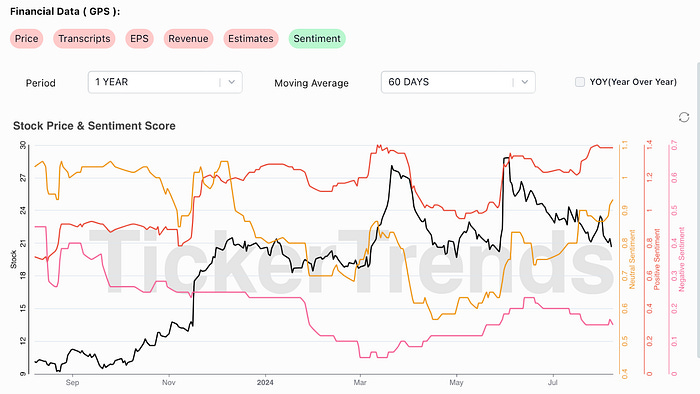

Gap $GPS Alternative Data Overview | TickerTrends.io

The TickerTrends Social Arbitrage Hedge Fund is currently accepting capital. If you are interested in learning more send us an email admin@tickertrends.io .

Ticker: $GPS

Sector: Clothing

Company Description

The Gap, Inc. operates as an apparel retail company, offering apparel, accessories, and personal care products for men, women, and children under the Old Navy, Gap, Banana Republic, and Athleta brands. Its products include denim, tees, fleece, and khakis; eyewear, jewelry, shoes, handbags, and fragrances; and fitness and lifestyle products for use in yoga, training, sports, travel, and everyday activities for women and girls. The company offers its products through company-operated stores, franchise stores, Websites, third-party arrangements, and catalogs. It has franchise agreements with unaffiliated franchisees to operate Old Navy, Gap, Athleta, and Banana Republic stores and websites in Asia, Europe, Latin America, the Middle East, and Africa. As of April 2024, the company has 3,650 stores and franchises. It also provides its products through e-commerce sites. The Gap, Inc. was incorporated in 1969 and is headquartered in San Francisco, California.

Collaborations

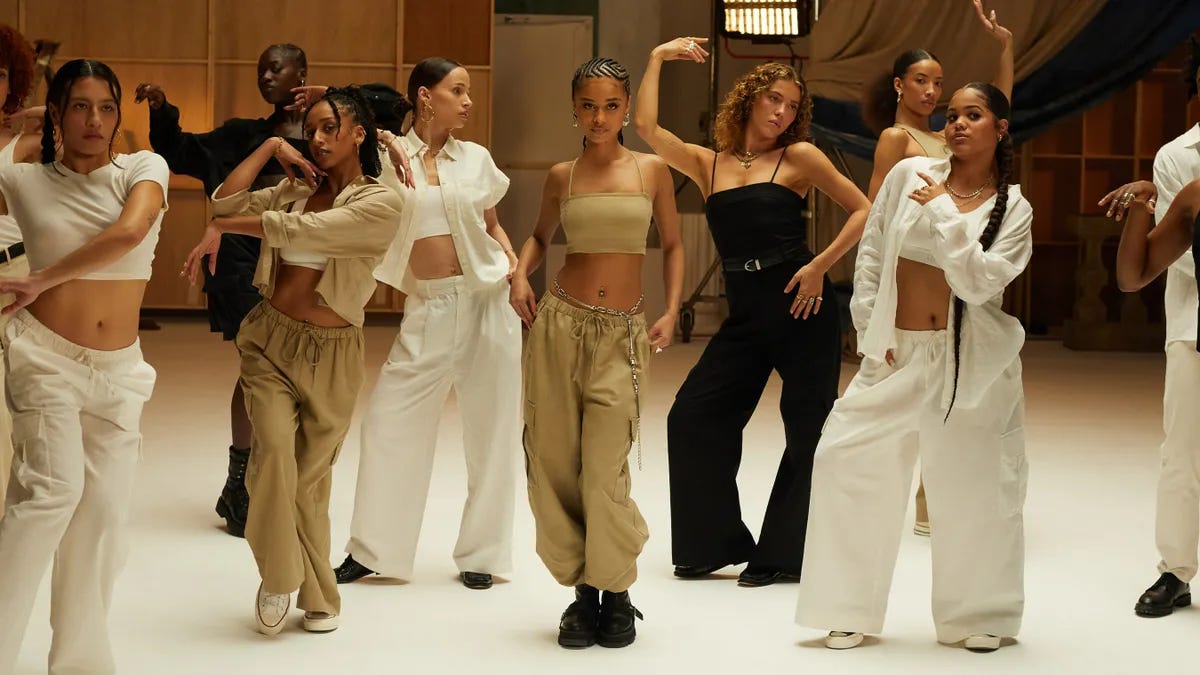

There has been a lot of talk around Gap’s recent collaborations with up and coming brand Doen, and trendy sweatsuit brand MadHappy. Both brands have distinct brand identities that have more niche audiences. Doen encapsulates a cottage core vibe and their pieces usually come with a steep price. By collaborating with Gap, which has a relatively “normal” vibe, it results in a collection that is more interesting than their normal pieces. That’s not to say their permanent collections aren’t successful, as it targets a different audience than the collab collections. By pricing the pieces at a lower price, it made for the collection to be extremely popular as everyone wants to have Doen pieces but don’t want to pay a higher price. By creating this dynamic it resulted in the collection selling out immediately and the collection gaining traction on social media. The cottage core trend has been popular for a while but there has also been a resurgence with the trad-wife trend as well as the Scandinavian style trends.

The Mad Happy collaboration on the other hand targets a slightly different audience. It’s towards a larger range of people as sweatsuits have become highly wearable in day to day life as a result of the increase of work from home employees after covid as well as athleisure and sweatsuits just becoming more popular overall.

The ad campaigns have also proven highly effective as they used influence Devon Lee Carlson who is dubbed the “cool girl” of social media and who is also friends with many celebrities. By using her as the face of the collaboration, it has kickstarted high anticipation for the release. Similar to the Doen collab they have also been sending PR packages to influencers, increasing the reach and anticipation. Overall, by collaborating with brands who hold high desirability for their products, it broadens the audience for Gap and its other brands as well as reviving their reputation from just being a middle of the road brand to being more in touch with specific niches and trends.

The brand’s rebrand and new initiatives towards targeting new types of customers comes after new CEO, Richard Dickson, and new creative director, Zac Posen, have been making changes in the company. Appointed in December 2023, he said, “To some extent, the clarity of the conversation with consumers just needed an edit. Our product is a great product, but it’s lost in the message”. After coming from Mattel and being attributed with the accomplishment of reviving Barbie to be more “culturally relevant” he seems to be taking a similar approach with Gap, as portrayed by these two collabs.

In an interview with CNBC, Dickson spoke of the financials of Gap, saying the company has gained market share due to the strength of its two largest brands and efforts in operational and financial discipline. This is evident in their expanded gross margin by 530 basis points, operating margin by 570 points, and a 16% reduction in inventory compared to last year. As they begin 2024, they have a great inventory composition and new energy. They closed the previous year on strong financial footing, with just under $2 billion in cash on the balance sheet. Dickson emphasized that the focus remains on reinvigorating their brands while maintaining discipline in strategic priorities and operational and financial rigor, which will help revitalize their portfolio.

Gap’s turnaround could possibly be similar to Abercrombie & Fitch ($ANF), which has also experienced a revitalization this year due to its trend-focused and more relevant designs. Both companies have successfully adapted to changing consumer preferences by updating their product lines and leveraging their brand heritage. Abercrombie specifically has focused on growing up with their customers meaning the clothing lines are now portraying more put together aesthetics. This strategic shift has allowed them to reconnect with customers they already had in the past and drive growth in a competitive market. $ANF financial profile was perfect, it will be up to management at $GPS if they can achieve a similar stunt.

Discord Link: https://discord.gg/dGEW4Pyacd

Hedge Fund Enquiries: admin@tickertrends.io

Follow Us On Twitter: https://twitter.com/tickerplus