Pop Mart Faces Cooling Secondary Market Labubu Demand but Maintains Strong Collectibles Momentum

Secondary market pricing and social interest show local deceleration, yet elevated absolute demand and sector strength suggest long-term growth resilience

Introduction

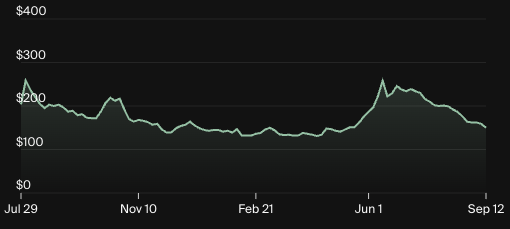

“What surprised many was that despite its popularity, Labubu—along with several of Pop Mart’s bestsellers—saw prices plunge on the secondary market. On social media, consumers welcomed the drop, while scalpers and toy investors reported losses.

Data from e-commerce app Dewu shows that over the past 90 days, the average transaction price of third-generation Labubu collectibles has steadily fallen. As of publication, both sealed boxes and full collections were down about 80% from their peak.”

https://kr-asia.com/pop-mart-pricks-labubus-resale-bubble-in-bid-to-outlast-the-hype

Secondary market pricing of Labubu collectibles has turned lower, fueling a market narrative of cooling demand. Asian publications have already highlighted this downturn, and the narrative has spilled into investor concerns around whether Pop Mart’s growth trajectory is sustainable.

Our strategy is to allow near-term fear to play out while closely monitoring inter-quarter performance. Despite clear signs of cooling in social activity, absolute demand remains elevated relative to increased supply. This creates room for earnings to surprise positively if production growth meets consumer appetite.

The key risk lies in further deceleration. Should social activity continue to roll over more sharply, demand may contract faster than expected. Our current tracking does reflect social risk leading an end of year decline in demand should the holidays not revive consumer interest.

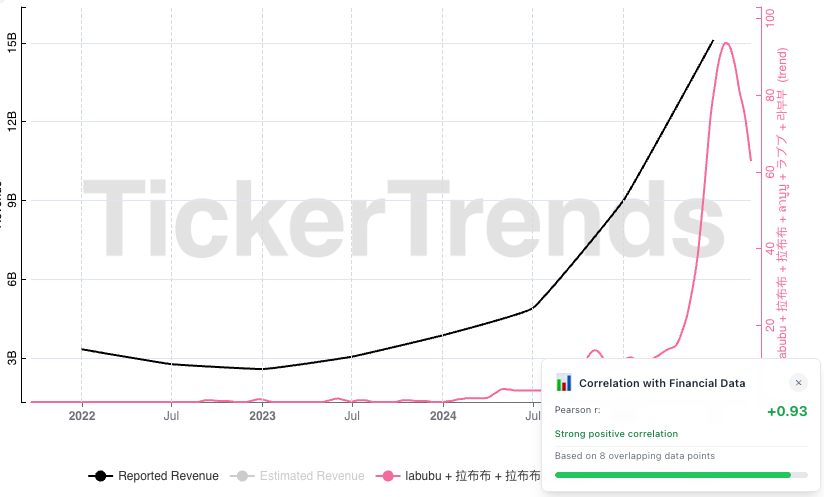

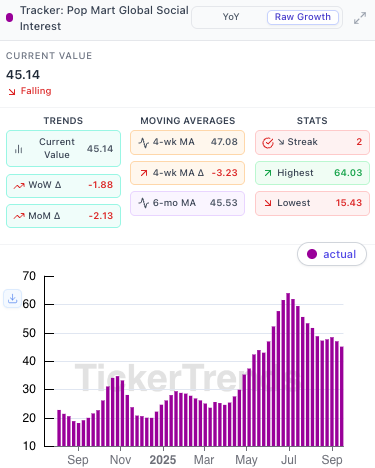

In the case of social driven brands like Pop Mart, social interest has a high direct correlation to revenue growth.

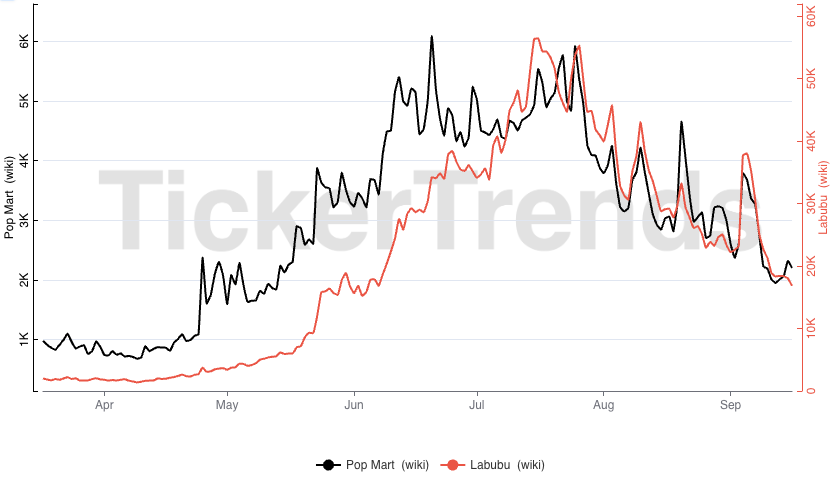

Social Performance

Secondary Market: Prices for three top-volume Labubu boxes are down ~50% from peak. This is an undeniable signal of speculative froth being flushed out. However, transaction volumes remain robust, indicating continued end-user engagement versus outright collapse.

It is important to realize that squashing secondary market pricing, is part of Pop Marts current strategy.

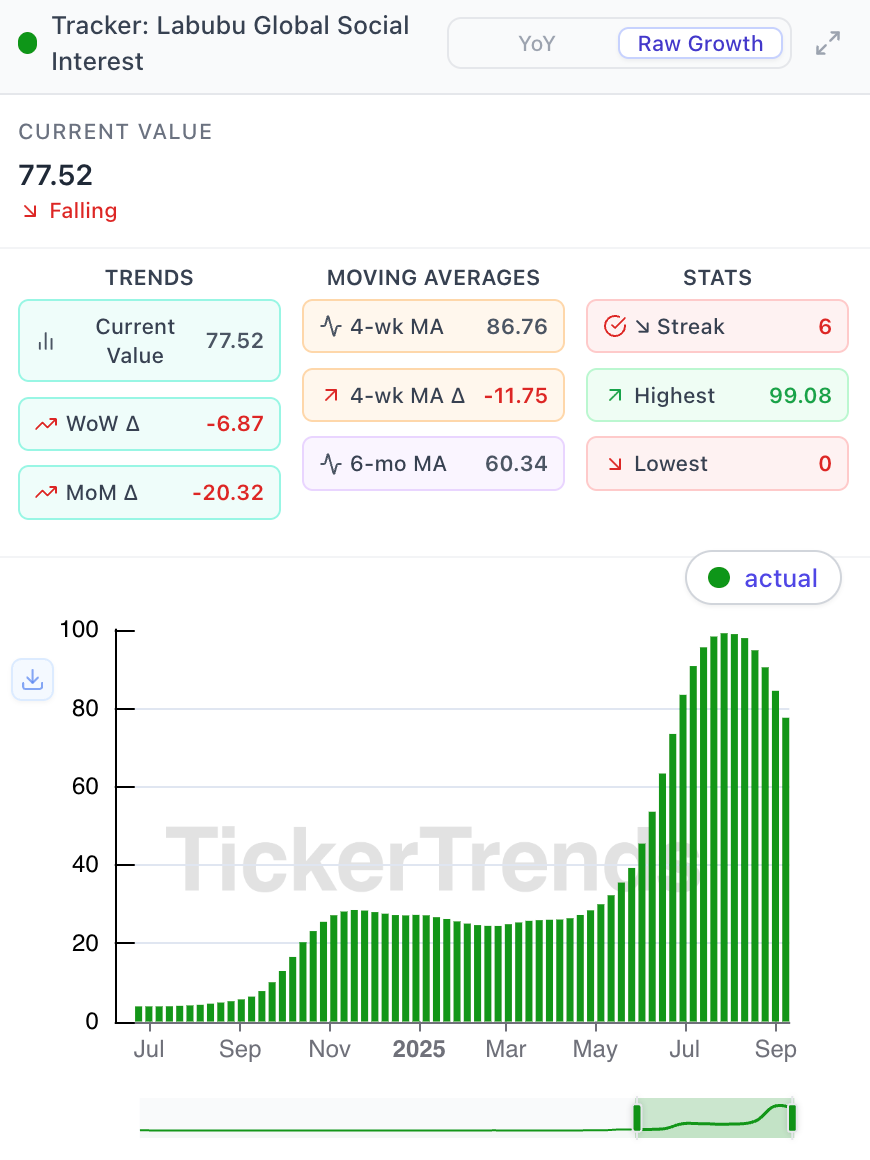

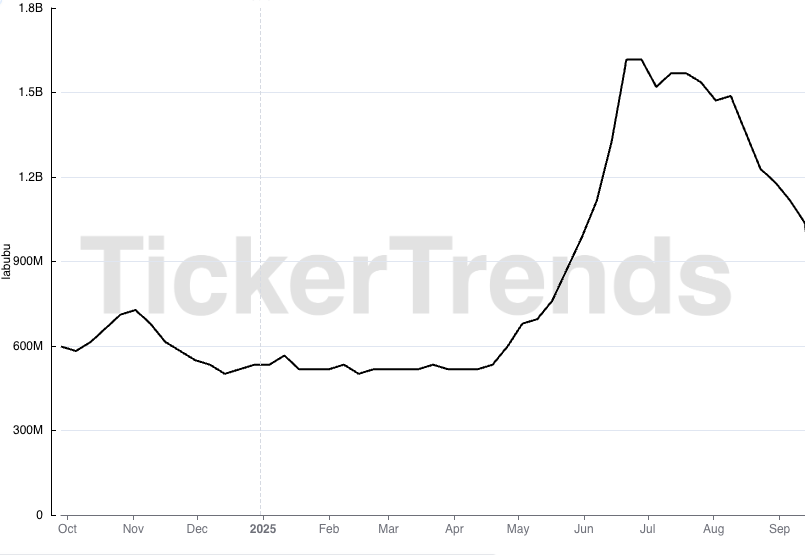

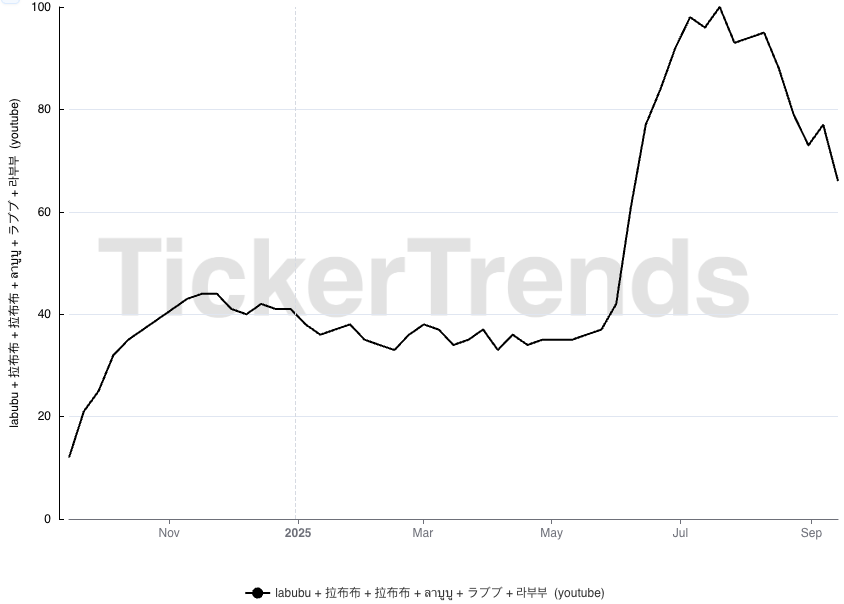

Social Interest: Global social media engagement is trending lower across platforms. While broad interest remains above early-year levels, local declines are most visible in the U.S.

Labubu global social interest is down 22.48% from the peak, while still being up 185% on the year.

Pop mart global social interest has declined 30.63% from its peak while still being up 80.49% on the year.

While the decline is consistently seen throughout metrics, it is important to note that the rate of decline in its current state is still sustaining some of the growth from the first half of the year.

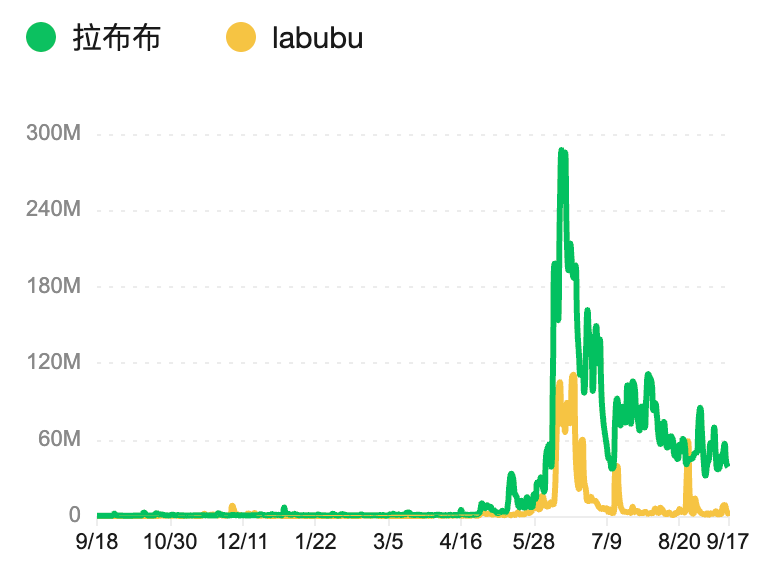

China: Consumer interest in China is moderating but still high, providing a critical floor of demand. This is roughly flat since the beginning of the year.

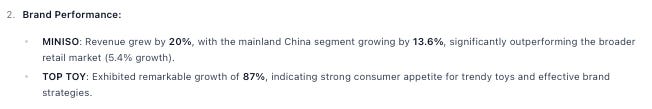

Sector Strength

Rising interest in adjacent plush and collectible categories confirms that Pop Mart’s demand is not purely Labubu-driven. Competitors show weaker traction, reinforcing Pop Mart’s position as category leader.

Actionable Takeaway: Pop Mart’s deliberate choice to sacrifice secondary pricing to capture primary sales should support top-line resilience. If investors rotate focus from speculative pricing to core IP monetization, sentiment could re-rate sharply.

Catalysts & Risk Monitor

Upcoming Earnings (Catalyst): Pop Mart’s next earnings will be the inflection point for whether elevated absolute demand offsets the visible social slowdown.

Holiday Seasonality: Historically, Q4 provides a demand lift. Current interest levels, if sustained, would suggest better than feared sell-through.

Key Risks:

Further Social Roll-Off: A sharper social decline (>50%-60% from peak) would validate the bear case.

China Weakness: If China, the current floor, cracks, the long thesis collapses.

Conclusion

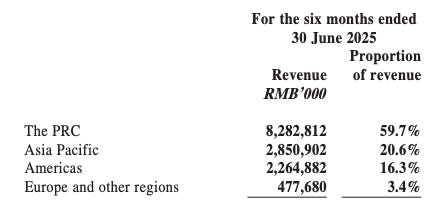

This is the peak of Pop Mart interest in the US, however the US is only 16.3% of the story.

Pop Mart is caught between bearish narrative risk and still strong fundamentals. With social demand declining but elevated from the beginning of the year, the setup favors waiting before positioning. If management executes on production expansion and China demand holds, the market may be underestimating revenue stability and upside surprise potential.

Actionable Positioning:

Base Case: Social moderation translates softness in FY 2026 guidance. Stock likely re-rates post-earnings.

Bull Case: Holiday demand and China resilience produce a sharp rebound in social, leading to a material revenue beat.

Bear Case: Social collapse accelerates (-50-60% from peak), China weakens, and the narrative becomes structurally bearish. Stock sells off materially.

Please email admin@tickertrends.io to gain access to our entire KPI dashboard which includes coverage of over 100 unique KPIs and 1000’s of tickers available on TickerTrends Enterprise: https://tickertrends.io/enterprise