OpenClaw and PicoClaw – A Tailwind for Raspberry Pi Demand $RPI

PicoClaw's Ultra-Efficient Rewrite Sparks Raspberry Pi Demand Increase – A Cost-Driven Tailwind Amid Mac Mini Dominance

OpenClaw (Node.js-based agent framework) and PicoClaw (Go rewrite, <10MB RAM, <1s boot) enable persistent, local AI agents for automation, orchestration, and integrations (e.g., Discord/Telegram, web search, shell commands).

While Mac Mini (especially M4 models) is the most popular “always-on” host, due to superior performance, unified memory for local LLMs (via Ollama), Neural Engine acceleration (~38 TOPS), and ease for power users, many opt for Raspberry Pi ( $RPI ) setups for cost, power, and scalability reasons. PicoClaw democratizes to ultra-cheap hardware, boosting Pi appeal.

Community consensus: Mac Mini for “lobster” (high-end, feature-rich) single-host setups; Pi (or equivalents) for “shrimp” (lightweight, distributed) swarms. Anecdotes show Pi hoarding for bulk deployments, shifting from 1-2 hobby units to multiples.

X/Reddit/HN buzz shows devs/startups buying 10s–100s for isolated swarms (e.g., agentic marketing, parallel tasks). Shifts hobby/education (1–2 units) to consumer bulk demand (~33% rev). Complements steady OEM/industrial base (70%).

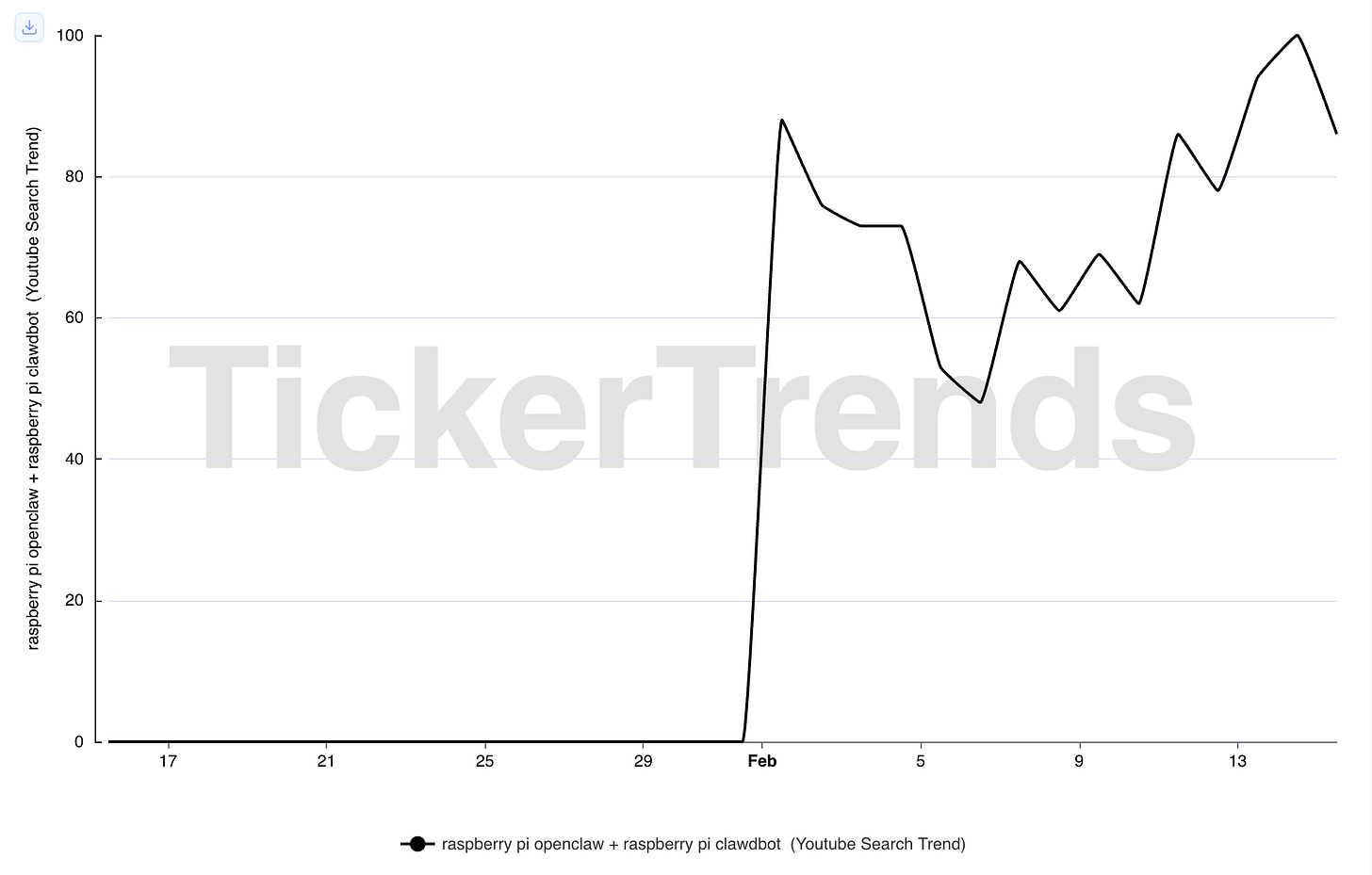

YouTube Search Spike (OpenClaw + Pi/Clawdbot terms): Explosive Feb 2026 jump (near-zero to ~80–100 index) from tutorials/guides, many Pi-focused.

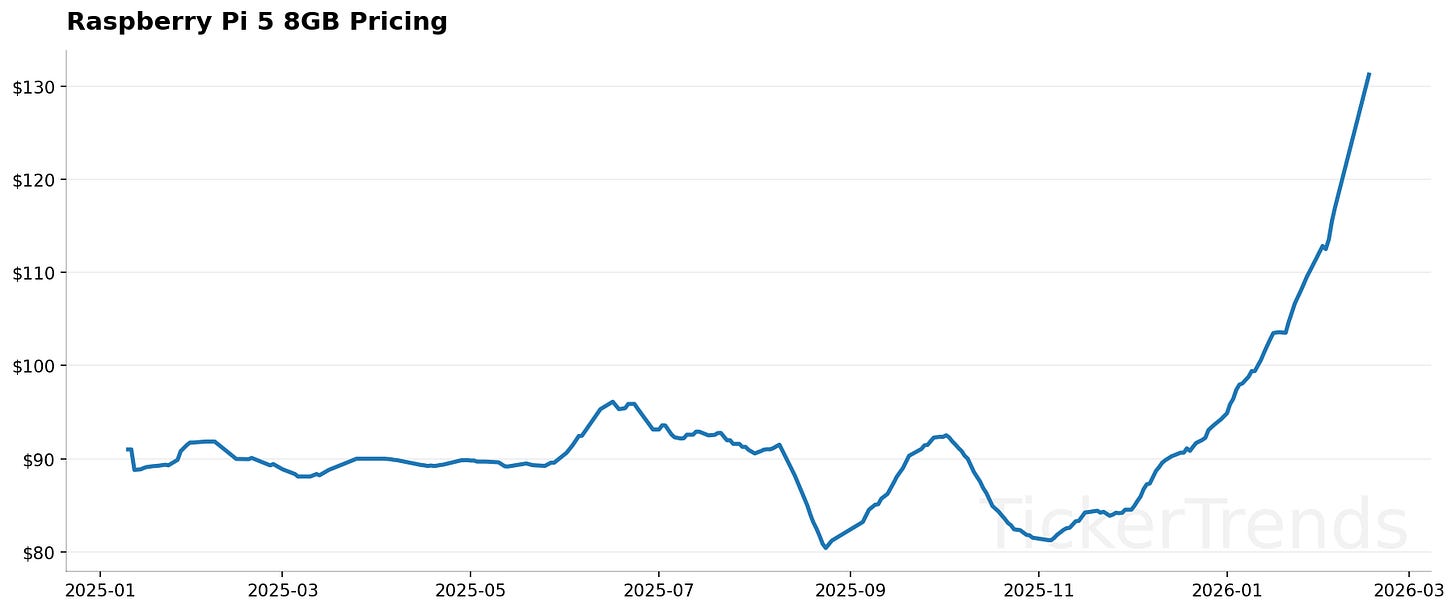

Pi 5 8GB Pricing Trend: Sharp rise from late 2025 (~$80-100) to ~$125-130+ in Feb 2026, reflecting memory hikes + incremental demand pressure.

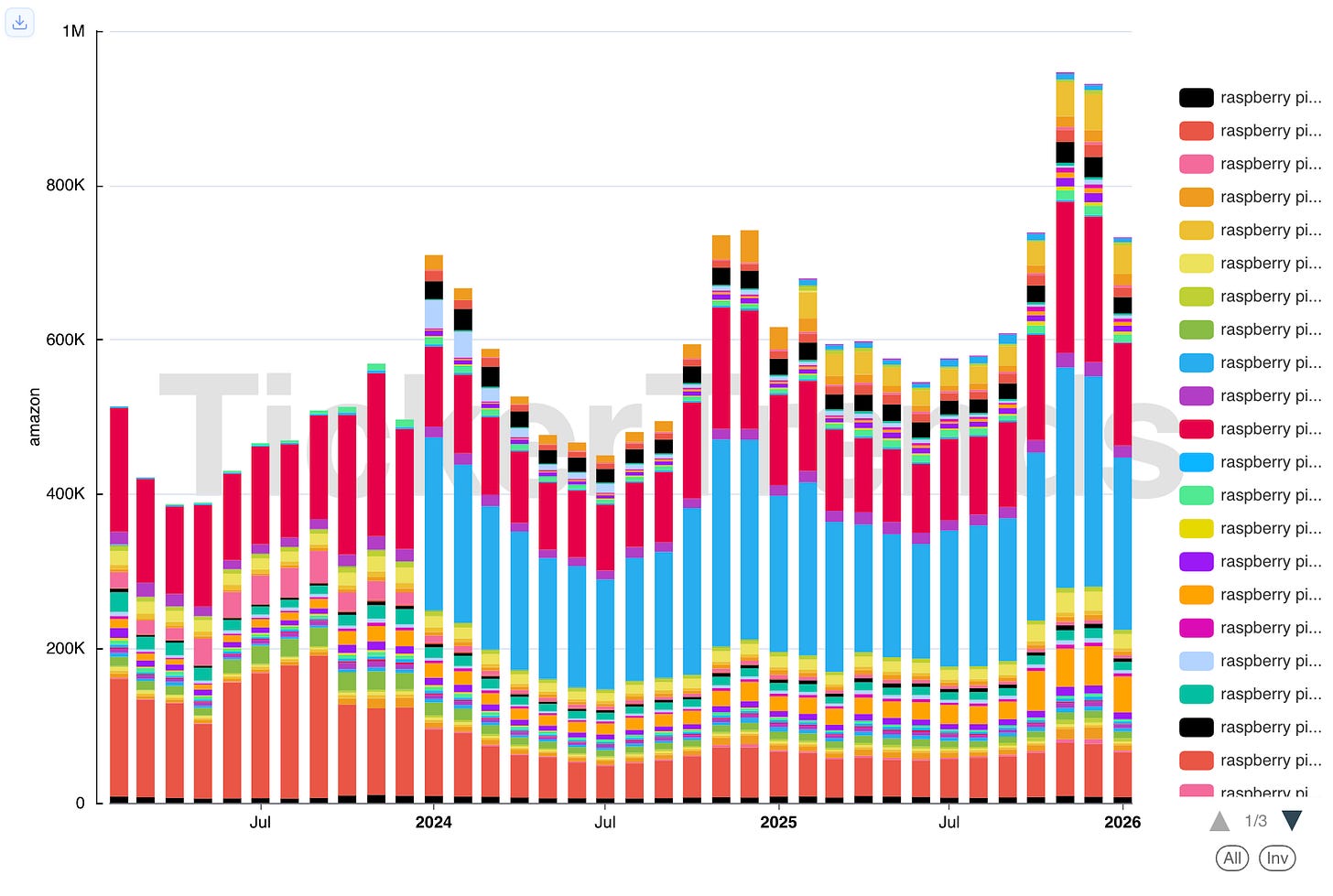

Amazon Search Volume (Raspberry Pi terms): Acceleration into 2026 (peaks ~800K+ monthly), broad resurgence including agent-driven interest.

Actionable Implications

Bull Case (Base View): 5–10% extra units (~400–800k incremental) from consumer/edge wave (Pi’s share in swarm use cases); revenue/margins lift beyond 14–17% base growth.

Monitor Triggers:

Q1 2026 shipments/earnings (H1 growth confirmation)

Reseller stock for Pi Zero/3B/5 (8GB)

PicoClaw GitHub stars + Pi tutorials spike

X sentiment on Pi vs. Mac Mini hoarding

Risks: Hype fade (low-persistent agents sticky); cheaper RISC-V competition (partial offset-Pi ecosystem wins); prolonged DRAM crunch caps upside (but hikes passed through).

Bottom Line: Mac Mini leads for high-performance single-host agents, but Raspberry Pi captures meaningful share in cost-sensitive, scalable/edge deployments, especially via PicoClaw. This under-the-radar consumer demand revival supports upside in a memory-starved AI market.