Genie 3 Generative Gaming and the Erosion of Structural Moats In Public Markets

How AI-Driven World Creation Threatens Margins, Platform Power, and Valuation Multiples Across Public Game Companies

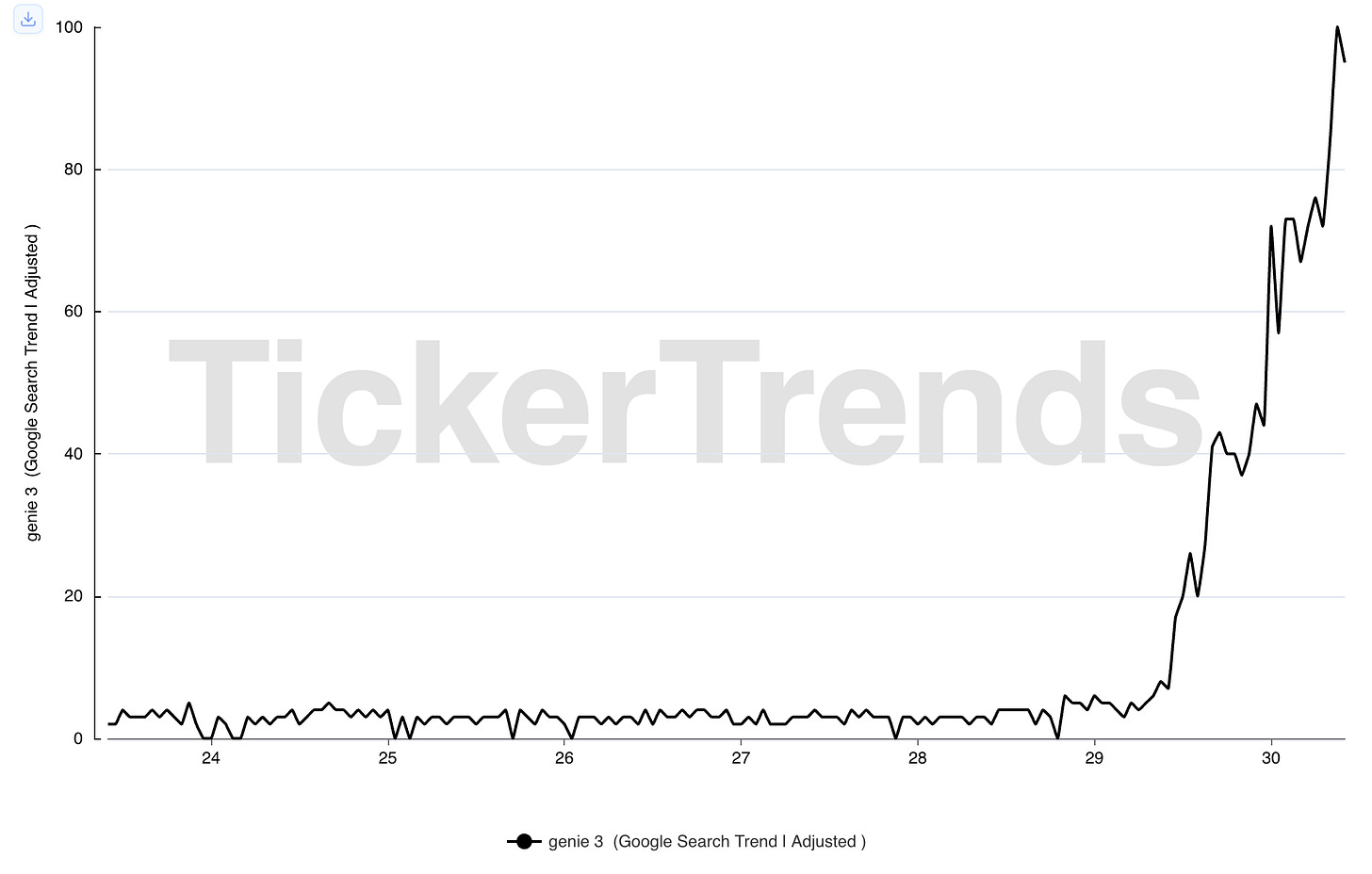

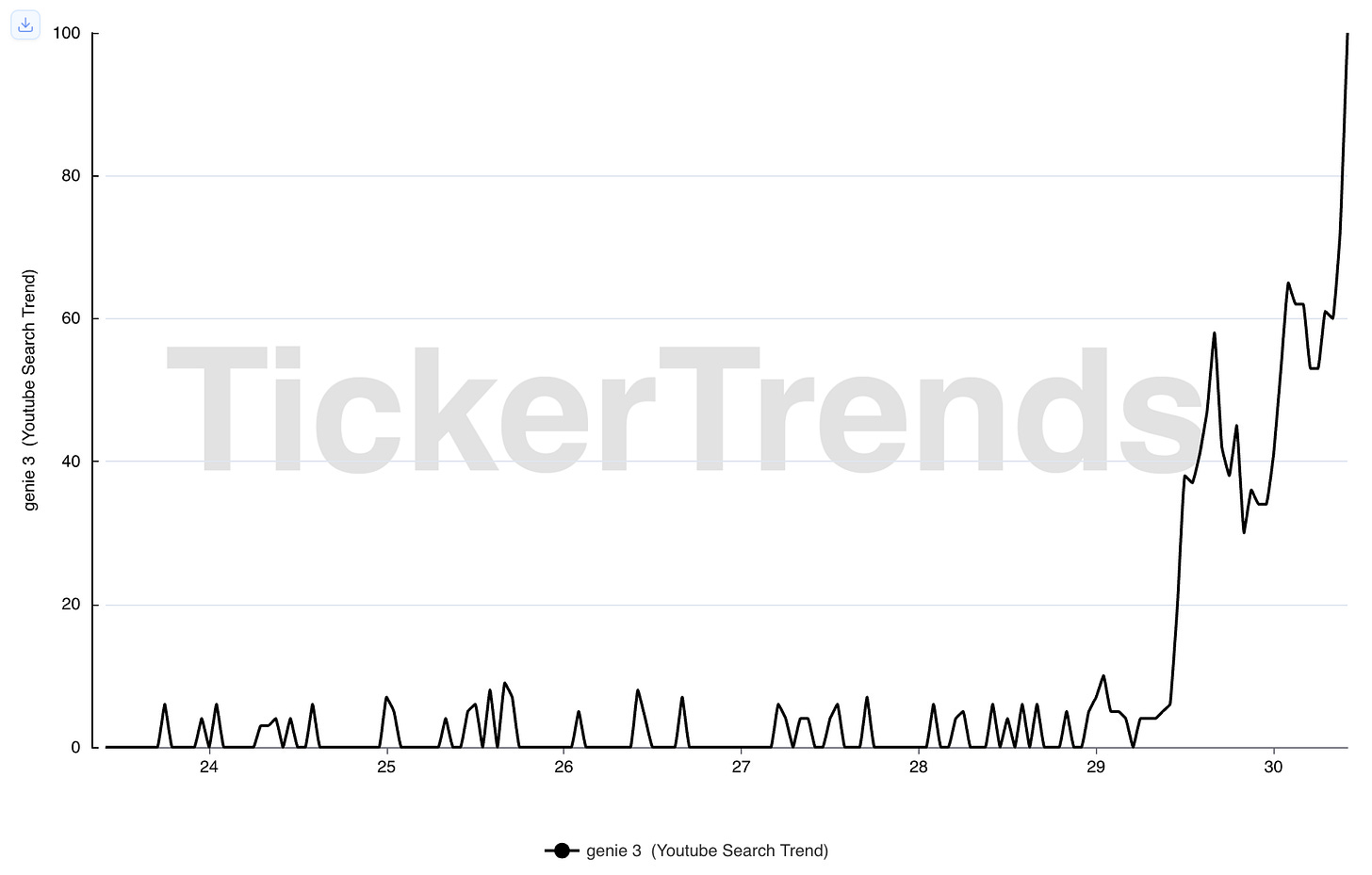

The public launch of Genie 3 has shown the market the power of generative world models. By materially lowering development costs and compressing production timelines, these systems threaten to erode the traditional advantages of scale, capital intensity, and proprietary tooling that have historically protected leading game publishers and platforms.

Generative gaming introduces a narrative risk to public markets similar to what AI-driven automation created in SaaS, where investors rapidly reframed high-multiple software businesses from “durable platforms” to “structurally replaceable tools.” As end-to-end creation becomes increasingly automated, markets may begin to discount traditional gaming companies on fears of margin compression, reduced switching costs, and faster competitive turnover.

Even before fundamentals materially deteriorate, shifting investor perception around long-term defensibility can drive multiple compression, increased volatility, and prolonged valuation pressure across exposed names.

We explore these narratives below.

Narrative: TTWO’s earnings power is heavily concentrated in large-scale, open-world franchises which have historically been protected by long development cycles, massive production budgets, and proprietary graphics and engine technology. As generative world models such as Genie enable individuals and small teams to rapidly create open-world experiences that replicate GTA’s structure, gameplay, and visual style, potentially approaching or exceeding the fidelity of traditional engines, the capital and technical barriers underpinning these franchises weaken. This lowers entry costs in previously protected genres, intensifies competitive pressure, and increases long-term risk to franchise monetization, pricing power, and returns on invested capital.

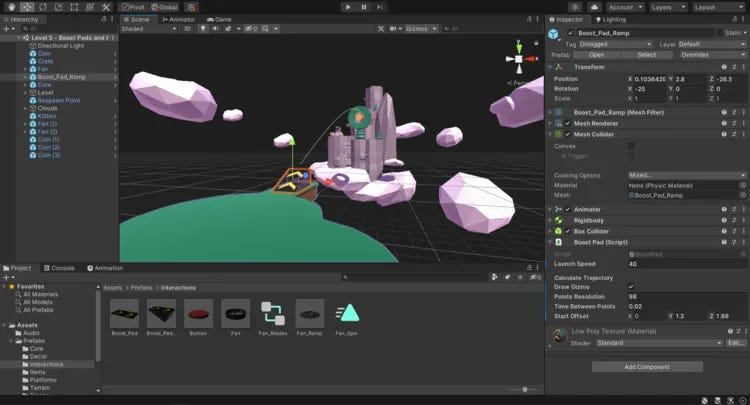

Narrative: Unity’s business model is built around serving as the core development infrastructure for independent and mid-tier studios. However, the emergence of AI-native creation platforms that integrate asset generation, physics simulation, and environment design into unified workflows threatens to bypass traditional engines. Over time, this risks structural disintermediation, weaker switching costs, and reduced pricing leverage, particularly if creators migrate toward vertically integrated generative ecosystems.

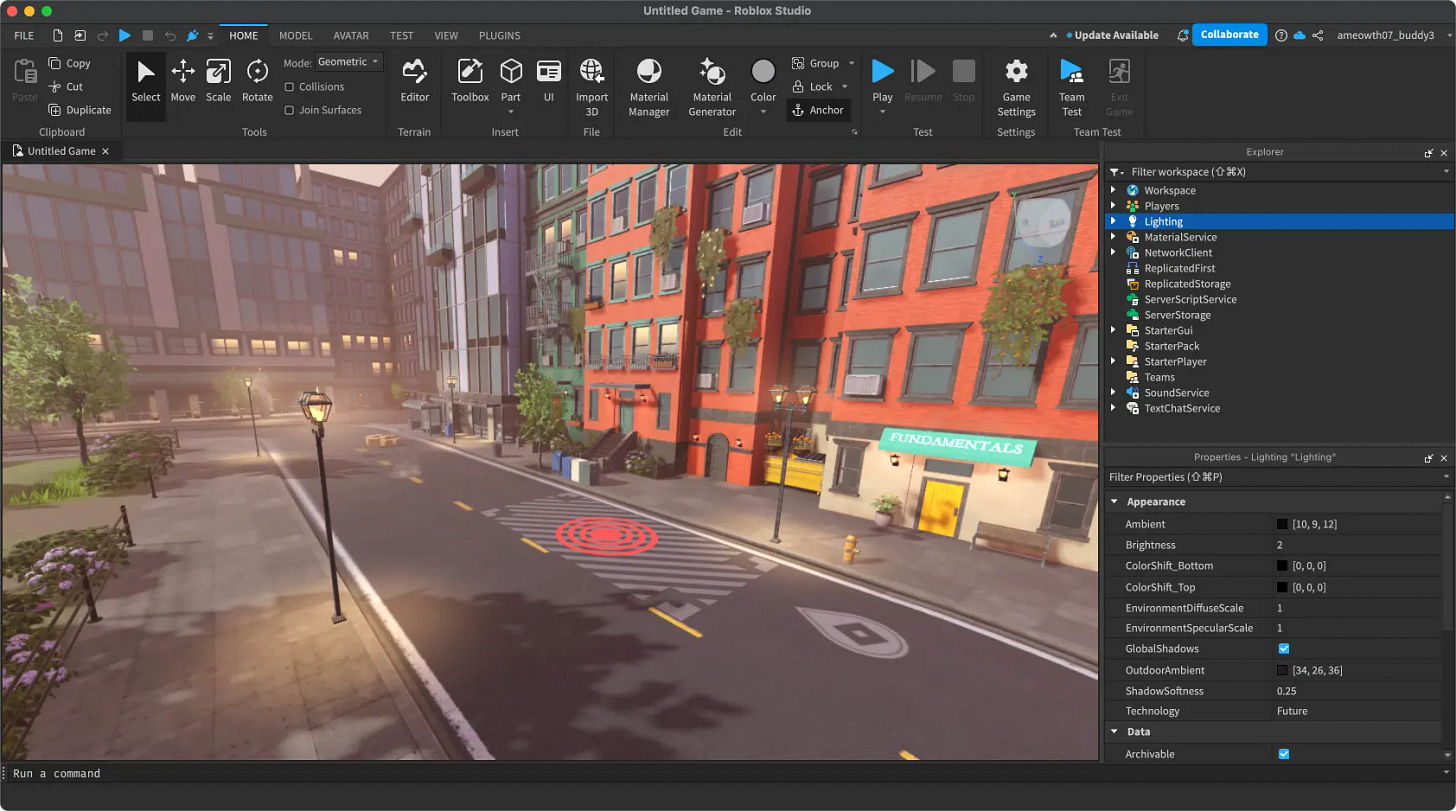

Narrative: Roblox derives much of its value from an ecosystem optimized for low-development-timeline, microtransaction-driven games built within its proprietary Roblox Studio environment. Large-scale generative world creation challenges this model by enabling creators to build fully realized experiences with minimal reliance on Roblox’s native tools. As content production becomes increasingly automated, the strategic importance of Roblox Studio diminishes, barriers to creation fall further, and content becomes more commoditized. This dynamic increases discovery congestion, fragments engagement, and weakens platform control over creators, ultimately pressuring take rates and long-term monetization durability.

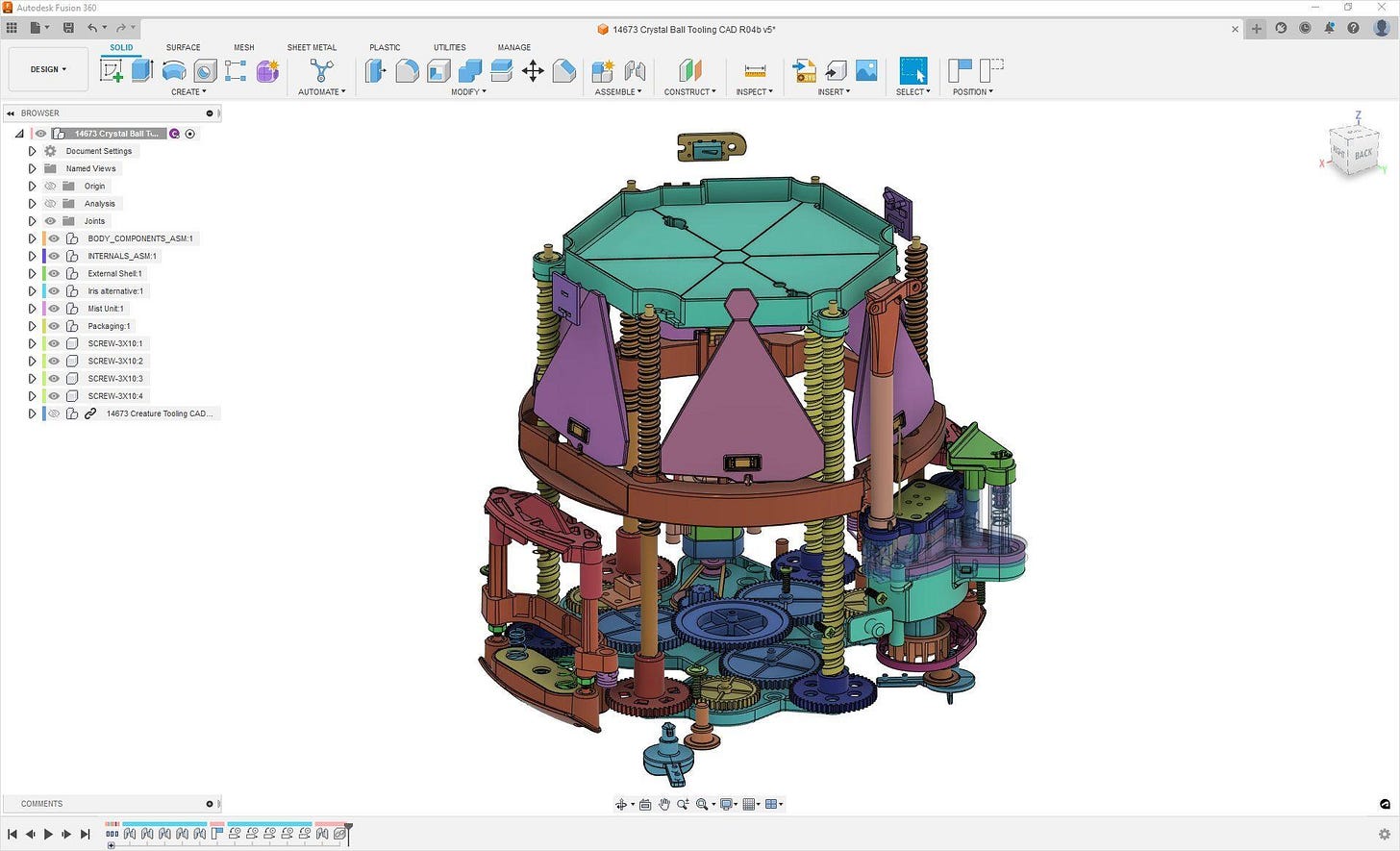

Narrative: Autodesk’s gaming exposure is tied to traditional asset creation, modeling, and animation workflows that are increasingly vulnerable to direct text-to-3D and environment-generation systems. As studios adopt AI-native pipelines capable of producing usable assets with minimal manual intervention, demand for legacy design software may structurally weaken. This creates long-term risk to subscription growth, pricing power, and enterprise stickiness within entertainment verticals.

Conclusion

Generative gaming could represent a structural inflection point for the industry, shifting competitive advantage away from capital intensity and toward automation, speed, and model-driven creativity. As production barriers fall and content supply expands, traditional moats built on scale and tooling face sustained pressure. For public market investors, the primary risk is not near-term disruption, but gradual erosion of pricing power, margin durability, and long-term valuation multiples as AI-native creation becomes embedded across the ecosystem.

Email admin@tickertrends.io to gain access to our entire KPI dashboard which includes coverage of over 500 unique KPIs available on TickerTrends Enterprise: https://tickertrends.io/enterprise