Netflix Earnings Preview: Growth Cracks Forming Across Key KPIs?

$NFLX KPI Metrics, Earnings Preview Tracking, Expectations And Alternative Data Comps

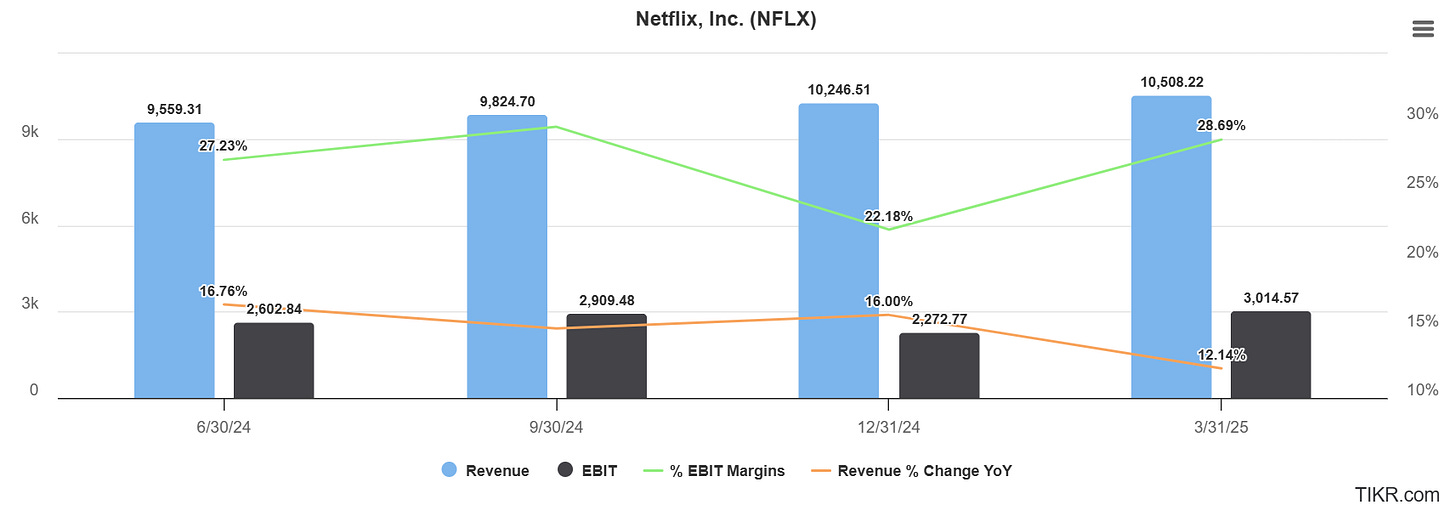

Market Expectations (Q1’2025E)

Revenue: $10,508 billion (+12.14% YoY)

EBIT: $3,014 billion (+14.5% YoY)

EBIT Margin: 28.69%

Netflix (NFLX 0.00%↑) enters Q2 with signs of fatigue across multiple core digital KPIs. While the company has made strides in advertising, live sports, and gaming, the underlying consumer engagement trends are sending mixed signals — raising questions about the durability of its global streaming dominance.

Netflix reported 301.63 million global paid subscribers in Q4 2024, an increase of 13% year-over-year and a net addition of 13.1 million subs for the quarter — its largest-ever quarterly gain.

Here’s the Q4 2024 KPI recap with exact numbers:

Subscriber Metrics

Total Global Subscribers: 301.63 million

Net Additions (Q4): 13.1 million

Annual Subscriber Growth (2024): 41 million net adds

% of U.S. signups on ad-tier (as of early 2025): 43%

Financials (Q4 2024)

Revenue: $10.25 billion (+16.0%)

Operating Income: $2.27 billion

Operating Margin: 22.2%

EPS: $4.27

Guidance Change

Netflix announced it will stop reporting quarterly subscriber numbers starting in Q1 2025, pivoting toward operating income and engagement (i.e. hours viewed) as primary KPIs.

Google Search Trends: Volatility Returns

Netflix's Google search interest has swung back and forth since late 2024, alternating between contractions and rebounds:

Steep dips in February (-9.16%) and January (-11.65%) show softening organic interest in '“netflix” search interest.

Recent gains in April 2025 (+3.16%) and March (+1.9%) are modest compared to the declines earlier in the year although at least indicate stabilization.

“netflix login” search interest continues to trend lower.

Long-term trend: Net downtrend with sporadic recoveries—suggesting search growth may not be structural as bulls hope.

TikTok Mentions: Hot Start, Cold Finish

The viral engine started strong in early 2025:

+19.38% MoM TikTok volume in January shows major viral traction due to Netflix’s foray in live sports with the Jake Paul Mike Tyson fight as well as the return of Squid Games latest season.

But by March, interest plunged 7.13%, following a brutal -23.04% in February.

TikTok’s volatility may hint at boom-bust hype cycles rather than sustained engagement.

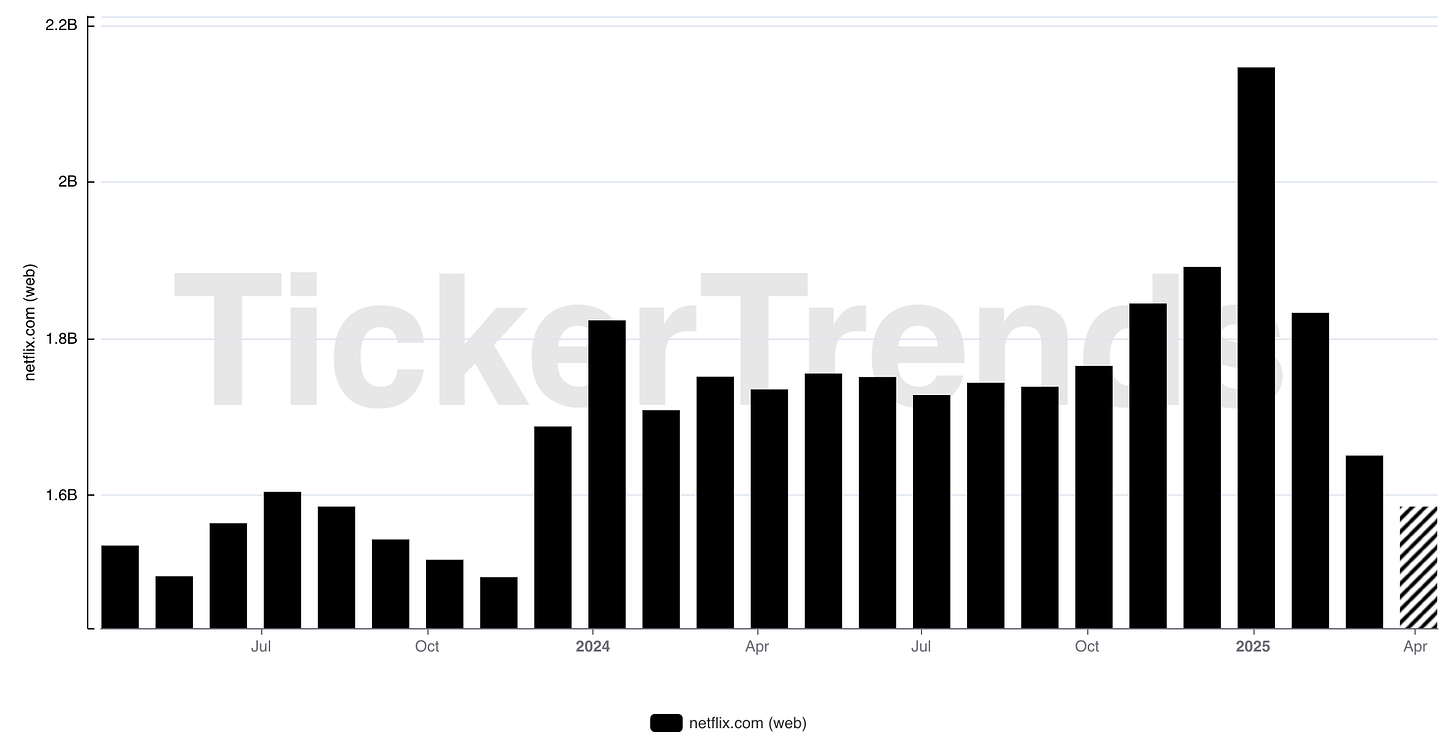

Website Traffic: Negative Inflection Point

Traffic to Netflix.com is now firmly in decline:

After peaking in late 2024 (+8.21% MoM in November), traffic has contracted for 4 straight months.

April 2025 saw a -2.13% drop, following a -12.88% crash in January and -8.99% in March.

This trend suggests reduced subscriber activity, less browsing, or a softening in free trial conversions.

Mobile App Engagement (Android): Mostly Red

Play Store session estimates and downloads signal user weakness:

Q1 2025 was rough: -7.72% MoM in February and -4.32% MoM in March.

Only a couple of positive months in the past 12: most of 2024 showed steady declines. The late Q4 2024 / early Q1 2025 pop shows similar declines to other alt data sources mentioned

Despite a strong +10.37% MoM spike in November 2024, the trend quickly reversed.

Final Take: Consumer Momentum Weakening

Across Google, TikTok, website traffic, and Android app metrics, Netflix appears to be losing steam. The narrative that it’s bulletproof in the streaming wars might be due for a reset.

Investors should watch:

Next season’s content drops for signs of rebound.

Mobile App DAUs, Website Traffic, TikTok traction, and Google Search interest for clues on subscriber sentiment.

Whether Netflix’s free ad-tier and mobile games can offset weakening top-of-funnel trends.

All-in-all, there are reasons to be cautious into Q1 earnings. It is certainly possible Netflix’s free ad-tier helps make up top-of-funnel weakness. Additionally Netflix will no longer give subscriber KPI guidance, so a weaker internal subscriber number expectation may not be broadcasted to the market. Do deeper analysis on tickertrends.io! Contact admin@tickertrends.io for details on Enterprise Terminal pricing.