TickerTrends' Advantage in Monitoring Structural Consumer Shifts

Bridging the Gap Between AI Narrative and Financial Reality

Software businesses, particularly enterprise SaaS, are under valuation pressure as markets trade heavily on narrative surrounding AI’s transformative potential, while actual revenue contributions, margin expansion, and broad KPI improvements from AI remain limited and uneven across most companies.

The disconnect is clear: widespread experimentation and pilot deployments continue, but meaningful translation into financials lags for the majority. Organizations report productivity gains in targeted use cases (e.g., software engineering and IT workflows), yet enterprise-wide revenue or EBIT impacts are minimal, with many firms still viewing significant P&L effects as future aspirations rather than current reality.

This creates ongoing volatility: software valuations embed forward expectations of AI-driven disruption, new monetization models, and enhanced developer productivity, but hard data confirming adoption at scale, revenue attribution from AI features, or competitive shifts has yet to broadly materialize, leading to downward pressure on multiples as speculation confronts emerging evidence.

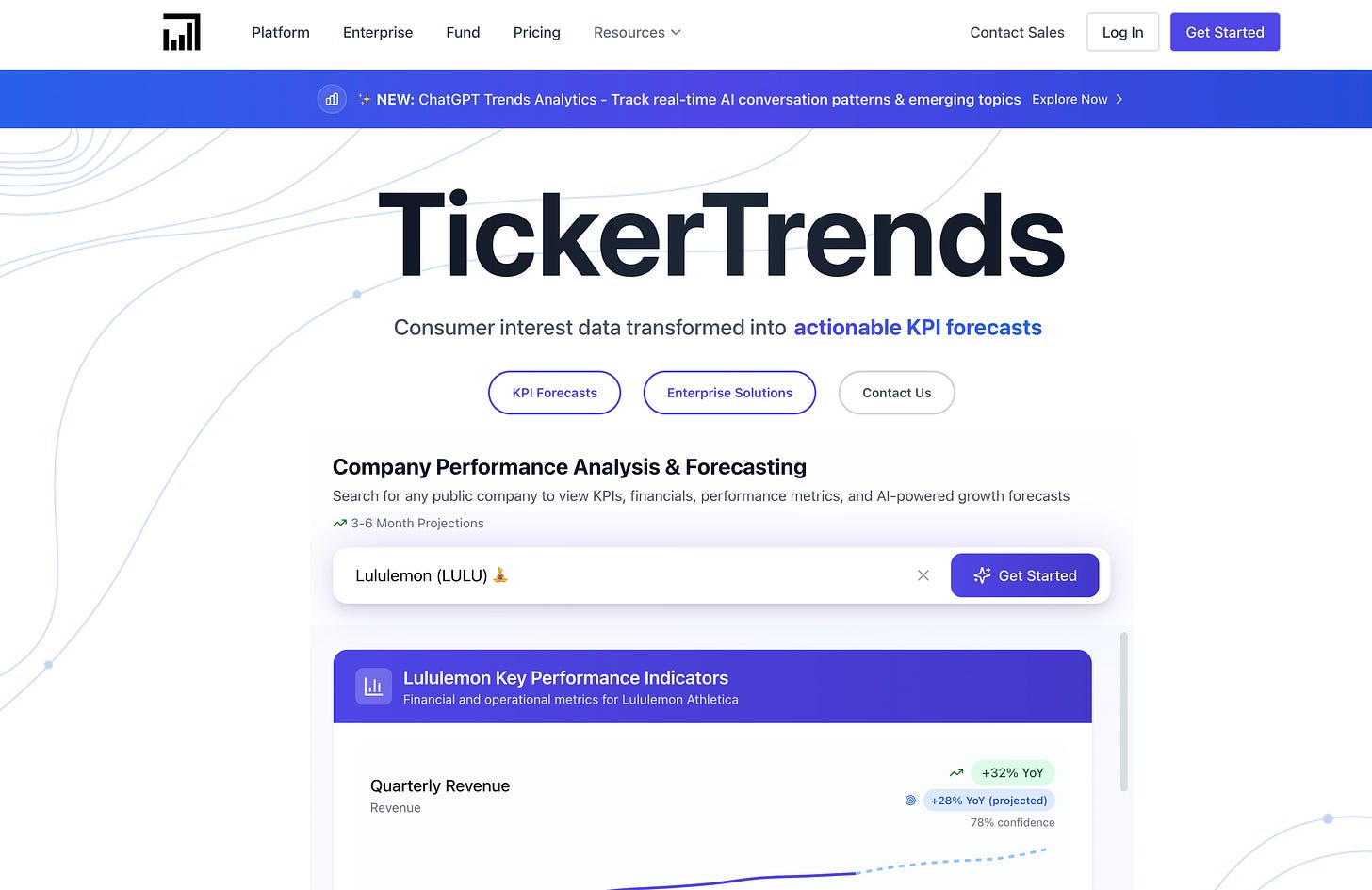

TickerTrends provides the decisive edge by delivering proprietary tracking of the actual materialization of AI-driven changes in real time, capturing leading signals from consumer and enterprise behavior before they fully register in financial reports or earnings.

Our platform leverages proprietary models to process millions of real-time data points from diverse alternative sources. This enables accurate, forward-looking forecasts of critical KPIs such as:

Developer and user adoption rates for AI tools and features

Workflow integration and engagement metrics

Early revenue trends tied to AI-enhanced products or capabilities

Brand and category momentum in areas like agentic AI, developer platforms, and enterprise applications

Key Strengths for Tracking AI in Software

Proprietary forecasting models identify pre-earnings shifts in demand, usage, and adoption patterns, consistently outperforming market estimates.

Exploding Trends Dashboard surfaces surging keywords, discussions, and topics linked to AI platforms and software categories, revealing where attention is rapidly converting to measurable usage and intent.

Real-time alerts, competitive benchmarking, sentiment overlays, and contextual analysis track how narratives evolve into quantifiable fundamentals.

24/7 global monitoring across AI-impacted software segments.

TickerTrends has a proven record of detecting early inflection points in fast-moving tech shifts, empowering institutional investors, hedge funds, and analysts to anticipate KPI changes and position ahead of confirmation in reported results.

In the current environment, where AI narratives fuel speculation but revenue realization trails, TickerTrends equips users with precise, proprietary intelligence to monitor how adoption, usage, and value creation are truly unfolding across software businesses.

Visit https://tickertrends.io/ to see how our platform delivers actionable alpha as AI impacts shift from narrative to data-driven confirmation.