$LULU Lululemon Q2: Low Bar, High Volatility Setup

Consensus weakness sets the stage for asymmetric upside if U.S. demand or management tone surprises

Executive Summary

Market expectations lean toward weakness. The risk is that this weakness is more consistently reflected across alternative datasets than not. The key question becomes whether the degree of weakness is overstated relative to signal noise, leaving room for unexpected upside if Lululemon delivers above-muted expectations.

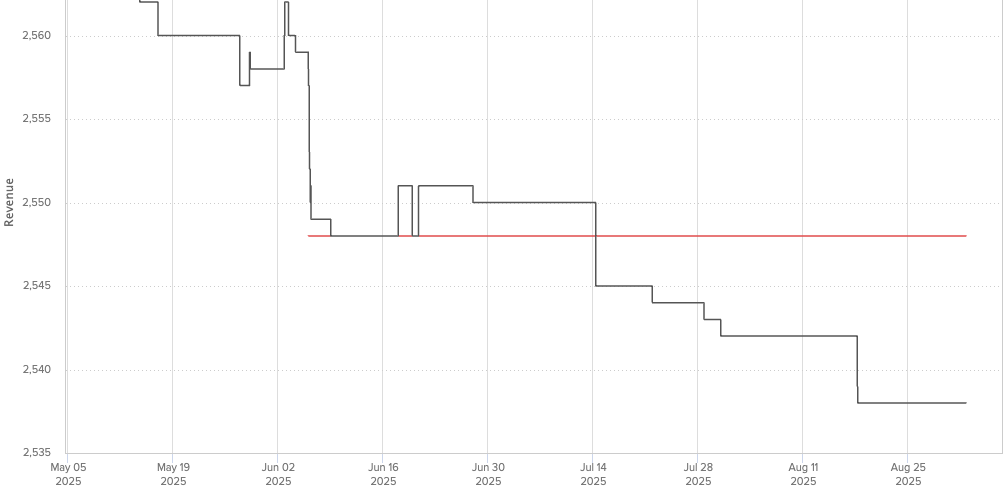

Consensus

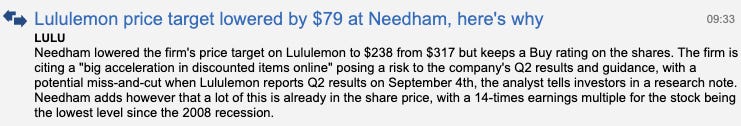

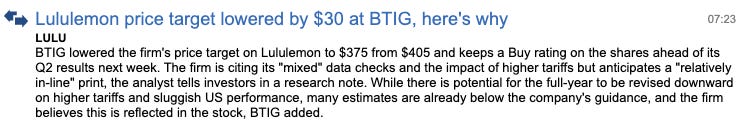

Street consensus is tilted flat to negative, reflecting broad agreement on a performance slowdown and mixed alt-data checks.

The opportunity lies in the variance across tracking sources, this quarter requires precision in interpretation. Any incremental optimism from management or stronger-than-expected datapoints could flip market sentiment toward a positive surprise. Importantly, consensus estimates sit below company guidance for Q2 2025, establishing a lower bar for management to clear.

Near-term setup favors heightened volatility, particularly to the upside if the company avoids a meaningfully weak print.

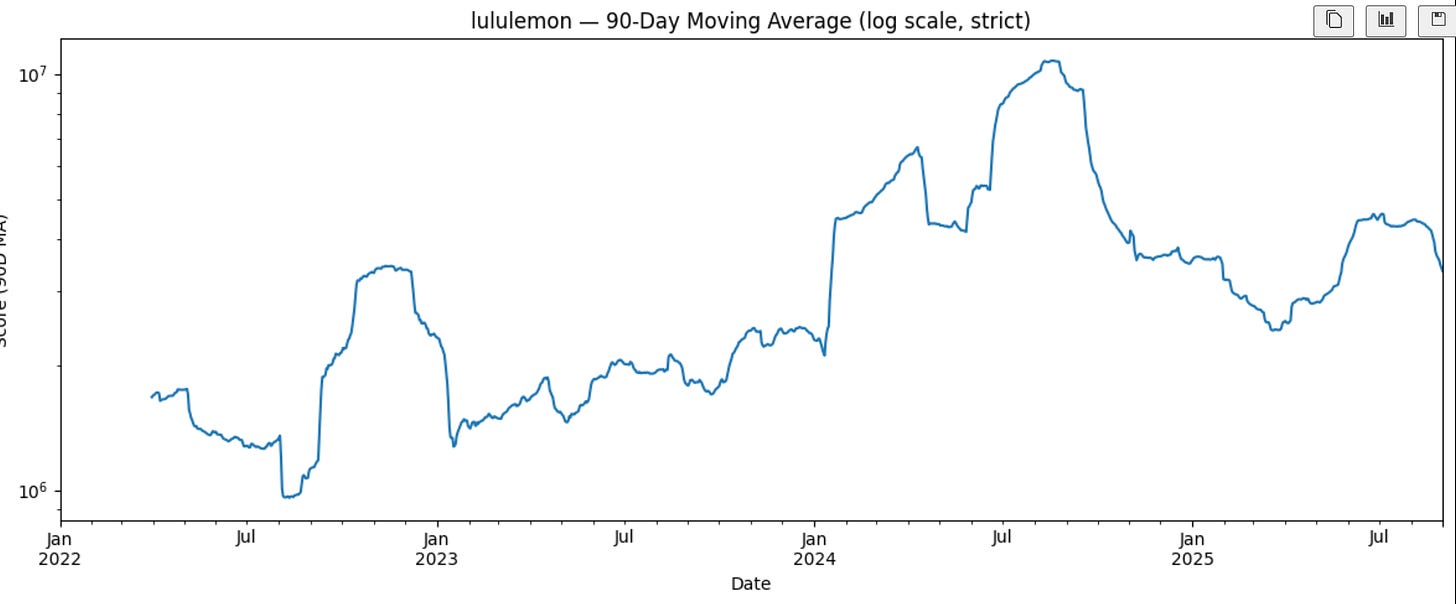

Growth

Corroborating analysts, there are mixed signals across different aspects of the business.

International segments remain consistent to slightly strong compared to prior quarters.

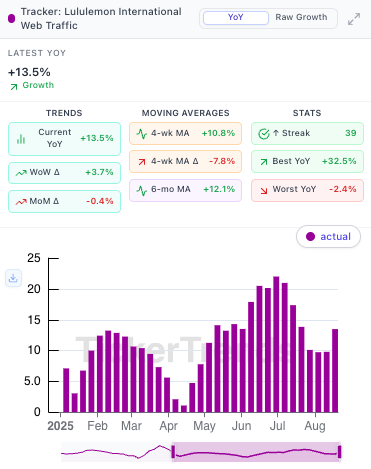

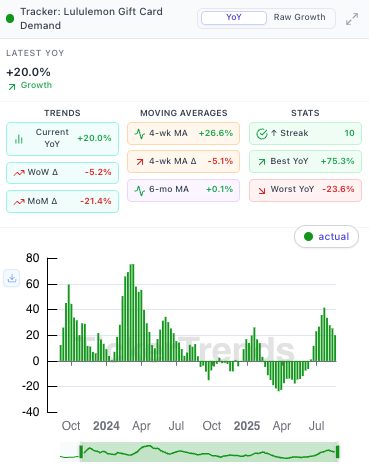

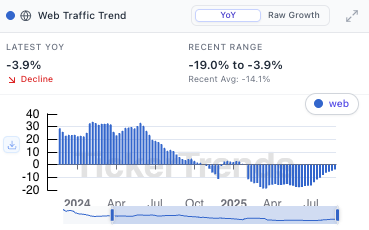

Consumer gift card demand has risen in addition to broader US web traffic has regained strength as it nears a positive flip to YoY growth.

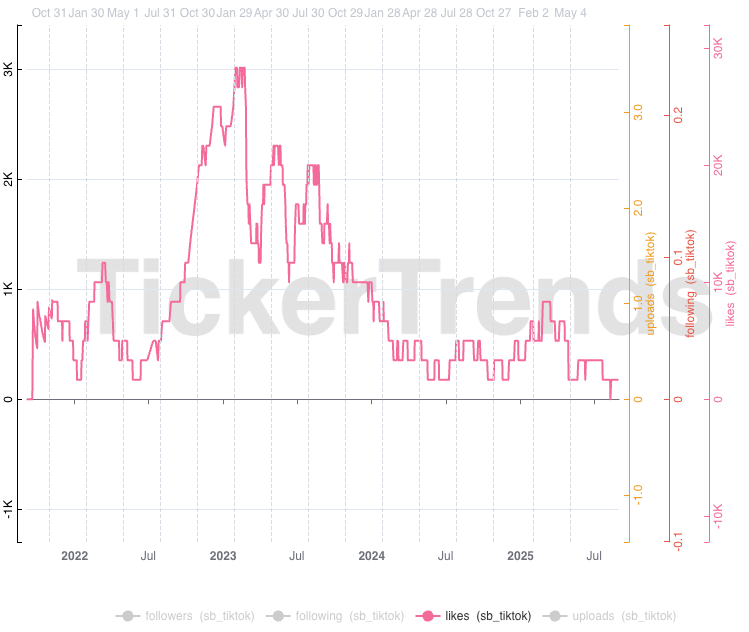

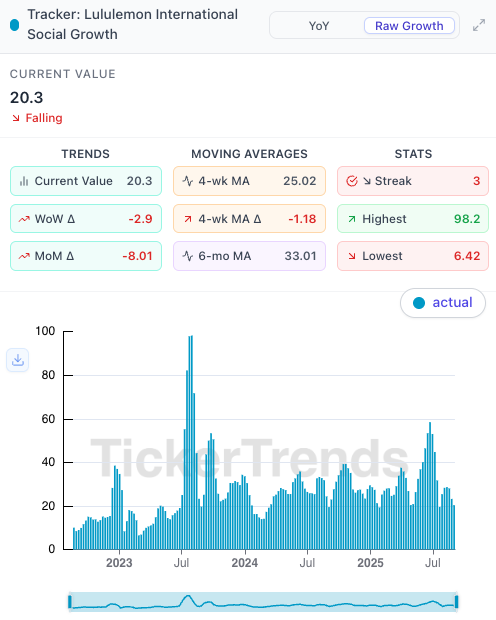

Social & Brand Momentum: Domestic social engagement remains flat and uninspiring, consistent with Lululemon losing cultural edge to competitors. A reinvigorated marketing or influencer push could reset sentiment.

International Social: Flat to modest strength, suggesting brand resilience abroad.

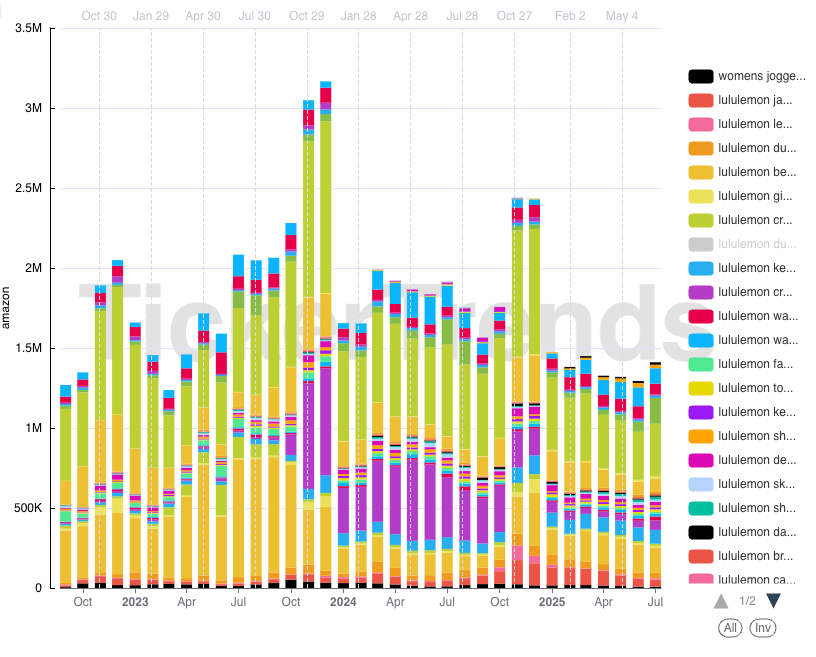

Amazon search interest remains consistent with the weak consumer demand, however, it is important to note that there is a limited set of Lululemon products available on the platform.

WeChat consumer discussion of Lululemon is slow YoY also containing minor weakness.

Conclusion & Actionable Takeaways

Lululemon enters Q2 earnings with sentiment tilted negative, consensus below guidance, and alternative data sending mixed signals. This creates an asymmetric setup:

Upside Risk: Even modest strength in U.S. traffic or gift card trends, or management striking an optimistic tone on product innovation and international expansion, could spark sharp short-term upside given the low bar.

Downside Risk: If reported numbers match or fall below weak sentiment—especially on U.S. sales—the Street’s bearish bias will be validated, likely leading to multiple compression.

Trade Implication: The setup skews toward high volatility. Positioning strategies should reflect the potential for a relief rally if numbers are simply “less bad,” but caution remains warranted if management fails to instill confidence in a rebound.

Key Watchpoints on the Call:

Tone around U.S. consumer recovery and marketing strategy.

Commentary on international resilience, particularly China.

Guidance trajectory relative to already lowered consensus.