GLP‑1 Gold Rush: Winners, Risks, and the TickerTrends Model Alt Data Portfolio | Tickertrends.io

The TickerTrends Social Arbitrage Hedge Fund is currently accepting capital. If you are interested in learning more send us an email admin@tickertrends.io

The GLP-1 Revolution: A $470B Market at Its Inflection Point

Discover the Strategic Playbook Behind Wall Street's Hottest Investment Theme

The race to own the future of metabolic medicine has created unprecedented investment opportunities. With Eli Lilly and Novo Nordisk commanding a $1 trillion duopoly in weight loss therapies, the GLP-1 landscape offers a rare combination of massive addressable markets and explosive growth dynamics. But the real alpha lies in understanding the complex ecosystem beyond these giants.

Exclusive Market Intelligence You Need:

How Lilly's triple-digit growth trajectory and $60B 2025 revenue forecast outpace Novo's defensive positioning

Why the end of compounding loopholes creates a $725M opportunity for telehealth disruptors

The untold story of how AI-powered prior authorization is driving 50%+ approval rates for GLP-1s

Secret Medicare strategy plays that could triple revenues for positioned companies

What Top Funds Are Missing: Our deep-dive analysis reveals critical market blind spots including the quantum impact of the Medicare Part D weight loss exclusion on 60M beneficiaries, the disruptive potential of oral GLP-1 formulations versus injectables, and strategic vulnerabilities in the CVS-Wegovy partnership that could reshape market dynamics by 2027.

Investment Strategy Decoded: Get immediate access to our proprietary "GLP-1 Basket" allocation model with strategic small-cap plays capturing optionality. This framework is engineered to compound above S&P 500 returns while minimizing volatility.

Limited-Time Access: Secure comprehensive analysis including detailed drug pipeline evaluations, competitive moat assessments, and risk-adjusted return projections for the next 5 years. Our research team tracks every FDA signal, reimbursement change, and clinical trial update to keep your positions ahead of market consensus.

Click below to unlock the full investment thesis and join the elite group of investors positioning for the greatest pharmaceutical opportunity of this decade.

The GLP-1 receptor agonist revolution represents one of the most significant pharmaceutical breakthroughs since the advent of statins. These medications, initially developed for type 2 diabetes management, have rapidly evolved into transformative therapies for obesity – a global health epidemic affecting nearly 40% of adults in developed markets.

The Core Opportunity: Current market leaders Wegovy (semaglutide) and Zepbound (tirzepatide) have demonstrated unprecedented efficacy, with weight loss results of 15-22% surpassing any previous pharmacological intervention. This clinical success has translated into explosive market dynamics, with the total addressable market expanding from diabetes care ($80B) to include obesity treatment (potential $150B+ annually).

Key Market Forces:

Supply Chain Normalization: After 18 months of shortages, both Eli Lilly and Novo Nordisk have achieved manufacturing scale, enabling broader patient access

Regulatory Landscape: FDA shutdown of compounded alternatives forces patient volumes back to branded products

Payer Evolution: Commercial insurers and Medicare increasingly recognizing obesity as a chronic disease rather than lifestyle choice

Competitive Dynamics: The market has consolidated into an effective duopoly, with Lilly's tirzepatide gaining momentum against Novo's semaglutide franchise. This competition drives innovation pipelines including oral formulations, triple-agonist mechanisms, and combination therapies that could sustain franchise value beyond 2030.

Overview of GLP-1 Receptor Agonists (RA)

Glucagon-like peptide-1 (GLP-1) receptor agonists are a class of medications that mimic the action of the GLP-1 hormone to improve blood glucose control and induce weight loss. These drugs bind to GLP-1 receptors in the pancreas, stomach, and brain, enhancing insulin secretion and satiety while suppressing glucagon release and slowing gastric emptying. Through these mechanisms, GLP-1 agonists lower blood sugar and reduce appetite, making them effective for treating type 2 diabetes and obesity. Patients taking GLP-1 RAs often experience significant glycemic improvement and clinically meaningful weight reduction, alongside secondary benefits like lower blood pressure and improved cardiovascular markers.The dual actions on metabolism and appetite distinguish GLP-1 agonists as a transformative therapy for metabolic diseases.

GLP-1 was originally developed for type 2 diabetes management, GLP-1 receptor agonists have become mainstay treatments for hyperglycemia in patients who cannot achieve targets with oral medications. All approved GLP-1 RAs have indications in type 2 diabetes, where they not only improve glycemic control but also frequently lead to weight loss and favorable cardiovascular effects. Over the past decade, these drugs have expanded into obesity treatment. High-dose formulations of GLP-1 RAs (notably liraglutide 3.0 mg and semaglutide 2.4 mg) earned FDA approval specifically for chronic weight management in obese or overweight patients with comorbidities. In 2023, the first dual incretin agonist (activating GLP-1 and GIP receptors) was approved for obesity, further cementing this class’s role in weight loss therapy. Beyond diabetes and obesity, GLP-1 RAs are being explored for related conditions: they have shown cardiovascular risk reduction in diabetics, potential benefits in nonalcoholic fatty liver disease, and even possible uses in treating polycystic ovary syndrome and other metabolic disorders. However, the two overwhelmingly dominant uses in 2025 remain type 2 diabetes and obesity management.

THE GLP-1 Evolution:

The GLP-1 agonist class has grown rapidly since the mid-2000s, with successive innovations improving potency, dosing convenience, and now dual hormone activity. The first GLP-1 agonist, exenatide (Byetta), was approved in 2005 as a twice-daily injection for type 2 diabetes. This was followed by longer-acting agents like exenatide extended-release (Bydureon) in 2012 and dulaglutide (Trulicity) in 2014, which introduced once-weekly dosing. Novo Nordisk’s liraglutide (Victoza) gained approval in 2010 for diabetes and later in a higher dose as Saxenda in 2014 for obesity. The most significant breakthrough was semaglutide, a potent once-weekly GLP-1 analog: it launched as Ozempic for diabetes in 2017 and as Wegovy for obesity in June 2021. Semaglutide also became the first oral GLP-1 agonist (Rybelsus, approved 2019) for diabetes, thanks to a specialized tablet formulation. Most recently, Eli Lilly’s tirzepatide – a dual GLP-1/GIP agonist – was approved as Mounjaro for diabetes in May 2022 and as Zepbound for obesity in late 2023. Tirzepatide’s approval represents the next generation of incretin (gut hormones) therapies that leverage multiple hormone pathways for greater efficacy.

Semaglutide’s approval for obesity (Wegovy) in 2021 was a watershed, being the first GLP-1 agonist explicitly indicated for weight loss in those without diabetes. It was soon followed by tirzepatide’s obesity indication (Zepbound), which received FDA clearance in late 2023. These approvals were supported by landmark clinical trials showing unprecedented weight loss – up to ~15% of body weight with semaglutide and over 20% with tirzepatide in some studies – far outstripping older weight-loss drugs. The FDA has also continued to expand labels: in 2023 semaglutide (Wegovy) became the first obesity medication approved to reduce risk of cardiovascular events in obese patients, reflecting its broader health benefits.

Meanwhile, older agents have seen patent expirations: the first generic GLP-1 agonists were approved in late 2024, including generic exenatide (Byetta) and liraglutide (Victoza). These generics mark the beginning of competition for earlier-generation drugs, though they target declining products and have minimal impact on the current market’s growth drivers (semaglutide and tirzepatide remain under exclusivity). Overall, the GLP-1 market’s evolution from 2005 to 2025 showcases steady improvement in therapy options – from a twice-daily niche diabetes drug to blockbuster once-weekly and oral agents that address obesity on a global scale.

Current Industry Dynamics:

As of May 1, 2025, the GLP-1 market in the U.S. is experiencing explosive growth and rapid change, driven by surging demand, new product launches, and an evolving regulatory environment. The past 18 months have seen unprecedented public interest in GLP-1 medications (often dubbed “weight-loss injections” in the media), leading to record prescriptions for obesity and diabetes and straining supply chains.

Both major manufacturers – Novo Nordisk and Eli Lilly – have achieved exceptional sales growth, propelling their market capitalizations to among the highest in pharma. We will review the latest press releases, FDA actions, and market trends shaping the industry right now and how we see this playing out over the next few quarters.

Booming Demand and Market Growth:

Demand for GLP-1 agonists continues to outpace expectations. An estimated 12% of U.S. adults have tried a GLP-1 drug for weight loss or diabetes as of early 2025, reflecting how mainstream these medications have become.

Novo Nordisk’s Semaglutide franchise (Ozempic and Wegovy) and Lilly’s tirzepatide (Mounjaro) collectively generated over $40 billion in global sales in 2024. Novo’s Diabetes/Obesity segment sales reached $39.4B for 2024, while Lilly’s comparable segment hit $30B. These figures represent YoY revenue growth of 26% for Novo and 32% for Lilly in 2024 – the fastest among large pharmaceutical companies. For 2025, Novo is guiding a milder 16–24% growth, whereas Lilly projects another 32% jump at the mid-point, signaling that Lilly’s momentum is accelerating and Novo might be struggling. Industry analysts forecast the global GLP-1 market to exceed $150 billion annually by the early 2030s if current trends continue.

As of May 2025, the GLP-1 receptor agonist (RA) market in the United States is experiencing a period of accelerated growth and transformation, marked by significant shifts in how these drugs are perceived, prescribed, and distributed. Clinical guidelines have evolved accordingly. The American Diabetes Association now places GLP-1 agonists high in the treatment algorithm for type 2 diabetes, particularly in patients with obesity or cardiovascular risk. More striking, however, is the paradigm shift occurring in obesity care: GLP-1s are now being embraced as long-term pharmacological treatments for weight loss, akin to the way hypertension or cholesterol are managed chronically. This represents a departure from the historic reliance on lifestyle changes or bariatric surgery, substantially broadening the eligible patient pool. The GLP-1 market is no longer limited to diabetics—it now encompasses millions of people with obesity, and the medical community is responding in kind.

The extraordinary demand for Wegovy and Zepbound has catalyzed a parallel expansion of the ecosystem delivering these therapies. Telehealth platforms, specialty compounding pharmacies, and integrated weight-loss programs have risen to meet demand. Companies like Hims, Ro, and Sequence (now part of WeightWatchers) emerged as popular access points for consumers looking for weight-loss solutions, combining convenience with discretion. These digital platforms capitalized on the shortage by working with compounding pharmacies to create semaglutide and tirzepatide alternatives, sometimes navigating regulatory gray areas in the process. Retail giants and PBMs, such as CVS Health, have also entered the fold by launching programs that cater specifically to GLP-1 users.

The Rise and Regulation of Compounded GLP-1s

Compounding is the process by which pharmacies create tailored medications for patients, gaining traction in the GLP-1 market primarily due to widespread shortages and prohibitive costs associated with branded injectables such as semaglutide and tirzepatide. Telehealth companies and compounding pharmacies, including prominent startups like Hims and LifeMD, capitalized on these market conditions, offering lower-cost compounded alternatives, thereby expanding patient access and significantly boosting their revenues. However, this rapid expansion drew scrutiny concerning safety, legality, and regulatory compliance under the United States Food, Drug, and Cosmetic Act (FD&C Act), specifically sections 503A and 503B.

The phenomenon arose initially due to substantial shortages caused by unprecedented demand, particularly for obesity indications where GLP-1 agonists, medications that stimulate insulin secretion and suppress appetite by mimicking naturally occurring hormones, became increasingly popular. Compounding became attractive as branded solutions such as Novo Nordisk’s Wegovy and Eli Lilly’s Mounjaro experienced sustained supply-chain disruptions. Consequently, pharmacies legally compounded these medications, leveraging the FDA's shortage declarations, enabling them to bypass typical patent infringement concerns by modifying molecular forms (such as creating salts rather than base forms of active ingredients), although this sparked considerable controversy. The FDA closely monitored the compounding market, eventually intervening to restore traditional pharmaceutical market dynamics as manufacturers normalized supply. Key FDA actions included formal resolutions of shortages and stringent deadlines after which compounding would no longer be legally permissible.

For tirzepatide, branded as Mounjaro, the FDA initially announced the shortage resolved on October 2, 2024, effectively ending the legal basis for its compounding. This prompted immediate legal challenges from compounding industry groups, notably the Outsourcing Facilities Association (OFA), claiming the resolution was premature and arbitrary. A consequential lawsuit, OFA v. FDA, led a Texas court in October 2024 to remand the decision back to the FDA for reevaluation. After reconsideration, the FDA reaffirmed the shortage resolution on December 19, 2024, but acknowledged the industry’s reliance by instituting a grace period, allowing pharmacies designated under section 503A to continue compounding tirzepatide until February 18, 2025, and section 503B outsourcing facilities until March 19, 2025. Despite further attempts by OFA to delay enforcement through injunctions, the Texas court ultimately upheld the FDA’s decision in March 2025, firmly ending lawful compounding of tirzepatide beyond that date.

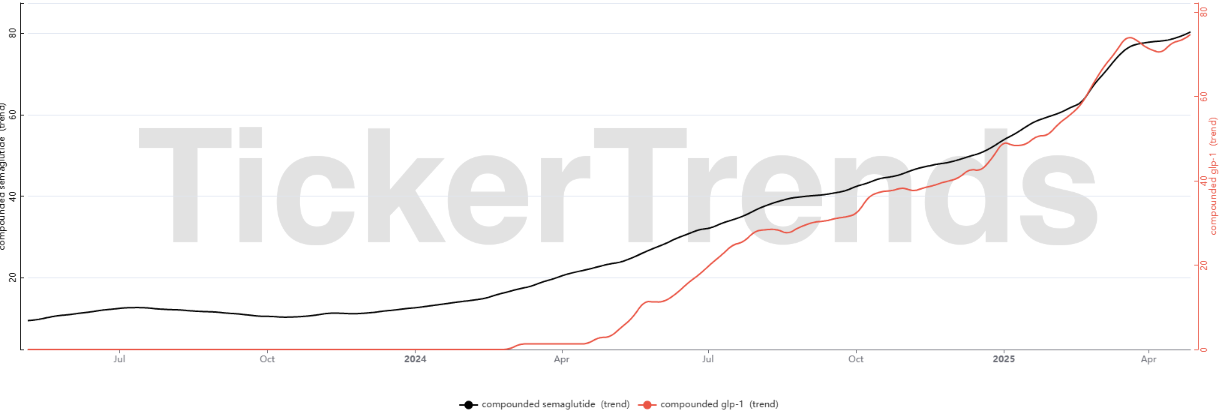

Similar regulatory measures unfolded for semaglutide, marketed as Wegovy and Ozempic. Persistent shortages due to overwhelming consumer demand prompted prolonged compounding activities. Nevertheless, on February 21, 2025, the FDA officially declared the semaglutide shortage resolved following substantial production scaling by Novo Nordisk. Initial enforcement deadlines allowed 60-day (503A pharmacies) and 90-day (503B outsourcing facilities) wind-down periods, but anticipating further legal actions, the FDA subsequently refined these timelines. On March 10, 2025, the FDA clarified enforcement discretion, extending compounding permissions for semaglutide under 503A until at least April 22, 2025, or pending litigation outcomes, and under 503B until May 22, 2025. OFA and other industry groups indeed filed legal challenges, yet the FDA’s timelines ultimately remained intact, decisively prohibiting compounded semaglutide formulations identified as essentially identical to branded solutions post-May 2025