M&A Advisory Firms Alternative Data Overview | TickerTrends.io

The TickerTrends Social Arbitrage Hedge Fund is currently accepting capital. If you are interested in learning more send us an email admin@tickertrends.io .

Ticker: $HLI, $EVR, $PJT, $MC

Sector: M&A Advisory and Investment Banking boutiques

Lina Khan and FTC’s Aggressive Antitrust Stance — How Will a Trump Win Impact M&A boutiques?

Lina Khan’s Tenure and Policies:

Lina Khan, appointed by President Joe Biden in 2021, has led the FTC with a strong focus on stringent antitrust enforcement. This approach represents a significant shift from previous administrations, emphasizing the prevention of mergers and acquisitions (M&A) that could potentially harm competition across various markets, including labor and supply chains, beyond just consumer prices. Taking a strong stance in favor of more stringent antitrust laws has been increasingly politically popular because it makes a party look like they are tougher on big corporations. The FTC under Khan has challenged several high-profile mergers, such as Microsoft’s acquisition of Activision, Amazon’s acquisition of IRobot, and Tapestry’s purchase of Capri, based on this strict antitrust criteria.

Impact on M&A Activity:

The aggressive antitrust stance of the Biden administration has created substantial regulatory hurdles, leading to a notable slowdown in M&A activity. Many companies have preemptively abandoned potential mergers due to increased uncertainty and a higher likelihood of regulatory intervention. This has particularly affected megadeals, transactions valued at over $10 billion, and has had a significant impact on advisory fees and transaction volumes for investment banks and advisory firms.

Many M&A advisory boutique firms have been treading water since 2021 as a result of the decreased deal activity, with flat or down stock prices. Could a new presidential administration impact future deal activity? And how can we think about the future of these companies?

Future Under a Potential Trump Administration:

A potential return of Donald Trump to the presidency could lead to a significant shift in the FTC’s approach to antitrust enforcement. During his previous tenure, Trump’s administration was generally less aggressive in antitrust actions compared to the current administration. If Trump wins the 2024 election, Lina Khan’s tenure would likely end, and the FTC could pivot back to a more lenient stance on M&A. This shift could rejuvenate deal activity, benefiting investment banks and advisory firms by reducing regulatory barriers and uncertainty. Trump’s general deregulation stance could potentially lead to major changes at the FTC, although the exact replacement candidate is unknown. Investors should certainly keep a watchful eye for who is chosen and research said replacement if selected.

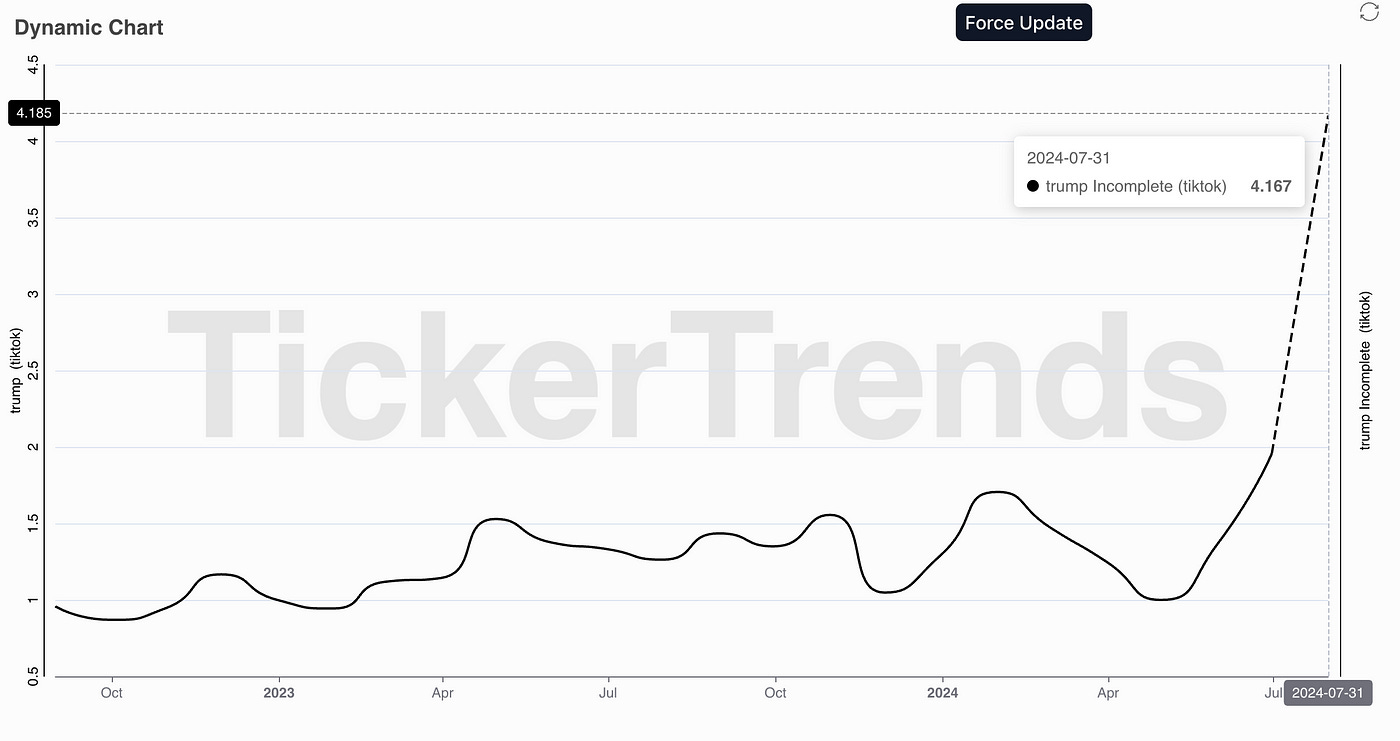

TikTok view growth seen below for the candidates.

Kamala and Trump growth vs Biden (weak in comparison) YOY % growth. Trump is the highest total volume.

Wikipedia view growth seen below on separate axis for the candidates.

Impact on M&A Advisory Firms

Houlihan Lokey ($HLI): Houlihan Lokey, a leading global investment bank, reported revenues of $1.91 billion for fiscal year 2024. The Corporate Finance (CF) segment, which includes M&A advisory, generated $1.11 billion, slightly down from $1.13 billion in fiscal 2023. The CF segment accounts for approximately 58% of the firm’s total revenue, highlighting its significant reliance on M&A advisory services. A more favorable regulatory environment could boost deal volumes and advisory fees.

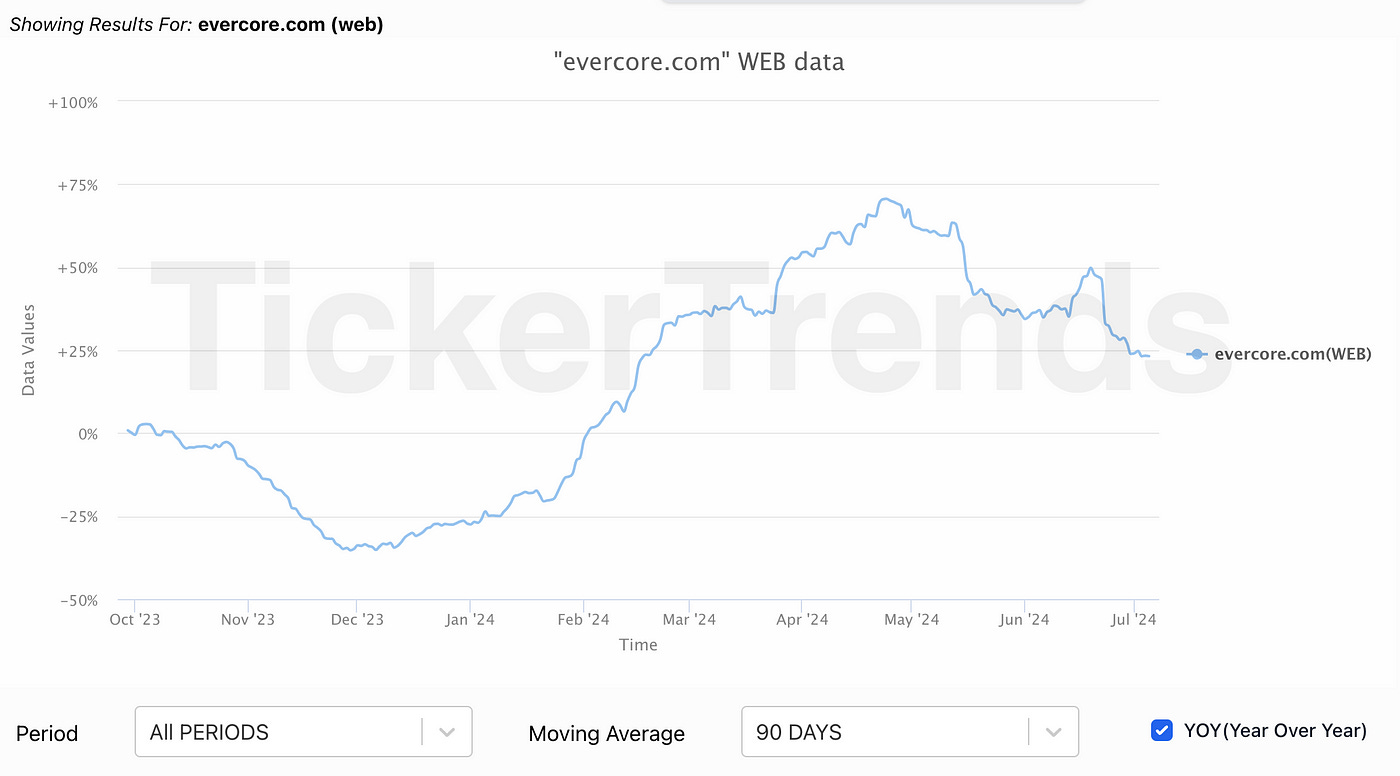

Evercore ($EVR): Evercore derives a substantial portion of its revenue from M&A advisory services. In 2023, Evercore’s advisory fees totaled approximately $1.96 billion, accounting for a significant portion of its total revenue ($2.43 billion total fiscal 2023 revenue). As a prominent advisor on large and complex transactions, Evercore stands to benefit greatly from a resurgence in M&A activity should regulatory conditions become more favorable.

PJT Partners ($PJT): For fiscal year 2023, PJT Partners reported total revenues of $1.15 billion. M&A advisory services form a substantial part of PJT’s revenue, reflecting the firm’s focus on strategic advisory and restructuring services. The firm’s financial performance is closely tied to the volume of transactions. An improvement in the regulatory environment could facilitate more M&A deals, boosting PJT’s advisory revenues. Specifically, the firm’s advisory revenues for fiscal 2023, were $1.026 billion, which indicates the significant role of M&A in its overall revenue mix.

Moelis & Company ($MC): Moelis & Company is another major player in the M&A advisory space. The firm’s revenue is significantly influenced by the volume of M&A transactions. In a more lenient regulatory environment, Moelis could see increased deal activity, leading to higher advisory fees and improved financial performance.

Conclusion

The current aggressive antitrust enforcement under Lina Khan has led to a slowdown in M&A activity, impacting investment banks and advisory firms. A potential shift in administration could reverse these policies, creating a more favorable environment for mergers and acquisitions. Firms like Houlihan Lokey, Evercore, PJT Partners, and Moelis & Company would likely benefit from increased deal activity should the FTC become less stringent on enforcing antitrust laws under a Trump administration. The election outcome, of course, is currently very uncertain, but a rising Trump odds could potentially be a bullish catalyst for stocks in this sector as expectations re-price. Vice versa, falling Trump odds would imply less of a chance of changes at the FTC. These stocks can serve as an interesting trading vehicle for election bets as a result.

Discord Link: https://discord.gg/dGEW4Pyacd

Hedge Fund Enquiries: admin@tickertrends.io

Follow Us On Twitter: https://twitter.com/tickerplus