How to Integrate App Usage Data Into Investment Strategy

App usage data is transforming investment strategies by offering real-time insights into user behavior and market trends. Here's how you can use it:

Key Metrics to Track: Focus on Daily Active Users (DAU), Monthly Active Users (MAU), retention rates, and revenue indicators like Average Revenue Per User (ARPU).

Why It Matters: App data helps spot growth opportunities, assess user engagement, and predict risks early.

Tools to Use: Platforms like TickerTrends provide real-time analytics for smarter decisions.

Ethical Considerations: Ensure compliance with data privacy laws like GDPR and CCPA.

Important App Usage Metrics for Investors

Tracking User Growth and Market Reach

Strong user growth often points to an app's potential to dominate its market. With the global mobile app market expected to hit $935.2 billion by 2025, growing at a 19.1% CAGR from 2020 to 2025 [6], tracking growth metrics becomes crucial.

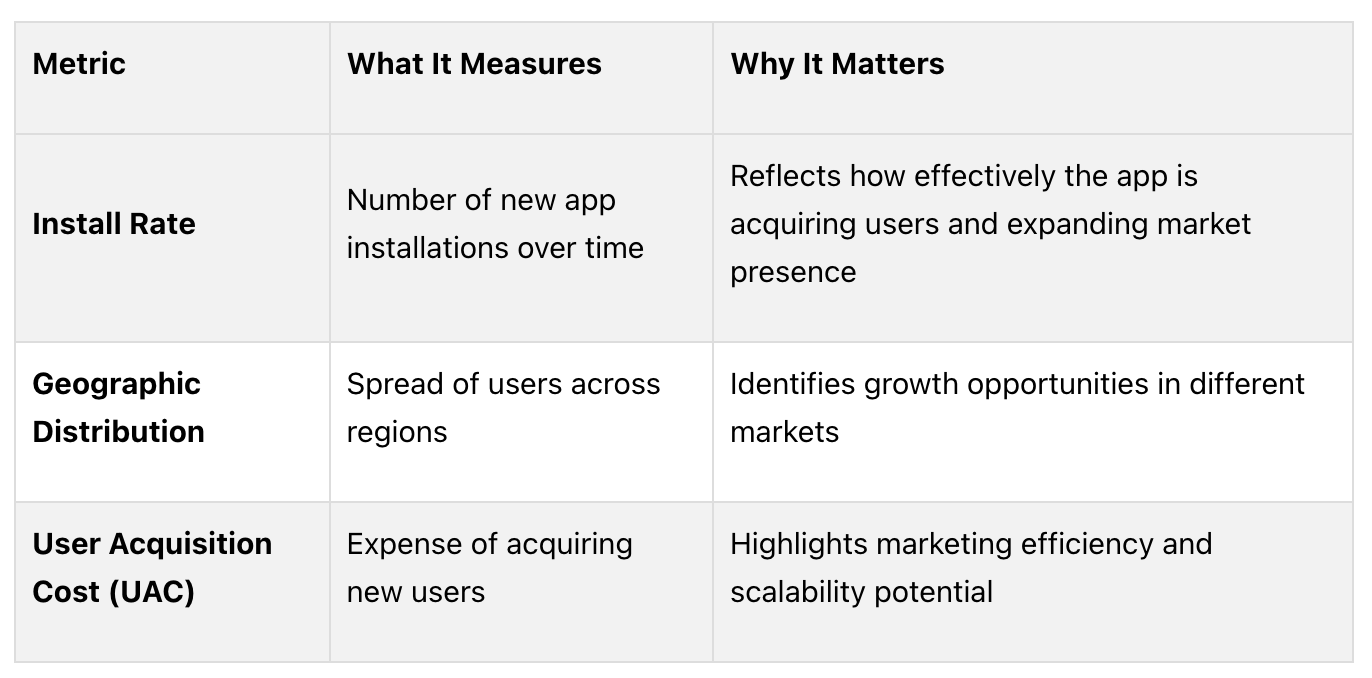

Key metrics to monitor include:

While growth metrics shed light on market potential, engagement and retention metrics reveal how well the app keeps its users coming back.

Measuring Engagement and Retention

Engagement metrics are critical, especially given that 71% of app users stop using apps within 90 days [5]. These metrics help investors understand how effectively an app keeps its users engaged.

Key engagement metrics:

Daily Active Users (DAU): Tracks how many users interact with the app daily, showcasing consistent engagement.

Monthly Active Users (MAU): Measures the broader stability of the user base.

DAU/MAU Ratio: Indicates how loyal and "sticky" the app is to its users.

Session Length: Gauges the depth of user interaction during each visit.

Analyzing Revenue Metrics

User growth and engagement are only part of the story. Revenue metrics give a direct view of financial performance, helping investors assess the app's profitability. Tools like TickerTrends allow real-time tracking of these indicators:

Average Revenue Per User (ARPU): Measures revenue generated per user.

In-app Purchase Conversion Rates: Tracks how effectively users convert to paying customers.

Subscription Retention Rates: Indicates the ability to maintain paying subscribers over time.

Tracks overall revenue trends and patterns.

"The key takeaways are to focus on relevant app usage metrics, combine data with other sources of information, use practical tools and platforms for analysis, and ensure ethical and responsible use of data" [4].

Top 10 Mobile App Metrics & KPIs

How to Access and Use App Usage Data

Understanding and using app usage data can help investors spot emerging trends and make informed decisions.

Best Tools for App Usage Data

Tool

Features

Ideal For

TickerTrends

Real-time analytics, API access

Professional investors

Analytics Platforms

Engagement metrics, revenue analysis

App-specific insights

Market Intelligence

Competitive analysis, forecasts

Strategic planning

Evaluating Data Quality and Usefulness

To make the most of app usage data, it’s essential to ensure the information is up-to-date, accurate, and collected through reliable methods. Many top financial institutions run rigorous tests to validate data accuracy.

Key factors to assess include:

How often the data is updated

Whether the sample sizes are representative

Transparency in how the data is collected

The reputation and reliability of the data source

Combining App Data With Other Sources

"Data integration in fintech is crucial for adding new solutions to the existing financial infrastructure, enhancing collaboration, and streamlining workflows" [7].

App usage data becomes even more powerful when combined with other datasets, such as:

Social media activity

Consumer spending trends

Market research reports

It’s important to implement privacy measures to protect sensitive information while using these insights. By effectively combining and analyzing data, investors can uncover profitable trends and reduce risks in their strategies.

Discover Alternative Data Insights

Access comprehensive consumer data, track market trends, and gain actionable insights with TickerTrends' innovative data terminal and API services.

Using App Usage Data in Investment Strategies

Spotting Trends and Growth Areas

App usage data can uncover new investment opportunities by showcasing patterns in growth, user engagement, and revenue. Metrics like DAU (Daily Active Users), ARPU (Average Revenue Per User), and retention rates help investors gauge market potential and pinpoint sectors with strong prospects before they gain widespread attention. These insights not only highlight areas of growth but also support informed decision-making in investments.

Example: App Data in Tech Investments

Morgan Stanley's integration of ChatGPT demonstrates how app usage data can refine financial advisory services, improve portfolio management, and support decisions based on data [1]. Their success stemmed from methodical testing, thorough data analysis, and measurable enhancements in client services.

Mitigating Risks with Usage Data

App metrics can also serve as early warning signs for potential risks. For instance, drops in engagement, rising churn rates, or lower satisfaction scores often hint at upcoming financial challenges. By keeping an eye on engagement patterns, user behaviors, and revenue trends - while comparing them to competitors - investors can foresee problems and adjust their strategies. Tools like TickerTrends provide real-time and historical data, helping investors make informed decisions while maintaining a balanced approach to risk.

Although app usage data offers valuable insights, it’s crucial to ensure its use complies with ethical and regulatory standards for responsible investing.

Guidelines and Ethics for Using App Usage Data

Following Privacy and Regulatory Rules

Regulations like GDPR and CCPA establish clear rules for handling app usage data, especially in investment analysis. Companies need to implement strong data protection measures and obtain explicit user consent before analyzing app data. Conducting regular compliance audits ensures they meet current privacy standards while safeguarding the integrity of the data used for investment decisions.

Weighing Costs Against Benefits

When considering investments in app usage data, firms should carefully assess the associated costs and their impact on returns:

For example, Morgan Stanley integrated ChatGPT with over 100,000 research inputs, striking a balance between cost and governance to improve its advisory services [1].

Ensuring Data Security

To protect against potential threats, firms should use encryption, enforce strict access controls, and regularly update security protocols. The rise in digital financial services - demonstrated by a 17% increase in app sessions in early 2023 [3] - highlights the importance of strong security measures.

Conclusion: Using App Usage Data to Make Better Investments

Key Takeaways

App usage data offers a powerful lens into trends and consumer behavior, making it a valuable resource for modern investment strategies. Metrics like DAU (Daily Active Users) and MAU (Monthly Active Users) play a critical role in guiding decisions that focus on user engagement and growth [2]. As the financial sector continues to evolve digitally, app data is becoming a cornerstone for spotting opportunities and managing risks.

Investors can take practical steps to integrate app data into their decision-making process.

How to Start Leveraging App Data

Combining app metrics with traditional analysis provides a more comprehensive view of potential investments. Monitoring metrics such as user engagement and revenue can help uncover early opportunities in the market [2][8]. By following these steps, investors can gain actionable insights and make more informed decisions.