$MNST Monster Energy Earnings Preview | TickerTrends.io

$MNST KPI Metrics, Earnings Preview Tracking, Expectations And Alternative Data Comps

Market Expectations

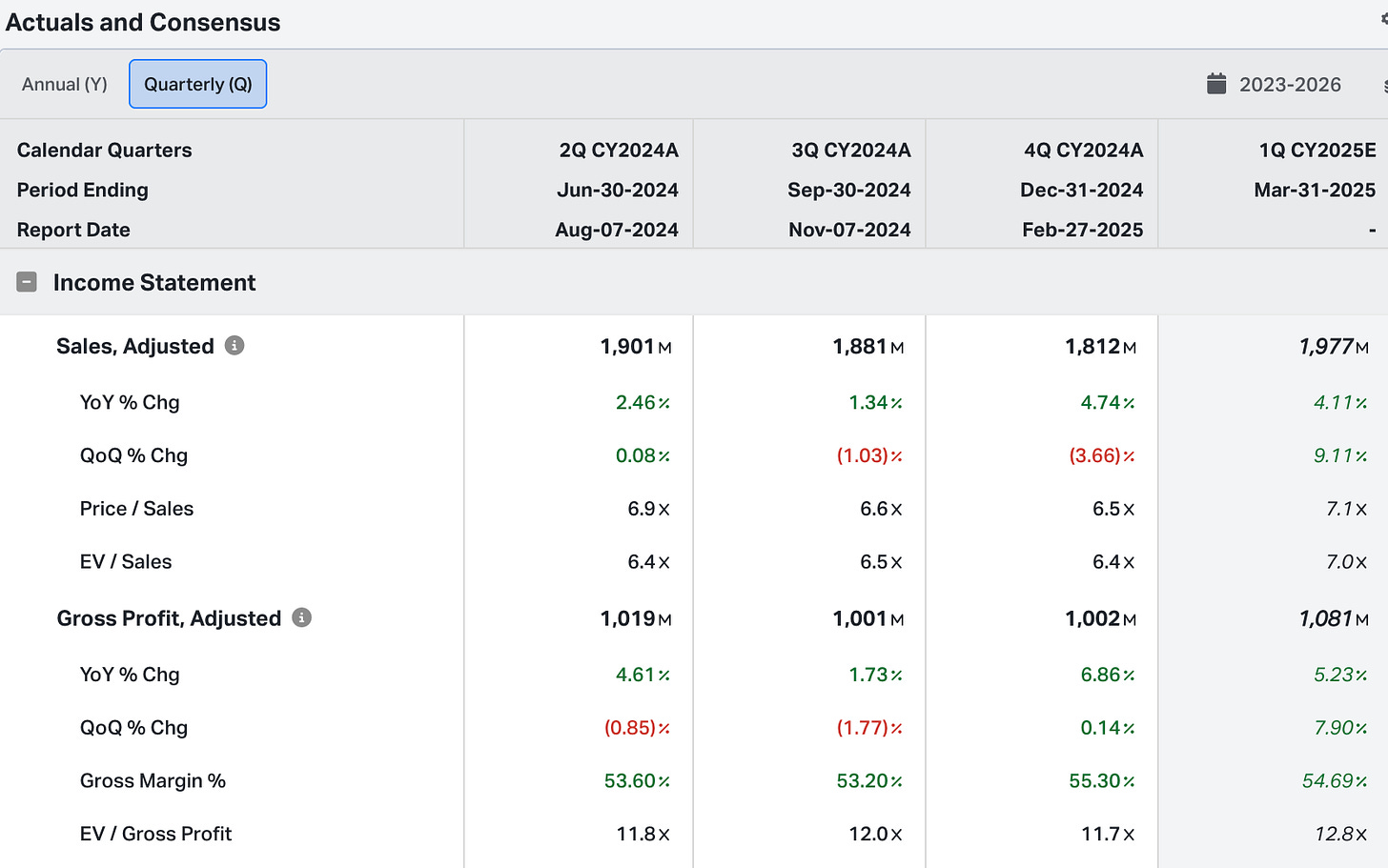

Analysts expect 4.11% YOY growth which is an acceleration of 9.11% QoQ going into Q1 2025.

Monster Beverage Corporation (NASDAQ: MNST) reported its Q4 2024 earnings on February 27, 2025, showcasing a mixed performance with record sales but challenges in profitability. Here's an analysis of the key performance indicators (KPIs) from the report: The Motley Fool

Revenue & Sales Performance

Net Sales: Increased by 4.7% year-over-year to a record $1.81 billion, surpassing analyst expectations of $1.79 billion. On a currency-adjusted basis, net sales grew by 7.8%. Nasdaq

Segment Breakdown:

Monster Energy Drinks: Sales rose 4.5% to $1.67 billion; adjusted for currency, the growth was 7.6%.

Strategic Brands: Including Coca-Cola-acquired brands, sales increased 11.1% to $102 million; currency-adjusted growth was 14.7%.

Alcohol Brands: Sales declined 0.8% to $34.9 million, impacted by a $130.7 million impairment charge.

International Sales: Grew 11.7% to $711.5 million, accounting for 39.3% of total net sales; on a currency-neutral basis, international sales increased by 19.9%. The Motley Fool Nasdaq GuruFocus

Profitability Metrics

Gross Profit Margin: Improved to 55.3% (reported) and 55.5% (adjusted), up from 54.2% and 54.5% respectively in Q4 2023, primarily due to reduced input costs. GuruFocus

Operating Income:

Reported: Decreased to $381.2 million from $434.0 million in Q4 2023.

Adjusted: Increased by 7.9% to $517.9 million from $480.1 million in Q4 2023. GlobeNewswire

Net Income:

Reported: Declined 26.2% to $270.7 million from $367.0 million in Q4 2023.

Adjusted: Decreased 6.6% to $375.7 million from $402.4 million in Q4 2023. GuruFocus

Earnings Per Share (EPS):

Reported: Fell to $0.28 from $0.35 in Q4 2023.

Adjusted: Remained flat at $0.38, missing the analyst estimate of $0.40. GlobeNewswire The Motley Fool

📊 Operating Expenses

Total Operating Expenses: Increased to $621.2 million from $504.4 million in Q4 2023. The Motley Fool

Adjusted Operating Expenses: Rose to $488.7 million from $463.2 million in Q4 2023. GlobeNewswire

Expense Breakdown:

Distribution Expenses: Decreased to $77.6 million (4.3% of net sales) from $79.6 million (4.6% of net sales) in Q4 2023.

Selling Expenses: Increased to $193.4 million (10.7% of net sales) from $176.8 million (10.2% of net sales) in Q4 2023.

General & Administrative Expenses: Rose to $350.3 million (19.3% of net sales) from $248.0 million (14.3% of net sales) in Q4 2023. GlobeNewswire

🔍 Strategic Insights

Product Innovation: The launch of new products, such as Monster Energy® Ultra Vice Guava®, contributed to sales growth. GlobeNewswire

Pricing Strategy: Implemented a 5% price increase on certain brands and packages (excluding Bang Energy®, Reign®, and Reign Storm®) in the U.S. effective November 1, 2024, aiding revenue growth. GlobeNewswire

Market Expansion: Continued international expansion, with significant sales growth in markets outside the U.S., highlighting the company's global reach. GlobeNewswire

Alternative Data

Amazon Interest

Recent data indicates a +15.66% MoM acceleration in amazon interest for “monster energy”.

Reddits Subs

Recent data indicates a +4.21% MoM acceleration in reddit subscribers.

TikTok

Recent data indicates a +9.9% MoM acceleration in tiktok views.

Social Followers

Recent data indicates a +15.33% MoM acceleration in social followers.

Search Trends

Recent data indicates a +5.55% MoM acceleration in search interest.

Conclusion

Monster Beverage’s Q4 2024 results highlight a company navigating the tension between record-setting sales and margin pressures. While profitability slipped on a reported basis, the company showed resilience through strong international growth, strategic price increases, and continued product innovation. Looking ahead to Q1 2025, analysts project a 4.11% year-over-year revenue growth—an acceleration from the previous quarter—suggesting optimism for continued momentum.

Meanwhile, alternative data paints a bullish picture: digital signals from Amazon (+15.66% MoM), TikTok (+9.9%), and search trends (+5.55%) all point to rising consumer interest. Social metrics, such as a +15.33% MoM increase in followers and +4.21% in Reddit subscribers, further reinforce Monster’s brand strength and cultural relevance. These insights offer a forward-looking edge beyond the fundamentals.

Track real-time alternative data on TickerTrends.io