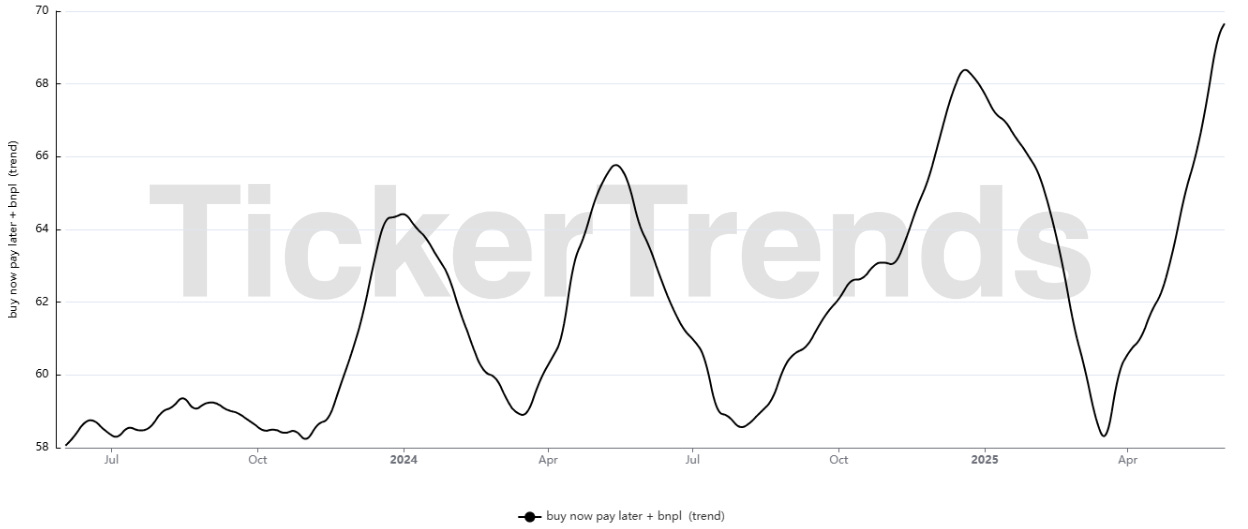

$SEZL Sezzle Inc. | $SEZL Sezzle Inc. | BNPL: Boom Now, Pleateu Later? | Tickertrends.io

The TickerTrends Social Arbitrage Hedge Fund is currently accepting capital. If you are interested in learning more send us an email admin@tickertrends.io

Ticker: $SEZL

Sector: Credit Services

Share Price: $ 106.71

Market Cap: $ 3.55B

Business Intro:

Sezzle Inc. traces its roots to Minneapolis in 2016, when payments veteran Charlie Youakim and long-time collaborator Paul Paradis set out to lower processing costs for e-commerce merchants. Within a year they pivoted toward the emergent “buy now, pay later” (BNPL) model, but did so with an unusually explicit social mandate: the company reincorporated as a Delaware Public Benefit Corporation and soon earned Certified B-Corp status, embedding consumer financial empowerment into its charter rather than treating it as marketing veneer. That ethos resonated with impact-minded investors and regulators alike, helping Sezzle secure an Australian Securities Exchange listing in 2019, complete a direct listing on Nasdaq in August 2023, and finally wind down its Australian quotation in January 2024 so that all trading now occurs under the ticker SEZL.

At the heart of the platform is a short-tenor, interest-free installment plan—most commonly “pay-in-four” across six weeks—that approves or declines each transaction in real time without a hard credit inquiry. Instead of levying interest on shoppers, Sezzle makes money by charging the merchant a small discount fee that rises or falls with modeled risk, aligning its incentives with responsible spending rather than revolving debt. The absence of compounding interest, coupled with automated reminders and one-click rescheduling tools, positions Sezzle as a friendlier alternative to credit cards for Gen Z and millennial consumers who are wary of traditional finance.

Crucially, the company treats point-of-sale lending as a gateway to longer-term financial health, not an endpoint. Users who graduate to “Sezzle Up” have on-time payments reported to TransUnion and Experian, allowing them to build or repair a conventional credit file while they shop online or in-store—a feature few mainstream BNPL rivals replicate. Sezzle’s merchant strategy has likewise evolved from small Shopify storefronts to national retailers. A single-use virtual-card overlay lets chains such as Target and Nike activate Sezzle at the register or inside their mobile apps without re-engineering existing payment stacks—dramatically shortening sales cycles and reducing charge-off risk. By combining frictionless enterprise integrations with disciplined underwriting and credit-reporting incentives, Sezzle positions itself less as a niche checkout button and more as an embedded financial-wellness partner that can scale across both digital and brick-and-mortar commerce.

The Industry:

The United States’ buy-now-pay-later sector has advanced from an experimental checkout add-on into a full-fledged, multi-rail credit infrastructure whose imprint now extends across e-commerce, mobile wallets, point-of-sale terminals and, increasingly, the card networks themselves. Estimates put the value of purchases routed through BNPL plans at roughly US $109 billion in 2024, and is projected to climb to about US $122 billion in 2025 and more than US $184 billion by the end of the decade, implying an 8.5 percent compound annual expansion once the market enters its mature phase. Although the growth curve is easing from the 20-plus-percent CAGRs recorded during the pandemic surge, BNPL is still outpacing every other branch of unsecured consumer credit and is on track to absorb a larger slice of the nation’s US $1 trillion-plus discretionary retail spend.

Penetration is no longer confined to Gen-Z sneaker drops or one-off fashion splurges. The payments-intelligence firm PYMNTS reports that fully half of credit-active U.S. adults—about 128 million people—used a pay-later instrument at least once in the year to March 2025, and adoption skews surprisingly toward the upper end of the income spectrum: six in ten BNPL users now report household income above US $100,000. Adobe’s holiday-shopping tracker reported that a record US $18.2 billion of gifts and year-end purchases were completed with instalment loans during the 2024 season, a 9.6% jump from the prior year, and nearly 80% of those transactions were executed on a smartphone—evidence that BNPL is as much a mobile UX phenomenon as it is a credit innovation.

Macroeconomic conditions reinforce the appeal. Revolving balances on general-purpose credit cards reached an all-time high of roughly US $1.21 trillion at December 2024, while median card-rate offers for sub-prime borrowers now exceed 25 percent. Against that context, a zero-interest pay-in-four plan or a single-digit APR twelve-month instalment looks like a rational hedge, not merely a fad. Merchants have taken notice: internal data from Stripe, Shopify and BigCommerce show cart-conversion lifts of 20-to-30 percent when a BNPL button is visible at checkout, and average ticket sizes often rise by a similar magnitude. Retailers therefore treat the 3-to-6 percent merchant-discount fee less as financing cost and more as performance advertising, a dynamic that underwrites the sector’s still-robust gross-profit pools despite higher funding costs.

Competitive intensity, however, has been increasing. Affirm gross merchandise volume reached US $8.6 billion in the March-ended quarter, up 36% YoY, driven by zero-percent APR promotions and accelerated adoption of the Affirm Card, which now accounts for more than US $800 million of quarterly spend. Klarna, privately held but transparent with headline metrics ahead of an eventual IPO, booked US $25 billion of GMV in the first quarter of 2025 and logged its fourth consecutive positive adjusted operating result, a feat built on rigorous cost discipline and an AI-assisted re-architecture that cut servicing head-count 40 percent without denting customer-satisfaction scores.

Afterpay processed US $10.3 billion of volume in the March quarter and converted that flow into a 23 percent increase in segment gross profit, thanks in part to Cash App’s 55 million monthly active users funnelling incremental spend across both debit and installment lines. PayPal’s “Pay in 4” and “Pay Monthly” propositions, while a smaller slice of the company’s US $417 billion quarterly TPV, provide a stickier checkout experience for the platform’s 436 million actives and help explain why management has kept BNPL front-and-centre even as total payments growth normalises.

Traditional banks are also moving from tentative toe-dipping to full participation. American Express’s “Plan It,” JPMorgan’s card-linked equal-payments plans and U.S. Bank’s “Avvance” pilot all speak to incumbents’ resolve to keep younger, limit-averse customers inside the branch ecosystem. At the network layer, Visa and Mastercard are effectively rewriting the rails that once confined instalments to proprietary fintech APIs. Visa’s Flexible Credential—a single PAN capable of toggling among debit, credit, instalment and loyalty-points tender types—went live in late 2024 with Affirm and had 1.7 million active U.S. users within six months, while Mastercard’s Installments programme opened to every eligible online merchant in October 2024, promising acquirer-agnostic access to pay-later offers routed over existing tokens.

Those network developments are pivotal because they foreshadow margin compression for standalone BNPL originators that must pay interchange to ride card rails or surrender exclusivity when a retailer can switch providers at processor level. They also tilt the field toward issuers with low-cost deposit funding and balance-sheet depth, intensifying the need for alternative funders to securitise or syndicate receivables at competitive spreads. Warehouse costs have already widened 150-to-200 basis points since late 2022, a drag that is visible in higher discount-rates quoted to large merchants during the 2024 holiday procurement cycle.

Technological differentiation therefore matters more than ever. Klarna’s decision to rebuild its servicing stack around generative-AI agents trimmed customer-support costs by 40 percent, while Affirm’s proprietary cash-flow-underwriting platform, which pulls more than five thousand data points per applicant, keeps thirty-plus-day delinquencies below comparable card cohorts despite faster unit growth. The industry is converging on the view that BNPL is not simply alternative tender but a data-rich credit-decision engine whose real-time insights can price risk in fractions of a second. Providers that master that loop will protect take-rate even as headline discount fees drift downward.

In May 2024 the Consumer Financial Protection Bureau issued an interpretive rule classifying pay-in-four loans as credit-card products under Regulation Z, a move that would have forced lenders to provide periodic statements, error-resolution rights and refund protocols familiar to traditional plastic. One year later the bureau pulled back, announcing it would not prioritise enforcement of the rule and signalling possible rescission as it re-allocated resources to what it termed “more pressing threats” such as fraud targeting service members. That retreat has not stilled the policy debate; it has devolved it to the states. New York’s 2025 budget bill, signed three weeks after the CFPB announcement, mandates a lending licence for BNPL operators, applies the state’s 16 percent APR cap to any plan that does charge interest, and portages parts of the federal Truth in Lending Act into state law. California, Massachusetts and Washington are drafting similar regimes.

The emerging patchwork sets up a compliance hurdle that some sub-scale fintechs will struggle to clear. It also gives nationally chartered banks an inherent advantage: a single regulatory interlocutor and pre-emption of most state licensing demands. Investors must therefore handicap the regulatory trajectory company by company, evaluating who has the capital, the licences and the legal playbook to navigate a fifty-state chessboard. For securitisation buyers, the question is no longer whether BNPL receivables are asset-backed-securities eligible but whether the servicing algorithms can dynamically suppress default rates if certain states impose fee caps or disclosure protocols that alter consumer behaviour.

Credit performance to date remains resilient but voltage is rising on the circuit. Aggregate charge-offs across the five largest U.S. BNPL platforms peaked at 3.8 percent of outstanding receivables in late 2022, eased to the low 3s by mid-2024 and have hovered there since—comfortably inside the 4-to-5 percent card range but not immune to macro deterioration. Klarna’s global loss ratio ticked up from 0.51 to 0.54 percent in first-quarter 2025, and internal cohorts show deeper stress among borrowers juggling three or more simultaneous instalment plans. The harder edge is “phantom debt”: because many short-tenor BNPL loans still bypass the bureaus, subsequent lenders may be blind to embedded leverage, raising the probability of systemic over-extension in a downturn.

Funding costs are amplifying the tension. Investors in BNPL asset-backed paper demand floating-rate coupons and structural credit enhancement; with SOFR still north of 5 percent, forward margin on a four-pay loan that yields 7 percent all-in leaves scant cushion for loss absorption after servicing, fraud and network fees. Market leaders therefore scramble to build diversified liquidity stacks: trendline securitisations, forward-flow deals with insurance-linked funds, committed warehouse lines and in some cases on-balance-sheet retention that can be recycled into higher-APR twelve-month contracts. The units that honour this discipline will retain pricing power; those that chase volume for its own sake may find the warehouse door shut if credit turns.

Healthcare has become a battleground as elective-procedure clinics embed six-to-twenty-four-month plans directly into patient portals, and education fintechs are experimenting with semester-level tuition financing that sits somewhere between BNPL and income-share agreements. Travel-and-hospitality partnerships rose 38 percent year-over-year in 2024, according to ARC data, as airlines used pay-later promotions to secure fare lock-ins without discounting base prices. These verticals carry higher ticket sizes and longer tenors, thus heavier capital intensity, but they also loosen the historical tether between BNPL and apparel-centric retail seasonality, producing steadier month-to-month receivable curves.

In effect, the sector is recalibrating from land-grab exuberance to a contest of balance-sheet stamina, data mastery, and regulatory dexterity: lenders able to fuse real-time cash-flow underwriting with cheap, diversified funding and state-compliant playbooks will keep merchants loyal even as discount fees compress, while those that cannot will discover that volume alone is a brittle moat. Sezzle—having strung together four straight profitable quarters and deliberately shifted its mix toward large-ticket, enterprise merchants—embodies that higher bar and thus sits squarely at the point where disciplined risk analytics, scalable capital, and widening omnichannel demand converge, positioning it to harvest the next leg of BNPL growth more efficiently than many of its bulkier rivals.

Business Analysis:

Sezzle's strategic focus on younger demographics, particularly Gen Z, has allowed it to carve out a significant niche in the competitive BNPL landscape. This success is not merely a product of its core offering but also a result of a deep understanding of this generation's financial habits, values, and expectations from service providers.