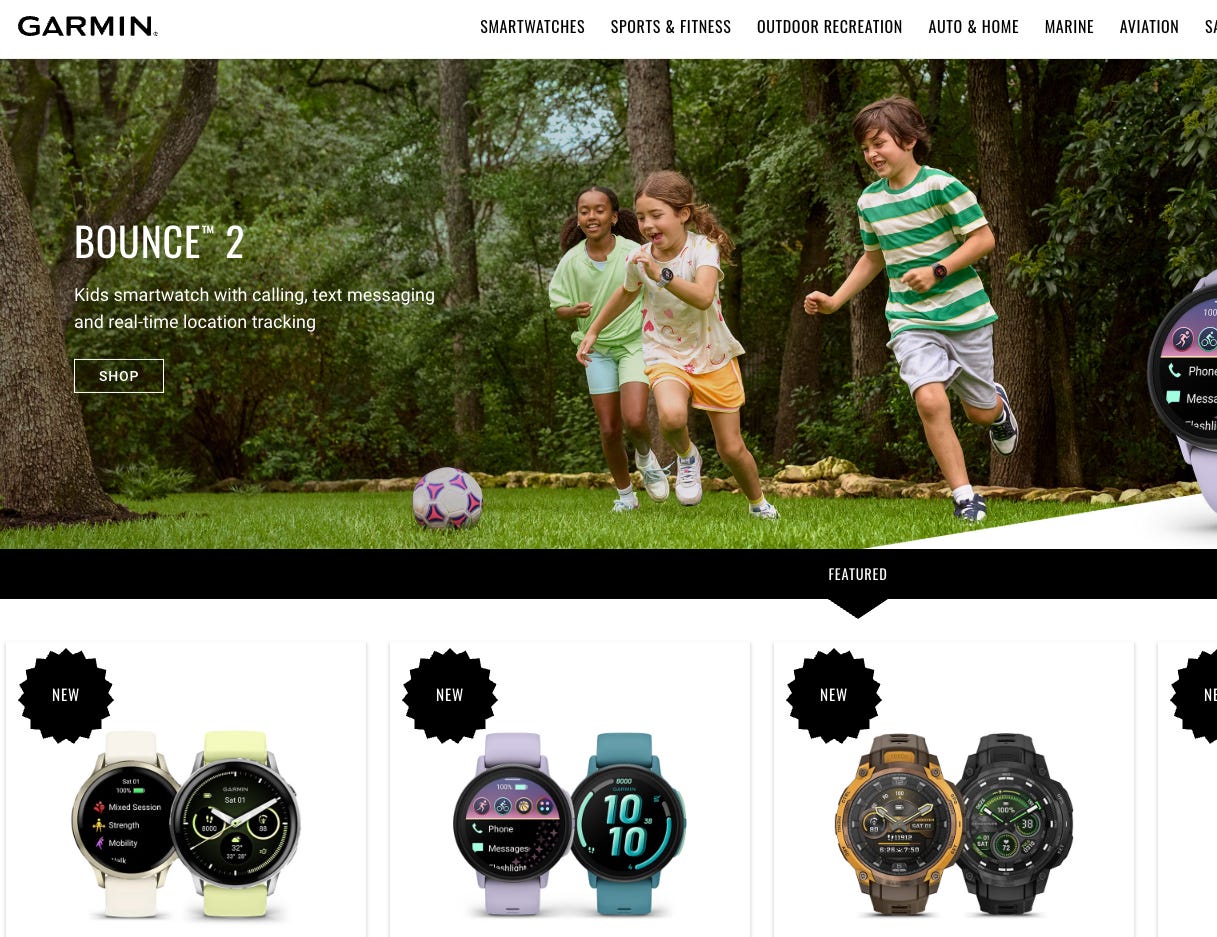

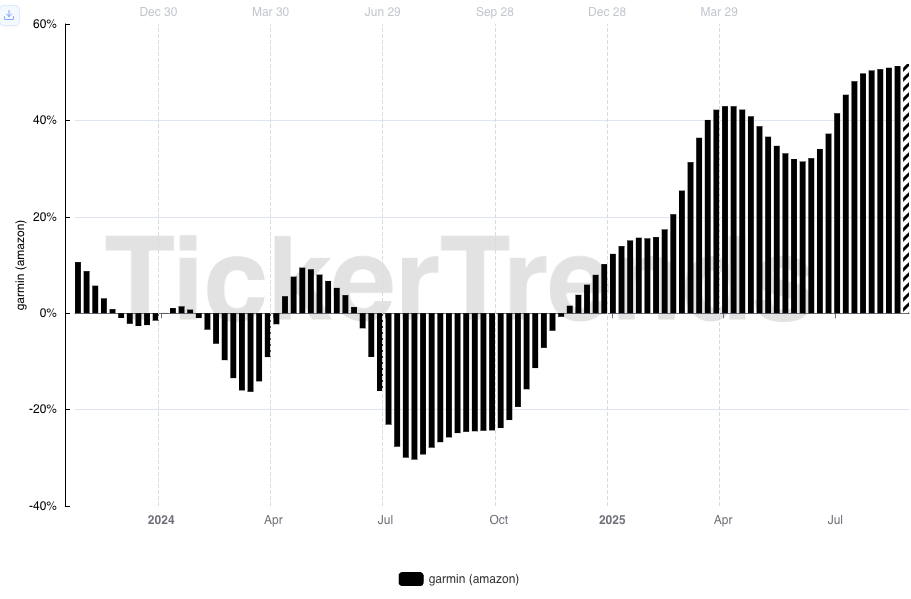

Garmin ( GRMN 0.00%↑ ): demand stayed hot; Street still underestimating durability?

Data (TT):

Amazon search interest ~+50% YoY (Garmin).

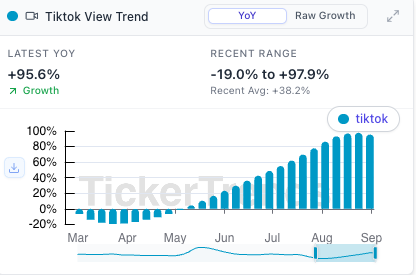

TikTok viewership +95.6% YoY (Garmin).

Analyst setup:

Consensus trackers show FY’25 revenue/EPS near the company’s raised guide, with incremental 2026 growth modeled from continued wearables strength and auto OEM. (Reference: Yahoo Finance analyst estimates page.) Yahoo Finance

Narrative:

Despite a wobbly April quarter reaction (profit miss) the company raised full-year revenue then delivered record Q2, suggesting demand is proving stickier than “post-launch bump” fears. Reuters

Garmin continues to benefit from premium endurance/tri and outdoor overlap, where content and community (Strava, training plans) keep cohorts engaged—aligning with our TikTok-tracked attention.

Watch items: tariff/FX puts and takes (notably TWD), supply normalization, and the cadence of advanced wearable launches into holiday.

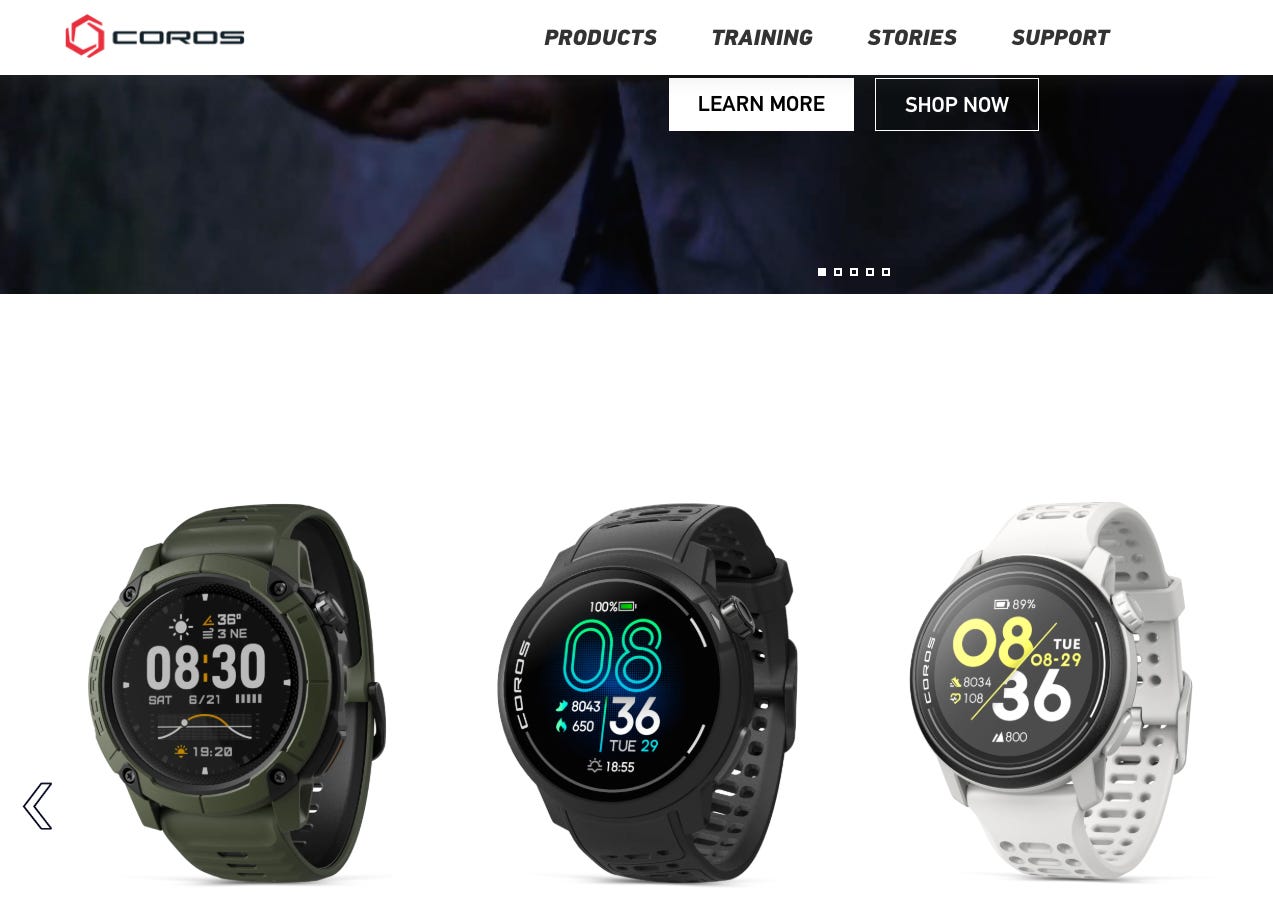

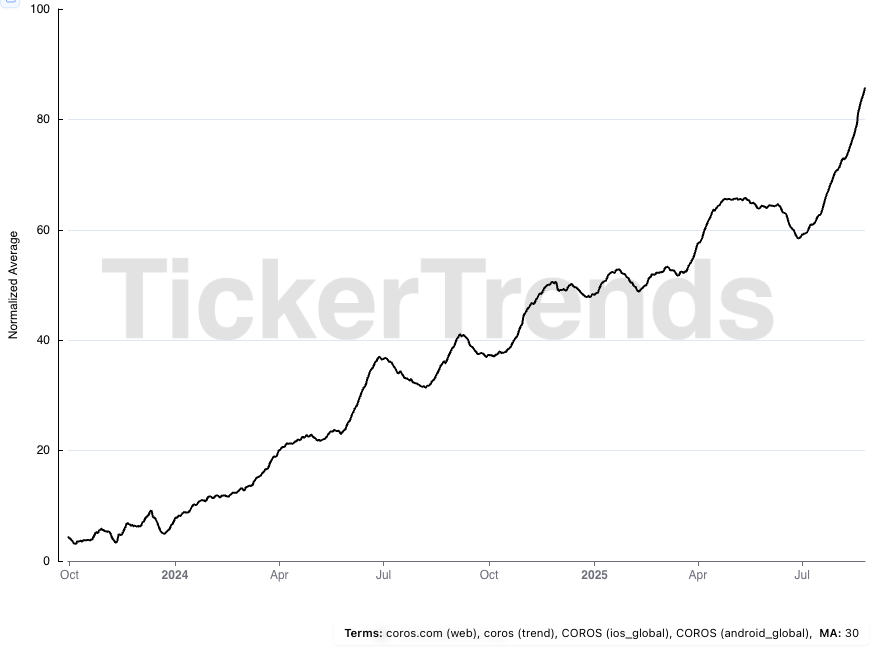

COROS (Private): the “performance value” insurgent

Data (TT): Our blended brand demand metrics are at all-time highs, consistent with product-cycle momentum.

Company/product context:

Portfolio spans PACE 3 / PACE Pro (value race watches), APEX 2, VERTIX 2S (ultra/adventure), plus DURA (cycling). Reviews highlight low weight, long battery, accurate GNSS—features resonating with endurance athletes shifting between running, trail, and hybrid training. Coros

Independent market analysis suggests units skew to the lower-priced PACE line (volume driver), with higher margins from VERTIX—consistent with a strategy that builds community at entry price points and upsells to adventure. the5krunner

What to watch: cadence of firmware feature drops (training readiness analogs, running-form tests), retail/geo expansion, and whether PACE Pro (higher ASP than PACE 3) successfully migrates the base up the stack. DC Rainmaker

TickerTrends Signals (recap)

Amazfit (ZEPP): Ecommerce demand +18.9% last 4w; +94.9% YoY. TikTok views +110.8% YoY.

Garmin (GRMN): Amazon search ~+50% YoY; TikTok views +95.6% YoY.

COROS: Blended demand at all-time highs.

These align with company-reported momentum for ZEPP and GRMN and with COROS’s product-cycle tailwinds into holiday.

Conclusion: structurally healthier category, not just a one-off spike

Zepp/Amazfit has credible product-led momentum and a guidance ramp that explains the stock’s sharp rerating; margin execution is the next proof-point. Zepp

Garmin continues to convert attention into revenue, raising FY’25 despite early-year noise; Street models now roughly track the company guide, but our leading indicators suggest upside sensitivity if holiday launches land. Garmin

COROS is winning share with performance-value + battery life, using frequent feature drops and community pull—classic insurgent mechanics that can sustain growth without outsized ad spend. the5krunner

Bottom line: Social attention and ecommerce/search demand are coherently elevated across brands. We view this as a category-level upshift—with ZEPP most levered to near-term growth optics (accel guide), GRMN the steady compounder into holiday/new-year training cycles, and COROS as the high-engagement private insurgent benefitting from the shift toward hybrid endurance + strength training.