Peloton Earnings Preview: Record Subscriber Loss in Sight as Subscription Headwinds Mount

Subscriber erosion deepens as usage and engagement metrics tumble, leaving Peloton’s cost-cutting efforts struggling to counter a shrinking core business.

Peloton, once a pandemic darling, now faces a tougher truth: its core subscription business is weakening. The early data suggest trouble ahead for their “Ending Paid Connected Fitness Subscriptions” metric, and given subscription revenue makes up a large chunk of total revenue (~60-65%), that’s a red flag for the brand’s long-term trajectory.

Subscription and Member Trends

TickerTrends Consumer Usage Tracker shows a significant deterioration in alternative data.

The “Paid Connected Fitness Subscriptions” line already started falling quite a bit to 2,800,000 last quarter and trending lower (fell 75,000 QoQ):

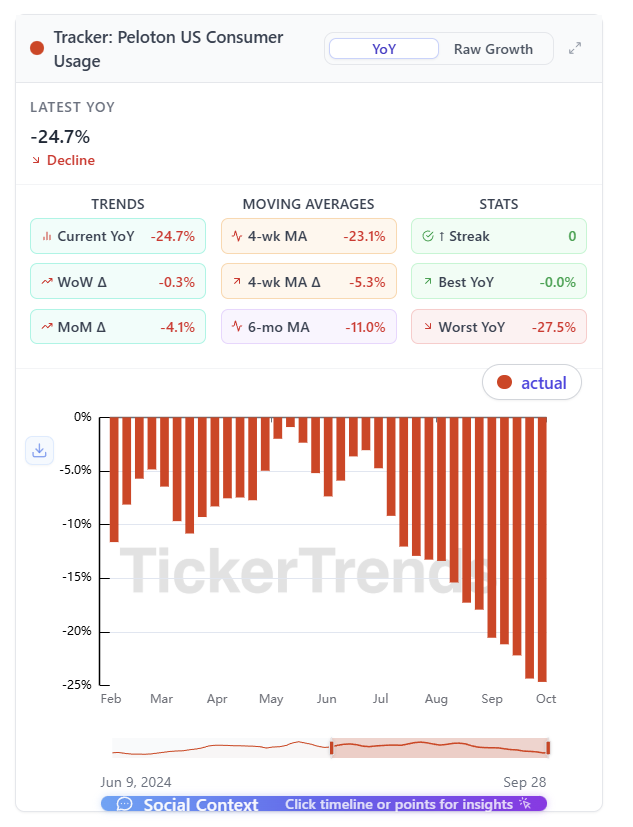

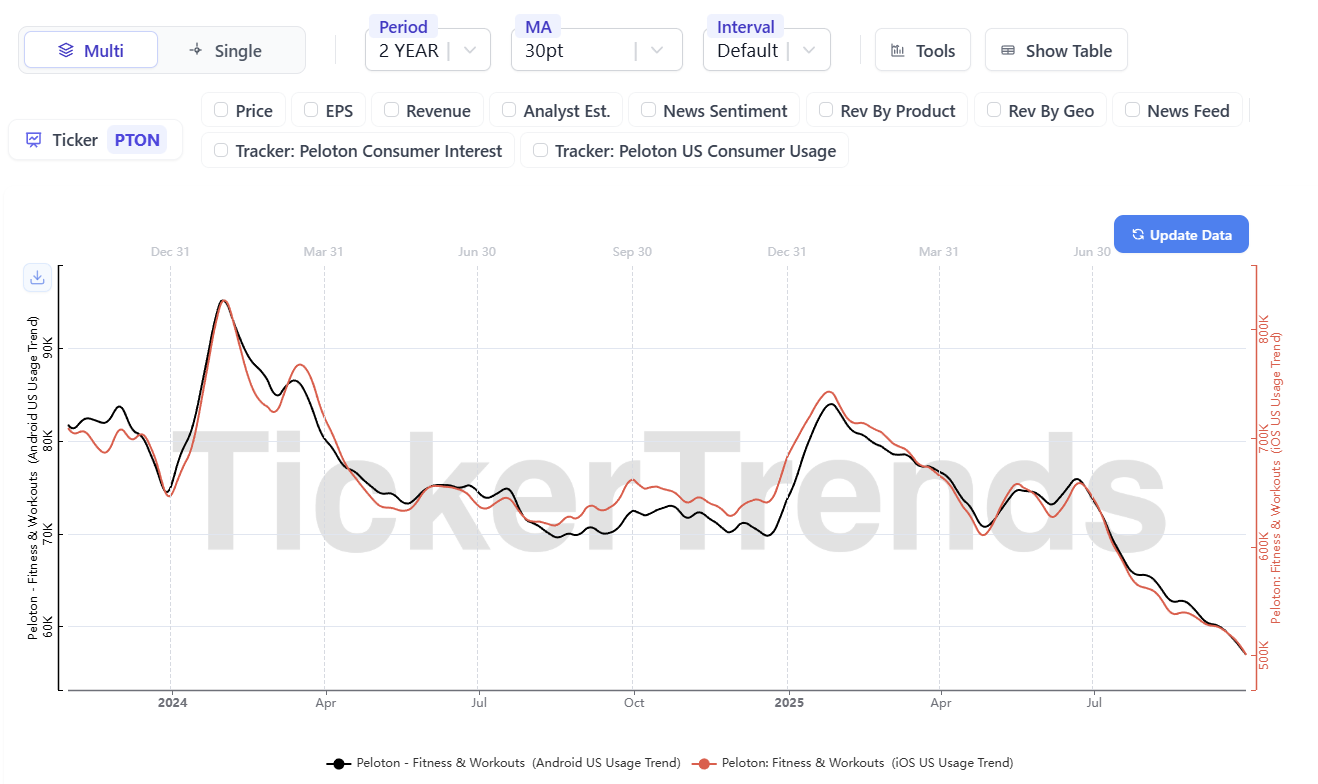

Mobile App Usage Trends (iOS and Android) took a sharp downturn in the last few months from what had been a more steady decline, currently down 24% YoY.

Website Traffic Trends are slipping fast, deeply negative YoY.

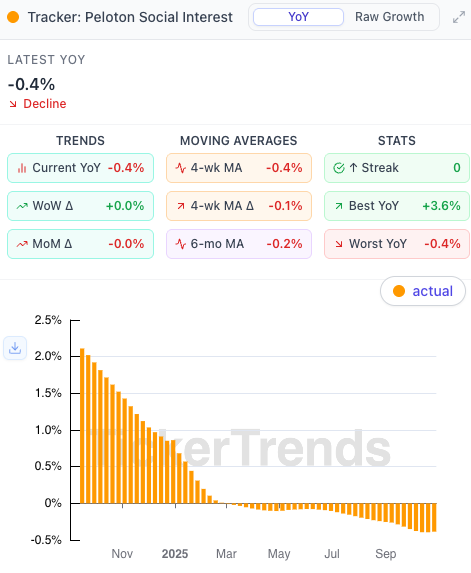

Social Interest has accelerated to the downside.

This combination leads up to believe PTON 0.00%↑ might report a 100,000 or more subscriber loss this quarter.

Revenue Mix & Cost Control

Subscription revenue has become the dominant pillar. Peloton’s subscriptions accounts for ~60-65% of total revenue.

On the positive side, Peloton has made meaningful progress cutting operating expenses. In Q2 FY25, operating expenses were down ~25% YoY.

While cost control is a silver lining, the fundamental driver, subscriber base growth or retention, appears to be on shaky ground.

Why This Looks Troubling

Subscription drop = revenue risk. If the installed base of paid connected fitness subscriptions is falling, the recurring revenue stream shrinks. That’s bad news when subscriptions represent the bulk of profit contribution.

Usage and engagement slowing. The sharp decline in usage data hints at lower member activity or fewer new activations, both of which raise risk of higher churn or fewer new subscriptions.

Hardware headwinds remain. Peloton’s equipment sales keep waning, so the company is relying more on services. When services falter, the business becomes very exposed.

Brand strength may be fading. The drop in social metrics (Instagram followers turning flat or negative) supports the view that Peloton might be losing cultural momentum among consumers.

Cost cuts don’t replace growth. While expense reductions help bottom-line metrics in the near term, without top-line subscription growth the company’s long-term growth story is in doubt.

TickerTrends Verdict

We expect there to be significant churn risk coming in the next few quarters for Peloton.

Last quarter saw a ~$10M drop to $408M. We see this trend accelerating to downside. We see a sub $400M Subscription Revenue coming along with continued weakness for future quarters, likely more than investors betting on a turnaround in the name expect.

Given the combination of decelerating subscriber numbers, declining usage trackers, and a revenue mix heavily dependent on subscriptions, we lean negative on Peloton going into the earnings report on November 6, 2025. The one positive in this story remains cost controls. Ultimately, Peloton’s aimed 100M in run-rate cost saving can’t offset the financ — is insufficient on its own to offset the risk from shrinking membership and engagement. Until subscriber trends stabilize or reverse, we believe the stock’s risk/reward is skewed to the downside.