$LWAY Lifeway Foods, Inc Earnings Preview | TickerTrends.io

$LWAY KPI Metrics, Earnings Preview Tracking, Expectations And Alternative Data Comps

Market Expectations

Analysts expect 8.66% YOY growth which is an acceleration of 3.34% QoQ going into Q1 2025.

Lifeway Foods (NASDAQ: LWAY) delivered record-breaking financial results for Q4 and the full year 2024, marking its 22nd consecutive quarter of year-over-year growth. However, this strong performance is juxtaposed with significant corporate governance challenges, including a proxy battle initiated by former executive Edward Smolyansky and a rejected acquisition offer from Danone North America. Food Processing

Key Financial Highlights (FY 2024)

Net Sales: $186.8 million, a 16.7% increase from 2023.

Q4 Net Sales: $46.9 million, up 11.5% year-over-year.

Gross Profit Margin: 26.0%.

SG&A Expenses: 18.3% of net sales.

Net Income: $9.0 million.

Earnings Per Share: $0.61 (basic), $0.60 (diluted).

Adjusted EBITDA Target: $45–$50 million by FY 2027. Lifeway Newsroom PR Newswire Food Business News

Strategic Business Developments

Product Innovation: Launched lactose-free kefir and probiotic smoothies with collagen to meet evolving consumer preferences.

Distribution Expansion: Secured placements for Lifeway Farmer Cheese in 1,400 Albertsons stores and ProBugs Organic Kefir in over 250 Harris Teeter locations.

Production Capacity: Upgrades at the Waukesha facility aim to nearly double production capacity and triple bottling speed.

Marketing Strategy: Enhanced brand exposure through interactive retail efforts, e-commerce strategies, and partnerships with social media influencers.

Corporate Governance Challenges

Despite robust financial performance, Lifeway Foods is facing internal turmoil. Former Chief Operating Officer Edward Smolyansky, who was previously terminated for cause, has initiated a proxy battle by nominating seven candidates to replace the company's entire Board of Directors at the 2025 annual meeting. The company's Audit and Corporate Governance Committee is reviewing the nominees, and the Board will make recommendations in due course.

This governance conflict introduces significant uncertainty, potentially impacting strategic initiatives and investor confidence. The company's leadership has emphasized its commitment to continued growth and shareholder value amidst these challenges.

Rejected Acquisition Offer from Danone

In September 2024, Danone North America PBC, a subsidiary of French multinational Danone SA, made an unsolicited, non-binding proposal to acquire all outstanding shares of Lifeway Foods at $25 per share, valuing the company at approximately $283 million. Danone, which already owned about 23% of Lifeway's shares, later increased its offer to $27 per share, bringing the total valuation to around $300 million. Food Processing Food Business News

Lifeway's Board of Directors rejected both offers, stating that they "substantially undervalue Lifeway and are not in the best interests of the company and its shareholders." In response to Danone's proposals, the Board adopted a limited duration shareholder rights plan, commonly known as a "poison pill," to prevent any unsolicited acquisition attempts. Food Processing

The rejection of Danone's offers has further intensified the ongoing proxy battle, with Edward and Ludmila Smolyansky expressing support for the acquisition, citing it as an opportunity to enhance shareholder value. Food Processing

Market Position & Outlook

Lifeway Foods has established a strong presence in the probiotic and functional foods market, benefiting from increasing consumer interest in gut health and wellness. The company's consistent growth and strategic investments position it well for continued success. However, the ongoing proxy battle and potential governance issues may impact future performance and strategic direction.

Alternative Data

Web Traffic

Recent data indicates a 4.95% MoM rise in web traffic to amazon kefir searches .

Search Trends

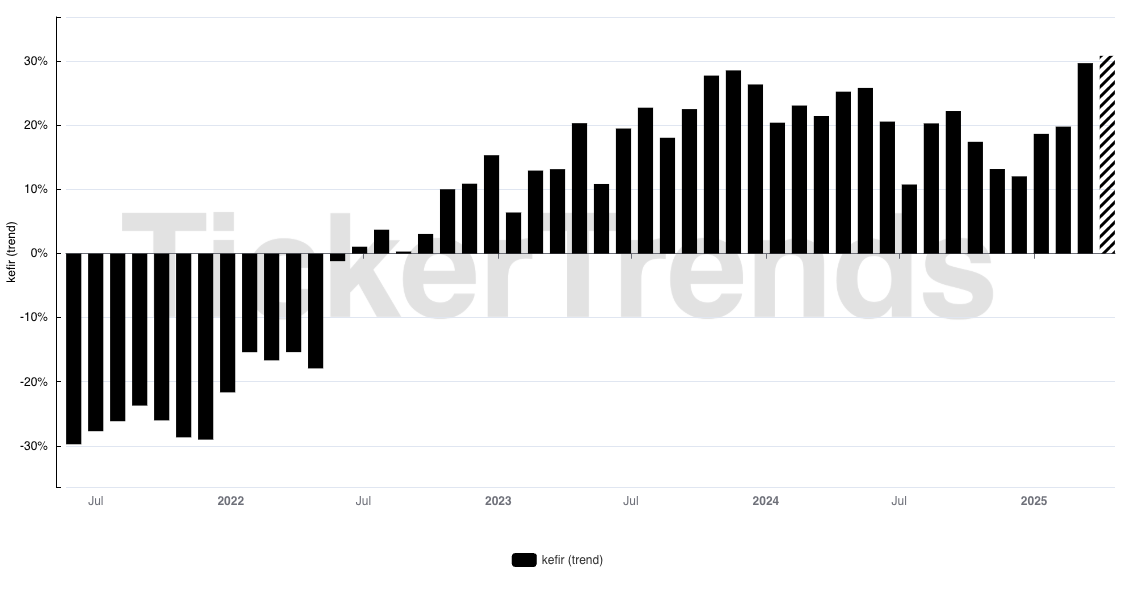

Recent data indicates a 30.88% YoY rise in search interest for kefir .

Recent data indicates a 4.83% MoM rise in search interest for lifeway kefir .

Social Data

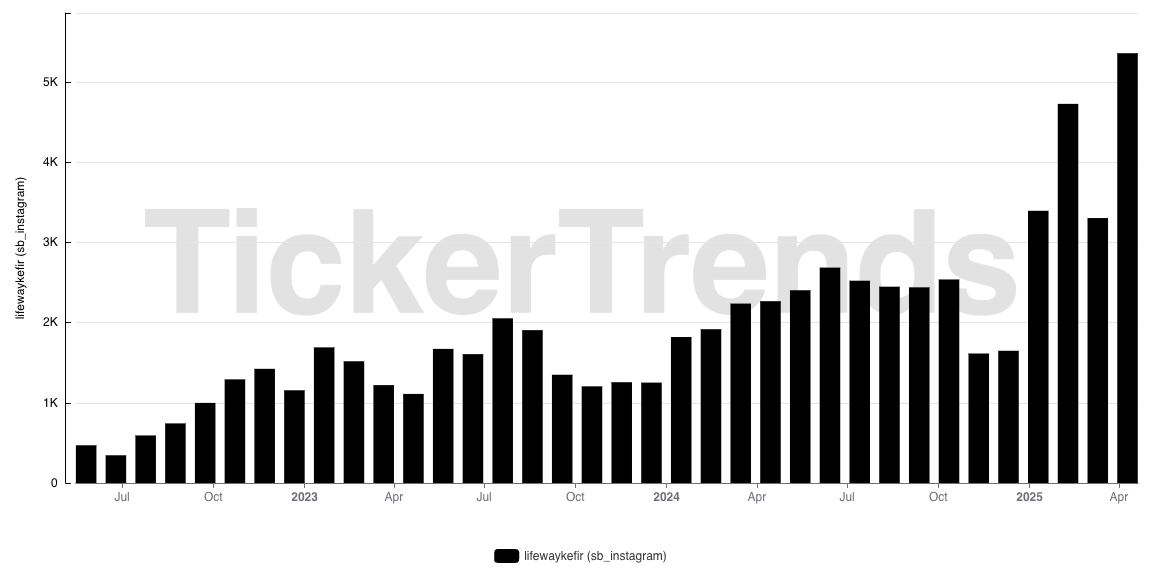

Recent data indicates a 62.23% MoM rise in instagram followers for lifeway kefir .

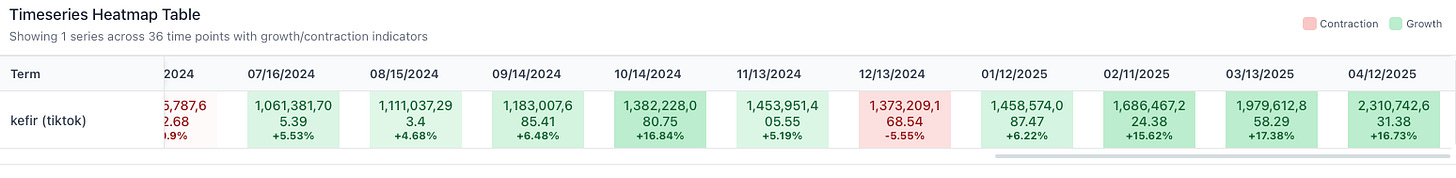

Recent data indicates a 16.73% MoM rise in search interest for kefir on tiktok .

Recent data indicates a -4.64% MoM decrease in interest for kefir on youtube .

Wiki

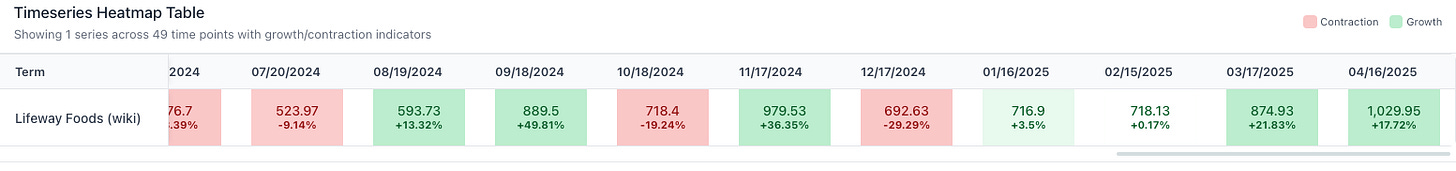

Recent data indicates a 17.72% MoM rise in search interest for lifeway foods on wikipedia .

Conclusion

Lifeway Foods continues to impress on the operational front, delivering its 22nd consecutive quarter of year-over-year growth and closing FY 2024 with record-breaking sales and solid margins. Analysts project continued momentum into Q1 2025 with an expected 8.66% YoY growth, reflecting acceleration in consumer demand and expanding retail distribution.

However, the business is not without risk. The intensifying proxy battle led by Edward Smolyansky, coupled with the board’s rejection of a $300 million acquisition offer from Danone, introduces a layer of uncertainty that could impact strategic direction and shareholder sentiment. While leadership remains committed to long-term value creation and has fortified its position with a shareholder rights plan, the internal conflict may become a distraction if left unresolved.

Alternative data points—including rising web traffic, search interest, and social engagement—indicate strong consumer interest and brand momentum, particularly across platforms like Instagram and TikTok. These signals reinforce the company’s market positioning in the functional foods space and suggest continued top-line strength if strategic execution remains intact.

Overall, Lifeway’s fundamentals are strong, but stakeholders should keep a close eye on governance developments as they may shape the company’s trajectory just as much as its growing kefir sales.