How Consumer Data Shapes Investment Strategies

Consumer data is transforming how investments are made by offering real-time insights into spending patterns, preferences, and market trends. Here's what you need to know:

Why It Matters: Real-time data like transaction trends and social media activity helps investors predict market shifts faster than traditional methods.

Key Sources: Platforms like Banyan and Earnest Analytics provide e-commerce and transaction data, while tools like TickerTrends analyze social media sentiment and web traffic.

How It’s Used: Investors combine these data sources to forecast revenue, track brand health, and identify risks early.

The Results: Hedge funds using consumer data report up to a 10% improvement in stock prediction accuracy.

This shift allows smarter, faster decisions in a rapidly changing financial world. Read on to learn how to leverage consumer data effectively for your investments.

How hedge funds use alternative data to make investments

Main Sources of Consumer Data for Investments

Knowing where to access dependable consumer data is crucial for making informed investment choices. It provides real-time insights into consumer behavior and market trends.

E-commerce and Spending Data

Platforms like Banyan collect data from over 100 e-commerce sites, offering details about what consumers buy, when they buy it, and how much they spend. This type of information helps investors predict revenue patterns and make adjustments to their portfolios.

Earnest Analytics focuses on transaction data for sectors like retail, restaurants, and technology. Their insights allow investors to spot trends early - well before they show up in traditional financial reports.

Social Media and Website Traffic

Social media and web traffic offer a window into consumer sentiment and how engaged people are with brands. Tools like TickerTrends gather data from various alternative sources and use their own scoring system to turn social sentiment into actionable insights. This helps investors understand brand momentum and identify when markets are becoming saturated.

Analyzing website traffic can uncover how consumers interact with brands online. Metrics like site visits, time spent on pages, and engagement patterns can signal market changes before they show up in standard financial analyses.

Consumer Data Providers

Specialized companies like Numerator focus on tracking brand performance, market shifts, and consumer preferences. Their data supports better market predictions and sharper investment strategies.

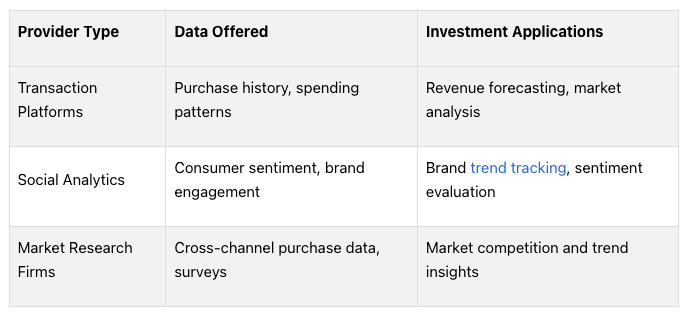

Here’s a breakdown of how different types of consumer data providers contribute to investment research:

To get the most out of consumer data, investors often combine multiple sources. This approach creates a fuller view of market dynamics, enabling smarter strategies and revealing hidden opportunities.

Discover Alternative Data Insights

Access comprehensive consumer data, track market trends, and gain actionable insights with TickerTrends' innovative data terminal and API services.

Using Consumer Data to Improve Investment Strategies

Analyzing Detailed and Real-Time Data

Investment strategies today lean heavily on real-time consumer data to stay ahead. A 2021 Refinitiv study found that hedge funds using consumer spending data saw a 10% boost in quarterly stock prediction accuracy [1]. This shows just how impactful timely insights can be.

By analyzing transaction data as it happens, investors can gauge a company's performance even before earnings reports come out. This allows for quick portfolio adjustments based on shifting trends. Once the data is reviewed, the next step is choosing tools that align with specific investment goals.

Customizing Data Tools for Investments

To make the most of consumer data, investors need tools tailored to their objectives. In fact, 65% of hedge funds now use alternative data to guide their decisions [2]. The challenge is finding tools that deliver insights relevant to your specific market focus.

For example, TickerTrends pulls data from sources like social media, web traffic, and app usage. Their platform turns this information into actionable insights, helping investors spot opportunities in the market more effectively.

Customizing these tools lays the groundwork for using predictive models to forecast market shifts.

Using Predictive Models for Market Trends

Predictive models build on customized tools by turning data into future-focused insights. Companies like Earnest Analytics and Banyan specialize in converting raw consumer data into forecasts that investors can act on.

These models dig into patterns like spending behavior, online sentiment, and web traffic to uncover trends before they fully emerge. For instance, when exploring eco-friendly investments, predictive models can highlight growing interest in sustainable products by analyzing social media chatter, search activity, and purchase data.

"Real-time transaction data allows hedge funds to assess company performance before official earnings reports are released, enabling timely adjustments to investment strategies" [1].

Tips for Using Consumer Data in Investments

To make the most of predictive models, it's important to use consumer data wisely and responsibly. These tips can help you get started.

Keeping Data Accurate and Compliant

With privacy laws like GDPR and CCPA becoming stricter, ensuring data accuracy and compliance is more important than ever. Regular audits and strong security measures are a must. For instance, TickerTrends ensures compliance by aggregating verified data and cross-checking it across sources like social media, web traffic, and consumer behavior patterns.

Mixing Up Your Data Sources

Relying on multiple data sources can give you a broader view of the market. Combining different types of data can uncover trends that might otherwise go unnoticed. For example, pairing SKU-level retail data with social media sentiment analysis can highlight early shifts in consumer preferences. This mix reduces the chances of being misled by false signals and helps confirm trends.

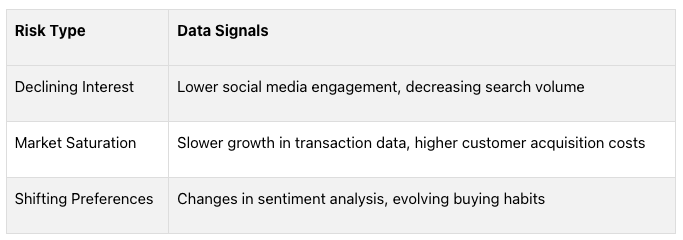

Spotting Risks Through Consumer Data

Consumer data can act as an early warning system for potential investment risks. By tracking real-time behavior, you can identify red flags before they affect market performance. Here are some examples:

For example, if social media engagement or search volume drops, it might be time to rethink your investment strategy or consider hedging. To effectively manage these risks, focus on filtering relevant data points and key performance indicators (KPIs). Regularly validating your data sources and keeping your analysis tools up-to-date will help ensure you make informed decisions.

Conclusion: The Role of Consumer Data in Smarter Investments

Consumer data has reshaped how investment strategies are developed, offering sharper tools for analyzing markets and making decisions. Investors now rely on this data to stay ahead of market shifts and uncover opportunities.

Take real-time consumer data, for example. During the 2020 pandemic, hedge funds analyzed aggregated credit card transactions to predict changes in consumer spending. Companies like YipitData and Second Measure specialize in providing this type of alternative data, helping investors spot trends before they appear in traditional financial reports.

Platforms such as TickerTrends cater to this growing need by offering insights that guide investors in making informed decisions while adhering to data protection laws.

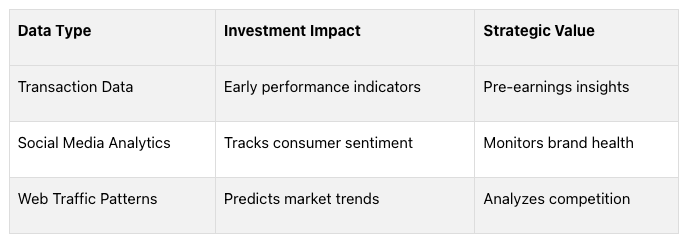

Here’s a quick overview of how various consumer data types contribute to investment strategies:

The ability to succeed in investments increasingly depends on how well consumer data is utilized. By combining multiple data sources and ensuring compliance with regulations, investors can refine their market analysis and build smarter strategies. The challenge lies not just in accessing data but in interpreting it effectively and managing the risks involved.

As consumer behavior continues to shift, staying ahead will require more than just data. Investors must focus on turning insights into action while maintaining a careful balance between opportunities and potential risks.