KPI Prediction Platforms Compared: Exabel vs. Maiden Century vs. TickerTrends

The Rise of KPI Prediction and Alternative Data in Hedge Funds

Hedge funds and buy-side analysts are increasingly turning to KPI prediction platforms – advanced research tools that leverage alternative data like social sentiment analytics, web traffic, geolocation, and transaction trends – to gain a competitive edge in alpha generation daloopa.com alpha-sense.com. These platforms help forecast companies’ key performance indicators (KPIs) (such as revenue, user growth, or sales) ahead of earnings announcements, allowing investors to anticipate surprises and market movements. In today’s fast-paced markets, the ability to predict KPIs accurately and early can mean the difference between generating alpha or lagging behind competitors. In fact, integrating alternative datasets into investment models has been shown to improve predictive accuracy by up to 25% in some cases daloopa.com, underscoring why the buy-side is embracing these tools.

Several notable platforms have emerged to meet this need. Exabel and Maiden Century are two prominent examples offering broad alt-data integration and AI-driven KPI forecasting. Newer entrants like TickerTrends have introduced a unique focus on social data analysis – mining signals from search trends, social media, and online consumer behavior – to spot emerging trends even earlier than traditional transaction data might reveal. This article provides a comprehensive comparison of Exabel, Maiden Century, and TickerTrends, with a focus on their use for hedge funds and buy-side analysts. We’ll highlight each platform’s approach to data sources, prediction models, and the timing and accuracy of insights, and explain how TickerTrends’ unique strengths – its social sentiment focus, anticipatory trend detection, and unconventional signals – offer a potential competitive edge in the quest for alpha.

Exabel: Integrating Diverse Data for KPI Forecasting

Exabel is often described as a “next-generation alternative data platform” designed to help investment teams seamlessly incorporate a wide range of datasets into their KPI forecasting process paragonintel.com. In practice, Exabel acts as a one-stop hub where hedge funds can map and model multiple data sources against fundamental company KPIs. The platform comes pre-loaded with dozens of curated data sets – over 50+ pre-mapped alternative datasets (from web analytics to geolocation and sentiment data) – which are already integrated with fundamental KPI benchmarks from providers like FactSet and Visible Alpha paragonintel.com. This means an analyst can quickly align alternative metrics (e.g. credit card spending trends, satellite imagery insights, web traffic, etc.) with a company’s reported KPIs in a unified environment.

One of Exabel’s core strengths is its flexibility and focus on customization and collaboration. Analysts can onboard proprietary data (their own datasets) and combine it with Exabel’s data to build custom KPI models paragonintel.com. The platform offers tools for mapping data to specific KPIs, running predictive modeling, and backtesting – all without requiring heavy coding. In fact, Exabel launched a dedicated KPI Analyzer feature that lets users easily “map, monitor and predict company KPIs” by leveraging pre-built vendor mappings and rigorous modeling frameworks exabel.com. By streamlining the once laborious task of connecting messy alt-data feeds to real financial metrics, Exabel enables non-technical analysts and portfolio managers to harness alternative data at scale exabel.com. Teams can collaborate in shared workspaces, ensuring that insights gleaned from, say, a spike in online app usage or an uptick in foot traffic, translate into consensus-beating KPI forecasts that everyone on the desk can trust.

For hedge funds, the value proposition is significant. Exabel essentially turns disparate data into a cohesive insight engine. All data is centralized and standardized, which saves analysts the time of juggling multiple vendor portals or spreadsheets. According to the company, Exabel seamlessly integrates 75+ datasets with fundamental KPIs, giving unparalleled visibility into how each data signal maps to financial performance exabel.com. Its users can build “sophisticated prediction modeling of any company KPI” across those data sources exabel.com. In practice, this might mean a portfolio manager can incorporate real-time e-commerce sales data, Google search trends, and even social sentiment data (through Exabel’s integrations) to forecast a retailer’s quarterly revenue – all on one platform. By aggregating various alternative data streams and applying AI-driven analytics, Exabel helps investors uncover hidden patterns and generate actionable forecasts paragonintel.com paragonintel.com. The platform’s focus on robust backtesting and benchmarking (including comparing model outputs to Wall Street consensus) also provides confidence in the signals’ reliability. In summary, Exabel offers hedge funds a powerful all-in-one toolkit for alternative data analysis and KPI prediction, emphasizing data integration, user-friendly modeling, and collaborative research workflows.

Maiden Century: Consolidated Alt-Data for Real-Time Insights

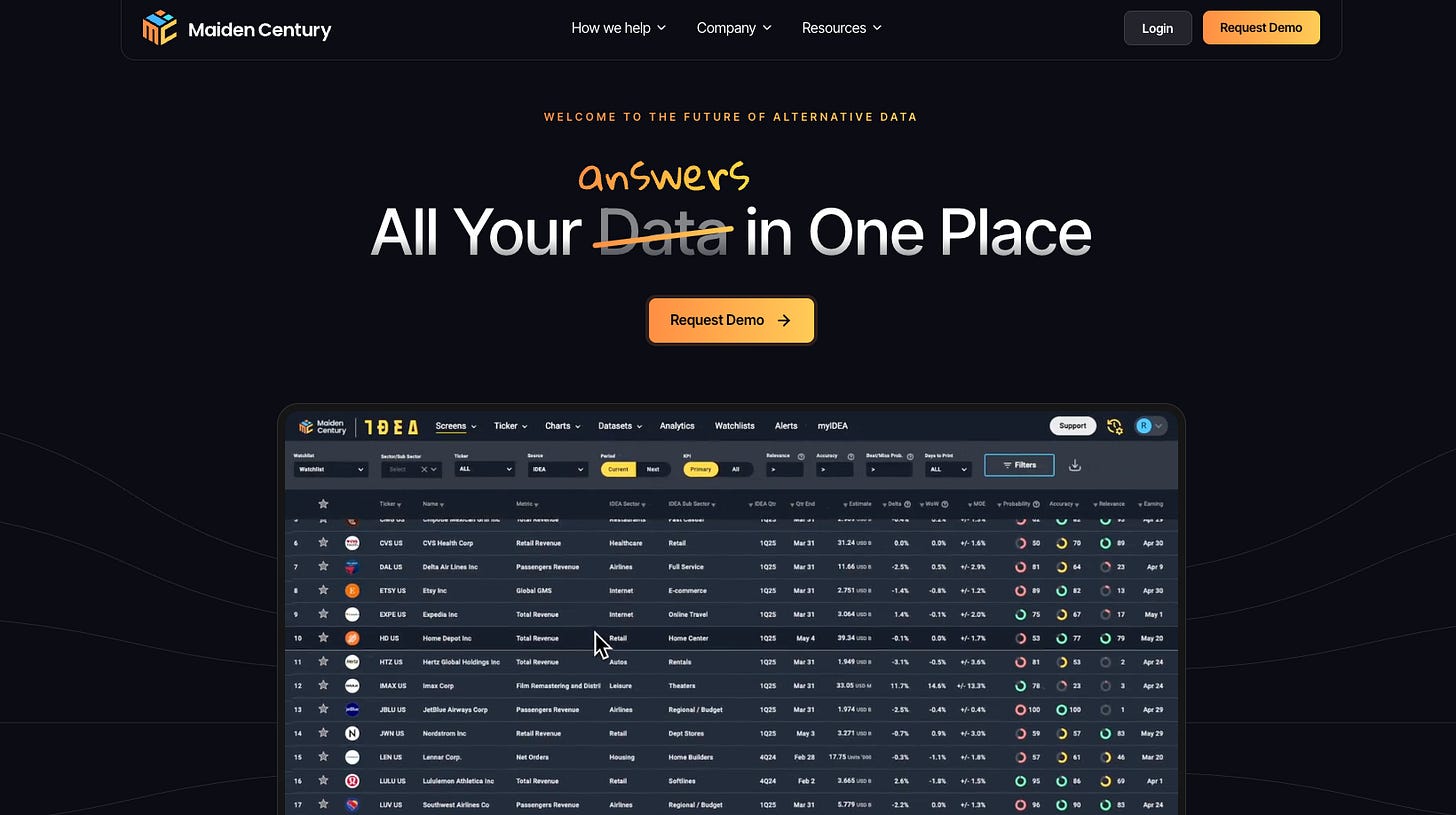

Like Exabel, Maiden Century is an alternative data platform built to bridge the gap between a flood of diverse data and the investor’s need for timely, accurate KPI forecasts. Founded in 2021 by buy-side veterans, Maiden Century was “built on the buy side” and battle-tested with a track record of strong alpha generation visiblealpha.com. Its platform sits at the confluence of asset management and technology, aiming to consolidate data from multiple providers and turn it into investable insights paragonintel.com.

Maiden Century’s hallmark is the extensive scope of its coverage and the readiness of its data. The platform boasts “real-time, on-demand insights on 3,000+ tickers, 10,000 companies and over 8,500 KPIs” across global markets maidencentury.com. In other words, Maiden Century has already loaded, cleaned, and mapped a vast array of alternative data to thousands of different KPIs, so analysts can simply query a company or metric and retrieve up-to-date signals without heavy data wrangling. All data feeds are fully mapped and back-tested against financial outcomes, giving users a high degree of confidence in their predictive power maidencentury.com. This level of preparation frees analysts from the painstaking manual work of collecting and aligning data each quarter – a process that used to take “hundreds of hours” in Excel, but which Maiden Century has automated visiblealpha.com visiblealpha.com.

The platform’s approach to modeling is also a key selling point. Maiden Century comes with industry-trusted models and multiple modeling frameworks baked in, reflecting techniques used by top investment firms maidencentury.com. It runs “tens of thousands of models every day” on its data feeds visiblealpha.com, updating forecasts in real-time as new data arrives. For example, Maiden Century can combine mobile app usage data with credit card spending and online ad metrics to improve a company’s revenue prediction maidencentury.com – an approach they call multi-source modeling. The ability to correlate different alt indicators (say, foot traffic from geolocation data plus web search trends) and connect them to a KPI like same-store sales means users get a robust view of business drivers from multiple angles. The platform also integrates closely with industry consensus data: Maiden Century uses granular consensus estimates (via Visible Alpha) to benchmark its forecasts and highlight where its alt-data signals diverge from the market’s expectations visiblealpha.com. This helps hedge funds identify differentiated views – cases where their data-driven insight predicts a KPI better (or differently) than Wall Street, flagging a potential trade opportunity.

In summary, Maiden Century’s strength lies in all-in-one data consolidation and real-time modeling at scale. It turns the “avalanche of alternative data” into a streamlined source of alpha by standardizing everything in a single platform visiblealpha.com. For fundamental analysts, it means no more stitching together CSV files from dozens of vendors. For quants and data scientists, it means repetitive data prep tasks are automated, allowing more time to test strategies. Maiden Century offers “alpha-producing signals for investors, automation for data scientists, and improved processes for managers” through one unified system paragonintel.com. Ultimately, much like Exabel, it empowers hedge funds to make data-driven investment decisions, but with an emphasis on scale (covering thousands of KPIs) and speed (real-time forecast updates). It’s a comprehensive hedge fund research tool that maximizes the value of alternative data by making it accessible and actionable in the investment workflow.

Other KPI Prediction Platforms and Approaches

Beyond Exabel and Maiden Century, the landscape of KPI prediction and alternative data tools is broad and rapidly evolving. Traditional financial data firms and startups alike are innovating to help investors squeeze insights from unconventional data sources. For instance, platforms like Thinknum Alternative Data focus on web-scraped metrics (e.g. tracking companies’ job postings, app rankings, or product reviews) to serve as early indicators of growth. Others, such as Social Market Analytics (SMA) and Bloomberg’s sentiment analysis tools, zero in on social sentiment analytics by quantifying Twitter and news sentiment around stocks. There are also data-specific providers – for example, firms offering credit card transaction data or satellite imagery – which hedge funds sometimes use in-house or via marketplaces like BattleFin. However, integrating these disparate feeds and translating them into KPI forecasts remains a challenge if one doesn’t use a unified platform.

This is where the likes of Exabel and Maiden Century have broken ground – by providing that integration layer plus analytics on top. Even newer solutions are appearing with niche focuses: some specialize in ESG and consumer sentiment, others in supply chain data or web traffic. The alternative data market overall is booming – valued at over $6 billion in 2023 and projected to reach $79 billion by 2029 businesswire.com – which reflects how vital these new datasets have become for investors seeking alpha generation. The common thread among these platforms and providers is the promise of discovering hidden signals that traditional analysis of financial statements or price charts would miss. By combining multiple uncorrelated data sources (from satellite images of store parking lots to social media buzz about a product), hedge funds aim to gain a mosaic advantage – a more complete and timely picture of a company’s performance.

Yet, not all platforms emphasize the same types of data. Many legacy alt-data efforts have centered on hard metrics like purchases (transaction data), foot traffic counts, or supply chain data, since those tie directly to revenues. Fewer have truly capitalized on human-generated digital data – the vast troves of consumer opinion and interest expressed online. This is the gap that TickerTrends has set out to fill, by focusing on the social and behavioral signals that often precede actual transactions. In the next section, we turn to TickerTrends and explore how its unique approach complements and in many ways extends the capabilities of the more established platforms.

TickerTrends: Social Sentiment Analytics for Early Alpha

TickerTrends is a next-generation KPI prediction platform that differentiates itself with a singular focus on social data analysis and consumer trend signals. While platforms like Exabel and Maiden Century cast a wide net across alternative data, TickerTrends hones in on what people are talking about, searching for, and interested in online. The premise is persuasive: in the digital age, shifts in consumer sentiment and buzz on social media can be leading indicators of economic trends and company performance. By capturing those signals early, TickerTrends aims to anticipate trends weeks or even months ahead of when they show up in traditional data or earnings reports tickertrends.io.

At its core, TickerTrends is an alternative data platform built around social listening and online behavior. According to the company, it “tracks consumer behavior, social trends, and search activity to uncover early investment insights” across public companies and sectors tickertrends.io. In practice, TickerTrends aggregates data from a variety of online sources: search engine trends, social media platforms (Twitter/X, Reddit, etc.), e-commerce sales and reviews, app store rankings and reviews, news sentiment, and even government web data tickertrends.io. All of this data is anonymized and aggregated, then updated on a daily or weekly basis to keep signals fresh tickertrends.io. Essentially, TickerTrends transforms the noisy online chatter and activity of millions of individuals into quantifiable indicators – think of it as a real-time pulse of the consumer. For example, an unusual spike in Google searches for a new product, a trending hashtag about a brand on TikTok, or a surge in positive app reviews for a service could each be captured by TickerTrends and flagged as a potential indicator that the company’s demand is taking off.

Where TickerTrends truly shines is in turning these unconventional data points into actionable KPI forecasts. The platform uses proprietary AI-powered forecasting models to analyze patterns in the social and web data and predict critical business metrics weeks before earnings announcements tickertrends.io. Those metrics might include things like active user growth, number of paying subscribers, product unit sales, or website traffic – non-financial KPIs that often correlate with future revenue and earnings. By leveraging machine learning, TickerTrends sifts through the seasonality and noise in the data to detect when an upward trend in online engagement is significant. The team behind TickerTrends brings together both data science and finance domain expertise, enabling them to fine-tune models that link a burst in social media sentiment or search interest to a likely outperformance or underperformance in the corresponding KPI tickertrends.io. In fact, TickerTrends boldly claims that its alternative-data-driven forecasts have “unprecedented accuracy” and consistently outperform Wall Street analyst consensus tickertrends.io. A cited example on their site showed TickerTrends successfully predicting quarterly active user numbers for a tech company ahead of time, coming closer to the actual figures than the sell-side consensus, thereby giving users of the platform an informational edge.

Another distinctive feature of TickerTrends is its emphasis on discovering emerging themes and inflection points that other platforms might overlook. TickerTrends doesn’t just monitor known metrics – it actively scans for “exploding trends” and rising topics. The platform’s Exploding Trends tool, for instance, is designed to identify consumer interests, products, or brands that are gaining exponential traction in real time tickertrends.io tickertrends.io. By using advanced pattern recognition, TickerTrends can distinguish genuine sustainable trends from short-lived fads or hype tickertrends.io. All this happens across multiple online channels (unifying search data with social media and web traffic) to validate that a trend is broad-based and not an isolated blip tickertrends.io. For hedge funds, this capability is extremely powerful: it means you could spot a new viral product or a shifting consumer preference before it hits the news or shows up in sales figures. TickerTrends explicitly markets this value, noting that investors can discover emerging trends “weeks or months before they’re reflected in stock prices or mainstream media” tickertrends.io. In other words, TickerTrends is built for early trend detection, giving hedge funds a chance to position their portfolios preemptively for trends that competitors might only realize in hindsight.

To illustrate, imagine a scenario: A particular sneaker brand gets wildly popular on TikTok due to a viral video challenge. Traditional data providers and analysts might not register this until a month later when perhaps credit card purchase data or quarterly sales show a jump. But TickerTrends’ TikTok Trends tracker (yes, it even offers a dedicated product for TikTok trends tickertrends.io) would capture the surge in mentions and engagement as it happens. The platform would flag this as an “exploding trend” in footwear. A hedge fund analyst using TickerTrends could then investigate the company behind that sneaker brand and potentially buy the stock before the sales spike becomes obvious to the broader market. This kind of social arbitrage – profiting from information gleaned from social and consumer data ahead of traditional sources – is precisely what TickerTrends enables. In fact, TickerTrends operates a “Social Arbitrage Fund” alongside its data platform, underscoring its commitment to this investment approach blog.tickertrends.io.

Why TickerTrends Offers a Competitive Edge

TickerTrends’ unique strengths can be summarized in a few key points that highlight why it offers hedge funds and buy-side analysts a distinct competitive edge:

Focus on Social Sentiment & Consumer Buzz: TickerTrends is purpose-built to capture social sentiment analytics – tracking what consumers are excited or concerned about in real time across social media, forums, and search engines. This focus on people-driven data (what AlphaSense categorizes as data “generated by individuals” alpha-sense.com) yields insights into consumer behavior and brand perception that other platforms, which emphasize transaction or firm-generated data, may miss. By quantifying online word-of-mouth, TickerTrends taps into a predictor of sales that has been shown to have statistically significant impact on revenue greenbook.org. In short, it measures the why behind the numbers, not just the numbers themselves.

Anticipating Trends Ahead of Traditional Data: Because social and search data often reflect interest before action, TickerTrends often acts as an early warning system. Customers tend to research and discuss products online before they open their wallets. Thus, TickerTrends can detect a building trend ahead of transaction data or earnings results. Alternative data experts note that sources like social media, web searches, and app usage offer a real-time lens that can reveal shifts “before traditional data providers catch on” daloopa.com. TickerTrends capitalizes on this, enabling investors to get in front of trends rather than reacting after the fact. This time lead – measured in days, weeks, or sometimes months – can be critical for capturing alpha. By the time credit card purchase reports or government retail figures validate a trend, a hedge fund leveraging TickerTrends may have already made their move.

Unique Signals Not Emphasized Elsewhere: TickerTrends monitors signals that many other platforms do not track deeply. For example, it looks at TikTok viral trends, niche subreddit discussions, Amazon review sentiment, and Google Trends data for specific product keywords – highly granular insights into consumer tastes. While Exabel or Maiden Century might incorporate sentiment data at a high level, their core use-cases revolve around integrating big datasets like point-of-sale transactions, satellite counts, etc. TickerTrends, by contrast, was designed around these alternative signals of consumer interest (it even offers a Chrome extension and API to pull such data directly tickertrends.io tickertrends.io). This means TickerTrends can surface investment ideas that others might overlook. It’s essentially scanning the collective consciousness of consumers for investable information. In an age where a single influencer’s post can make or break a product, having a tool that systematically tracks those otherwise hard-to-quantify signals is invaluable for investors.

Integrated Prediction Engine Tailored to Social Data: TickerTrends doesn’t just dump data on your desk; it provides a narrative and forecast around it. Its proprietary algorithms and AI models are specifically calibrated to link online buzz to KPI outcomes tickertrends.io. This specialization means that the noise of social data is filtered out to deliver a clear signal. For instance, TickerTrends’ models attempt to differentiate between a fleeting viral meme and a meaningful shift in consumer preference (via “advanced pattern recognition” that filters hype tickertrends.io). The output is often a predictive KPI figure or an alert about an “exploding” trend, which is actionable information. By providing these early alerts and quantitative forecasts, TickerTrends helps portfolio managers make informed decisions (such as adjusting a position or digging deeper into a thesis) faster than a traditional research process would allow.

Comparing Data Sources, Models, and Insights Timing

It’s helpful to directly compare how Exabel, Maiden Century, and TickerTrends stack up in a few important dimensions for hedge fund use: the types of data sources they emphasize, the nature of their prediction models, and the accuracy or timing of the insights they offer.

Data Sources: All three platforms leverage alternative data, but their focus differs. Exabel and Maiden Century take a broad-spectrum approach – they aggregate dozens of data types (upwards of 50–60 datasets) including credit/debit card transactions, ecommerce receipts, web traffic analytics, geolocation (foot traffic) data, satellite imagery, supply chain data, news sentiment, and some social/web data paragonintel.com visiblealpha.com. The idea is to be comprehensive: any data that can move the needle on a KPI is integrated. TickerTrends, on the other hand, concentrates on social and consumer sentiment data sources. It pulls from search engines, social media, app stores, online retail platforms, and public web data tickertrends.io. It might not have, say, satellite crop images or corporate exhaust data in its arsenal – but it has a richer, more detailed feed of what the crowd is thinking and doing online. For an analyst, Exabel/Maiden provide a 360° view including hard data, whereas TickerTrends provides a deep dive into the voice of the consumer. Many hedge funds actually use these in tandem – for example, using TickerTrends to spot a rising consumer interest and using Exabel to confirm it with transaction data from a vendor, marrying the social “lead” indicator with a transaction “lag” indicator for a full picture.

Prediction Models: All platforms incorporate AI/ML models, but the usage differs. Exabel positions itself as a platform where you can build and customize your own models easily (with help from their AI tools). It provides frameworks to map data to KPIs and lets users run backtests or custom forecasts exabel.com exabel.com – essentially a sandbox for quantitative analysts, enhanced by collaboration features. Maiden Century leans toward fully automated modeling at scale – running thousands of predefined models on its data feeds every day, and offering ready-made forecasts and alerts on KPI trends visiblealpha.com visiblealpha.com. It emphasizes efficiency and real-time updates, so a PM can rely on Maiden’s continuously updated signals without tweaking every model. TickerTrends takes a somewhat different approach: its models are purpose-built for trend detection and KPI forecasting from social data. The user doesn’t necessarily build models; instead, they access TickerTrends’ proprietary predictions (for example, a forecast of a company’s quarterly active users or revenue) which are generated by the platform’s algorithms analyzing the alternative data tickertrends.io. The heavy lifting is done under the hood by TickerTrends’ AI, which has been trained on historical relationships between consumer buzz and financial outcomes. All three approaches have merit – Exabel offers flexibility, Maiden Century offers scale and automation, and TickerTrends offers specialization in a high-alpha niche. For a hedge fund, the choice might come down to whether they want a generalist platform to do a bit of everything or a specialist platform like TickerTrends that zeroes in on a particular alpha source (social sentiment).

Timing and Accuracy of Insights: Hedge funds care deeply about getting better information sooner than others. Here, the distinction is clear: TickerTrends is explicitly built to deliver early signals. By capturing trends “before they impact public market prices” tickertrends.io and before they’re reflected in mainstream data, TickerTrends can alert investors to an inflection point (say, an upcoming spike in demand) earlier in the cycle. Exabel and Maiden Century also aim to beat the Street – their use of alt data is inherently about being ahead of consensus – but the timing advantage they provide might be shorter lead-time and more about accuracy than ultra-early discovery. For example, using credit card data via Exabel might allow an analyst to predict a quarter’s sales a few days or weeks before earnings (once the monthly spending data is in), which is a big improvement over not having it at all, but it’s often confirmatory. By contrast, a burst in social media mentions captured by TickerTrends could occur well before purchases actually happen, flagging a trend even prior to the credit card data reflecting it. In terms of accuracy, all platforms claim to improve on traditional estimates. Exabel and Maiden Century help reduce error by incorporating more information and avoiding one-dimensional biases (they encourage corroborating a thesis with multiple data points) exabel.com. TickerTrends claims its models have outperformed analyst consensus consistently in backtests tickertrends.io. Ultimately, accuracy can be scenario-dependent – but one might surmise that combining these approaches yields the best results. A noteworthy point: alternative data isn’t just about beating Wall Street’s number; it’s also about catching the trajectory of a KPI right. TickerTrends excels at identifying that a growth trend is accelerating or decelerating in real time (via social buzz momentum), which can be just as valuable as nailing the exact number.

Conclusion: Gaining an Edge with the Right Tool

In the modern investment landscape, information is alpha. KPI prediction platforms like Exabel, Maiden Century, and TickerTrends exemplify the new wave of hedge fund research tools that help investment professionals harvest insights from the vast field of alternative data. Exabel offers a flexible, integrative approach suited for teams that want to blend many data sources and build bespoke models. Maiden Century delivers a scaled, plug-and-play solution for real-time KPI forecasting across thousands of companies, perfect for funds that want breadth and automation. Both have proven their worth by enabling analysts to map unconventional data to financial outcomes and identify trading signals that would be invisible in traditional research.

TickerTrends, meanwhile, represents a focused evolution in this space – one that recognizes the outsized value of social sentiment and consumer trend analytics in predicting market moves. By zeroing in on the digital narratives and behaviors that often presage economic outcomes, TickerTrends adds a powerful arrow to the quiver of buy-side analysts. Its ability to sniff out budding trends in the data noise – and do so ahead of the pack – can translate into a true competitive advantage for those who use it. Hedge funds leveraging TickerTrends’ early signals can enter or exit positions with greater foresight, effectively practicing a form of social arbitrage that exploits the time lag between public sentiment shifts and financial results.

In a world where alternative data is abundant, the real challenge is extracting signal from noise and doing it faster than the competition. KPI prediction platforms are the answer, and choosing the right one (or combination) is now an important strategic decision for any fund. For many, the solution may not be either-or but rather complementary: for example, using Exabel or Maiden Century to handle a wide array of datasets while deploying TickerTrends to zoom in on the social pulse of the market. What’s clear is that the era of relying solely on 10-Qs and quarterly earnings calls is over. The investment teams that thrive will be those who harness alternative data – whether tweets, taps, or satellite snaps – to see the story forming before it’s fully told. Platforms like TickerTrends, with their knack for illuminating the hidden currents of consumer sentiment, give hedge funds and buy-side analysts a new lens through which to spot opportunity, manage risk, and ultimately, generate alpha ahead of the crowd.

Sources: The information and claims in this article are supported by data and statements from platform providers and industry analyses, including Exabel exabel.com exabel.com, Maiden Century maidencentury.com visiblealpha.com, TickerTrends tickertrends.io tickertrends.io, and independent research on alternative data’s impact on predictive accuracy daloopa.com and the value of social sentiment in forecasting market trends daloopa.com greenbook.org. These sources illustrate how each platform operates and underscore the growing importance of alternative data in investment strategy.