$GAP Gap Inc. Turnaround | TickerTrends.io

The TickerTrends Social Arbitrage Hedge Fund is currently accepting capital. If you are interested in learning more send us an email admin@tickertrends.io . Join our Discord here for more discussion.

Ticker: $GAP

Sector: Apparel

Share Price: $ 21.08

Market Cap: $7.93B

Business Intro:

The Gap, Inc. operates as an apparel retail company. The company offers apparel, accessories, and personal care products for men, women, and children under the Old Navy, Gap, Banana Republic, and Athleta brands.

Its products include denim, tees, fleece, and khakis; eyewear, jewelry, shoes, handbags, and fragrances; and fitness and lifestyle products for use in yoga, training, sports, travel, and everyday activities for women and girls.

The company offers its products through company-operated stores, franchise stores, Websites, third-party arrangements, and catalogs. It has franchise agreements with unaffiliated franchisees to operate Old Navy, Gap, Athleta, and Banana Republic stores and websites in Asia, Europe, Latin America, the Middle East, and Africa. It also provides its products through e-commerce sites. The Gap, Inc. was incorporated in 1969 and is headquartered in San Francisco, California.

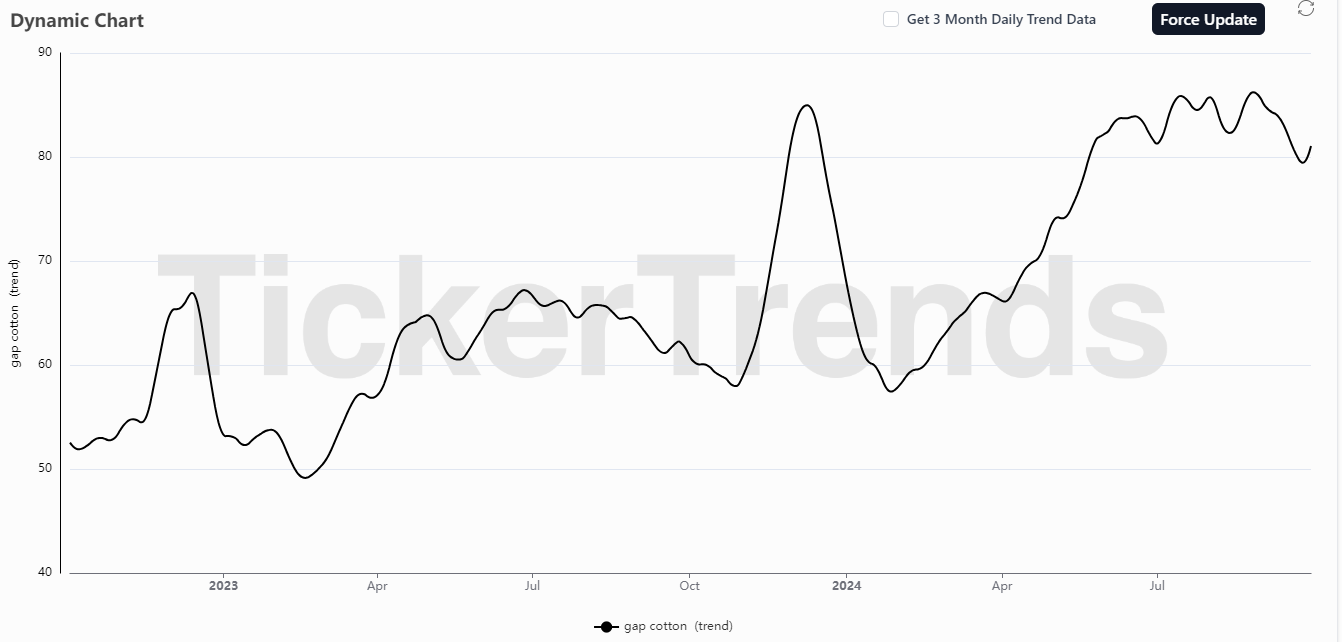

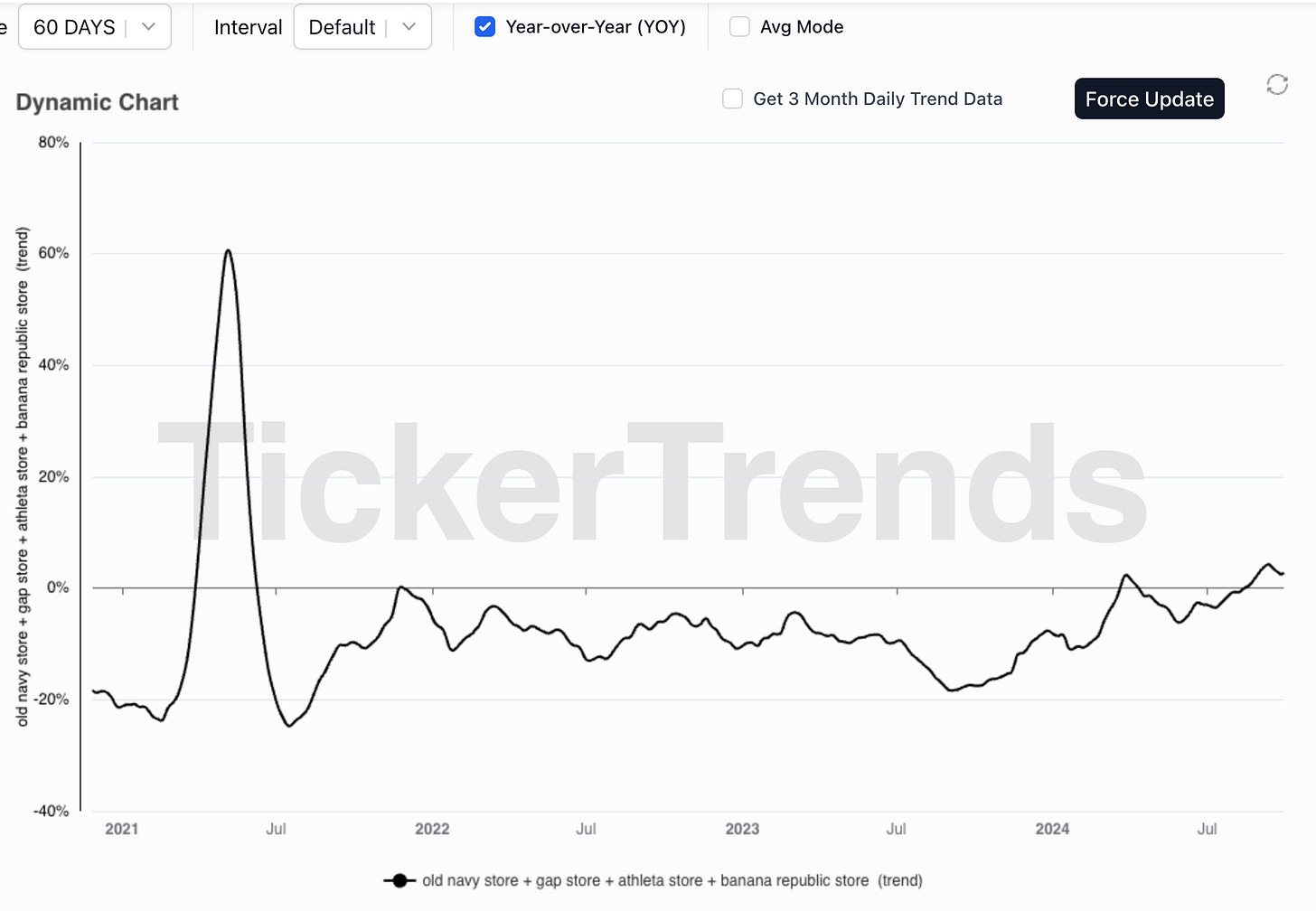

Social Arb Data:

GAP’s Turnaround

In 2024, GAP Inc. reached a critical juncture in its efforts to reverse years of declining sales and waning brand relevance. Under the leadership of CEO Richard Dickson, the company finally broke its long losing streak by posting growth in all four of its brands—GAP, Old Navy, Banana Republic, and Athleta—for the first time in seven years. This marked a turning point for the apparel giant, which had long struggled to maintain its footing in a fast-changing retail landscape. Wall Street took notice, with GAP’s stock price surging by 20% following the announcement. Dickson, who became CEO in 2023 after serving on GAP's board, had previously been credited with revitalizing Mattel’s Barbie brand, and he was brought in with high hopes that he could similarly transform GAP Inc.

A key element of Dickson’s turnaround strategy involved simplifying GAP’s product offerings and sharpening the identity of each of its core brands. Over the years, GAP Inc. had become overly complex, with too much internal competition between its brands, such as GAP’s activewear line conflicting with Athleta’s core business, or Old Navy cannibalizing GAP's sales.

Dickson sought to cut through the clutter, reducing the overall product assortment by 20% to ensure that each brand offered a more focused, compelling selection of merchandise. This approach not only simplified the customer experience but also allowed GAP Inc. to streamline operations, reducing costs and boosting profitability.

For instance, Old Navy, which had faced product misfires in previous years, returned to form by emphasizing its core strength: affordable, family-friendly fashion. Through more concise product assortments and a renewed focus on storytelling, Old Navy gained market share and bolstered consumer confidence in its brand.

Additionally, Dickson implemented a major overhaul of GAP’s marketing strategy, aiming to reconnect the company's brands with today’s consumers. Recognizing that modern fashion is as much about cultural relevance as it is about aesthetics, Dickson worked to ensure that GAP Inc.’s messaging was consistent across its various channels and reflective of contemporary tastes. To achieve this, he brought in Omnicom Media Group as GAP’s sole advertising agency, a strategic move designed to streamline communications and create marketing campaigns that could more effectively cut through the noise in today’s crowded media landscape. Dickson personally oversaw the fine-tuning of GAP Inc.'s brand narratives, going so far as to joke that he served as the company’s unofficial "Chief Editing Officer." By eliminating off-brand messaging and reinvigorating the company’s ad campaigns, Dickson aimed to restore GAP’s status as a cultural icon, much like he had done with Mattel’s Barbie franchise.

Strategy Moving Forward

Looking ahead, GAP Inc. is focusing on several key strategic pillars to ensure the sustainability of its turnaround and position the company for long-term growth. These pillars center around operational efficiency, brand reinvigoration, cultural relevance, and a seamless omni-channel experience.

First, GAP Inc. is doubling down on operational and financial discipline. The company has already made significant strides in this area, cutting over $550 million in annualized costs, reducing inventory by nearly $800 million, and improving its gross margins through smarter sourcing strategies and less reliance on discounting.