Lemonade ($LMND) Alternative Data Overview | TickerTrends.io

The TickerTrends Social Arbitrage Hedge Fund is currently accepting capital. If you are interested in learning more send us an email admin@tickertrends.io .

Ticker: $LMND

Sector: Insurance

Company Description: Lemonade, Inc. provides various insurance products through various channels in the United States, Europe, and the United Kingdom. Its insurance products include stolen or damaged property, and personal liability that protects its customers if they are responsible for an accident or damage to another person or their property. The company also offers renters, homeowners, car, pet, and life insurance products, as well as landlord insurance policies. In addition, it operates as an agent for other insurance companies. The company was formerly known as Lemonade Group, Inc. and changed its name to Lemonade, Inc. Lemonade, Inc. was incorporated in 2015 and is headquartered in New York, New York.

Lemonade Insurance: Pioneering AI-Driven Efficiency in the Insurance Industry

Lemonade Insurance ($LMND) is rapidly transforming the insurance sector with its AI-first, digitally native business model. Specializing in renters, homeowners, pet, car, and life insurance, Lemonade leverages artificial intelligence to streamline processes, reduce costs, and enhance customer experiences. This approach not only allows for efficient scaling but also minimizes the operating expenses typically associated with traditional insurance companies.

Global Expansion and Diverse Product Offerings

Lemonade has made significant strides in expanding its global presence. The company recently launched its services in the UK, partnering with Aviva to introduce its innovative Homeowners’ insurance solutions to the British market. This move complements Lemonade’s existing operations in the United States, Germany, the Netherlands, France and many more countries. By offering a range of insurance products, Lemonade caters to a broad spectrum of customer needs, further solidifying its market position. This also increases Lemonade’s monetizable user base through cross-selling product offerings. A user who buys Renters’ Insurance initially for example might buy Pet or Homeowners’ insurance one day when they move. This increases the lifetime value of each customer and lowers customer acquisition costs.

AI-Driven Operational Efficiency

Central to Lemonade’s success is its use of artificial intelligence and machine learning. The company’s AI handles everything from underwriting to claims processing, ensuring a seamless and efficient customer experience, with over 98% policies sold with no human intervention. This digital-first approach allows Lemonade to scale its operations without the need for proportional increases in operating expenses, such as commissions and additional staffing. As a result, Lemonade can offer competitive pricing and quick service, which traditional insurers struggle to match. This is reflected in the Loss Adjustment Expense (LAE) metric, which measures cost associated with handling claims and operating efficiency where a lower number is better. Typically, mature insurance companies have an LAE of 10% or higher. The fact that such an early stage company like Lemonade is already below 8% LAE and still dropping speaks volumes. It indicates just how positive consumer trends towards their product offerings have been and the company’s internal expense management.

Rising Popularity and Focus on Younger Consumer Base

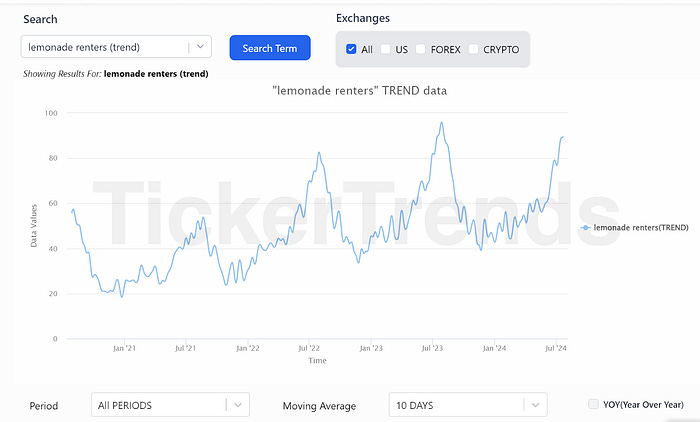

Lemonade has seen a notable increase in website traffic and app usage, particularly for its renters and pet insurance products. This growth is driven by the company’s user-friendly platform and quick claims processing, which have earned it high customer satisfaction ratings. Additionally, Lemonade is focusing on cross-selling opportunities, encouraging customers to bundle various insurance products, thereby increasing customer retention and lifetime value of each customer. Weekly app download data shows a large rise in favor of the company.

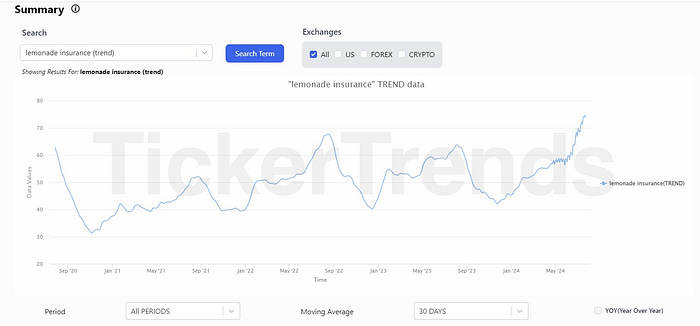

Additionally, website and Google Trend data show a largely positive story as well for the popularity of the insurance product offerings.

Since Lemonade is a digitally native company, it has to date attracted a largely millennial audience.

This is very positive for the very long term future of the company as customers continue to pay premiums for a long time to come.

Financial Performance and Future Outlook

The company is on track to achieve free cash flow breakeven by the end of fiscal year 2024, driven by premium rate increases and efficient operations. In Force Premium, a metric measuring premiums paid by customers continues to grow steadily despite lower headcount overall.

The company is efficiently using automation to decrease its cost per claim as well.

Conclusion

Lemonade Insurance is at the forefront of the digital transformation in the insurance industry. Its AI-driven model not only enhances operational efficiency but also provides a superior customer experience. As Lemonade continues to expand globally and diversify its product offerings, it is well-positioned to capture a larger share of the insurance market and drive long-term growth, assuming current consumer search trends continue to hold. Lemonade’s young consumer base and cross-selling opportunities help ensure a long runway for growth, and this will certainly be a company worth following in the coming months.

Discord Link: https://discord.gg/dGEW4Pyacd

Hedge Fund Enquiries: admin@tickertrends.io

Follow Us On Twitter: https://twitter.com/tickerplus