Life360 Q2 KPI Forecast: Ads and Paid Subs Signal Revenue Upside—Pet Launch Adds More Fuel

TickerTrends forecasts $110.2M in Q2 2025 revenue for Life360—slightly ahead of consensus—driven by MAU momentum, premium subscription growth, and rising ad monetization.

At TickerTrends, we are forecasting Lif360 to report another strong quarter of Monthly Active Users growth, with:

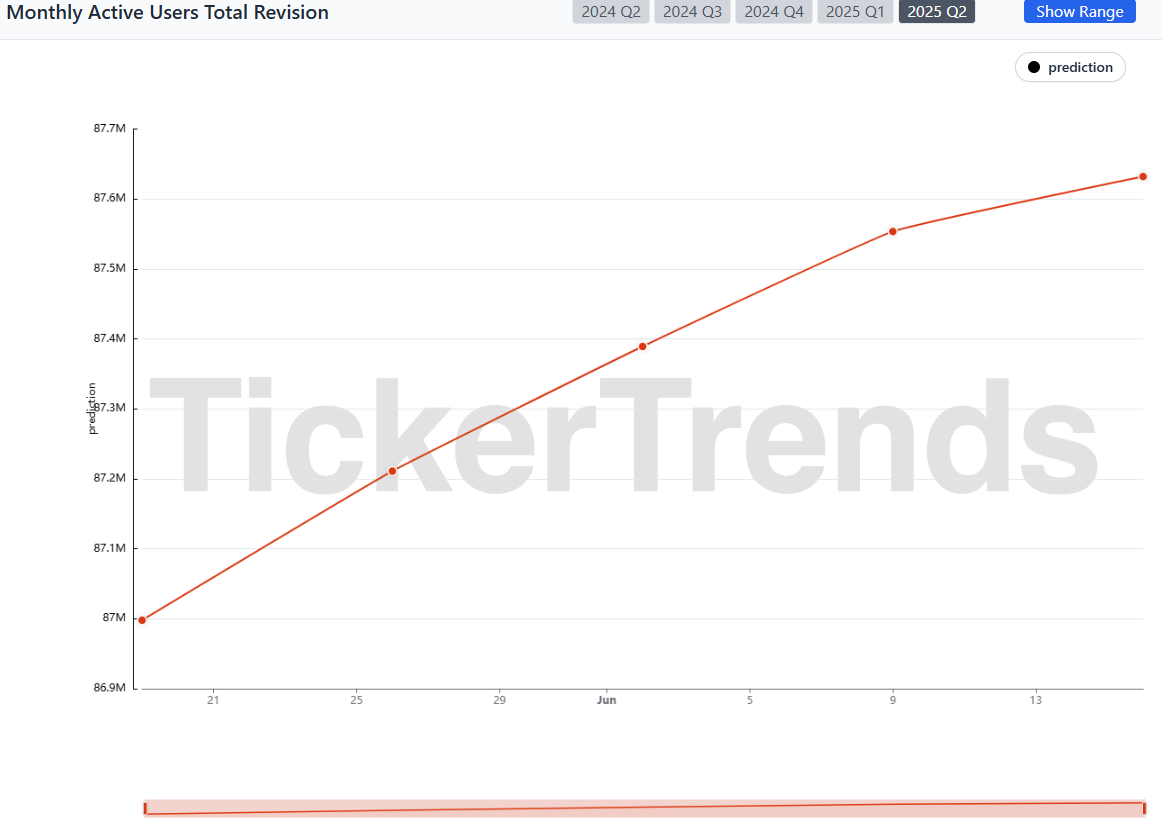

TickerTrends KPI tracking forecasts that Monthly Active Users will reach approximately 87.63 million, up 5.58% QoQ or 14.97% YoY.

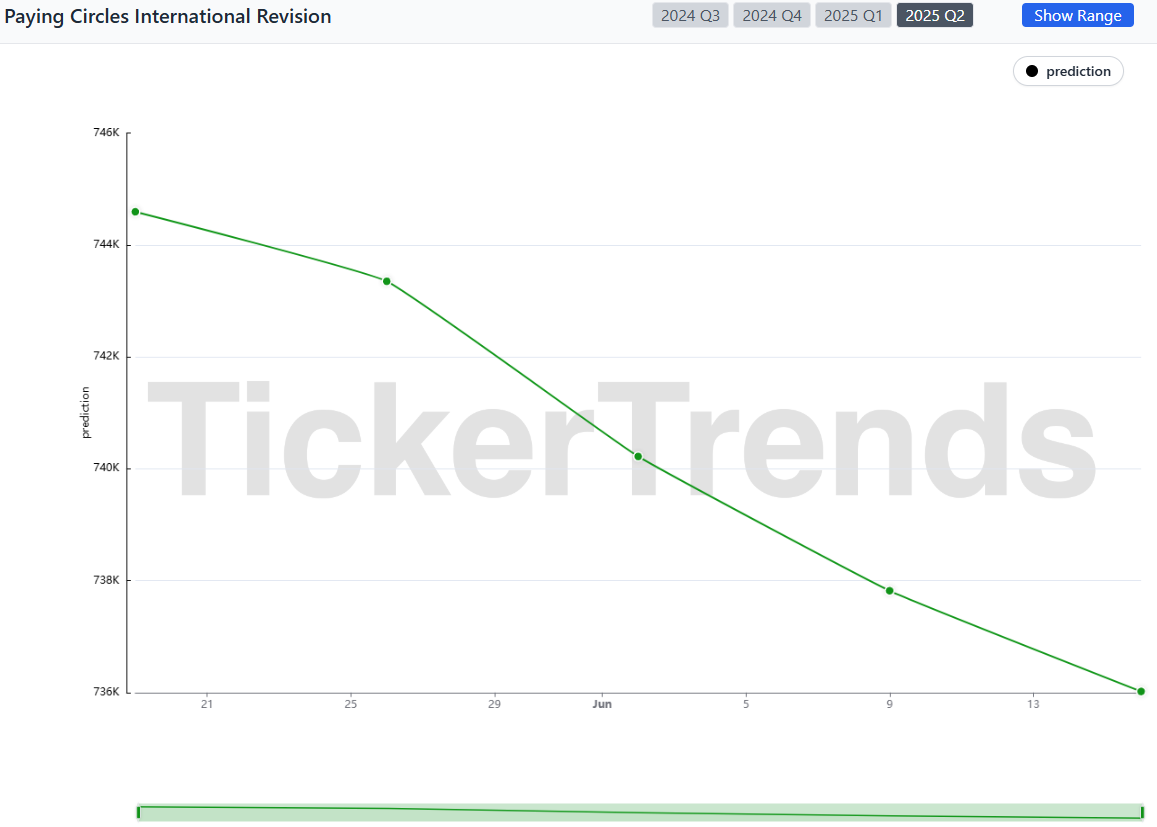

Our weekly revisions have indicated:

0.73% increase in Monthly Active users

0.49% increase in US paying circles

modest decline in international paying circles of 1.15%.

At TickerTrends, we are forecasting $86 million in subscription revenue representing 5% growth QoQ and 30.90% growth YoY. We also anticipate the Other Revenue to come in at $13.8 million driven by strong free user monetization and robust Monthly Active User Growth.

Strong Momentum Data

Google Search Trend Data: Stable YoY Growth

Web Traffic: Moderately Accelerating YoY Growth

Lif360 iOS App Usage : Stable YoY Growth

Lif360 Android App Usage: Moderately Accelerating YoY Growth

Life360’s web traffic and search trends data show flat growth year-over-year, a signal of strong user retention and baseline engagement even after prior price increases.

YouTube Search Trend Data: Significantly accelerating YoY

Life360’s rising weekly YouTube search trends suggests growing user interest and awareness which we believe should translate into stronger subscription growth but more importantly lead to higher ad revenue going into the second half of the year.

While our projected revenue of $110.2 million for Q2 represents only a modest beat over Street consensus of $109.77 million, it’s important to note that the beat is primarily driven by outperformance in advertising revenue and a stable increase in U.S. paid subscriber growth, as captured by our Monthly Active Users KPI.

Bottom Line:

Life360’s guidance for subscription revenue in FY2025 stands at $355 to $365 million. Given how robust the KPI trends have been going into Q3—including growing MAU momentum, rising U.S. and International paying circles, and the seasonally strong backdrop for conversions—we believe there is a strong case for subscription revenue to land at the top end of that range for FY25. Q3 is historically Life360’s most favorable quarter for subscriber additions, fueled by the back-to-school period and increased focus on family safety, and we expect that seasonality, combined with product tier mix-shift, will drive a significant step-up in new paid conversions. Additionally, the company might be taking pricing adjustments at scale which could provide further upside to ARPPC and FY25 subscription revenue.

Additionally, the expected launch of the Pet monitoring product in Q4 adds a new monetization vector and should incrementally lift ARPPC through bundled upgrades and premium tier adoption. We view this as a structural growth driver, not just a novelty feature, and believe it could provide long-term pricing power and user retention advantages.

On the advertising side, Life360 recently announced two innovations—Place Ads and Uplift by Life360—which are already showing signs of gaining traction. Place Ads enable real-world behavior targeting while Uplift delivers offline attribution, allowing advertisers to close the loop from media exposure to in-store visits. These advancements, when layered on top of accelerating MAU, give us conviction that Other Revenue could come in significantly above current expectations of $55-$65 million for the year.

With over 85 million MAUs and growing, Life360’s ad platform is becoming meaningfully more valuable by the quarter. The combination of strong user growth, premium product launches, and ramping ad monetization sets the company up for a powerful finish to 2025, with both subscription and advertising revenues positioned to outperform current Street expectations. We believe the company has the levers in place not only to exceed Q2 guidance but to potentially raise full-year guidance as early as the Q3 earnings call.

Stay Ahead

We’ll continue monitoring digital demand signals for LifeMD and other top companies. If you’re interested in getting access to these real-time forecasts across hundreds of public tickers, contact us at admin@tickertrends.io.

( For KPI revisions and tracking access email: admin@tickertrends.io )