Sezzle’s GMV Is Surging. Our KPI Model Says a Big Beat Is Coming.

Consumer interest data transformed into actionable KPI predictions

At TickerTrends, we track alternative data signals to get ahead of earnings surprises. This time, our KPI prediction is locked onto Sezzle ($SEZL) tracking for a large beat.

For fiscal Q2 2025, our model is predicting $912 million in Gross Merchandise Volume (GMV). That’s not just higher than the Wall Street consensus of $718 million — it’s in a completely different ballpark. Based on our analysis, Sezzle could deliver a GMV number 27 percent higher than what analysts are currently expecting.

This kind of gap is exactly what we look for in our KPI predictions and the edge Enterprise Users can expect to see on our platform. It’s what gives analysts, managers and investors an actionable edge heading into earnings.

Our Q1 prediction? Very close to the actual

To recap, here’s how we did last quarter:

TickerTrends Prediction (FQ1’25): $778 million

Sezzle Actual (FQ1’25): $809 million

Analyst Consensus: $498 million

Our model outperformed the analyst consensus by a wide margin. The actual result came in much closer to our KPI-driven forecast, which was built using real-time behavioral and digital consumer activity data.

This strong track record gives us added confidence going into the next quarter.

What is driving our Q2 prediction?

Our $912 million forecast is not just a guess. At a 13% GMV take rate, our SEZL Q2’25 Revenue forecast is $118M vs the $93M current analyst consensus, implying a staggering 27% beat relative to Wall Street. It can be seen in clear trends in the data we track, including:

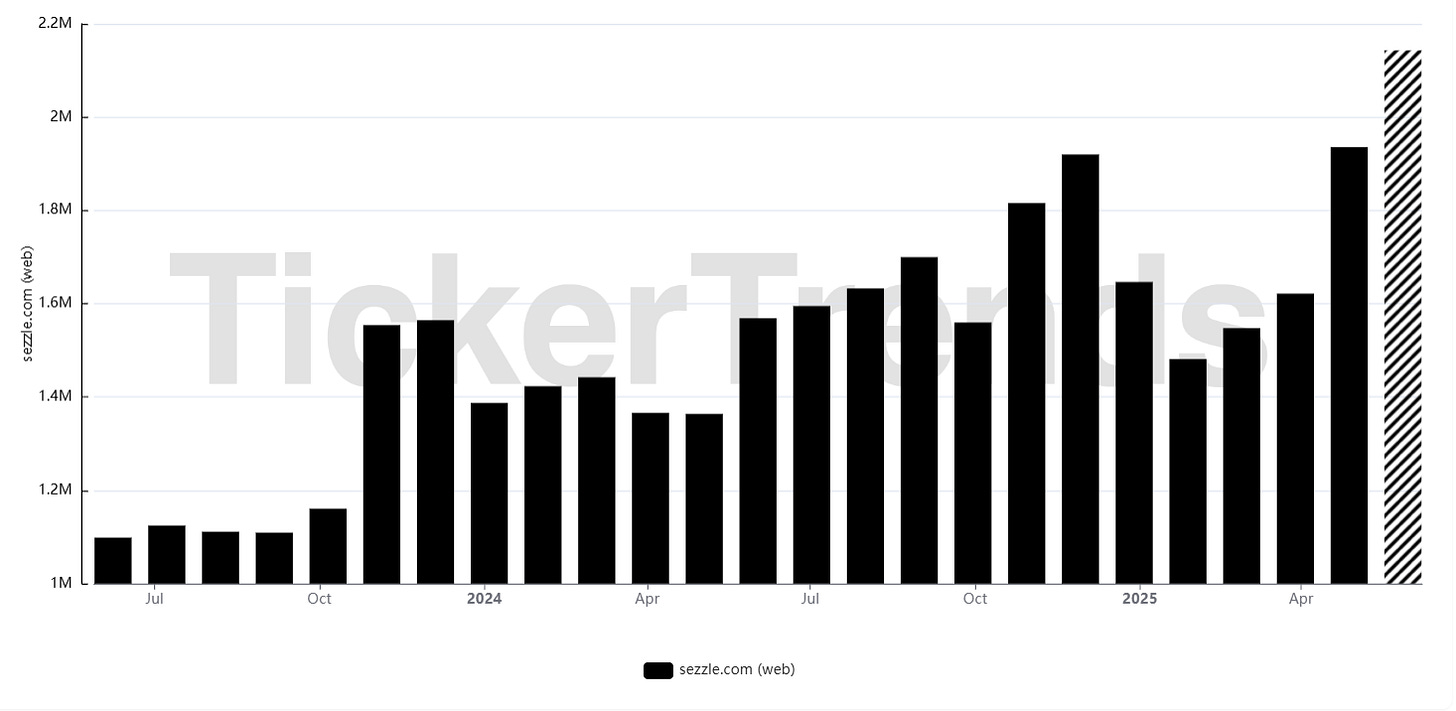

Website traffic: Visits to Sezzle’s main site and merchant checkouts have picked up meaningfully quarter over quarter.

App usage: Daily active users momentum continues running almost triple digits higher YoY, based on third-party data sources we monitor between combined iOS and Android DAUs.

Google Search interest: Consumer curiosity around “buy now, pay later” and Sezzle-related queries is trending up and recently the company signed a sponsorship deal with the Minnesota Timberwolves potentially sparking more consumer discovery of the brand.

And more…

Our model is designed to detect inflection points in consumer-facing businesses and has a historical margin of error of less than 3% for $SEZL. We believe this quarter has one of those inflection points.

Please email admin@tickertrends.io to gain access to our entire KPI dashboard which includes coverage of over 100 unique KPIs available on TickerTrends Enterprise: https://tickertrends.io/enterprise