Roofing Sector Alternative Data Overview | TickerTrends.io

The TickerTrends Social Arbitrage Hedge Fund is currently accepting capital. If you are interesting in learning more send us an email admin@tickertrends.io .

Ticker(s): $BECN, $OC

Sector: Building Products

$BECN Company Description: Beacon Roofing Supply, Inc., founded in 1928 and headquartered in Herndon, Virginia, distributes residential and non-residential roofing materials and building products in the U.S. and Canada. Its offerings include pitched and low slope roofing products, gutters, sidings, lumber, skylights, windows, decking, HVAC products, and various insulation types. The company also provides waterproofing membranes, coatings, tools, equipment, and solar panel systems to contractors, home builders, and retailers.

$OC Company Description: Owens Corning manufactures and sells insulation, roofing, and fiberglass composite materials globally, operating in three segments: Composites, Insulation, and Roofing. The Composites segment produces glass reinforcements and fiber products for building structures, roofing shingles, tubs, pools, decking, flooring, pipes, electrical equipment, and wind turbine blades, selling directly to parts molders and fabricators. The Insulation segment offers thermal and acoustical batts, loosefill insulation, spray foam, and foam sheathing under brands like Owens Corning PINK and FOAMULAR, with products used in construction and sold to installers, retailers, and distributors. The Roofing segment provides asphalt roofing shingles, oxidized asphalt materials, and roofing components for residential and commercial use, sold through distributors, home centers, retailers, and contractors. Incorporated in 1938, Owens Corning is headquartered in Toledo, Ohio.

Roofing Stocks Poised for Gains Amid Record Ocean Temperatures and Active Hurricane Season

As the ocean’s surface temperatures soar to some of the highest levels on record, the National Oceanic and Atmospheric Administration (NOAA) forecasts an unusually active hurricane season with 17–25 hurricanes expected. This unprecedented combination of warm waters and storm activity is set to significantly impact roofing demand, offering potential gains for key players in the roofing industry such as Beacon Roofing Supply ($BECN) and Owens Corning ($OC).

The Atlantic and Caribbean are experiencing record sea surface ocean temperatures this summer, with temperatures over 3 standard deviations above the past 4 decade average in both ocean regions.

As investors, we don’t hope for more hurricanes to happen but the reality is that an above normal hurricane season is likely to occur this summer and fall. This has many implications for stocks that deal with residential and commercial roofing projects. Although interest rates tend to heavily affect demand for residential products like this, it seems like even without the hurricanes, there was already a trend reversion back to the mean in building demand. “Roofing repair” has been seeing a spike back to ~2020/2021 levels after many delayed projects in 2022/2023.

Other terms like “gutter repair” have seasonal spikes in the summertime and also looks like demand bottomed out and is now going to be back on the rise.

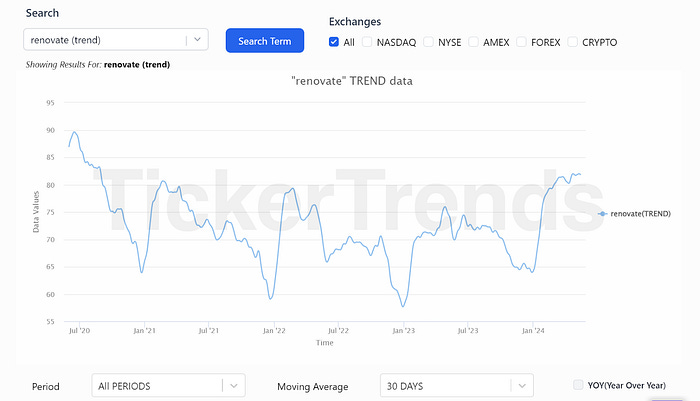

High interest rates do slow down the housing market, but they have been high for a while. It is plausible that many homeowner’s realized that rates will be higher for longer and are now making arrangements to live in the house they now find themselves essentially trapped into, as evidenced by “renovate” search.

Beacon Roofing Supply (BECN)

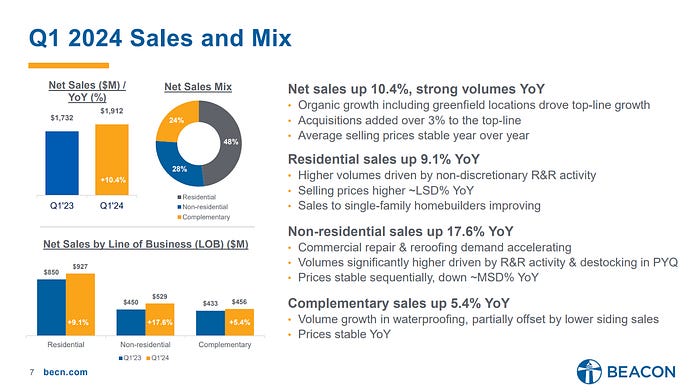

Beacon Roofing Supply stands out as a leading distributor of residential and non-residential roofing products. With a robust network across North America, Beacon is well-positioned to meet the surge in demand for roofing materials in the aftermath of hurricanes. The company’s comprehensive product range, including shingles, underlayments, and complementary building products, ensures that it can cater to both immediate repair needs and long-term reconstruction projects. As hurricanes damage roofs extensively, Beacon’s sales in residential and non-residential segments are likely to spike, driving revenue growth.

Residential and non-residential segments drove about ~76% of total revenue last quarter, so the company will likely move many more units if there is indeed a strong hurricane season.

Owens Corning (OC)

Owens Corning, renowned for its high-quality roofing materials, is another stock to watch. The company’s advanced roofing shingles, such as those with SureNail technology, offer superior performance in extreme weather conditions. This makes Owens Corning a preferred choice for homeowners and businesses looking to fortify their roofs against hurricanes. The expected increase in hurricane activity will likely boost demand for Owens Corning’s durable and reliable roofing products, leading to potential sales growth.

Although $OC is diversified in its offering (Roofing, Insulation, and Composites), increased demand in even one or two of these segments can drive the company to outperform expectations.

Conclusion

Both Beacon Roofing Supply and Owens Corning are set to benefit from the anticipated rise in roofing demand due to the forecasted active hurricane season. As homeowners and businesses rush to repair and replace damaged roofs, these companies’ strong market presence and high-quality product offerings position them for significant gains. Investors looking for opportunities in the wake of severe weather patterns may find these roofing stocks particularly attractive. Beacon Roofing Supply and Owens Corning, with their extensive product ranges and market reach, are well-equipped to capitalize on the increased demand for roofing solutions. As the hurricane season unfolds, these stocks could see substantial benefits, making them worthy of consideration for investors seeking to leverage weather-driven market opportunities.

Hedge Fund Enquiries: admin@tickertrends.io

Follow Us On Twitter: https://twitter.com/tickerplus