$JSDA The Nuka-Cola Effect: Jones Soda’s Viral Turnaround

The Fallout Collaboration Drove a 600% Rise Consumer Interest, Triggered National Costco Distribution, and Fueled a Strategic Pivot for the Micro-Cap Brand

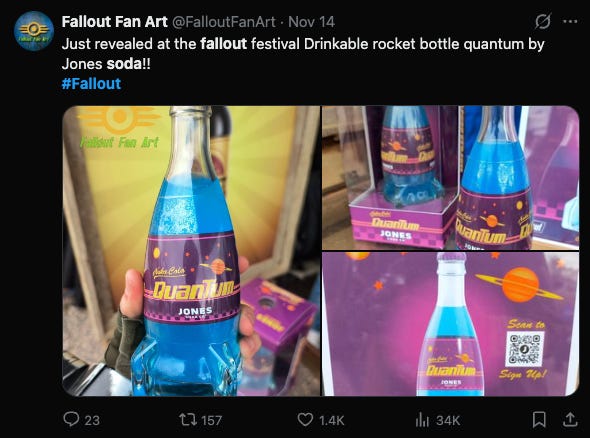

The release of the latest Jones Soda x Fallout collaboration has triggered a massive resurgence in interest for the micro-cap brand, transforming a legacy craft soda player into the center of a viral retail event.

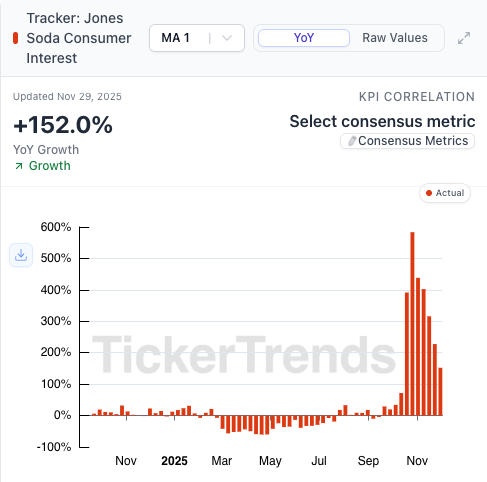

Explosive Brand Heat: Consumer interest in the Jones Soda brand has hit a peak of nearly 600% YoY growth.

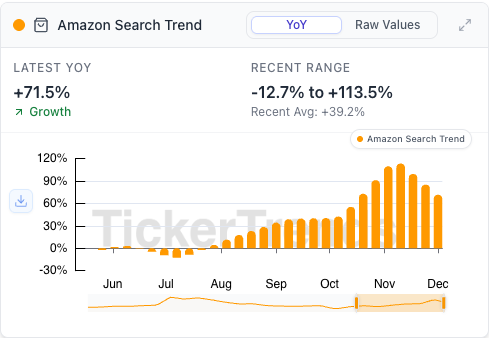

High Purchase Intent: This isn’t just passive buzzing; Amazon search interest for Jones products has climbed over 100% YoY, indicating direct demand.

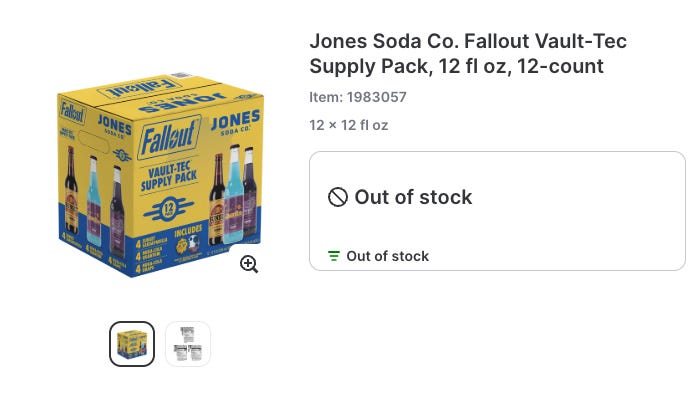

Scarcity & Sentiment: The Fallout SKUs are sold out across major retail footprints, including Costco locations nationwide.

Sentiment is overwhelmingly positive, fans are treating the product as a “real-world” collectible rather than a simple beverage.

The Scalper Index: The secondary market confirms the scarcity value, with resellers on eBay successfully moving product at 100%+ markups over retail price.

Crucially, this viral demand is converting into material business improvements and a streamlined corporate strategy:

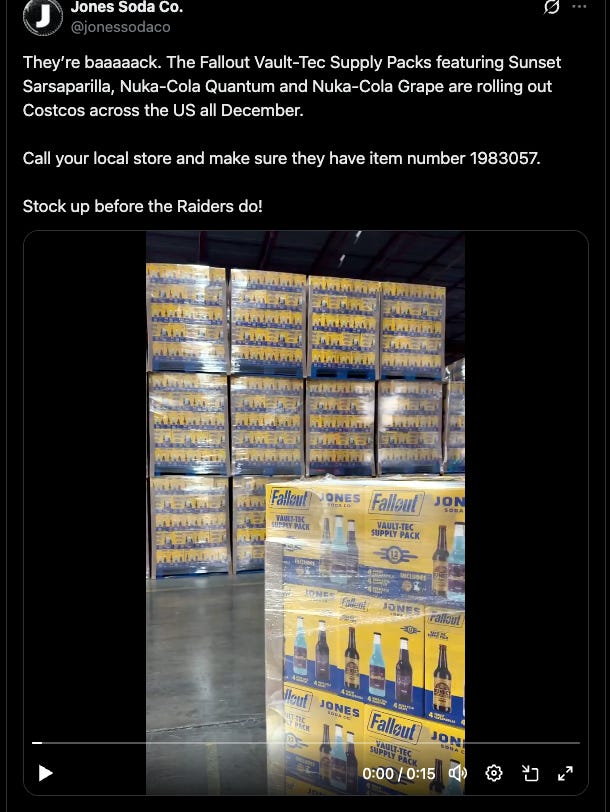

Novelty to National Scale: Unlike previous limited-run drops, this collaboration features a massive brick-and-mortar footprint. The “Vault-Tec Supply Pack” (a 12-pack sampler) launched nationwide at Costco in December after a regional test run sold out in days. This moves the product from a niche online collectible to a high-volume mass-market SKU.

Proven Top-Line Impact: This IP strategy has already demonstrated financial leverage. In Q2 2024, Jones reported a 49% revenue increase (their best Q2 since 2009), explicitly citing the earlier “Nuka-Cola Victory” launch as a primary driver. Current Q3 2025 filings indicate that the new Costco wave is generating significant purchase orders that will bolster revenue through late 2025 and early 2026.

Strategic Refocus & Divestiture: The company has cleared the deck to capitalize on this momentum. In mid-2025, Jones divested its cannabis division (”Mary Jones”) for ~$3M, exiting a high-regulatory, capital-intensive sector. Under new leadership (CEO Scott Harvey), the company has refocused entirely on profitable core beverages and high-margin IP partnerships like Fallout.