Hims & Hers (HIMS) Earnings Preview: Growth Moderation in Focus

Stable Consumer Momentum Meets Lofty Expectations, No Clear Catalyst Ahead of Hims Q2 Earnings

While Hims continues to scale its subscriber base and draw significant consumer interest, we’re taking a more neutral stance heading into earnings.

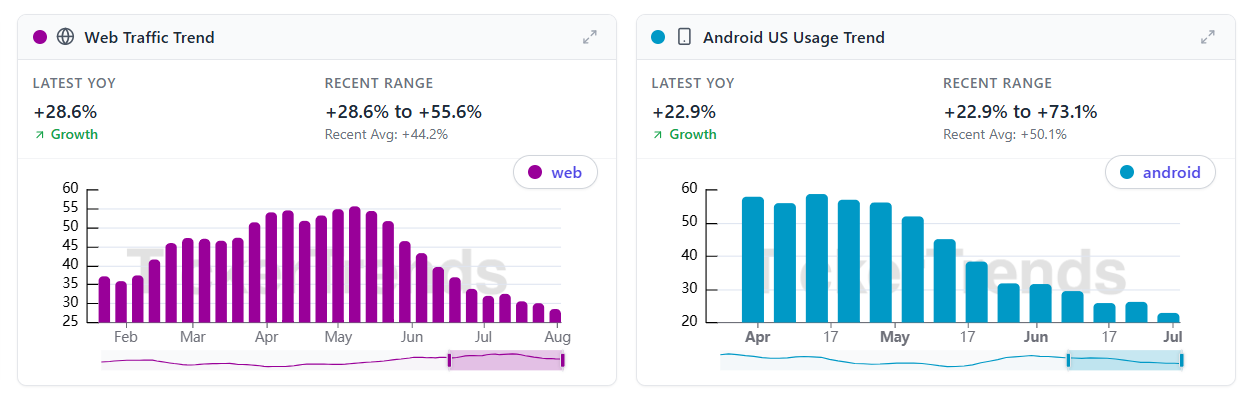

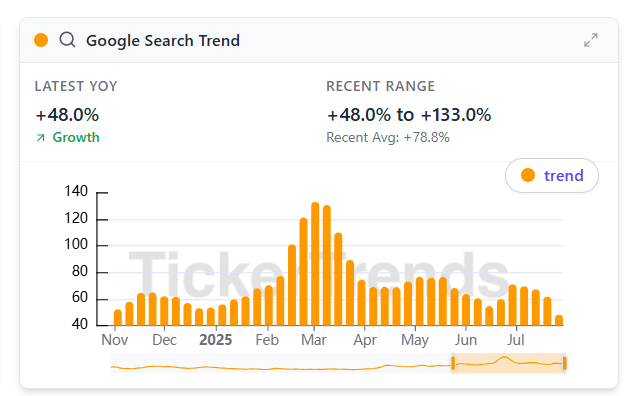

The latest TickerTrends alternative data still shows healthy, but slower, momentum:

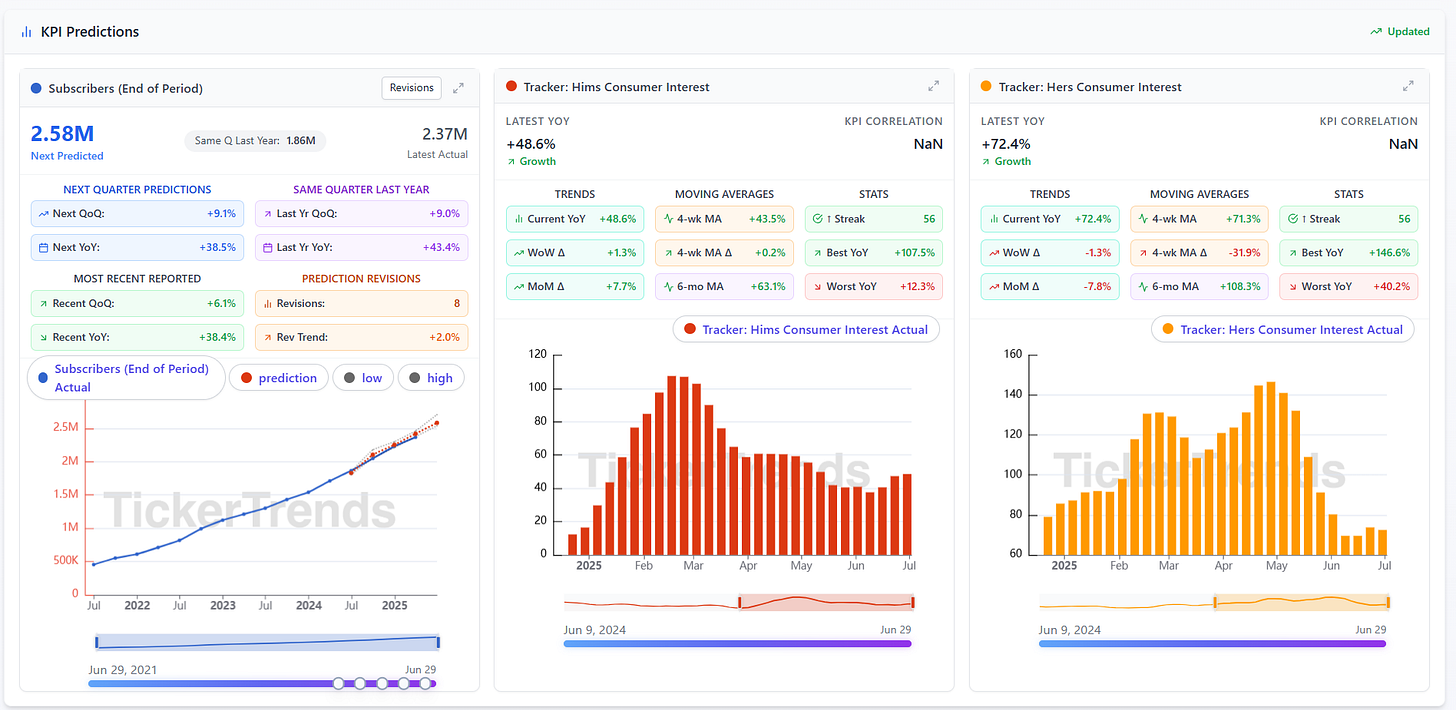

Consumer interest in Hims is up +48.6% YoY, and Hers is up +72.4%, based on aggregated Google Search, website traffic, and social signals.

Our subscriber growth model predicts 2.58M by quarter end Q2, a +9.1% QoQ and +38.5% YoY jump, aligning closely with historical quarterly growth.

However, this is occurring alongside a moderation in overall revenue growth trajectory for future quarters.

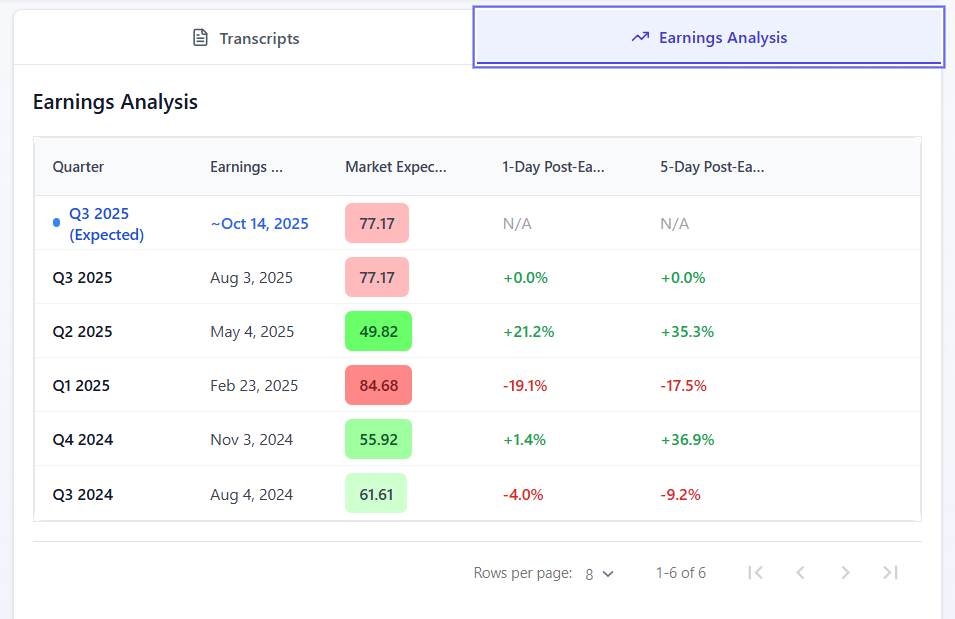

The analyst consensus for 2025 Q3 revenue is $584.1M, implying a +45.5% YoY increase, down from the +74.9% YoY expected for Q2. We believe this deceleration is warranted based on the current pace of consumer engagement and order volume growth.

The HIMS 0.00%↑ TickerTrends’ Whisper Score is >77, indicating elevated investor expectations into this earnings print.

We’re not taking a strong position here. With consumer interest stable but not accelerating, we see limited evidence for an upside surprise or disappointment. Our internal trackers suggest the company may guide roughly in-line at around ~$580M for Q3, consistent with street estimates.

Bottom Line: Hims has built a strong brand and continues to expand its addressable market through new product categories, but this print likely won’t be a major catalyst. We are staying on the sidelines for this name for now, while the risk reward remains difficult to justify on the long or short side.

Please email admin@tickertrends.io to gain access to our entire KPI dashboard which includes coverage of over 200 unique KPIs available on TickerTrends Enterprise: https://tickertrends.io/enterprise