Kamala Harris Win Trades Alternative Data Overview | TickerTrends.io

The TickerTrends Social Arbitrage Hedge Fund is currently accepting capital. If you are interested in learning more send us an email admin@tickertrends.io .

Ticker(s) mentioned: FSLR, NEE, ENPH, TSLA, UNH, CAT, ROAD, VMC, MSOS

Potential Stock Market Winners if Kamala Harris Wins the Presidency

The possibility of Kamala Harris winning the presidency brings with it the anticipation of various policy shifts that could influence specific sectors of the stock market. Based on her positions and the broader Democratic platform, several industries could see significant benefits under her leadership. Although there are no detailed policies written out on her website at the time of writing, we will infer based on historical comments and voting patterns what is likely to be Harris’ stance on key issues. First, we will go over some important pieces of legislation that will be decided upon during the next administration. Then, we will take an in-depth look at potential stock market winners if Kamala Harris were to secure the presidency.

The Polls Today

Currently, some of the best forecasters in the political world now believe that Kamala Harris is the favorite to win the US Presidency this November.

Nate Silver, largely attributed to being the best political forecaster in the arena, models Kamala as having a 3% edge in the popular vote, translating to quite the margin of victory in crucial swing states.

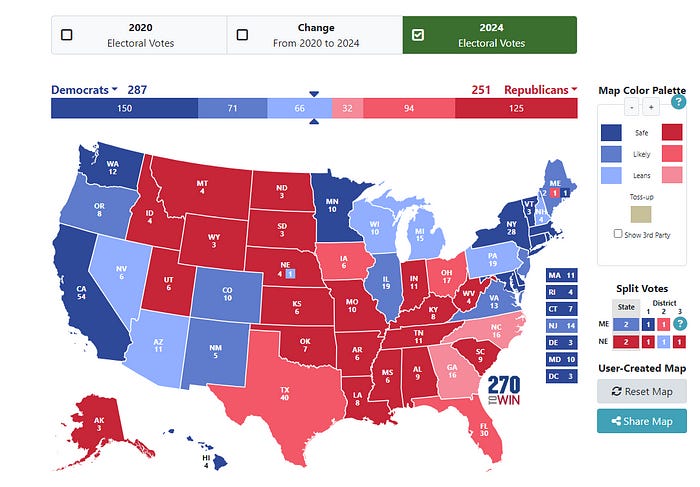

If the polls are accurate here, the current electoral map would look like the following below. It is important to note that even if Trump wins Nevada and Arizona, Kamala would still win with the Rust Belt states (Wisconsin, Michigan, and Pennsylvania) at 270–268.

Equally important are the House and Senate elections. That will determine the balance of power in terms of getting actual legislation passed. Cook Political Report rates different races and we can see the current expectations.

This is interesting because so far, the polls indicate that Democrats will lose the Senate with the fate of the House still a toss up.

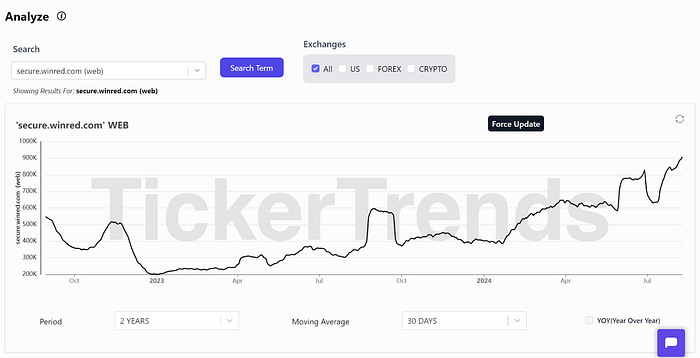

Looking at the donation websites for both the Democrats and Republicans, we see interesting momentum particularly with Kamala in this initial honeymoon phase, although user donation interest on both sides of the aisle are rising.

The donation website visits are tracking higher for Kamala’s campaign at the moment.

The Fate of the 2017 Trump Tax Cuts Under a Kamala Harris Presidency

The 2017 Tax Cuts and Jobs Act (TCJA), enacted during the Trump administration, significantly reduced the corporate tax rate from 35% to 21% and introduced various tax benefits for individuals and businesses. However, the future of these tax cuts could be uncertain under a Kamala Harris administration, particularly if Congress remains divided.

Potential Outcomes in a Divided Congress: If Kamala Harris wins but faces a divided Congress, with Republicans controlling one or both chambers, significant changes to the 2017 tax cuts would be challenging to implement. Harris has indicated support for raising corporate taxes, especially for high-income earners and large corporations. However, without full control of Congress, comprehensive tax reform may be off the table. Instead, we might see targeted adjustments, such as increasing the corporate tax rate modestly or closing specific loopholes, rather than a full repeal of the TCJA provisions.

Potential Outcomes in a Democratic Congress: If Kamala Harris wins but the Democrats control both the House and Senate, this makes a raising of the corporate tax rate and other tax reforms likely. Many companies would earn less net income in this scenario and should the tax code be enacted, the result would be likely downside volatility in markets as uncertainty over future policy takes hold.

Impact on Markets in the Interim: The uncertainty around tax policy could lead to increased market volatility, particularly for large corporations that benefited most from the 2017 tax cuts. Investors might need to brace for potential adjustments in corporate earnings projections if changes are enacted. However, the divided Congress could also mean that the most extreme changes are unlikely, providing some stability and continuity for businesses and investors.

The Inflation Reduction Act (IRA) and Its Impact on Solar/EV Tax Credits and Construction

The Inflation Reduction Act (IRA) of 2022 was a landmark piece of legislation aimed at addressing climate change, healthcare costs, and reducing the federal deficit. One of the key components of the IRA was its substantial investment in renewable energy and clean technology, including tax credits for solar and electric vehicles (EVs).

Solar and EV Tax Credits:

Enhanced Tax Credits: The IRA significantly expanded tax credits for both solar installations and electric vehicle purchases. For solar energy, the act extended the Investment Tax Credit (ITC), which provides a 30% tax credit for residential and commercial solar installations. This extension and enhancement have made solar energy projects more financially viable, leading to a surge in both residential and utility-scale solar installations across the country.

Electric Vehicles: The IRA also restructured the EV tax credit system, providing up to $7,500 in tax credits for new electric vehicles and introducing a $4,000 credit for used EVs. These credits are designed to make EVs more affordable and accelerate the transition to electric transportation. The act also introduced new requirements for vehicles to qualify for the credit, such as domestic manufacturing and sourcing of critical minerals, which are expected to boost U.S. manufacturing jobs.

Impact on Construction and Infrastructure:

Massive Construction Boom: The IRA’s provisions have spurred a massive wave of construction projects related in many sectors, from renewable energy and EV infrastructure to roads, bridges and data centers. Companies in the solar industry, such as First Solar (FSLR) and Enphase Energy (ENPH), have reported significant increases in demand for their products. Others like Construction Partners (ROAD) and Caterpillar (CAT) have seen far more demand, as more asphalt and heavy machinery is required for building. This construction has been driven by the financial incentives provided by the IRA.

Supply Chain Investments: Additionally, the requirements for domestic sourcing in the EV tax credits have led to investments in the U.S. supply chain, including the construction of new battery manufacturing plants and the expansion of critical mineral processing facilities. Companies like Tesla (TSLA) are investing heavily in U.S.-based production to ensure that their vehicles qualify for the full tax credits, further driving construction and job creation in the sector.

Should Harris win, the IRA is likely to remain intact, with all solar and EV tax credits remaining in place. However, these credits will be put in jeopardy if Trump wins.

Below, we will now think about potential long trades to prepare for a Kamala Harris presidency.

1. Clean Energy and Renewable Energy

Kamala Harris has been a vocal supporter of the Green New Deal in the past and other policies aimed at reducing carbon emissions and promoting renewable energy. As a result, the clean energy sector stands out as a clear potential winner.

First Solar (FSLR)

First Solar is a leading American manufacturer of solar panels and a key player in the global photovoltaic (PV) market. The company specializes in manufacturing thin-film solar modules and provides utility-scale PV power plants.

Why It Could Benefit: Kamala Harris has been a strong advocate for reducing carbon emissions and supporting the transition to renewable energy. Her administration could push for policies like tax incentives for solar energy, renewable energy credits, and investments in green infrastructure. This would directly benefit First Solar, as increased demand for solar energy projects would likely lead to higher sales of their solar panels and solutions. Additionally, First Solar’s focus on large-scale projects aligns well with potential federal investments in renewable energy infrastructure, which could lead to substantial contracts and revenue growth.

NextEra Energy (NEE)

NextEra Energy is one of the largest producers of wind and solar energy in the world. The company operates through two main subsidiaries: Florida Power & Light Company and NextEra Energy Resources, which is responsible for its renewable energy projects.

Why It Could Benefit: A Harris administration would likely prioritize the expansion of renewable energy to meet ambitious climate goals. NextEra Energy’s leadership in both wind and solar power positions it to benefit from potential government support for clean energy. This could include subsidies, tax credits, and grants for renewable energy projects, as well as mandates for utilities to increase their renewable energy portfolios. NextEra’s extensive portfolio of renewable energy projects and its ability to scale quickly could lead to accelerated growth and increased market share.

Tesla (TSLA)

Tesla is a global leader in electric vehicles (EVs) and renewable energy products, including solar panels and energy storage solutions. The company is well-known for its innovative approach to both automotive and energy sectors.

Why It Could Benefit: Kamala Harris has shown support for expanding the electric vehicle market and building the infrastructure needed for widespread EV adoption, such as charging stations. Tesla is uniquely positioned to capitalize on these potential policy shifts. Federal incentives for EV purchases, such as tax credits, could drive consumer demand for Tesla vehicles. Additionally, government investments in charging infrastructure would support Tesla’s Supercharger network, making EVs more accessible and practical for the general public. Furthermore, Tesla’s solar and energy storage products could see increased demand as part of a broader push towards renewable energy.

2. Healthcare Sector

UnitedHealth Group (UNH)

UnitedHealth Group is the largest healthcare company in the world by revenue and operates through two main segments: UnitedHealthcare, which provides health insurance, and Optum, which offers healthcare services and technology.

Why It Could Benefit: If Kamala Harris prioritizes expanding access to healthcare, UnitedHealth Group could see significant benefits. Policies that increase healthcare coverage, such as expanding Medicaid or providing government subsidies for private insurance, would likely result in higher enrollment in UnitedHealthcare plans. Additionally, the focus on improving healthcare outcomes and reducing costs could drive demand for Optum’s healthcare services and data-driven solutions. UnitedHealth’s diversified business model allows it to capitalize on both insurance expansion and the growing emphasis on healthcare technology and services.

3. Infrastructure and Construction

Caterpillar (CAT)

Caterpillar is a global leader in the manufacturing of construction and mining equipment, diesel and natural gas engines, and industrial gas turbines. The company serves various industries, including construction, mining, energy, and transportation.

Why It Could Benefit: Kamala Harris has expressed support for significant investments in U.S. infrastructure, which could include rebuilding roads, bridges, public transit, and renewable energy projects. Such investments would directly benefit Caterpillar, as the demand for heavy machinery and equipment would likely increase. Government contracts for infrastructure projects could provide a steady stream of revenue for Caterpillar, and the company has already been a massive beneficiary of the IRA as written above.

Vulcan Materials (VMC)

Vulcan Materials is the largest producer of construction aggregates in the U.S., including crushed stone, sand, and gravel. The company’s products are essential for the construction of roads, bridges, and other infrastructure projects.

Why It Could Benefit: A Harris administration’s focus on infrastructure would likely lead to increased demand for construction materials. Vulcan Materials, with its extensive network of quarries and distribution centers, is well-positioned to supply the raw materials needed for large-scale construction projects. The company could see a significant uptick in orders, leading to higher revenues and potentially expanding its operations to meet growing demand.

4. Cannabis Industry

MSOS ETF (AdvisorShares Pure US Cannabis ETF)

MSOS is an exchange-traded fund that offers exposure to U.S.-based cannabis companies, including multi-state operators (MSOs), which are central to the American cannabis market. The ETF includes companies involved in various aspects of the cannabis industry, such as cultivation, production, and retail.

Why It Could Benefit: Kamala Harris has historically supported cannabis reform, including federal decriminalization or legalization. If she were to win the presidency, there could be a significant push towards reforming federal cannabis laws. Even in a divided Congress, incremental changes, such as the SAFE Banking Act or the STATES Act, could pave the way for greater market access and financial services for cannabis companies. MSOS, which is heavily weighted towards U.S.-based cannabis companies, could see substantial inflows and appreciation as investors anticipate the expansion of the legal cannabis market. Companies in the ETF, like Green Thumb Industries (GTBIF) and Curaleaf Holdings (CURLF), could benefit from increased consumer access, lower costs of capital, and potentially fewer regulatory hurdles.

Discord Link: https://discord.gg/dGEW4Pyacd

Hedge Fund Enquiries: admin@tickertrends.io

Follow Us On Twitter: https://twitter.com/tickerplus