K-Beauty Revolution: Biggest Beneficiaries, Market Shockwaves, and the TickerTrends Blueprint | Tickertrends.io

The TickerTrends Social Arbitrage Hedge Fund is currently accepting capital. If you are interested in learning more send us an email admin@tickertrends.io

The beauty world is undergoing a seismic shift, a revolution quietly orchestrated from East Asia that is now thundering across the globe, leaving established Western giants in its wake and rewriting the rules of engagement, innovation, and financial success. This isn't just anecdotal; the entire K-beauty market is exploding. Forecasts from early 2025 indicate the global K-beauty products market will swell from around $11.56 billion in 2024 to $12.5 billion in 2025, and is projected to charge towards $16 billion by 2029 and potentially over $20 billion by 2035, demonstrating a robust and sustained compound annual growth rate. This isn't a niche ripple; it's a tidal wave of consumer demand and market expansion.

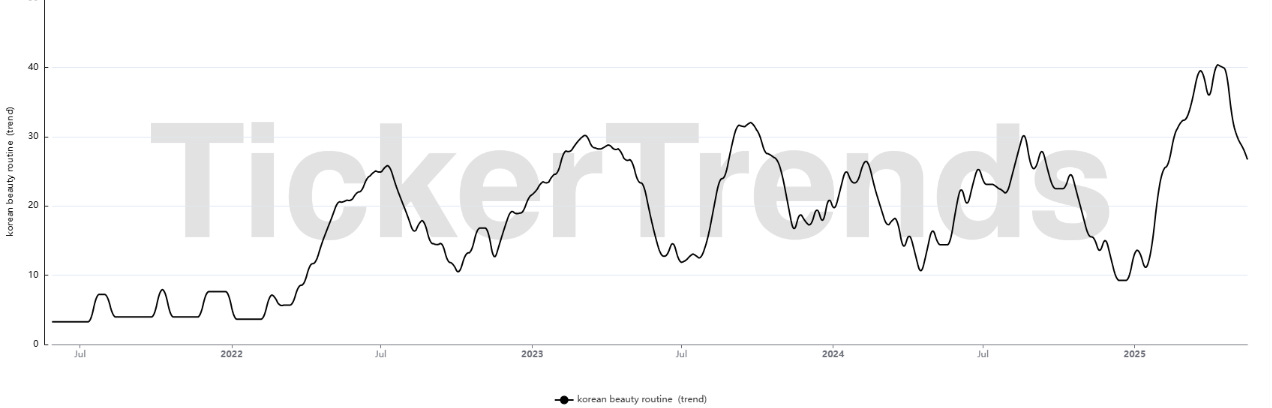

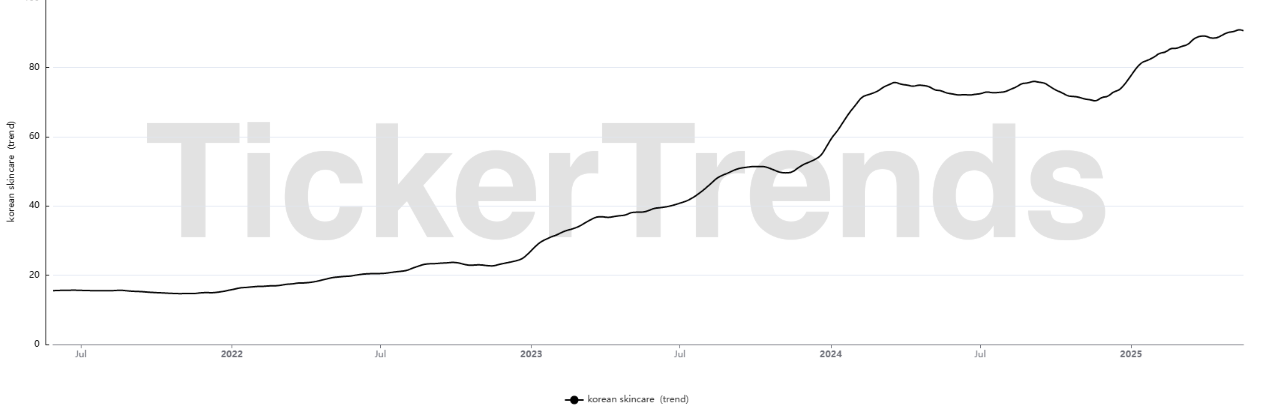

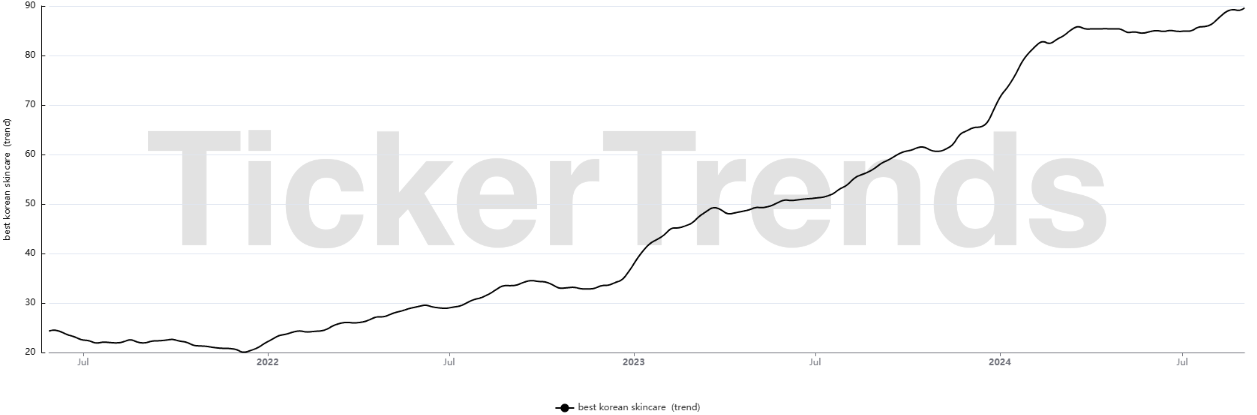

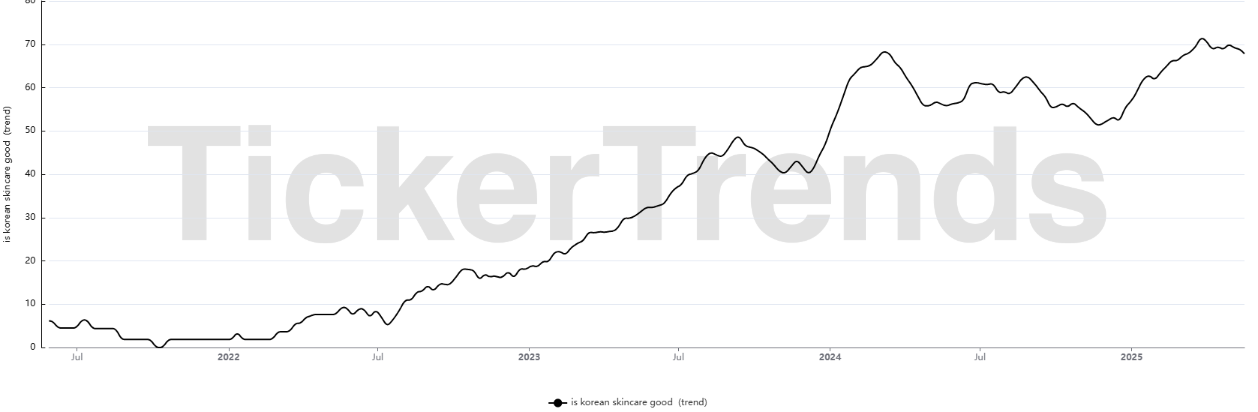

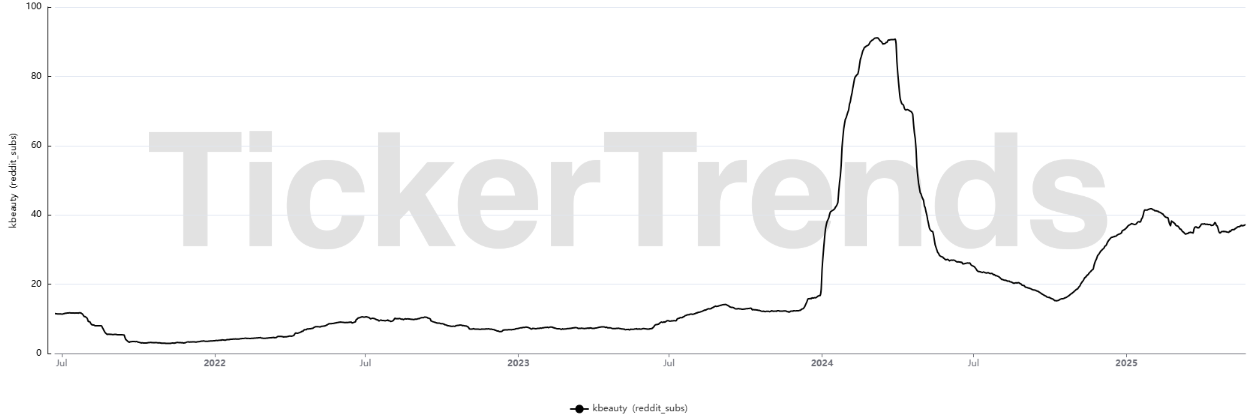

If you’re not paying close attention to this phenomenon, you’re not just missing a trend; you’re missing a fundamental restructuring of a multi-billion dollar industry. Online search trends paint an even more vivid picture of this consumer obsession: in the past year alone, searches for "Korean skincare" have skyrocketed.

This digital fervor is translating into tangible market shifts, with Korean cosmetics exports surpassing the $10 billion milestone for the first time in 2024, a staggering 20.6% increase from the previous year. The US market, in particular, has become a focal point of this explosive growth, with exports surging by an incredible 57% in 2024, positioning Korea as the top cosmetics exporter to the United States, even surpassing traditional strongholds like France. This isn't about niche products anymore; it's about a new vanguard of brands achieving hyper-growth, fueled by an uncanny understanding of digital culture, unprecedented product efficacy, and a business acumen that has investors and legacy corporations alike scrambling to catch up. The numbers alone are staggering, hinting at a gold rush where early understanding translates into significant opportunity.

Imagine a legacy cosmetics powerhouse, a name synonymous with beauty for decades, suddenly finding its revenue from the Americas explosively growing by 83 percent, toppling Greater China – its long-standing cash cow – for the first time in its storied history. This isn't an isolated incident; it's a testament to a strategic pivot so profound that it’s making the West the new battleground and proving that "modernized K-beauty" isn't just surviving a global slowdown, it's conquering higher-margin markets with astonishing speed. This inflection point, underscored by the massive surge in global demand and search interest, confirms that K-beauty is not merely resilient but voraciously expanding.

At the heart of this conquest is an operational engine unlike anything the traditional beauty industry has seen. Picture an ecosystem where social platforms are not just marketing channels but real-time demand signals, content studios, and direct distribution arteries all rolled into one. We're seeing brands where daily social media mentions, average view durations, and even "dupe chatter" are ingested by proprietary dashboards every midnight. These data streams don't just inform advertising; they dictate product cadence, pricing architecture, and even warehouse allocation. New flavor drops can be triggered, bundle discounts adjusted, and holiday-edition runs capped to protect scarcity, all within days, sometimes hours, of a social media spike. The old spray-and-pray media calendar has been obliterated, replaced by iterative sprints where every video is both content and a live focus group. One hydration line, once modest, now sees a single hero lip product – waved by a celebrity at an awards show years ago and since immortalized in millions of TikToks – outsell entire Western prestige portfolios. Its dedicated hashtag has garnered over 300 million views, a testament to user-generated content depicting everything from satisfying gel twirls to the glossy film peeling off chapped lips, far outperforming any clinical chart ever published. This is a world where the social cloud has become the de facto product manager.

The innovation isn't just in marketing; it's deeply embedded in the products themselves, creating a flywheel of demand. Consider a skincare line featuring at-home microneedling technology infused with cica spicules – microscopic, needle-like structures reportedly 14 times thinner than human pores – that has achieved viral status and sold over 11.7 million units worldwide. This isn't just about clever ingredients; it's about creating a tangible experience, a distinct tingling sensation that serves as immediate, shareable proof of efficacy. This democratization of advanced skincare, moving professional-level treatments into convenient at-home solutions, is carving out entirely new market categories. Another brand, built on traditional Korean herbal medicine (Hanbang) merged with modern science, saw its flagship sunscreen – celebrated for its lightweight, no-white-cast formula – sell over 18.5 million units globally, becoming one of the most viral products of the last year. This success translated into its parent company reportedly experiencing a sevenfold increase in sales, rocketing past the trillion Korean won mark in a single fiscal year. These are not just products; they are cultural phenomena, blending ingredient authenticity like Jeju green tea or six-year-aged Punggi ginseng with sensorial theatrics – gel-to-glaze transitions, elastic ampoules, bouncy serums – that translate into infinitely loopable short-form content, dramatically lowering the cost of customer acquisition.

The financial implications are equally breathtaking, creating a FOMO-inducing landscape for investors and industry observers. One newly listed device-centric company saw its share price surge 110% post-IPO, driven by beauty devices with gross margins approaching an astounding 70 percent. Its social momentum converts directly into retail velocity, with major US beauty retailers rolling out its entire assortment chain-wide, bypassing usual pilot phases. Another e-commerce giant, specializing in Asian beauty, watched its revenue jump 71.7% to nearly US$350 million, turning a group loss into a 5.5% net margin, largely thanks to a meticulously managed influencer network of over 400,000 creators that drives nearly 28% of its B2C turnover with commission structures and attribution windows that outcompete rivals. The acquisition of a TikTok-viral snail mucin essence brand for ₩755.1 billion by a larger conglomerate, after the essence garnered over two billion cumulative TikTok views, showcases the immense value of earned media – a scale of reach that would have cost multiples of the acquisition price to replicate organically. That same conglomerate saw its operating profit inflection outpace top-line growth by a factor of ten, as its social-commerce model converts variable selling expenses into quasi-fixed content assets; once a tutorial goes viral, incremental impressions cost nothing, yet each carries measurable conversion probability. Elsewhere, a specialist in regenerative aesthetics, leveraging unique PDRN technology from salmon DNA, secured a KRW 200 billion investment from a global private equity firm to accelerate its already dominant overseas expansion. Many of these K-beauty innovators are still trading at forward EV/EBIT multiples in the high teens, a discount to global peers despite faster growth trajectories and superior cash conversion, hinting at significant valuation upside for those who understand the underlying mechanics. Early-stage funding in K-beauty also saw a significant rebound in the first few months of 2025, signaling renewed investor confidence in the sector's next wave of disruptors after a quieter 2024.

This is more than just a collection of successful brands; it's a paradigm shift, underpinned by undeniable macro trends. The global fascination with K-culture, the "Hallyu wave," continues to drive interest, but the sustained growth is increasingly about tangible product benefits: innovative formulations, an emphasis on gentle yet effective ingredients, and a skin-first philosophy that resonates deeply with health-conscious consumers worldwide. It’s a story of how cultural soft power, combined with relentless product innovation, data-driven marketing, and agile supply chains, is creating a new generation of beauty titans. They are building defensible moats through ingredient traceability, sensorial product experiences that fuel organic virality, data architectures that close the loop between discovery and production in near real-time, and omnichannel distribution strategies that maximize returns across diverse platforms, from Sephora to Amazon to TikTok Shop. The strategic de-emphasis on previously dominant channels by some, while partnering with prestige retailers like Sephora for wider US rollouts, signals a maturation and a bold move towards premium positioning and controlled distribution, further enhancing brand equity.

The risks – platform volatility, competitive imitation, geopolitical friction – are real, but these companies are already building redundancies, hedging strategies, and even piloting final assembly in Western markets to mitigate these threats. The core question isn't if K-beauty will continue its dramatic ascent, the market data and search trends confirm it will, but how high it can fly, and which of these agile, innovative companies will become the enduring global leaders of tomorrow.

The narratives of these companies are not just case studies in success; they are blueprints for the future of consumer brands in a digitally native, globally connected world. They demonstrate a virtuous loop where ingredient credibility fuels sensorial storytelling, which in turn generates viral social content, leading to algorithmic demand planning, rapid product iteration, and ultimately, structurally higher returns – all validated by a global consumer base actively seeking out these innovations. For investors, marketers, and industry professionals, understanding the intricacies of this K-beauty phenomenon is no longer optional – it's critical. The full story, the deep dive into the specific strategies, the brand-by-brand breakdown of how this success is being engineered, and the future trajectory of this global takeover is a narrative packed with insights that could redefine your understanding of market disruption and value creation. Are you ready to look behind the curtain and see how the future of beauty is being built, one viral post, one innovative formulation, and one billion-dollar valuation at a time? The K-beauty gold rush is in full swing, backed by undeniable global momentum, and the window to fully capitalize on this knowledge is now.