LifeMD Q2 Telehealth Forecast: GLP-1 Momentum Could Drive Major Beat—If It Converts

TickerTrends forecasts $60.7M in Q2 2025 telehealth revenue for LifeMD—well above guidance—driven by GLP-1 partnerships and surging web traffic. We explore the upside case and key risks.

At TickerTrends, we are forecasting $60.7 million in telehealth revenue for Q2 2025 for LifeMD (NASDAQ: LFMD 0.00%↑) and new telehealth subscribers of 22.67k,

well above their guidance range of $52 to $53 million for the quarter

and analyst estimates of $53 million

This forecast is grounded in leading social indicators. It is important to note that if LifeMD delivers this number, it would represent its largest beat relative to guidance since becoming public, so we write extensively about the caveats and why this might be an outlier, while also pointing out green chutes in the data.

( For KPI revisions and tracking access email: admin@tickertrends.io )

Why We Are Forecasting a Beat

1. Branded GLP-1 Partnerships Launched in early March to mid-May

LifeMD is now integrated with both LillyDirect (Zepbound), launched on March 6, 2025, and NovoCare (Wegovy), launched on May 21, 2025, making it one of the only virtual care providers offering streamlined branded access to both major GLP-1 therapies. These partnerships are now live and allow patients to obtain branded medication through LifeMD’s care platform and third-party pharmacy partners.

While the company has stated that it earns no revenue from the medications themselves, the increased visibility and brand recognition from these partnerships are driving increased website traffic and, by extension, likely new subscriber acquisition.

2. Weight-Management Page Traffic Is Spiking

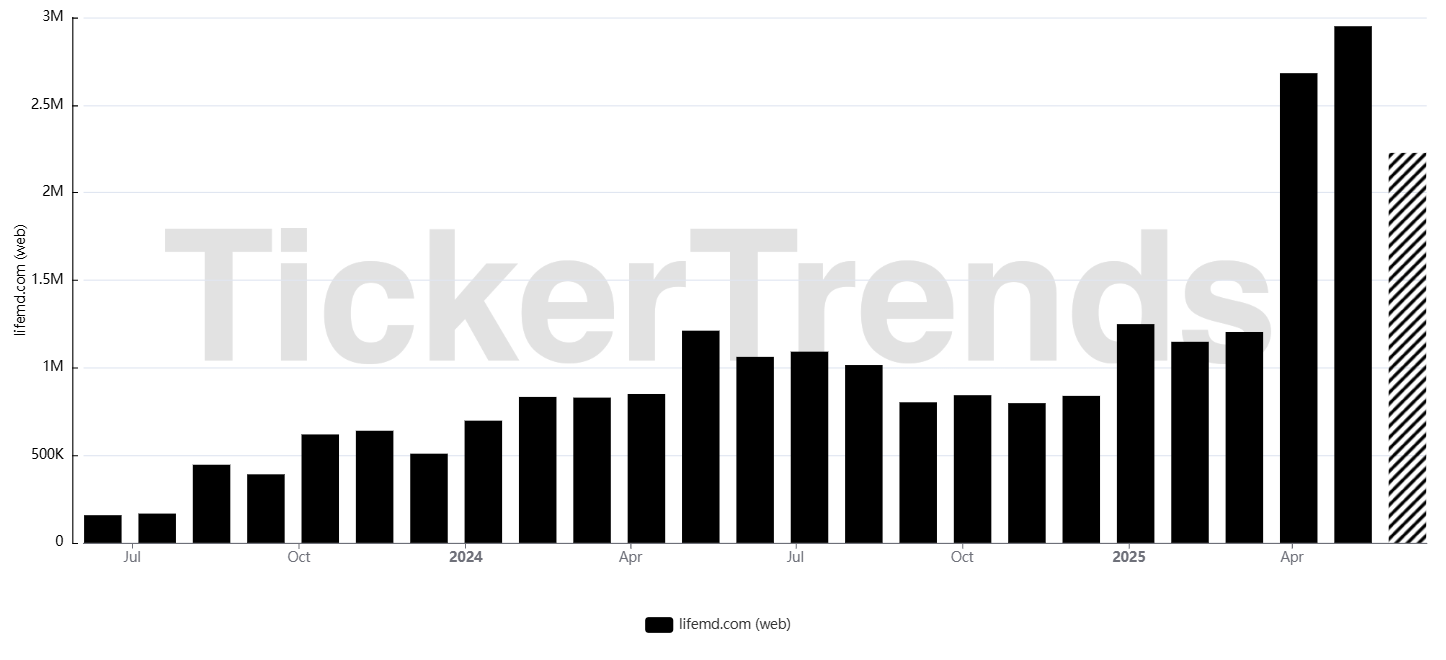

In May, LifeMD’s website saw a surge in traffic, particularly to its weight-management subdomain. Total site visits exceeded 2.90 million, up 9% month over month. Most of this new interest appears to be coming from users searching for GLP-1 subdomains as well as membership pages. Over 700,000 of these visits are from specifically the weight related subdomains.

RexMD, also owned by LifeMD, has seen an even more astronomical +125% month over month growth, hitting nearly 1.90 million website visits in May.

Our modeling treats specifically membership related pages as an intent signal for new patient starts, which also seeing triple the website visits it saw just in March 2025.

3. Last Quarter's Beat Was Driven by Retention and non-GLP growth, Not Partnerships

In Q1 2025, LifeMD reported $52.5 million in telehealth revenue, coming in at the high end of its guidance, despite the fact that management said on the earnings call that branded GLP-1 partnerships had not contributed to performance. The key to this upcoming earnings will be whether those customers viewing and buying GLP-1 related products stick around and stay subscribed to the LifeMD platform. Remember that GLP-1 direct drug sales go directly to Lilly and Wegovy… not LFMD 0.00%↑ revenue.

Why This Forecast Might Be Too High

1. Timing

Although the Lilly Direct partnership had started before Q2 started, NovoCare went live in mid-late May, roughly halfway through the quarter. Specifically the $299 introductory bundle for Wegovy garnered interest, with May website traffic soaring. Even with a surge in sign-ups, there may be too little time for all of those patients to move through consults, lab testing, and fulfillment for revenue to be recognized in Q2.

Subscription revenue is often recognized over time rather than up front, meaning a portion of the new patient revenue might only be realized in Q3.

2. This Level of Traffic May Be Temporary

While May web traffic was strong, the spike could be driven by promotional campaigns and public awareness around GLP-1 access. If June traffic reverts to April levels, or if users are just price shopping, the conversion into recurring subscribers could be lower than expected.

3. Lower Bundle Pricing Could Affect Revenue Per User

LifeMD has publicly mentioned plans to offer branded Wegovy access for as low as $299 as part of an introductory bundle, including clinical care. If a large portion of users opt for this lower-cost option, revenue per new user may fall compared to previous quarters. Additionally, if users previously paying cash for compounded GLP-1s switch to these discounted branded plans, it could reduce average revenue even as total subscribers rise.

4. Revenue Guidance Does Not Yet Reflect GLP-1 Impact

Management stated explicitly on the Q1 earnings call that full-year revenue guidance had not been updated to reflect the branded GLP-1 partnerships. While they are bullish on long-term upside, they want to see sustained conversion data before making adjustments. That makes us cautious about assuming too much Q2 upside from these partnerships.

Bottom Line

We are projecting a strong telehealth revenue beat for LifeMD in Q2 2025, driven by branded GLP-1 partnerships, a surge in website traffic, and rising consumer awareness of self-pay treatment options. Our model sees the potential for a record-breaking quarter in subscriber additions.

However, we also recognize the risks. The traffic surge may not persist. A portion of new revenue may be deferred to Q3. Lower average pricing could weigh on revenue-per-user metrics. And LifeMD’s historical revenue beats have typically been modest, not dramatic.

This is our current forecast, based on real-time alternative data inputs. But it would represent an outlier compared to historical performance and should be taken as an upper-bound scenario, not a base case.

Let us know if you want access to the full KPI dashboard or specific subscriber forecasts.

Stay Ahead

We’ll continue monitoring digital demand signals for LifeMD and other top companies. If you’re interested in getting access to these real-time forecasts across hundreds of public tickers, contact us at admin@tickertrends.io.

( For KPI revisions and tracking access email: admin@tickertrends.io )

Hello, thank you for the great article. Could you provide an update of the statistics for June? Thank you.