Nexon Co ($3659) ARC Raiders: Sales Under-Disclosure + Re-Accelerating Engagement Create Expectation Mismatch

Nexon Co ($3659) ARC Raiders Engagement Inflection Suggests Longer Tail Than Priced In

Recent disclosure around ARC Raiders unit sales appears meaningfully conservative relative to third-party estimates, while engagement indicators are re-accelerating post-launch. This combination, understated sell-through + improving demand signals, creates upside risk to consensus expectations for Nexon’s Western portfolio contribution.

We believe the market is anchoring to management’s Q4 commentary while missing evidence of a larger, more engaged installed base.

Sales Disclosure Likely Understates Reality

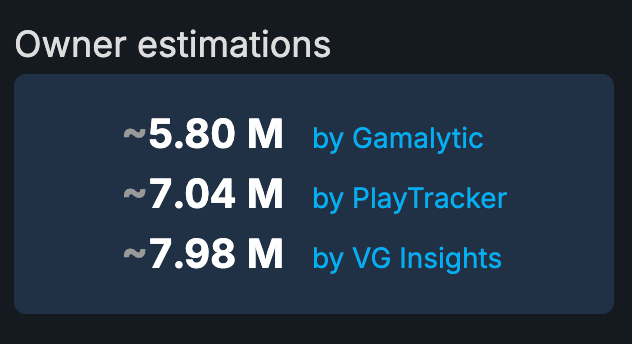

On the earnings call, Nexon guided to ~5.0–5.5M Q4 unit sales, noting ~4.0M units sold to date.

This discrepancy likely reflects conservative disclosure timing, partial platform inclusion, or intentional expectation management rather than a deterioration in demand.Independent tracking from Alinea Analytics estimates ~7.7M copies sold through end-November, already well above Nexon’s implied run-rate.

PC sales make up around 2/3 of the player base, meaning December Owner estimations imply an estimate of 10M+ cross platform sales.

Engagement Is Re-Accelerating, Not Decaying

Late-cycle engagement behavior is the critical signal for live-service durability.

Active players: Weekend peak concurrency rebounded from ~330k to ~386k (Dec 21), reversing a prior downtrend.

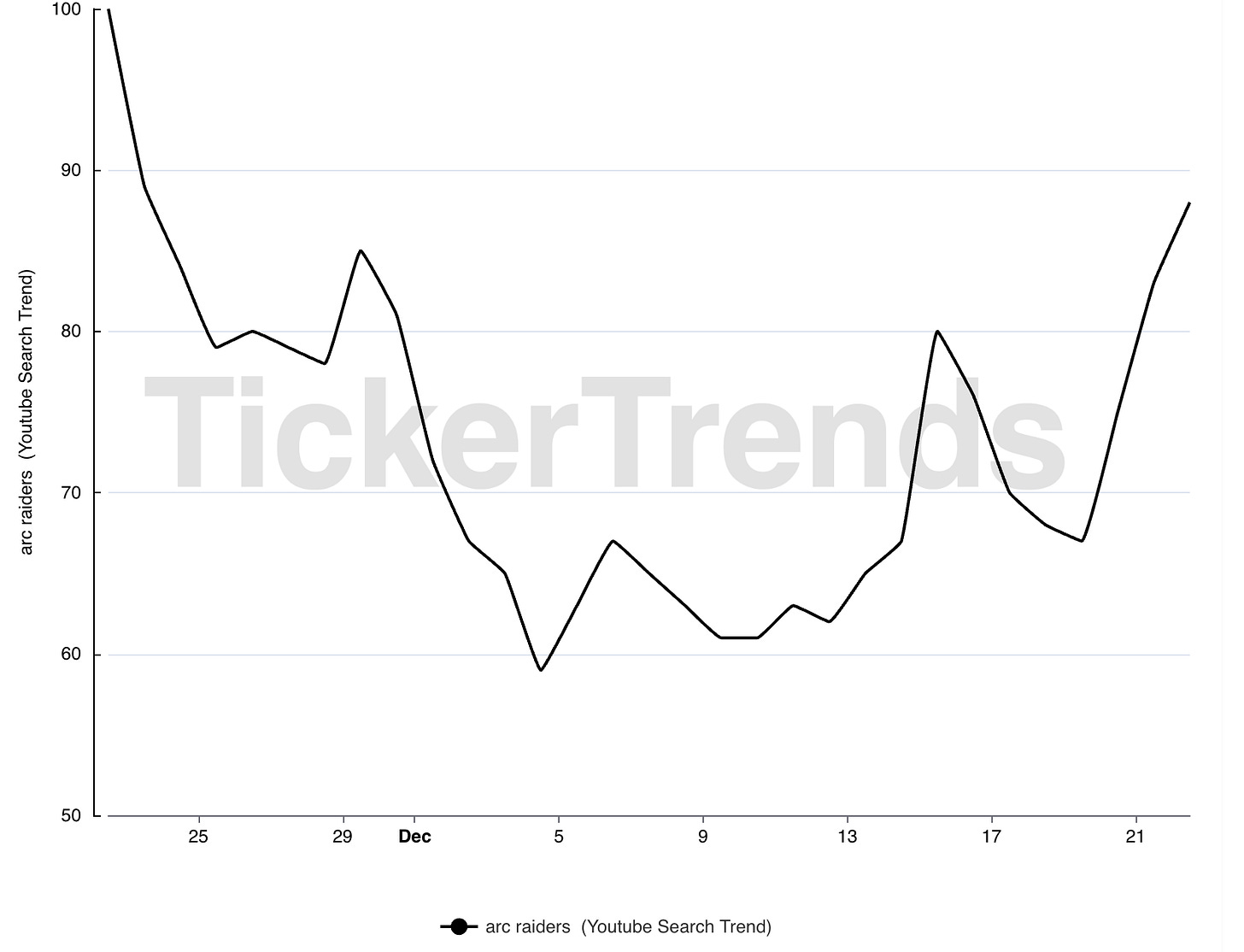

Search demand: YouTube search interest +45% since early-December lows following the Cold Snap update.

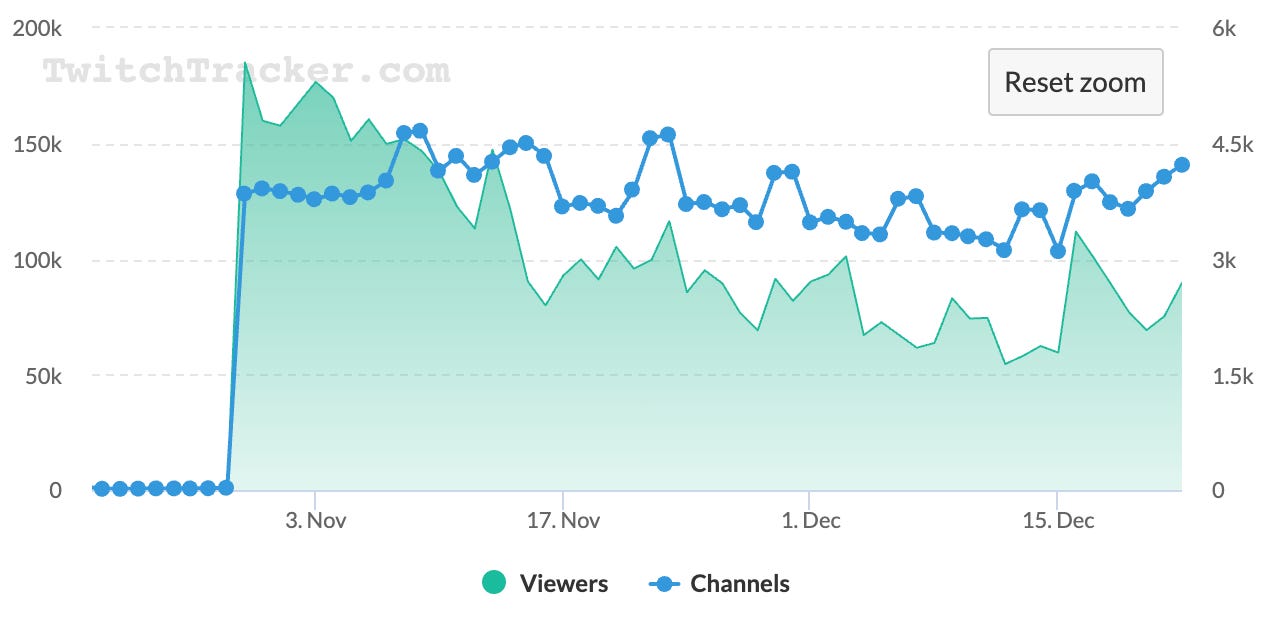

Streaming visibility: Twitch viewership doubled from trough levels (~60k → 100k+ viewers), indicating renewed discovery, not just retention.

Notably, the rebound is visible across player concurrency, search intent, and streaming visibility simultaneously, a pattern typically associated with content-driven re-engagement rather than short-term promotional spikes.

Why This Matters for Nexon Earnings

The market currently frames ARC Raiders as a front-loaded launch with limited tail. The data suggests otherwise:

A 8-10M+ installed base with improving engagement materially increases:

cosmetic attach probability,

seasonal content monetization,

long-tail revenue optionality.

Re-accelerating Twitch + YouTube interest historically correlates with higher ARPU, not just incremental unit sales.

Conservative guidance sets up positive revision risk as Q4 closes and full sell-through becomes clearer.