$GGDB Golden Goose Alternative Data Overview | TickerTrends.io

The TickerTrends Social Arbitrage Hedge Fund is currently accepting capital. If you are interested in learning more send us an email admin@tickertrends.io .

Ticker: $GGDB (IPO TBD)

Sector: Shoes

Company Description:

Golden Goose has become a well known shoe wear company established in Venice, Italy and founded in 2000. The company is known for their unique designs, prioritizing “perfect imperfection” and a worn in look while also being considered a luxury brand. In 2023 they opened 21 new stores, with a total network of 191 stores around the world. Golden Goose’s business model is centered around creating high-end, distinctive footwear and apparel that blend luxury with a unique, distressed aesthetic.

The Brand

The brand’s emphasis on uniqueness is highlighted by their distinctive design philosophy. Golden Goose sneakers often feature a deliberately worn and distressed look, setting them apart in the luxury market. This “perfect imperfection” aesthetic challenges conventional norms of luxury by embracing flaws as features, thus creating a product that is both unique and timeless.

Over the past couple years, the old money aesthetic has grown increasingly popular, especially given its focus on timelessness. Golden Goose shoes have been a staple in this aesthetic, becoming a symbol for preppy fashion. With the preppy aesthetic being a sub genre of old money, it has garnered attention specifically among younger girls on the east coast and in southern states of the U.S.. The brand’s versatile designs cater to various age groups and genders, making them a staple in diverse wardrobes. For younger consumers, the brand’s edgy and unique designs offer a way to express individuality. For older customers, the quality and craftsmanship provide a sense of reliability and luxury.

Golden Goose’s high price tag has been a double-edged sword. On one hand, it has sparked controversy, with critics questioning the value of distressed sneakers sold at luxury prices. On the other hand, this controversy has only heightened the brand’s allure, turning their sneakers into status symbols and collector’s items. The high cost serves as a barrier to entry, creating an air of exclusivity around the brand.

For many consumers, owning a pair of Golden Goose sneakers signifies more than just a fashion choice; it represents a statement of status and taste. The brand’s ability to maintain this delicate balance between controversy and desirability has been key to its sustained success in the luxury market.

Golden Goose’s commitment to longevity and uniqueness is also evident in every facet of their brand, particularly in their retail environments. Specifically, they have 5 “Forward” stores, which emphasize customization, repair, and resale. Customers are encouraged to make each purchase uniquely their own, whether through custom laces, hand-painted details, or other bespoke modifications. This approach not only enhances the product’s value but also fosters a deep emotional connection between the customer and the brand. The repair and resale process also emphasizes the eco-friendly goals of the company while also ensuring the customer that these are shoes you can keep for a long time.

IPO

Golden Goose, owned by private equity firm Permira, had initially set a price range of 9.50 euros to 10.50 euros for its share listing, targeting up to 558 million euros in proceeds before the over allotment option. At the high end of this range, the company’s enterprise value was estimated at approximately 2.4 billion euros, based on calculations by Reuters. This valuation fell short of Permira’s initial expectations; sources had revealed in April that the main shareholder aimed for an enterprise value of around 3 billion euros. Permira had acquired Golden Goose in 2020 at a valuation of 1.3 billion euros.

The pricing approach was described as conservative by a source close to the company, aiming to ensure a strong aftermarket performance. The share offering was to constitute about 30% of the company’s total capital, largely from shares sold by current shareholders. Invesco Advisers had committed to purchasing 100 million euros worth of shares as a cornerstone investor.

The offer period was scheduled to commence on June 13 and conclude on June 18, with the first trading day set for June 21. BofA, JPMorgan, Mediobanca, and UBS were appointed as joint global coordinators for the IPO, with BNP Paribas, Citigroup, and UniCredit acting as joint bookrunners.

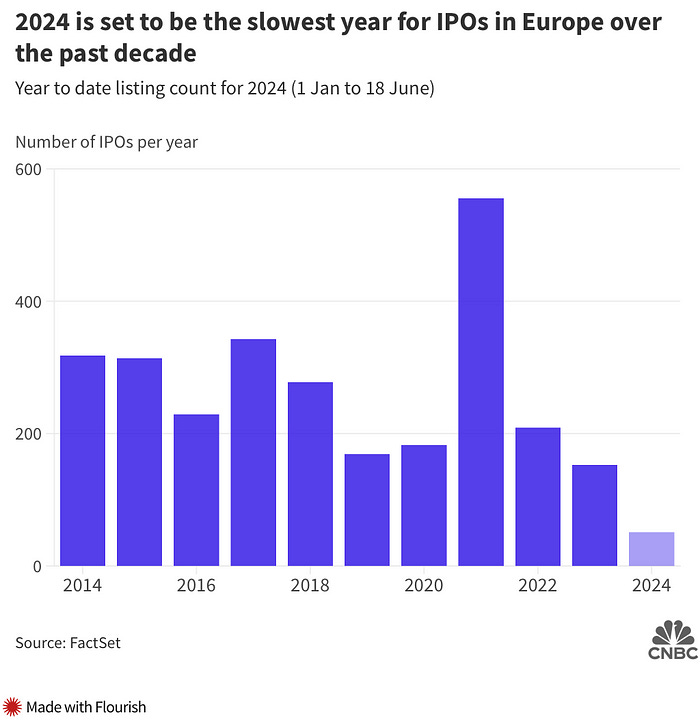

However, on Tuesday, Golden Goose announced a postponement of the IPO, citing unsuitable market conditions, with plans to reassess the IPO at a later date. This decision came amidst recent political upheaval, including the European Parliament elections and an upcoming general election in France, which had unsettled European markets and the luxury sector.

The recent European Parliament elections saw France’s far-right National Rally (RN) party securing about 31% of the vote, prompting President Emmanuel Macron to call a snap national election. The RN party’s gains led to nationwide protests against the rise of nationalist sentiment, causing the French CAC 40 index to drop more than 6.2% last week, its worst performance since March 2022.

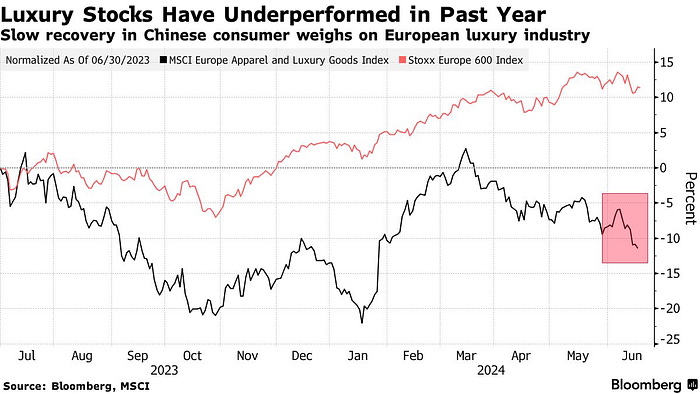

Additionally, concerns over demand have been impacting the luxury sector. The MSCI Europe luxury index fell by about 3% this month, with shares of brands like Moncler SpA, Burberry Group Plc, and Louis Vuitton owner LVMH experiencing similar declines. Morningstar analyst Jelena Sokolova noted the challenging environment, with Western consumption under pressure and Chinese sentiment and consumption remaining weak. She also raised concerns about the brand’s ability to diversify if demand for their specific shoe style diminishes.

Golden Goose’s IPO was poised to be Milan’s largest since gambling company Lottomatica SpA’s 599 million euro sale in May of the previous year. Earlier on Tuesday, bakery firm Europastry SA announced its plans for an IPO on Spanish stock exchanges.

Golden Goose intended to sell approximately 10.5 million shares, with majority-owner Permira offering 43.6 million existing shares. Invesco Advisers Inc. had agreed to take a 100 million euro stake at the final price. Golden Goose is aiming for net sales of around 1 billion euros by 2029, up from 587 million euros last year. The proceeds from the IPO were planned to be used to reduce debt.

Despite the postponement, the extensive preparation for the IPO and the strong interest from investors, particularly Invesco, highlight Golden Goose’s solid market position and future growth potential.

Discord Link: https://discord.gg/dGEW4Pyacd

Hedge Fund Enquiries: admin@tickertrends.io

Follow Us On Twitter: https://twitter.com/tickerplus