$FWONK Liberty Media Corporation Earnings Preview | TickerTrends.io

$FWONK KPI Metrics, Earnings Preview Tracking, Expectations And Alternative Data Comps

Market Expectations

Analysts expect 27.5% YOY growth which is an acceleration of 181.81% QoQ going into Q2 2025.

Liberty Media's Formula One Group (NASDAQ: FWONK) reported its Q1 2025 earnings on May 7, revealing a challenging quarter due to calendar shifts and fewer early-season races. Perplexity

Key Financial Highlights

Total Revenue: $447 million, down 24% year-over-year from $587 million.

Formula 1 Revenue: $403 million, a 27% decline from $553 million in Q1 2024. The Times of India

Primary F1 Revenue: $319 million, down 31% year-over-year.

Adjusted OIBDA: $85 million, a 59% decrease from $208 million. Liberty Media Corporation

Operating Income: Loss of $28 million, compared to a $136 million profit in Q1 2024.

Earnings Per Share (EPS): $0.05, surpassing the consensus estimate of -$0.18. MarketBeat

Operational Drivers

Race Calendar Impact: Only two races were held in Q1 2025 versus three in Q1 2024. The 2025 season maintains 24 races but in a different sequence, affecting quarterly revenue recognition. Nasdaq

Revenue Composition:

Media Rights & Sponsorship: Declined due to fewer races and event-specific revenue variations. Liberty Media Corporation

Hospitality & Experiences: Decreased, primarily due to one less Paddock Club event and the mix of races. Nasdaq

Team Payments: Reduced to $114 million from $163 million, reflecting the pro-rata distribution across the season. Liberty Media Corporation

Strategic Developments

Concorde Agreement: Finalized commercial terms with all F1 teams for the 2026 Concorde Agreement, ensuring financial stability. Liberty Media Corporation

Sponsorships: Secured new deals and extended contracts, including a renewal for the Miami Grand Prix through 2041. StockAnalysis

Subscriber Growth: Continued increase in F1 TV subscriptions, partially offsetting declines in media rights revenue. Nasdaq

Management Commentary

Liberty Media's President & CEO, Derek Chang, emphasized the company's resilience and long-term value creation, stating: Liberty Media Corporation

“Formula 1 is benefiting from exciting racing on the track and financial momentum underpinned by new commercial partnerships that took effect this year.” Liberty Media Corporation

Outlook

Despite the Q1 downturn, Liberty Media remains optimistic, citing: The Times of India

Future Revenue: $14.2 billion secured under contract as of March 31, 2025. Yahoo Finance

MotoGP Acquisition: Progressing with regulatory approvals for the planned acquisition, aiming to expand its motorsport portfolio.

Fan Engagement: Record attendance at events and increased viewership, particularly in the U.S., indicating strong demand.

Alternative Data

Web Traffic

Recent data indicates a -1.34% MoM decline in web traffic to formula1.com with rising YoY performance.

Search Trends

Recent data indicates a strong YOY performance in youtube and google search interest for formula 1.

Social Data

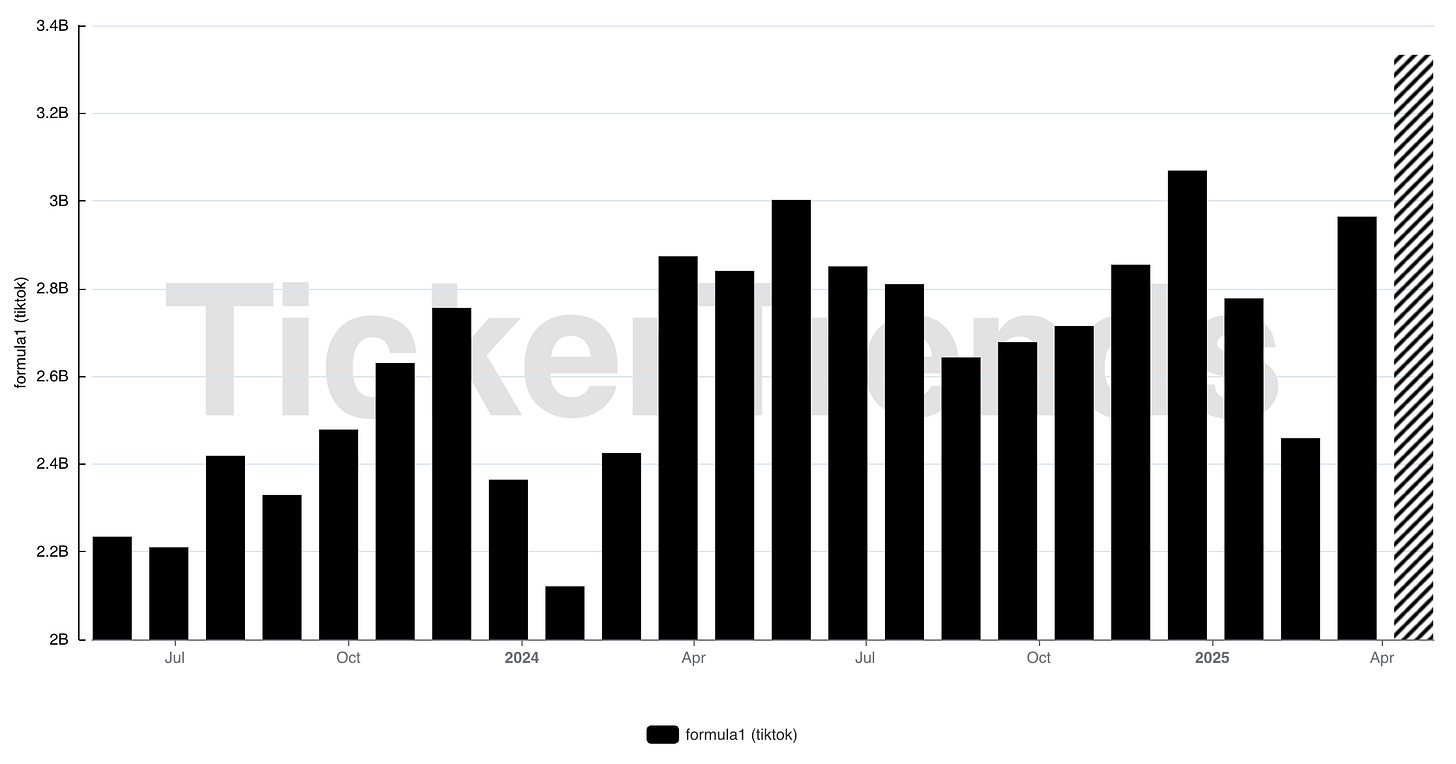

Recent data indicates a +12.45% MoM rise in social traction to formula 1 tiktok .

Wiki

Recent data indicates a +19.53% YoY rise in wiki pageviews to drive to survive .

Mobile Data

Recent data indicates a +84.33% MoM rise in active users on the formula 1 app .

Catalysts

Liberty Media’s Formula One Group (NASDAQ: FWONK) is experiencing several significant catalysts in 2025 that are enhancing its brand visibility, expanding its audience, and potentially boosting its long-term value.

MotoGP Acquisition

In April 2024, Liberty Media announced its acquisition of approximately 86% of Dorna Sports, the commercial rights holder of MotoGP, in a deal valued at €4.2 billion. The European Commission is expected to approve the deal without requiring concessions, which would significantly expand Liberty Media's presence in the motorsports market and create potential synergies between Formula One and MotoGP.

Thrilling 2025 Formula 1 Season

The 2025 Formula 1 season has been marked by intense competition and emerging talent. Oscar Piastri leads the championship after securing three consecutive victories, including a recent win in Miami. McLaren dominates the teams' standings, with Piastri and teammate Lando Norris occupying the top two positions. Additionally, 17-year-old Kimi Antonelli has made history as the youngest driver to lead a race, set a fastest lap, and secure pole position.

'Drive to Survive' Season 7

Netflix's "Drive to Survive" Season 7 premiered on March 7, 2025, offering a behind-the-scenes look at the 2024 season's pivotal moments. The series has been instrumental in broadening Formula 1's fanbase, particularly in the United States, by providing new entry points to the sport through personal stories and behind-the-scenes drama.

Upcoming 'F1' Movie

The highly anticipated movie "F1," starring Brad Pitt and directed by Joseph Kosinski, is set to release in theaters on June 27, 2025. The film features Pitt as Sonny Hayes, a retired driver returning to Formula 1 to mentor a rookie prodigy. Produced in collaboration with seven-time F1 champion Lewis Hamilton, the movie integrates real F1 teams and drivers, aiming to provide an authentic portrayal of the sport.

These developments collectively position Liberty Media's Formula One Group for increased visibility and growth, potentially enhancing its market value and fan engagement.

Conclusion

Despite a challenging Q1 2025 shaped by race calendar shifts and fewer early-season events, Liberty Media’s Formula One Group remains on a strong long-term trajectory. While revenue and adjusted OIBDA declined year-over-year, the quarter's performance was largely a result of timing rather than underlying weakness. EPS still beat expectations, and forward-looking indicators remain highly favorable. Robust alternative data—rising app usage, search interest, and social traction—confirms growing fan engagement. With the high-profile MotoGP acquisition, a thrilling 2025 season, the success of Drive to Survive, and the upcoming Brad Pitt-led F1 movie, Liberty Media is positioned to capture broader global interest and deepen monetization opportunities. As the calendar normalizes and catalysts take hold, FWONK may reaccelerate into the second half of the year, supported by both structural tailwinds and surging cultural relevance.