Nexon ($3659.T) set to deliver strong guidance boosted by Arc Raiders success

Embark’s $40 premium launch Arc Raiders is showing blockbuster traction, setting up Nexon for a potentially transformative Q4 as legacy franchises like MapleStory and FC Online maintain momentum

Embark and Arc Raiders: the new swing factor for Q4 guide

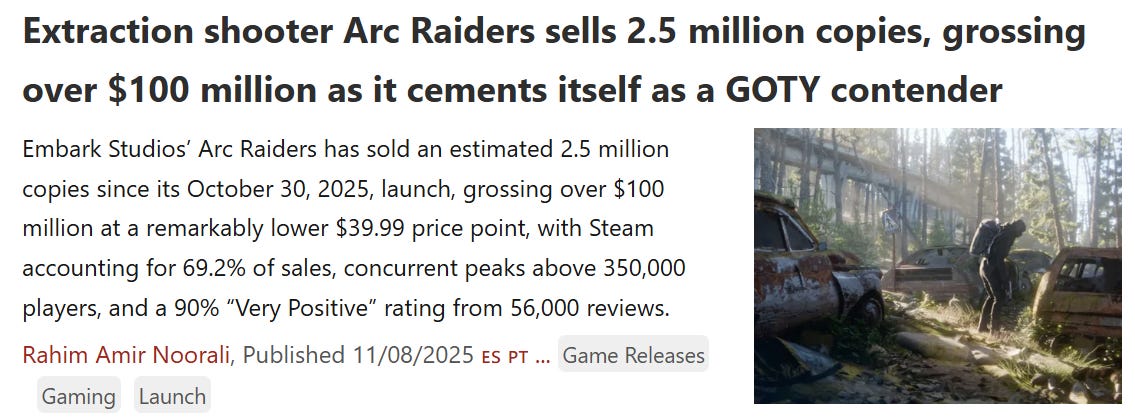

Embark’s Arc Raiders launched on October 30 at a 40 dollar price point and put up a strong first week. Multiple outlets report roughly 2.5 million copies sold in week one, with PC the majority of sales. That implies about 100 million dollars of gross bookings, or roughly 65 to 70 million dollars net to Embark after platform fees in a simple take-rate model. Since launch was after the September quarter, Arc Raiders will not impact Q3 reported revenue, but it should influence the Q4 outlook and investor Q&A. Embark is a wholly-owned Nexon subsidiary, so Arc Raiders revenue consolidates.

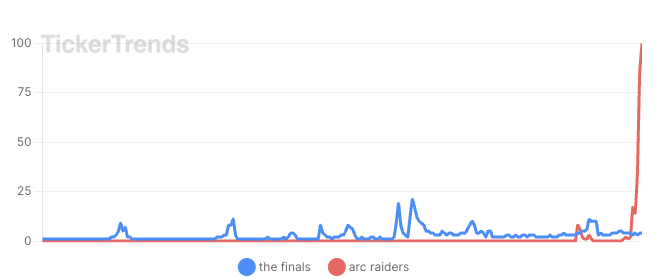

While Embark previously released The Finals, a free-to-play multiplayer shooter, its scale and consumer reach were far smaller than what we’re seeing with Arc Raiders. Google Search interest for Arc Raiders is several multiples higher than The Finals ever reached, showing that this launch has broken through to a much broader audience. For investors, that contrast matters, it signals that Arc Raiders is Embark’s first true blockbuster-scale release and could drive meaningful upside for Nexon if early engagement trends hold.

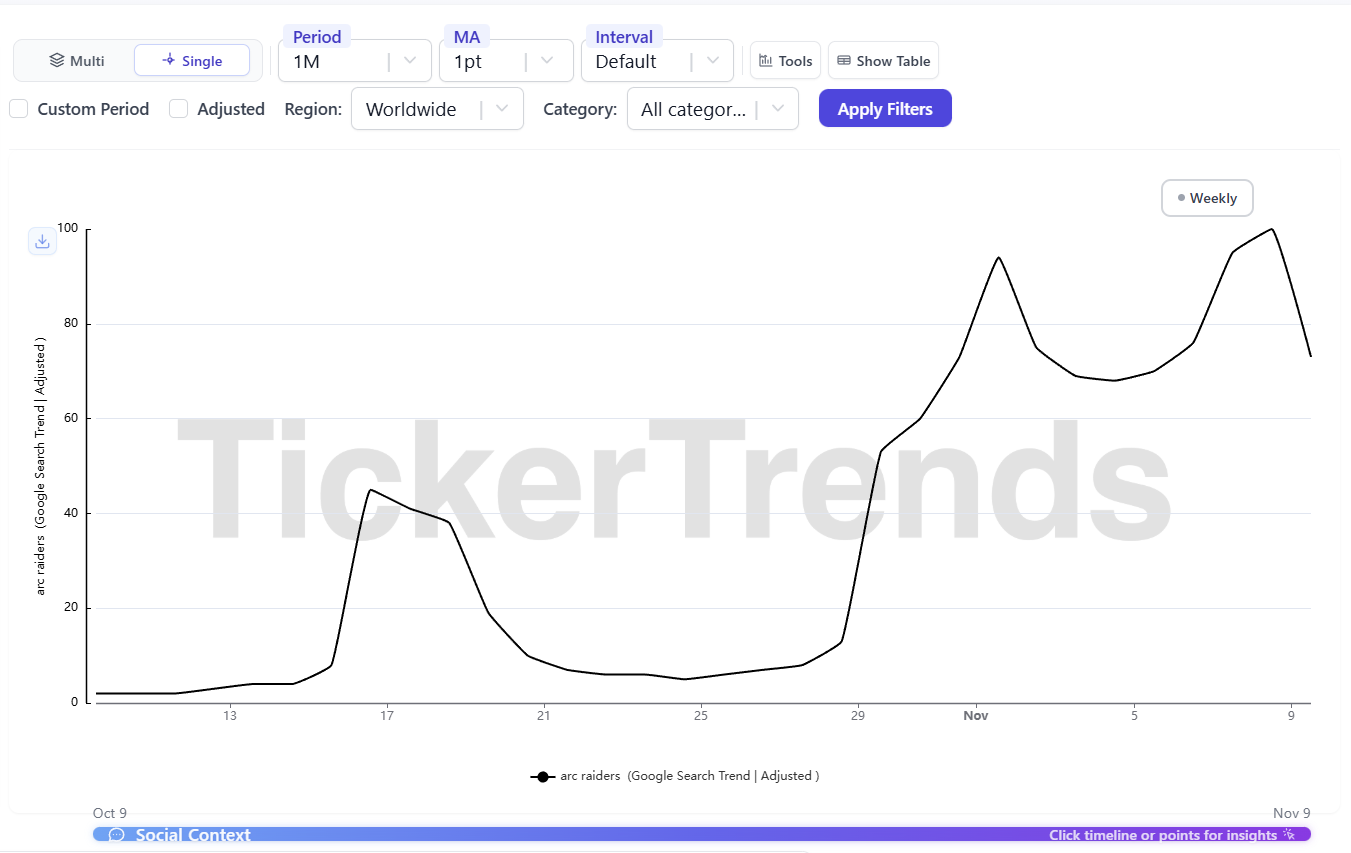

Arc Raiders trends are continuing beyond Week 1

Arc Raiders Google Search interest is holding up beyond the initial week hype (Oct 30 - Nov 6) — an extremely positive sign.

If this first-week pace holds for a few more weeks we can expect: 5+ million unit sales, gross 200+ million dollars, netting 130 to 140 million dollars to Nexon.

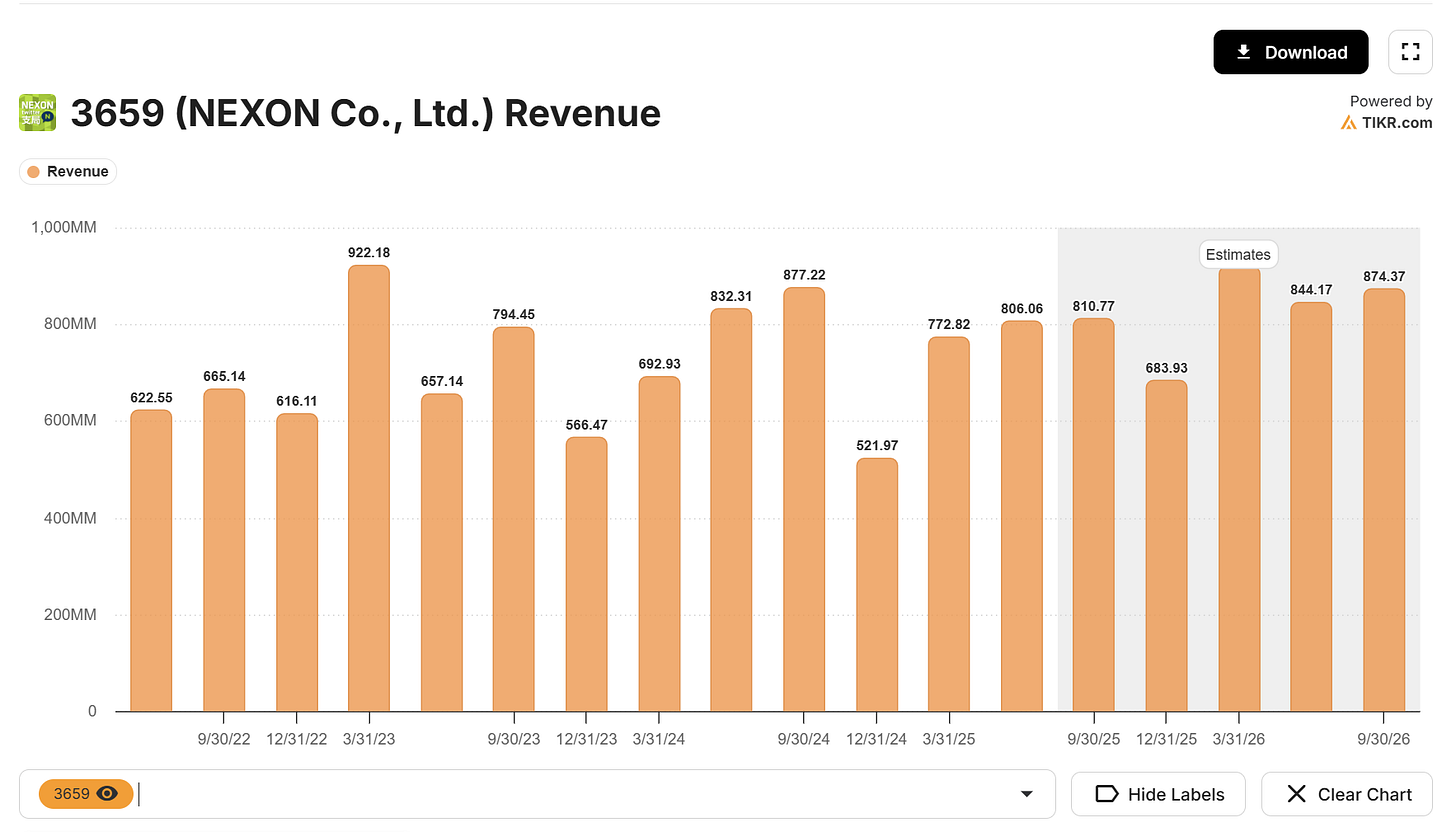

We see that the analyst consensus is decently above typical Q4 seasonality already (in US dollar terms), but we note that this ~130-140 million dollar incremental revenue boost is possible from essentially the first month of the Arc Raiders game. It is very possible to see some residual demand going into the holiday season.

Key proof points to listen to on the call: unit trajectory since day 7, game update release schedule, general game demand trajectory. Embark’s pre-launch notes on regional pricing changes are a reminder that ASP can drift by country, so watch management’s color on blended ASP.

Sentiment towards Arc Raiders among players is extremely positive.

MapleStory: momentum still doing the heavy lifting

MapleStory, a top franchise in Nexon’s portfolio, came into Q3 with excellent momentum. Management said the franchise grew about 60 percent year over year in Q2, with Korea PC up sharply following summer updates, and guided to roughly 70 percent year over year growth for the franchise into Q3. Western markets also posted strong growth in Q2. Expect MapleStory to remain a pillar for Q3 and to feature in color on live-ops cadence for Q4.

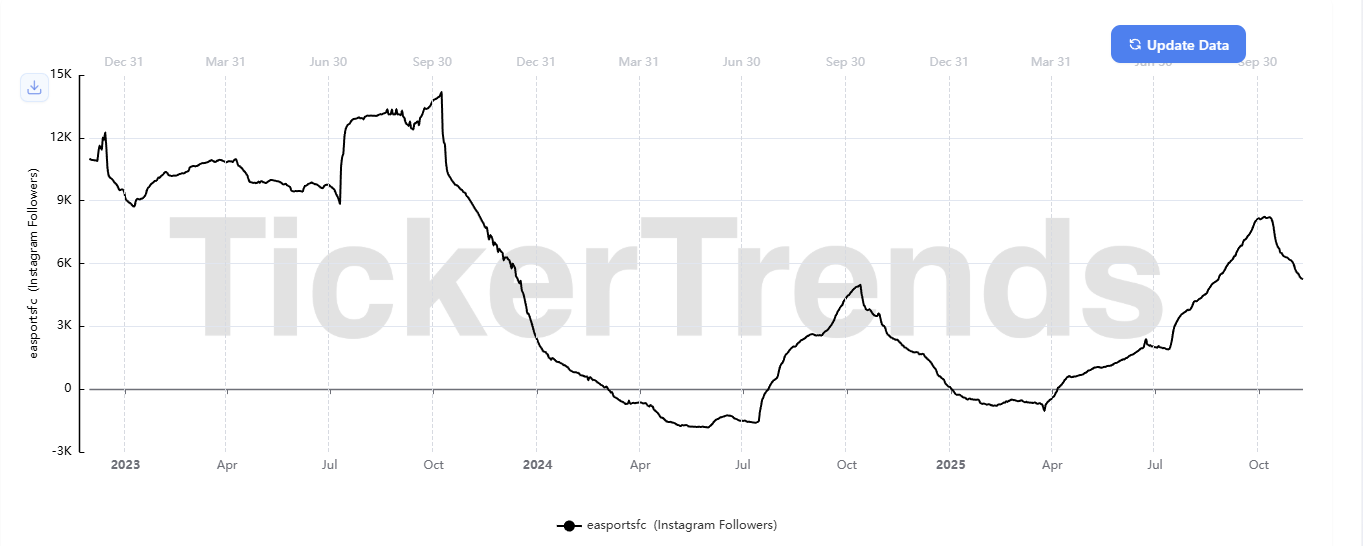

EA Sports FC Online: summer tailwinds likely helped

Nexon operates EA Sports FC Online in Korea. Management characterized FC Online performance as solid in Q2, and summer engagement events continued across the ecosystem. Heading into the print, assume stable to improved engagement versus Q2. Any commentary on esports events and in-game promos will help bridge Q3 to Q4.

Company guide rails to keep in mind

Back in August, Nexon guided Q3 revenue to 116.6 to 127.1 billion yen and operating income to 32.7 to 41.2 billion yen, with year over year pressure mainly from prior year launch comps. Tomorrow’s report is for that Q3 window. Expect the call to pivot quickly to Q4 focus given Arc Raiders and the holiday calendar.

What we’ll be watching on the call

1. Arc Raiders Traction and Monetization Path

The key focus will be how management frames Arc Raiders’ early success and what portion of the $100M+ launch revenue might recur / continue in the coming holiday season. We’ll be listening for commentary on live-service plans, cosmetic sales, and whether Embark intends to expand the title into a seasonal or battle-pass model. Sustained engagement over the next six weeks will determine whether this becomes a one-quarter pop or a durable franchise.

2. MapleStory and Dungeon & Fighter Stability

These legacy titles remain Nexon’s profit engines. MapleStory had strong summer updates, and tracker data continues to show solid engagement although there was a recent slowdown. Dungeon & Fighter Online should remain steady, but the mobile version has faced more competition. Investors will want to hear if there’s any new content roadmap that can reaccelerate player activity in early 2026.

3. EA Sports FC Online Momentum

Summer tournaments and in-game events supported engagement in Q3. The key question is whether management sees a slowdown into Q4 after the event calendar faded, or if renewed FIFA esports activity can maintain the user base.

4. KartRider: Drift and Other Newer Titles

KartRider+ has seen stability. Mobile App data shows that global engagement has held relatively steady. Any update on performance in Western markets would be incremental good news.

Overall, the story for this print is about how Arc Raiders changes Nexon’s revenue mix from reliance on long-running franchises like MapleStory to having a potential new blockbuster IP. Investors should focus on how management communicates that balance between legacy durability and new growth engines.

We see stability broadly in Nexon’s legacy game portfolio, as well as some larger titles like EA Sports FC showing strength. This makes for a very positive setup as Arc Raiders will be all incremental to this growth.

Quick model framing for investors

Q3 print

Within guided revenue band, supported by MapleStory strength and stable FC Online. Dungeon & Fighter Mobile remains a year over year headwind per prior guide.

Q4 setup with Arc Raiders

Working midpoint case: 5.0 million units by late Q4 window at a blended 37 to 40 dollar ASP yields ~192 million dollars gross, about 125 to 135 million dollars net after platform fees (just for Q4 alone). Layer a modest cosmetics attach and you have upside to net. All of this consolidates at Nexon via Embark. This will be Embark’s biggest game release ever so it could come as quite a surprise to investors.

Bottom Line

MapleStory momentum proved strong in Q3 per management’s prior commentary.

FC Online, KartRider, Mabinogi all stable to up versus Q2.

Arc Raiders week-one sales about 2.5 million units at 40 dollars. Strong signal for Q4 guide. Momentum has continued into the current week (Nov 10).

Embark is wholly owned by Nexon. Embark’s biggest game ever with Google Search interest more than 5x higher than “The Finals” ever was.

Actionable view

We forecast Q4 revenue of ¥135–145B versus consensus around ¥128B, implying ~6–12% top-line upside driven by:

Arc Raiders contributing roughly $130–140M net (5M+ units, ~$38 ASP).

MapleStory and FC Online sustaining Q3 run rates into Q4.

Modest holiday uplift across legacy franchises.

Investment Implication

Arc Raiders’ current sales velocity suggests potential for a meaningful top-line beat and upward revision to FY25 guidance if engagement sustains through November–December.

How do you have such few subscribers…?so much value on what you post